Which Bonus Structure Is Best for Your Company?

According to research by Payscale, the majority of organizations (73%) now provide some form of variable pay to their workforce in a bid to compensate valuable employees and motivate performance.

If you’re not already offering variable pay in the form of bonuses or you’re unsure which bonus structure is best suited to your situation, we’ve got some recommendations for you based on a survey of American employees.

We surveyed more than 200 full-time employees, asking multiple questions about how they’d prefer their bonus to be structured, and here’s what we found.

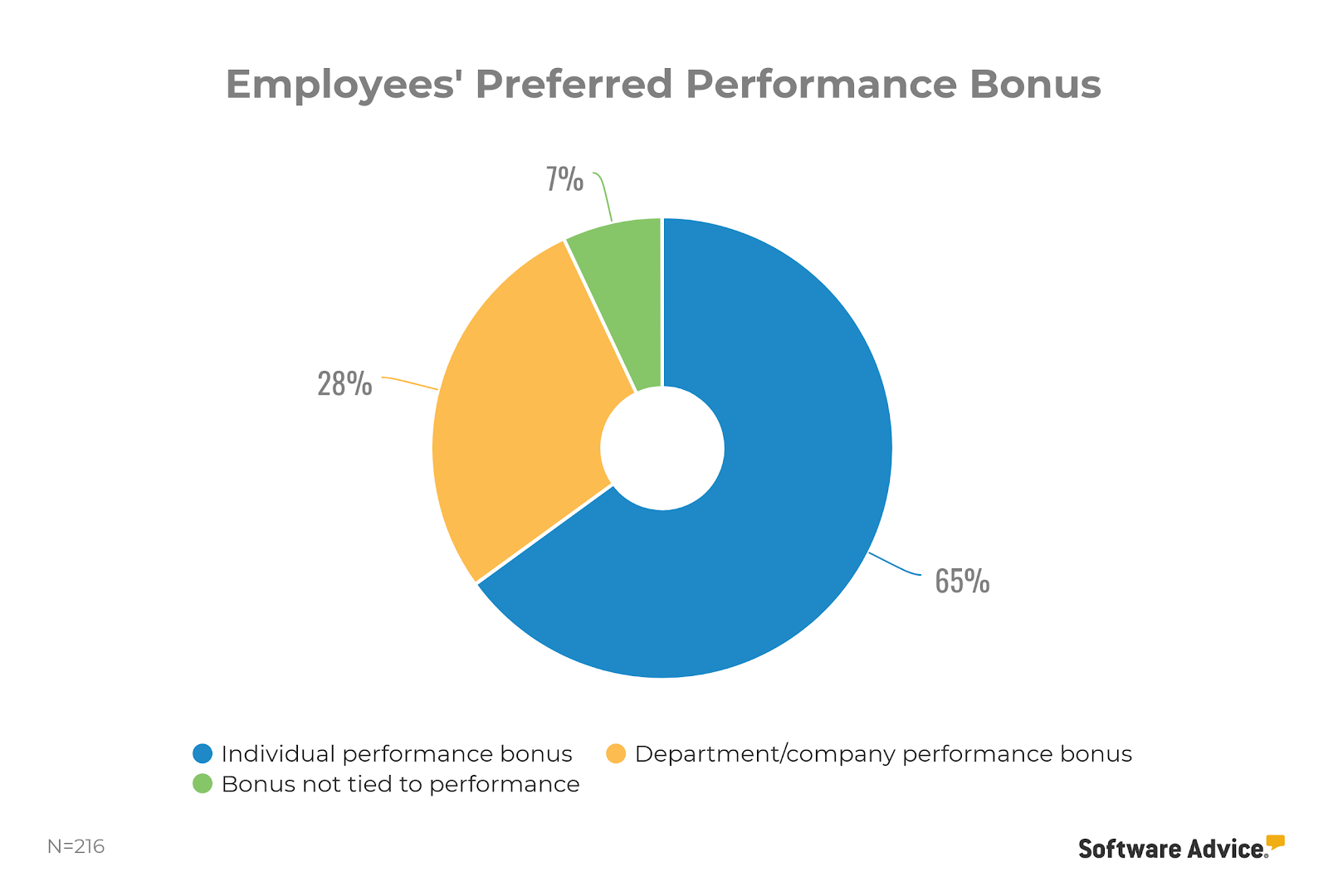

Tie bonuses to individual performance. Almost two-thirds of workers prefer a bonus tied to their individual performance over department/company bonuses or those not tied to performance at all.

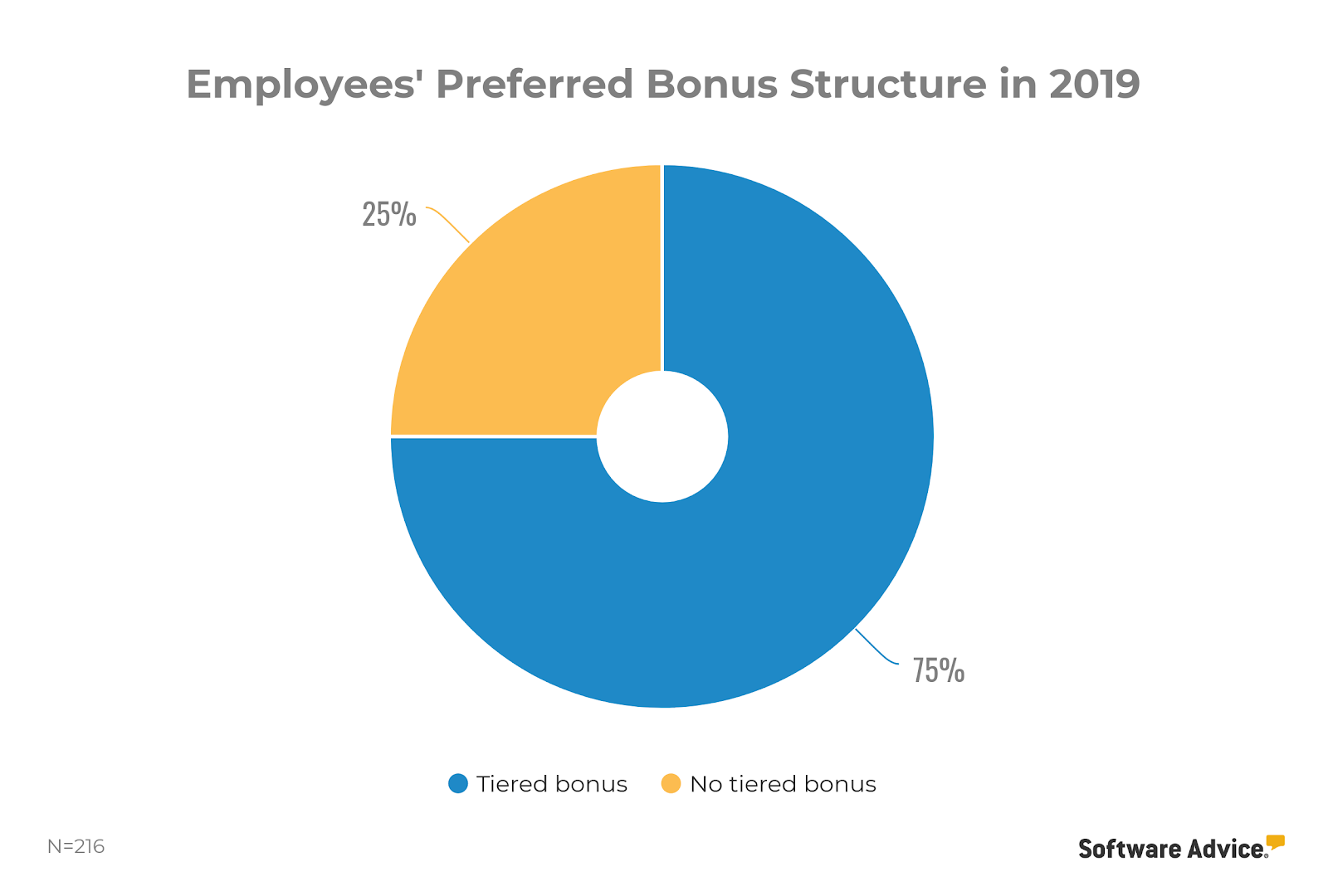

Get rid of hit-or-miss bonus targets. 75% of workers prefer to earn a percentage of their performance-based bonus for achieving a percentage of their goal (a tiered bonus) over earning only their full bonus if they hit their full goal.

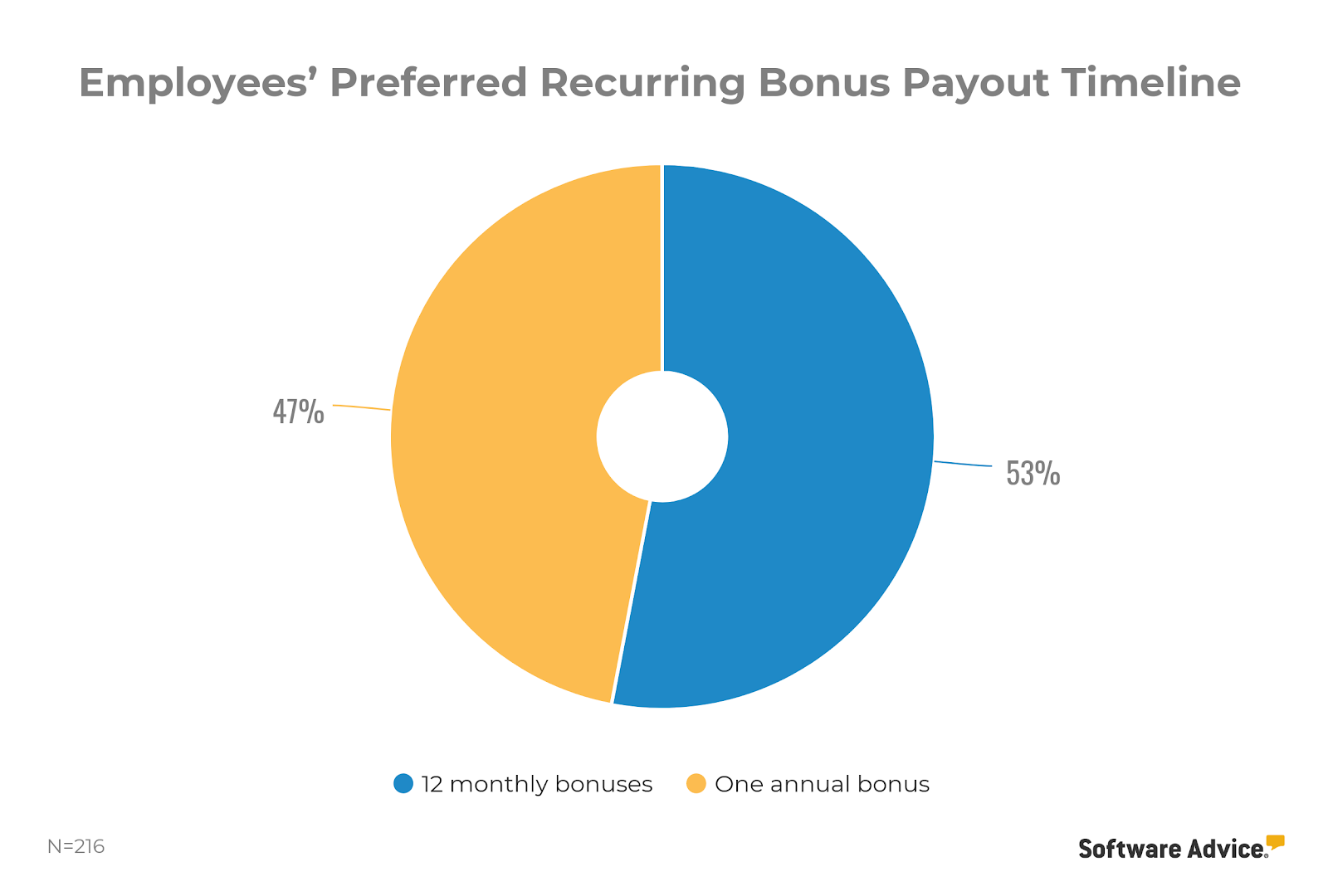

Ask employees what bonus payout timeline they prefer. The results were almost evenly split between 12 monthly bonuses (53%) and one annual bonus (47%), assuming they total the same amount.

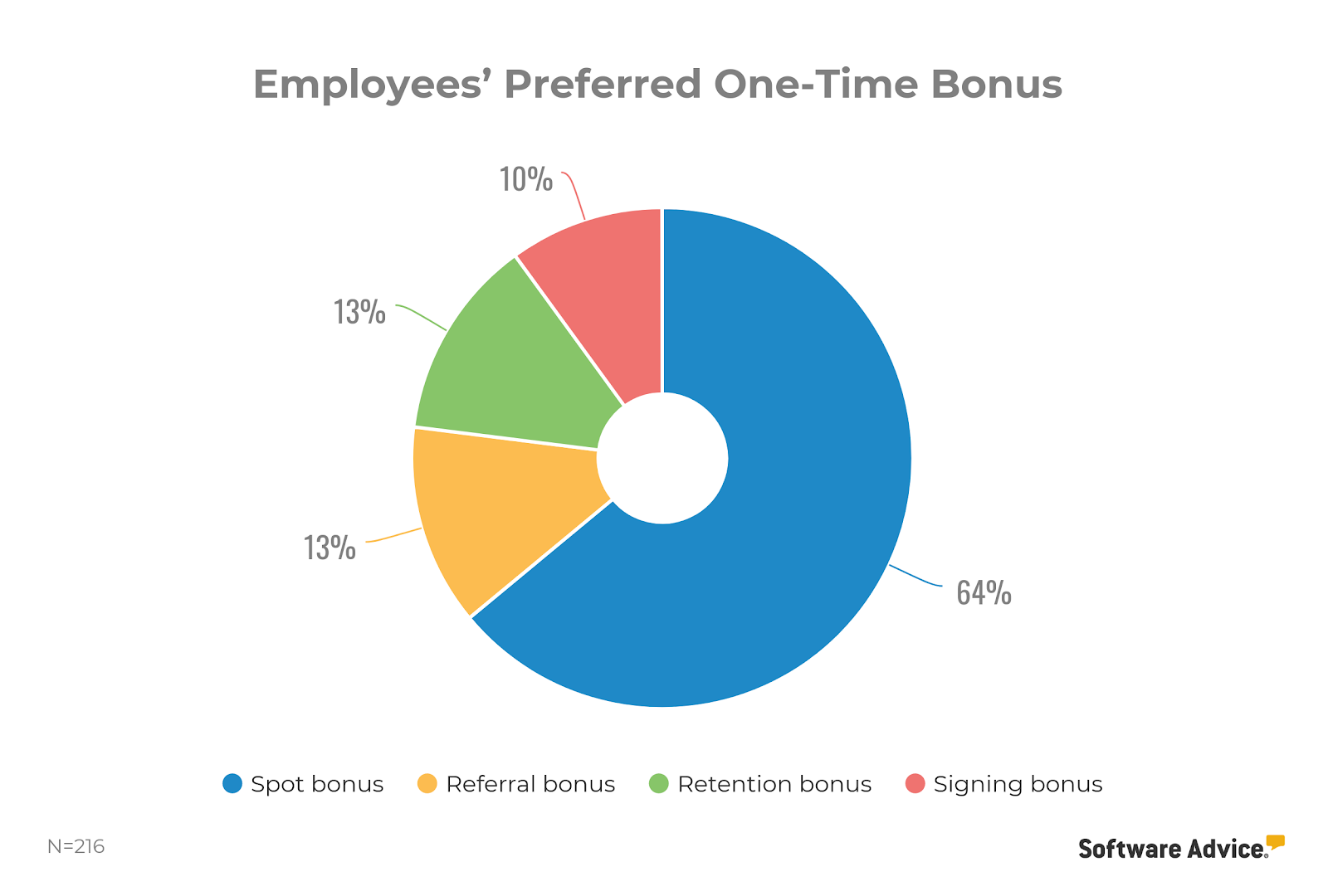

Consider spot bonuses for special effort. 64% of workers prefer spot bonuses over other one-time bonuses like signing bonuses, employee referral bonuses, or retention bonuses.

Utilize software to manage your bonus structure. Creating an effective bonus structure requires effort from multiple departments throughout the year, software can help you keep tabs of the process.

Tie bonuses to individual performance

When structuring recurring, performance-based bonuses, businesses generally have three options to consider:

Bonuses based on individual performance.

Bonuses based on department or company performance.

Bonuses not based on performance at all (e.g., a flat bonus for everyone).

When we asked workers which option they prefer, the favorite is clear: 65% prefer a bonus tied to their individual performance over a bonus based on group performance, or not tied to performance at all.

From an employee perspective, there are pros and cons to each option. A bonus not based on performance is guaranteed, but because there’s no performance incentive involved, the payout is often relatively small. It’s a no-risk, low-reward option.

On the other hand, bonuses based on individual performance can be incredibly lucrative—assuming workers can meet often-rigorous performance goals. It’s high-risk, high-reward.

Paying out a substantial year-end bonus to every employee in your business can certainly make headlines, but if employees expect to get the same bonus regardless of their performance, there’s little incentive to be more productive. In fact, it could even serve as a negative incentive, encouraging workers to do only the bare minimum.

To promote motivation and retention among your best workers, awarding bonuses based on individual performance is best. This method involves the most work—but software can help:

Performance management software can help organizations set goals and track employee performance against those goals in a digital environment.

Compensation management software can align performance goals and compensation budgets to determine optimal payouts.

Payroll software can ensure that correct amounts for bonuses end up in bank accounts, appropriate taxes are withheld and line items align accurately with the general ledger.

Get rid of hit-or-miss bonuses

Once you’re monitoring individual performance and doling out bonuses accordingly, you might be tempted to keep things “black or white” to make administration easier: If workers hit their target, they get their bonus. If they miss it, tough luck.

Beware though, this approach can backfire. Hit-or-miss bonuses have two negative effects:

High performers with nothing else to work towards will call it a day after hitting their mark.

Lower performers won’t even attempt to reach their goal if there’s a risk their efforts could all be for nothing (e.g., if a salesperson has an annual goal of 300 sales, why work harder and risk getting no reward for 299 sales?).

Employees don’t like it either: 75% of workers in our survey prefer tiered performance bonuses over “hit-or-miss” bonuses.

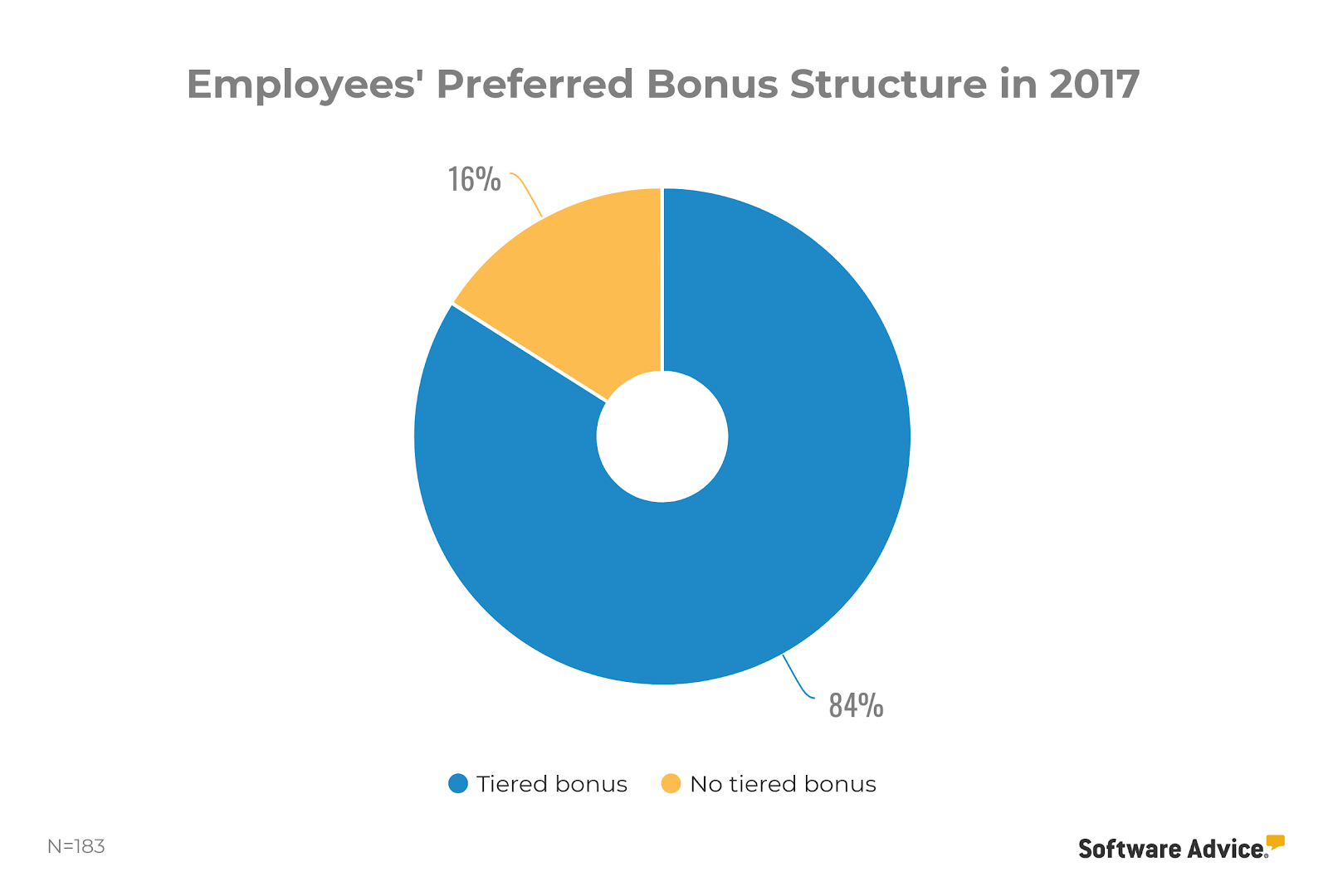

However, compared to the results of the same survey we ran in 2017, the preference for tiered bonuses has fallen by almost 10%.

Employees Preferred Bonus Structure, 2017

Employees Preferred Bonus Structure, 2019

Here’s the solution

Set multiple performance goals for each employee, and reward them a percentage of their bonus for achieving a percentage of their goal. This way, you can promote continuous effort among your employees without seeming unfair. It’s a small consideration but one that’s often overlooked.

Ask employees what bonus payout timeline they prefer

Businesses don’t want to waste time considering how to schedule payouts for recurring bonuses. Generally, there are two options: Pay your employees 12 smaller monthly bonuses or one large annual bonus.

Unlike the rest of our findings, the answer here is uncertain: Assuming they total the same amount, 53% of workers prefer 12 monthly bonuses and 47% prefer one annual bonus.

When deciding what timeline to follow at your organization, the best action to take is to ask your employees what payout timeline they prefer through a random survey.

If results at your workplace are similarly split, you may have to consider other factors, such as type of industry or workplace. For example, it’s likely that all sales teams will need monthly bonuses rather than yearly ones because of the nature of the job.

Employees prefer spot bonuses for special effort

Besides recurring bonuses, one-time bonuses given out for specific actions can also motivate employees. These may include:

Employee referral bonuses

Retention bonuses during mergers and acquisitions or tumultuous periods

Signing bonuses when accepting a job offer

Spot bonuses to acknowledge special effort

We asked employees which of these one-time bonuses they’d prefer, if they could only be eligible for one. The result: 64% say they’d prefer a spot bonus for special effort.

Spot bonuses are often up to managers’ discretion and limited to small amounts ranging from $25 to $500, but they’re a great way to reward and acknowledge special effort by employees.

With a modern payroll system, managing spot-bonus budgets and allocation is simple. Many systems allow for ad hoc payroll amounts to be added to payroll runs: For example, if Employee A gets a $37 spot bonus, you can add that amount to their paycheck manually.

Utilize software to manage your bonus structure

If there’s one trend that ties our findings together, it’s this: Workers want their bonuses to be as closely tied to their performance and their impact on the business as possible.

Here are some key things to remember when designing your bonus structure:

Creating an effective performance review process is priority number one.

Meet employee preferences in the middle. Have employees fill out a random survey to get exact details on what types of bonuses would motivate them. Then determine how you measure success and what resources you have available. This will lead to a solution that satisfies management, HR, and employees alike.

Integrate technology to maximize communication and automation. Awarding performance-based bonuses takes effort from multiple departments. By integrating payroll, performance review, and even accounting systems, you can create a seamless bonus process with fewer errors and duplicated entries.

Survey methodology

To collect data for this research report, we conducted an online survey of 216 Americans in October 2019. Responses came from a random sample of the U.S. population. We screened our sample to only include respondents who fit the specified criteria. In this case, respondents were screened to ensure they were currently in full-time employment and that their employer offers some form of bonus.

We also refer to data we collected in September 2017, where we ran an online survey of 183 Americans. Responses came from a random sample of the U.S. population. We screened our sample to only include respondents who fit the specified criteria. In this case, respondents were screened to ensure they were currently in full-time employment and that their employer offers some form of bonus.