Accounts Payable Software Buyers Guide

This detailed guide will help you find and buy the right accounts payable software for you and your business.

Last Updated on November 21, 2023Accounts payable software is a subset of broader accounting software that helps organizations manage their debts and other financial liabilities.

We wrote this guide to help prospective software buyers better understand the market for accounts payable software and what they should consider before making a purchase. Here’s what we’ll cover:

What is accounts payable software?

Common features of accounts payable systems

How much does accounts payable solution costs?

What type of business are you?

What are some other considerations for account payable software?

What is accounts payable software?

Most accounting and financial software platforms contain three core modules:

General ledger. The overall financial records of a company.

Accounts receivable. Manages accounts that owe the company money.

Accounts payable. Manages accounts the company owes money to.

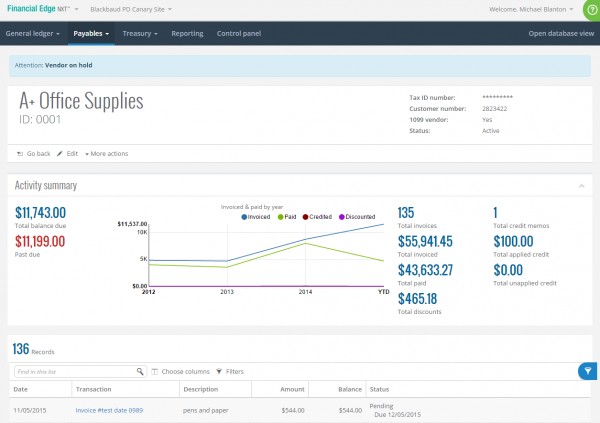

Accounts payable via Financial Edge by Blackbaud

Typically, these three modules are offered together as part of one comprehensive accounting platform. In turn, that accounting platform can also be offered as part of a broader enterprise resource planning (ERP) suite that includes applications for other functional areas like human resources and customer relationship management (CRM).

As such, accounts payable systems are almost always offered as a package with other core accounting modules. That said, some vendors may offer standalone accounts payable applications to help with more complex accounting situations.

Common features of accounts payable systems

Here are some common features you will find in most accounts payable modules:

Reports | Visualize accounts payable data. Typically displayed in a dashboard format with key performance indicators (KPIs) highlighted. |

Electronic Funds Transfer | Securely transfer funds between electronic bank accounts. |

Invoices | Compile, print and send invoices in a number of formats such as .PDF or .DOCX. |

Vendor management | rack and manage information for vendors the company has accounts with. |

1099 processing | Process 1099 forms for independent contractors and freelancers. |

Automation | Receive and collect receipts, transactional data and other information automatically for storage in the general ledger. |

How much does accounts payable solution costs?

Like other accounting software platforms, accounts payable software is typically offered either as a perpetual license or as a monthly subscription. With a perpetual license, an organization will pay a fee upfront, and then will typically pay annual fees for support, maintenance and updates. With a monthly subscription, an organization will pay one monthly fee.

Generally, pricing is determined by the size of the organization and its product requirements. Larger firms with more complex accounting needs will usually pay more than smaller firms.

Another thing to consider is that perpetual licenses typically mean that the software is hosted on your own computers or servers, while subscription-based software is often deployed in the cloud.

While businesses can generally rest easy knowing that their financial data is secure in the cloud, some businesses that have particularly sensitive financial data might wish to host their accounting solution on their own servers. Be sure to consult with an IT security professional to decide what your organization should do.

What type of business are you?

Most small businesses rely on QuickBooks to handle their accounting needs. While QuickBooks can work well for smaller businesses, it may not scale well for growing businesses which need a more advanced solution. Furthermore, businesses in particular industry niches might need certain functionalities that are not present in standard accounting platforms.

For example, nonprofit organizations often need accounting software that is equipped to handle unique tax situations. A construction company that deals with multiple subcontractors and suppliers will also need more advanced accounting features. And of course, companies that conduct any sort of international business need features like multi-currency support and international tax code support.

It is important to verify with prospective software vendors that they have other clients that are in your industry and are similar in size.

Be sure to also check out a vendor’s long term viability. Does the vendor have a growing customer base, and are they regularly updating the platform? If not, you may wish to look elsewhere. Mergers and acquisitions are also very common in the enterprise software world. Smaller vendors are often acquired by larger vendors. In many cases, nothing changes for the end user, though sometimes the acquiring vendor will sunset the acquisition’s product line.

What are some other considerations for account payable software?

Here are some other things to keep in mind:

Is your business growing rapidly, or planning to expand internationally?

You’ll want to deploy a system that can scale with your business and your needs. One major consideration is whether a platform complies with various foreign or international accounting regulations.

Does your business operate in a specific industry niche?

Most accounting platforms are considered to be “general purpose” and serve a range of industries. However, certain organizations in particular industry niches might have to seek out a more specialized platform. For example, a distribution company would want to use an accounting platform that can assist with something like international fuel tax compliance.

Do you have software needs that extend beyond accounting?

Organizations implementing new accounting software might choose an integrated software suite that covers other functional bases like human resources, customer relationship management, supply chain management and so on. If you’re in the market for a new accounting system, you should consider whether you want an integrated suite or a standalone accounting platform. Each approach has its own unique advantages and disadvantages. Individual best-of-breed applications often have a more extensive feature set, but lack the integrative capabilities of other applications. In contrast, integrated suites might lack features but come with the benefit of being totally integrated across all applications.

Will you need to train your employees on the new system?

In most cases, you will want to invest into ensuring that your employees are adequately trained to work with a new accounting system. Some accounting systems have steeper learning curves than others; in general, the more advanced the new system is in comparison to your old system, the more training your employees will need. That said, many vendors offer free or paid training services that you can purchase.