BlackLine

About BlackLine

BlackLine Pricing

Please contact sales for a quote

Starting price:

$105.00 per month

Free trial:

Not Available

Free version:

Not Available

Other Top Recommended Accounting Software

Most Helpful Reviews for BlackLine

1 - 5 of 18 Reviews

Balázs

Verified reviewer

Mining & Metals, 10,000+ employees

Used weekly for more than 2 years

OVERALL RATING:

5

EASE OF USE

4

VALUE FOR MONEY

4

CUSTOMER SUPPORT

5

FUNCTIONALITY

4

Reviewed February 2019

Good tool for account reconciliation in a GBS center

We started using it to replace our old client-server based software to support the month-end GL reconciliation process for various entities in our global company.

PROSDue to the cloud technology it is available from anywhere. It could be really useful if you should manage GL reconciliation for many entities with different ERPs (it was our case) Easy to use interfaces, very good support. Can support the internal or external audit procedure and can reduce its cost. Auto-certification is sophisticated with several customization possibilities.

CONSThe implementation was a bit longer than expected (it was also because of our internal resources). With our current setup line level info cannot be loaded, so Excel sheets - as attachments - are remained after go live.

KEELY

Package/Freight Delivery, 201-500 employees

Used more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed November 2020

Once you have it, you won't want to be without it

I don't have a single bad thing to say about this software. The company I work for now doesn't have it, and I really wish we did. I miss it every day! It is a great month end tool. Nothing better in my opinion. For corporations looking to get a better understanding of your account balances - this was wonderful. Asking and waiting for information was a thing of the past, when all you had to do is log in and pull up an account to see it's balance and supporting detail.

PROSI LOVE this software. As an accountant, there is no better tool at month end to get your accounts reconciled. Account Reconciliation becomes a breeze, and It makes those dreaded audits not so horrible. Everything is neatly tucked into a software, where the auditors can be set free (in their own approved audit login of course). From Account reconciliation, to matching, and bank reconciliation...I loved this software the more I used it. I even tried to find an open position to work for them!

CONSWhen you get started, its like anything, you learn how it all works. In the beginning the only con for me was the level of help (this was back when this software started). But now there are so many online tools to help you with any questions you may have. And their customer service is great and helpful. Super easy to submit a ticket for an issue, and response time was great.

Cansu

Consumer Goods, 10,000+ employees

Used daily for less than 6 months

OVERALL RATING:

2

EASE OF USE

5

VALUE FOR MONEY

1

CUSTOMER SUPPORT

5

FUNCTIONALITY

2

Reviewed November 2022

I tried but it is not suitable for me

It doesn't quite fit my work process. I am someone who can work with a more customizable and flexible product. Its functionality didn't appeal to me, but its customer support won my heart.

CONSIntegration is poor. And the billing process was not very professional.

Anonymous

2-10 employees

Used daily for less than 2 years

OVERALL RATING:

5

EASE OF USE

4

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed December 2022

blackline is a very handy tool

Based on my extensive experience, I will recommend Blackline.

PROSBlackline has an easy to use interface. We also have the possibility to have different transaction data with very useful features

CONSI haven't found any drawbacks since I started using it

Anonymous

1,001-5,000 employees

Used weekly for more than 2 years

OVERALL RATING:

4

EASE OF USE

4

VALUE FOR MONEY

4

CUSTOMER SUPPORT

5

FUNCTIONALITY

3

Reviewed August 2018

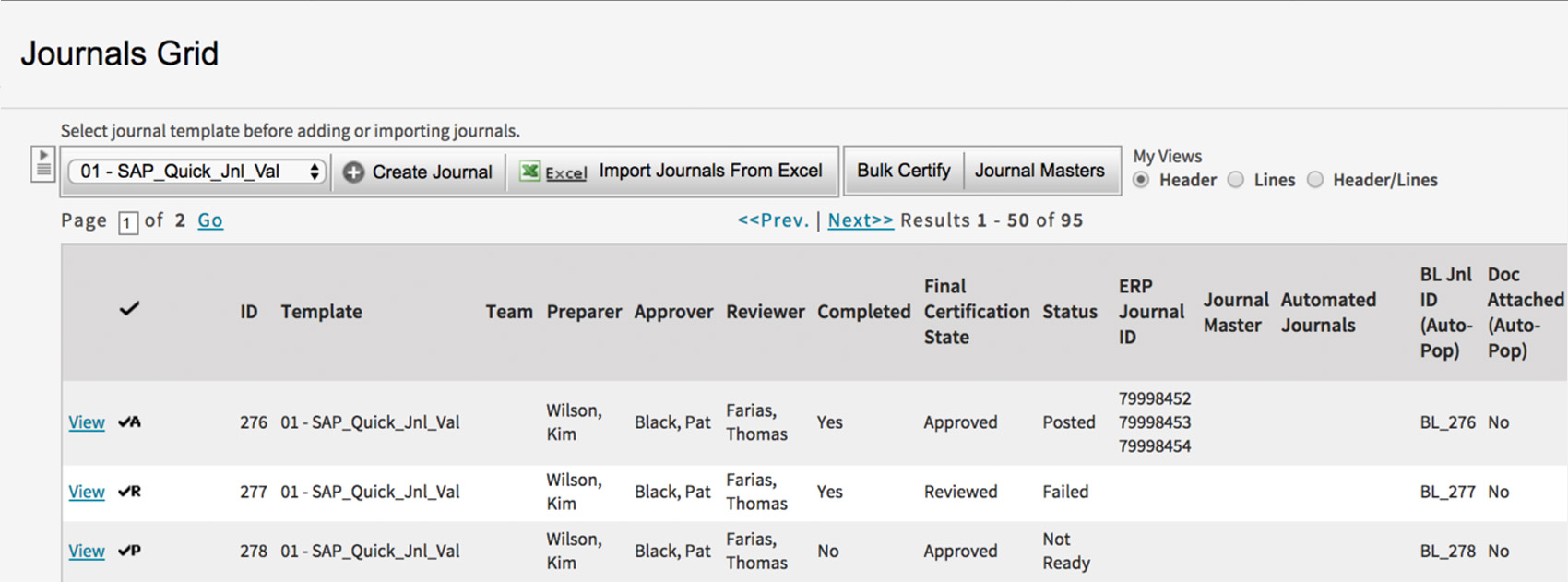

Blackline Integration with Data Management Software such as SAP

Since SAP has been integrated with BlackLine, reconciliations every day+5 of the month end processes are a lot easier. Variances and discrepancies are easily dealt with. Blackline has only been limited to its functions as well as the real-time processing of data.

PROSIt is a web-based application for performing account balances reconciliation which can be easily integrated with other financial software such as SAP.

CONSThe software is limited to reconciliations and intercompany transactions wherein the vast majority of software are investing on in-memory capacity and cloud for more flexible transactions.