Online Accounting Software Buyers Guide

This detailed guide will help you find and buy the right online accounting software for you and your business.

Last Updated on November 09, 2023With online, or Web-based accounting software, an organization’s financial data is hosted by the vendor. In this software-as-a-service (SaaS) module, data is stored on secure servers with automatic back-up and redundancy capabilities. In recent years, these programs have become highly customizable: businesses only pay for the services that they consume. This flexibility, along with the lack of capital investment requirements, attracts small and medium-sized businesses especially.

Because of the hundreds of online accounting programs, it can be very difficult to decide which one is best for your business. This buyer’s guide is designed to help you navigate the online business accounting software market. Here’s what we’ll cover:

What is online accounting software?

Accounting solutions track the financial transactions within an organization. Typical features include:

Accounts payable/receivable

Payroll and reporting modules

Specialty systems often have additional features dedicated to a particular market. These include fund accounting for nonprofits, commission calculations for sales-oriented businesses like real estate, rate analysis for banking or claims scrubbing for medical practices.

Online accounting systems are specifically designed to be used through the Internet, rather than being installed locally onto company computers. This reduces information technology requirements like server hardware, backups and maintenance and shifts the expenditure from being a large up-front capital cost to a much smaller, but ongoing, monthly or annual fee.

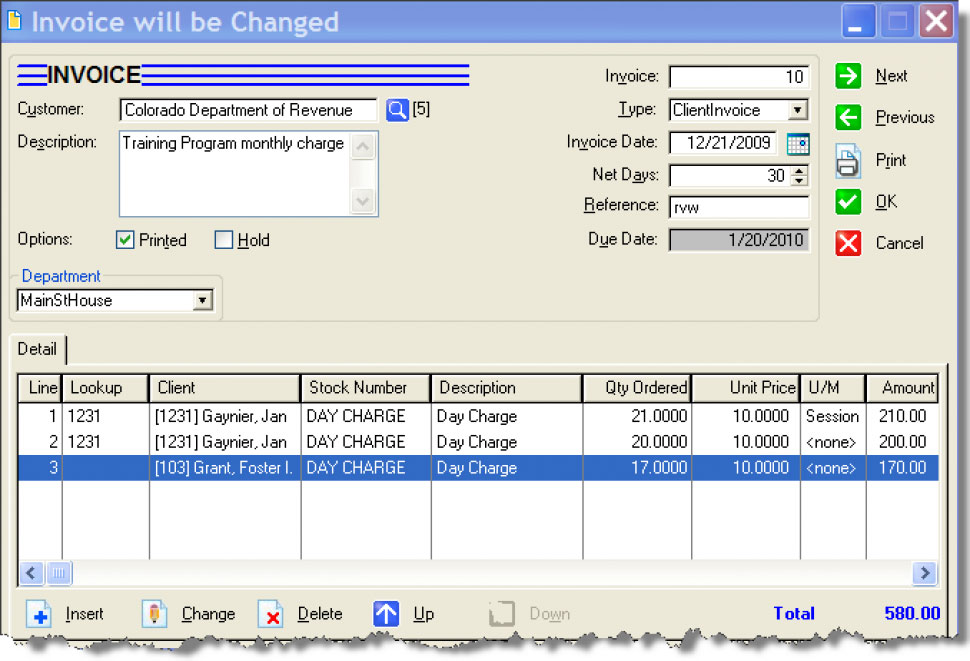

AR invoice screenshot in AccuFund

There are two types of accounting software online: browser-based, SaaS and application service providers (ASPs). SaaS solutions are designed for the user to access the information through an Internet browser like Internet Explorer, Firefox, Chrome or Safari. This allows the information to be accessed from anywhere, and it always looks exactly the same. An ASP is a client-server system, where the business installs a small software “client” onto their computers. In both models—SaaS and ASP—all of the data is hosted by the vendor on a remote server. Most ASPs are also “Web-enabled,” meaning that a Web-browser can be used if necessary, though it will come with a few disadvantages since it is not designed for that purpose.

What type of buyer are you?

Online financial software falls into three main categories:

Enterprise resource planning (ERP) solutions. This describes an integrated suite of features that includes manufacturing, sales, customer relationship management, project management, supply chain management etc. Buyers will want an ERP if they’re looking for a full-suite comprehensive solution, of which accounting is just a small part.

Basic systems. Basic programs online that aren’t part of an ERP tend to be much more cost effective to purchase outright and install locally, and there aren’t very many Web-based systems that focus in this market. But there are a handful available, if this is the deployment model you prefer and all you need is basic functionality. There are also a number of online vendors that will let you select only the features you wish to use.

Fund accounting solutions. There are several products out there designed specifically for the nonprofit market, which include industry-specific features like fund accounting, requisitions and grant and donation management.

What are the benefits and potential issues of online accounting software?

A Web-based system has a number of significant advantages over traditional on-premise software platforms:

Greater level of interactivity. Online bookkeeping software extends system capabilities with functions such as online payments and employee portals. An online accounting system can support a user interface for business employees and customers for communication and sales. Online payments save time by integrating with accounts payable/receivable and the general ledger to automatically update a company’s books. Online employee portals can increase the flexibility of communication and collaboration.

Limited IT burden. Browser-based access for Web accounting software avoids potential compatibility problems, which can sometimes happen when installing these kinds of programs locally to your system. In addition, the vendor handles all of the routine back-ups, upgrades and maintenance, saving considerable time and money on IT infrastructure, a particular benefit for smaller businesses.

Lower up-front costs. Rather than paying a large installation fee, Web-based systems come on more of a subscription basis. In the SaaS model, the user pays a monthly or annual fee, making it a low but ongoing operational expense rather than a capital one.

Data security. Web-based software vendors have stringent security requirements to ensure that your data is secure from hackers and protected from loss. Therefore, an on-premise crash, theft or other hazard to the company’s computers will not destroy the business accounting data. Many online solutions also allow businesses download their data locally, if that’s preferred.

Although Web-based solutions don’t require the same investment in hardware as traditional software installations, subscription costs can accrue over time. The longer it stays in use, the more the user pays, and after a few years the costs may exceed whatever would have been paid for an on-premise system. This is especially true for larger organizations that have the capital and IT infrastructure to make an on-premise system more cost-effective.

Another issue to consider whenever purchasing any new product is to ensure user buy-in. If people feel like they’re having new software “forced” on them, they’re more likely to resist its implementation. Therefore, it’s important to get them excited about the benefits of the new program. A great way to do this is to involve them in the selection process, either inviting them to the demos directly or, if there are too many users for that to be practical, at the very least surveying employees for their opinions on the features they’d want in a new program.

What are the market trends of online accounting software?

Customization. A growing trend in the SaaS accounting market is the ability to select the features your organization needs or wants. If all you need is core accounting, that’s all you pay for, and if you want forecasting but not grant management, the software won’t include it.

Electronic payments. The ability to pay invoices and collect receipts electronically is a great way to save time and money. The benefits are strong enough that most solutions are developing electronic payment features to allow their customers to take full advantage of those capabilities.

SaaS for larger businesses. In the past, Web-based systems were being marketed exclusively as online small business accounting software for companies that couldn’t afford the up-front costs associated with an on-premise system. Today, however—although many small business systems still offer SaaS models—more and more vendors are targeting larger companies with SaaS solutions offering extremely high-level functionality, as in the ERP realm, offering the best of both worlds.

The vendor landscape

These are the best online accounting software solutions and vendors to consider, categories by program type:

These types of buyers... | Should evaluate these systems... |

Enterprise resource planning (ERP) solutions | NetSuite, Epicor, Microsoft Dynamics GP, SAP, Royal 4 |

Basic programs | HIntacct, Accumatica, Lawson S3 |

Fund solutions | FastFund, Serenic, Accufund, Sage MIP Fund |