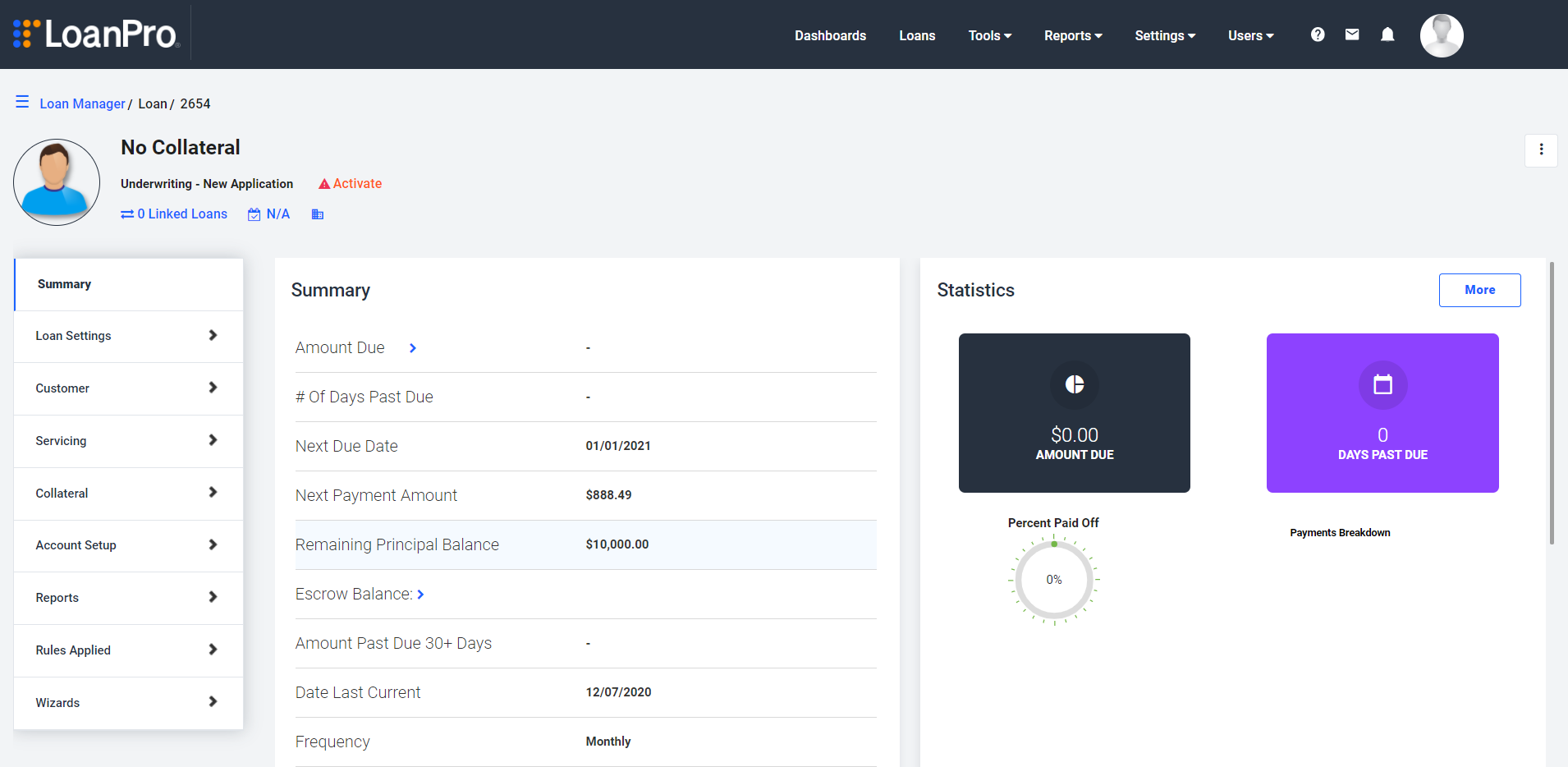

LoanPro

About LoanPro

LoanPro Pricing

LoanPro offers multiple pricing packages tailored to the needs of different lender types and sizes. Want assistance? Sign up for a free 10-minute pricing consultation today.

Free trial:

Not Available

Free version:

Not Available

Most Helpful Reviews for LoanPro

1 - 5 of 78 Reviews

Kevin

Financial Services, 201-500 employees

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed May 2021

LoanPro Lending Solution

Great level of experience and overall positive service

PROSHighly customized solution that is easy to install and onboard - anything from consumer loans to specialized SBA servicing solutions, and recently with high volume PPP loans.

CONSThe "out of the box" standard reports that produce daily require a bit of configuration the first time you go live so make sure to include the setup of these and be prepared to have a list of what you need ready.

Reason for choosing LoanPro

We use LoanPro at another company we own and have always had a good experience in servicing any type of product solution.

Vendor Response

Thanks for your review Kevin! We are so glad that you have had a great experience with us and we look forward to your continued growth!

Replied May 2021

Anonymous

11-50 employees

Used daily for less than 6 months

OVERALL RATING:

4

EASE OF USE

4

VALUE FOR MONEY

5

CUSTOMER SUPPORT

4

FUNCTIONALITY

5

Reviewed May 2021

Value is Unquestionable & a Solid Team

Easy to use from inital login - virtually turn key to take it as far as you want to go.

CONSThe screens are somewhat spread-out at least in Google Chrome. It makes finding page footers or menus difficult sometimes unless you know where to look.

Reasons for switching to LoanPro

We looked at LoanPro as a lateral upgrade within the family of companies and less of a typical conversion. So far this seems to be true.

Nancy

Used free trial

OVERALL RATING:

1

EASE OF USE

1

CUSTOMER SUPPORT

1

Reviewed April 2016

DOESN'T WORK AND THEY WON'T LET US OUT OF CONTRACT

We had an unusual set up and need. I spent extensive time with sales staff and trainers to make sure that it could be made to fit our needs and was reassured and promised repeatedly that it would. So, i signed up. We spent months trying to get it to work the way they said it would. Their tech staff tried, but their setup just doesn't work for what we need. I'm a business owner, so i understand that sometimes no matter how hard you try, it doesn't work for a customer. But that's when a good business would let you out of the contract. I paid a substantial ($2500) set up fee that I have no issue with them keeping. I just want to not have to continue to pay the monthly fee for a software I can't use. They refused. I filed a BBB complaint after their refusal to act reasonably. They have ignored it. I don't see any effort to do what's right.

Vendor Response

We are sorry All Family Finance feels this way. We strive for customer satisfaction both before and after the purchase of the software. We know your scenario was unusual, and after a lot of work by our support staff, they were able to accurately enter your unconventional contracts into AutoPal. The options to either sign a contract or use our software month-to-month were clearly explained. Our software will do what you need it to, and our support staff is standing by to help you get up and running.

Replied April 2016

Andy

Financial Services, 11-50 employees

Used daily for less than 2 years

OVERALL RATING:

5

EASE OF USE

4

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

4

Reviewed September 2021

A must have for fintechs with loan servicing needs

From the sales to the implementation process, LoanPro has been involved and professional every step along the way. They equipped us with great support during the initial implementation phase that allowed us to get up and running with a MVP loan servicing functionality for our lending product. Highly recommend to anyone in the consumer lending space who is considering a modern and effective loan servicing platform.

PROS- Easy to implement with well documented and robust APIs - Modern UI interface compared to legacy loan servicing platforms on the market - Amazing customer support from dedicated account managers who know all the nuances of loan servicing

CONS- Bit of a learning curve to get really familiar with all the features and functionalities - Have to keep up with new updates - Constant rotation of API keys for Secure Payments

Lisa

Automotive, 2-10 employees

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed May 2017

Very easy to set up and use. Would definitely recommend!

Accurate and simple loan management. Very "user friendly" for our staff and our customers.

PROSProvides all the pertinent information for loan management at the click of a button. Simple and convenient navigation for the customer with online access and payment options. The very few times we have had technical problems, AutoPal's technical group has an immediate answer, and has everything up and running very quickly.

CONSDoesn't account for "Lease Income" separately. The additional "tools" are quite expensive. The website offered is very limited in "edit" options.