What Is a Sliding Scale, and How Does It Work?

For small and midsize businesses (SMBs), the quest for sustainable yet flexible pricing solutions is constant. Sliding scale pricing is an option that allows SMB owners, such as yourself, to tailor pricing strategies to individual clients on a case-by-case basis.

For instance, some businesses face the challenge of not being able to address everyone in its audience (oftentimes lower-income clients). While a sliding scale fee means some customers would pay less, the business will benefit by addressing a wider audience and making a sale rather than alienating potential customers and not making a sale at all.

But what does sliding scale mean exactly? And how does it work? Let's take a look at this pricing concept and its practical applications for SMBs.

What is a sliding scale?

A sliding scale is a variable pricing structure that adjusts charges based on a customer's ability to pay or the volume of goods or services they purchase or plan to purchase on an ongoing basis. This approach is particularly relevant for SMBs as it offers them a customizable pricing method that can align with the varied financial capabilities of different industries and business sizes, ensuring fair access to services.

Sliding scales adjust prices within a range from lowest to highest, based on predetermined criteria such as the level of a customer’s income, the quantity of a purchase, frequency of returning purchases, or a combination of these and other factors. Sliding scale rates let you adjust your pricing to reflect the purchasing styles of different customers, which helps establish a more attractive, inclusive business model.

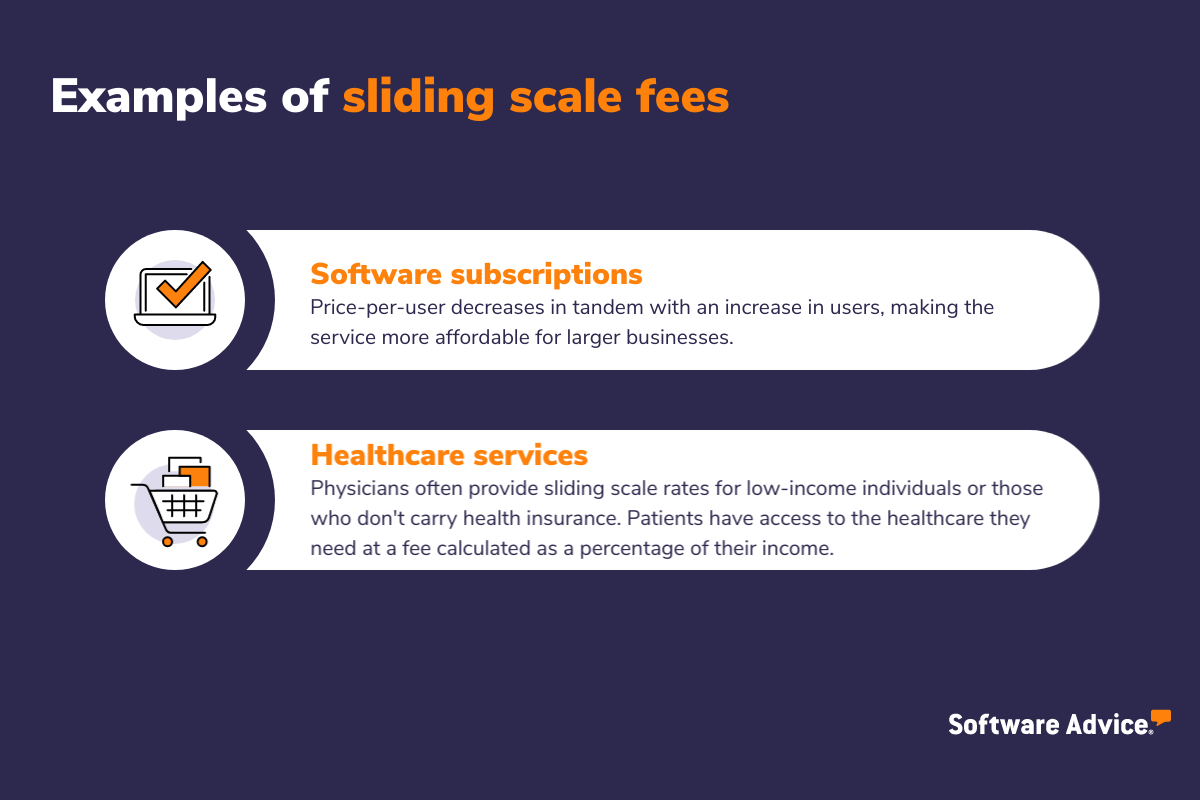

Healthcare practices, legal services, educational institutions, and software subscriptions often utilize sliding-scale pricing to cater to clients with different financial capabilities while maintaining a viable business model.

How can your customers qualify for sliding scale pricing?

To qualify for sliding scale pricing, customers typically need to provide information that proves their eligibility, such as income statements. For example, customers whose income statements verify income below an established threshold could be eligible for your sliding scale fee. If you have nonprofit clients, you could request tax documents proving nonprofit or charitable status.

Customers who require a sliding scale payment structure often want to know what they’ll be expected to pay prior to contacting you. You can establish clear guidelines for your customers to ensure a transparent and fair qualification process.

What are the benefits of sliding scale pricing?

Sliding scale rates offer benefits for your business and for your customers. Some of the more apparent advantages of establishing a sliding scale payment structure include:

Enhanced customer inclusivity. By offering prices that adapt to different financial situations, SMBs can serve a broader clientele and foster long-term relationships with loyal customers.

Improved cash flow management. With sliding scale pricing, you can keep your cash flow steady by attracting a diverse customer base with varying payment capabilities. Customers who can pay at the higher end of your scale help mediate any potential cash flow issues created if you have a high number of customers paying at the lower end of the scale.

Increased sales and market share. Sliding scale rates can lead to an increased volume in sales, improved revenue, and a stronger overall presence in your market by making products or services accessible to a wider audience.

Competitive edge. SMBs that implement sliding scales can potentially edge out competitors by catering to customers priced out of purchasing through more expensive companies.

Alignment with social responsibility goals. Sliding scale fees can be part of an SMB's commitment to social equity and community support. Today’s consumers appreciate businesses that don’t subscribe to corporate greed, thereby bolstering its brand image.

What are the drawbacks of sliding scale pricing?

Sliding scale pricing structures aren’t without disadvantages. Some of the reasons certain companies might choose not to engage in sliding scale rate options include:

Complexity in management. Implementing a sliding scale can complicate billing and administration processes, requiring more robust systems and training.

Potential for revenue loss. If not managed carefully, sliding scales can lead to reduced revenue from customers who might have been willing to pay full price.

Customer perception risks. There's a risk that customers might perceive the quality of services or products to be lower if they are offered at a reduced rate.

Challenges in standardizing prices. Determining the correct sliding scale rates can be challenging, as it requires a balance between affordability and profitability.

Risk of abuse. There's always a potential for customers to misrepresent their eligibility to take advantage of lower prices.

Prepare your business to offer sliding scale fees

To successfully implement sliding scale pricing in your organization:

Conduct thorough market research to set appropriate scales.

Invest in a robust accounting system to manage the varied pricing.

Train staff to understand and explain the sliding scale structure to customers.

Establish clear guidelines for eligibility to maintain transparency.

Monitor the impact on finances regularly to ensure sustainability.

A sliding scale fee is more than just a pricing method. It underscores your company's values and its dedication to customers and promotes inclusivity and flexibility.

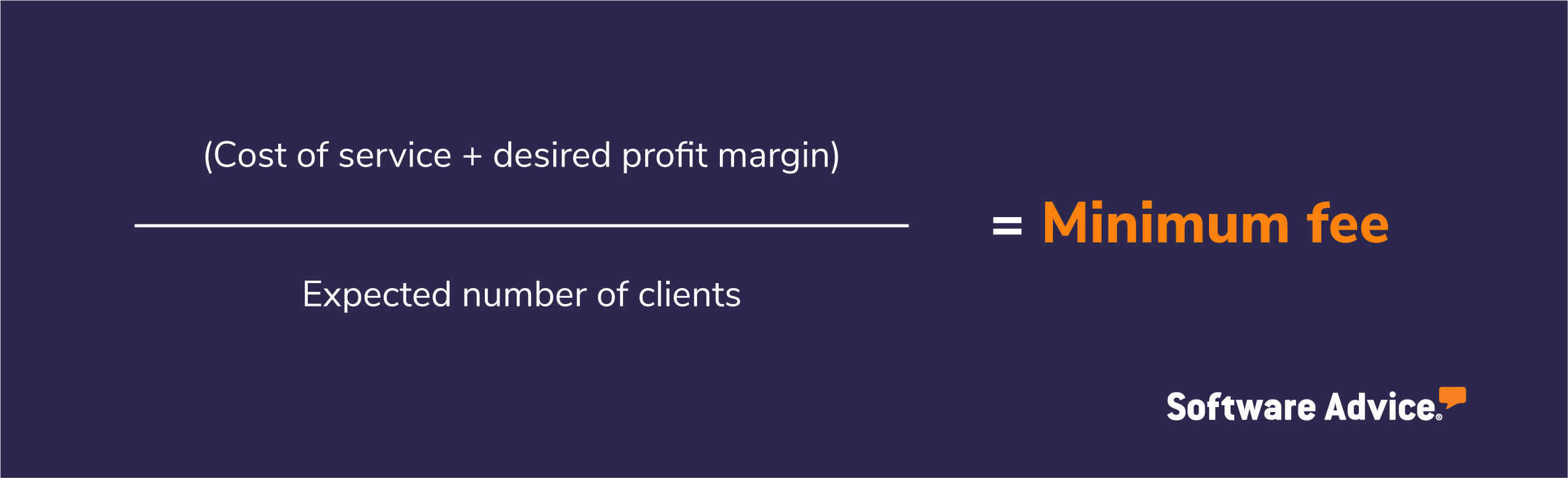

A calculator tool can help determine your minimum fee

A simple formula you can use to determine a sliding scale rate structure is:

Minimum fee = (Cost of service + desired profit margin) / Expected number of clients

If doing math isn't your thing, then various online calculators and productivity tools can effectively crunch these numbers for you.

For more pricing insights, explore these Software Advice resources: