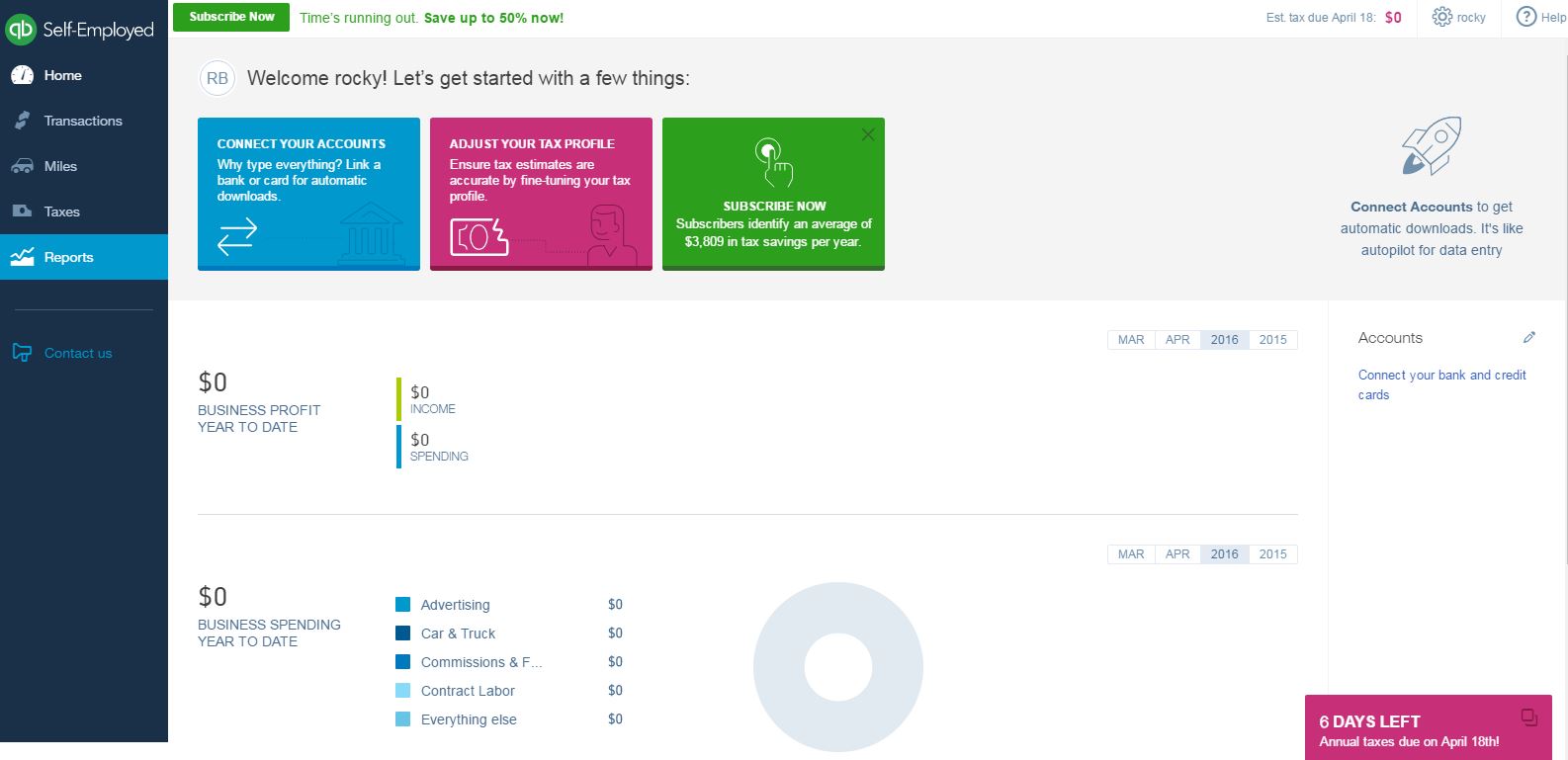

QuickBooks Self-Employed

About QuickBooks Self-Employed

Awards and Recognition

QuickBooks Self-Employed Pricing

Free trial:

Not Available

Free version:

Not Available

Other Top Recommended Accounting Software

Most Helpful Reviews for QuickBooks Self-Employed

1 - 5 of 96 Reviews

Dr. Holly

Mental Health Care, 2 - 10 employees

Used less than 2 years

OVERALL RATING:

5

Reviewed March 2022

Your Business Needs This

Waldo

Verified reviewer

Arts and Crafts, 2-10 employees

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

FUNCTIONALITY

5

Reviewed July 2022

Business Accounting Made Simple

It is extremely useful that this software integrates banking, car/fuel usage in the internal structure. The fact that income/expense entires can be custom-automated makes for an easy and intuitive workflow. Also, that filing of taxes become super easy as the software guides one through an intuitive process and does the filing at the end! This software is a money-saver and give true peace of mind.

CONSAt this time there are no features that the developers have not thought of!

Vendor Response

Hi, Waldo. We're thrilled to hear QuickBooks has helped you take care of your business needs. Whether you're creating invoices or ordering products, you can count on our software to get the job done. For tips and tricks on getting the most out of your software, be sure to check out our Community page: (http://community.intuit.com/). Best wishes! -Kristina, The QuickBooks Team

Replied August 2022

Peggy

Apparel & Fashion, 1 employee

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed December 2022

Very Useful Software

Excellent. I love this software! It has really made my job easier!!

PROSI love the Transaction processing. I can quickly snap a photo of a receipt and then categorize it. It has helped me keep up to date on all my receipts, income, etc.

CONSI found this software to be very easy to use. I don't have anything to add here that I don't like

Reason for choosing QuickBooks Self-Employed

Based on a recommendation from a colleague and a short demonstration that he gave me.

Reasons for switching to QuickBooks Self-Employed

Recommendation from a colleague

Brooks

Construction, 2-10 employees

Used daily for more than 2 years

OVERALL RATING:

1

EASE OF USE

1

VALUE FOR MONEY

1

CUSTOMER SUPPORT

1

FUNCTIONALITY

1

Reviewed July 2022

This program is an absolute nightmare

Truly hate it

PROSThere is nothing to like about INCONSISTENT software that can delay/hurt your business at any random moment.

CONSThe software is barely supported. Talking to a live technical agent is virtually impossible. Some minor glitches are constant and go on unfixed, but the major glitches come without warning and can literally bankrupt a small business, costing thousands of dollars in hassle. One glitch last year would deduct the GST amount owing from ONLY the customer's end of the invoice. It's not hard to imagine how quickly that damage adds up. This year I cannot send receipts. All receipts show up in the form of an invoice, an obvious disaster. Today, I can't even send invoices. They simply aren't getting to the clients. So today I'm left having to reach out to every client, troubleshooting. My business needs me to operate so that is an entire day's revenue lost. These are only a few examples, I could write a book on why to avoid this software. All I can do is hope a day will come when I have the time to transfer every single piece of customer data manually into different, more reliable software, because that's literally the only option this piece of trash software has once your already in.

Carly

Music, 2-10 employees

Used monthly for less than 12 months

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

4

CUSTOMER SUPPORT

4

FUNCTIONALITY

5

Reviewed November 2022

Perfect For Self Employed Accounting!

Overall I definitely would recommend this to anyone who is self employed or has a simple one person business. It's definitely geared toward beginners so don't expect all the bells and whistles that you'd get with the more advanced versions of Quickbooks, but it's perfect to track your finances as a self employed person. There's a good reason Intuit is the leader in this space!

PROSI love the interface, design and layout of QuickBooks Self-Employed! I use the online version and they've really designed it exactly for people who are self employed like myself. It makes tax time super easy and makes it easy to budget and keep track of expenses. You can also make invoices cleanly and quickly. Overall I love that it's geared for self employed individuals, as the name suggests!

CONSWhile I do love how simple it is, it's sometimes even a little too basic or user friendly. I can't fault it too much for this since that's also what make it so great, but don't expect this to be as in depth as regular Qiuckbooks as it really is just geared for self employed folks, and I would even as it's for beginners.

Reasons for switching to QuickBooks Self-Employed

I made the switch because I was looking for something simpler, and this is it! They also had a 50% off the first 3 months, which I have to say enticed me to try it!