Wave Payroll

About Wave Payroll

Wave Payroll is a cloud-based payroll solution for small businesses. Primary features include invoicing, accounting, online payments, lending and receipts. The accounting module allows users to create custom invoices, scan receipts, manage sales tax, generate accounting reports such as Profit and loss, sales tax report, calculate exchange rates and payment transaction reconciliation.

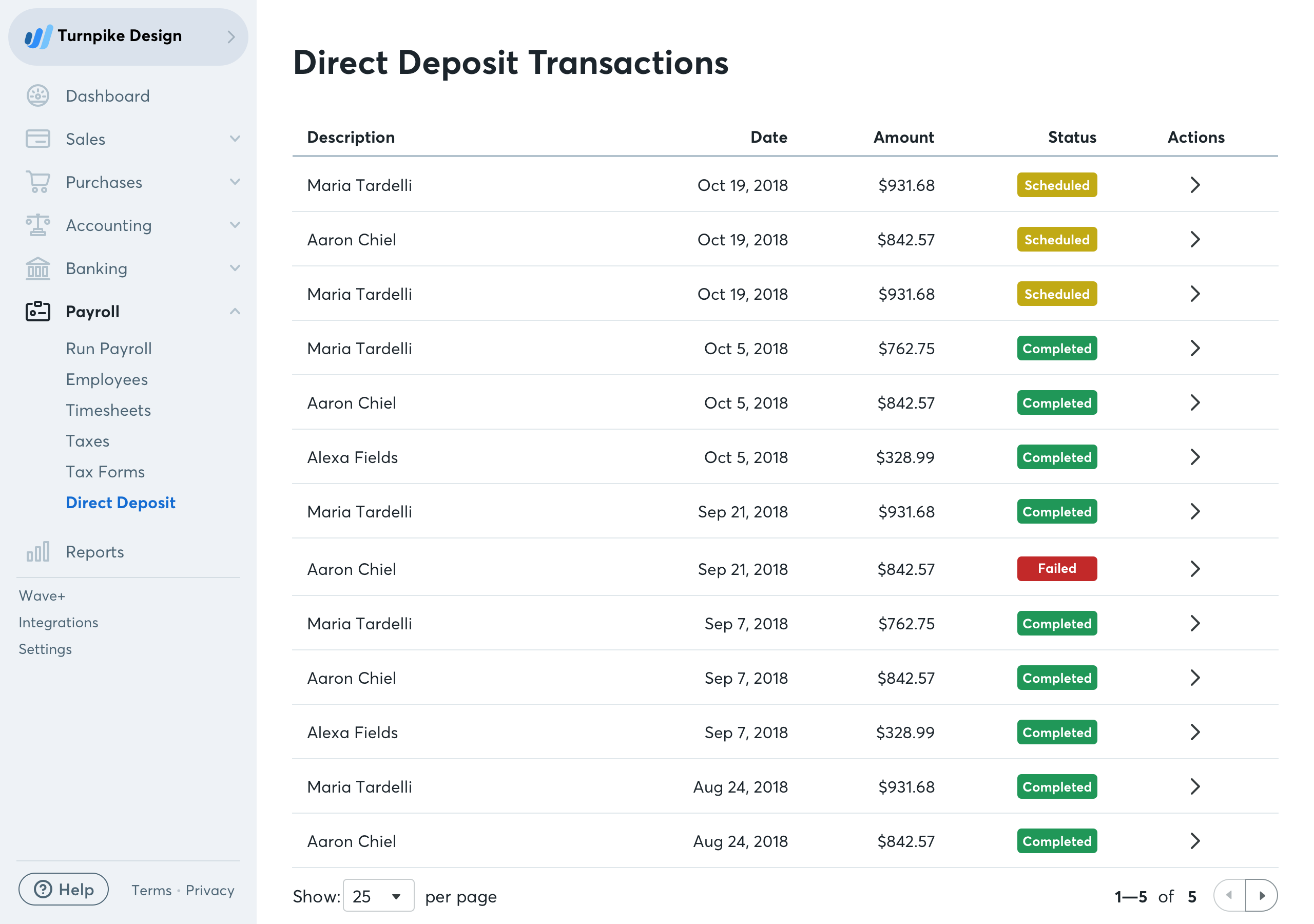

It allows users to create recurring bills, send automatic payment reminders, bookkeeping, share invoice status, create customer statements and accepts credit card payments. It automatically deposits the salary into the employee’s banks accounts. Employees can view their pay stubs online. It also allows employers to track hours worked, overtime and vacation time.

The solution is of...

Awards and Recognition

FrontRunner 2019

Software Advice's FrontRunners report ranks top products based on user reviews, which helps businesses find the right software.

Wave Payroll Pricing

USA pricing: Tax service states (California, Florida, New York, Illinois, Virginia, North Carolina, and Washington): $35/base fee + $4 per employee/month Self service states (All other 43 states): $20/base fee + $4 per employee/month Canada pricing: $20/base fee + $4 per employee/month

Free trial:

Available

Free version:

Not Available

No results found. Please adjust or reset filters to search again.