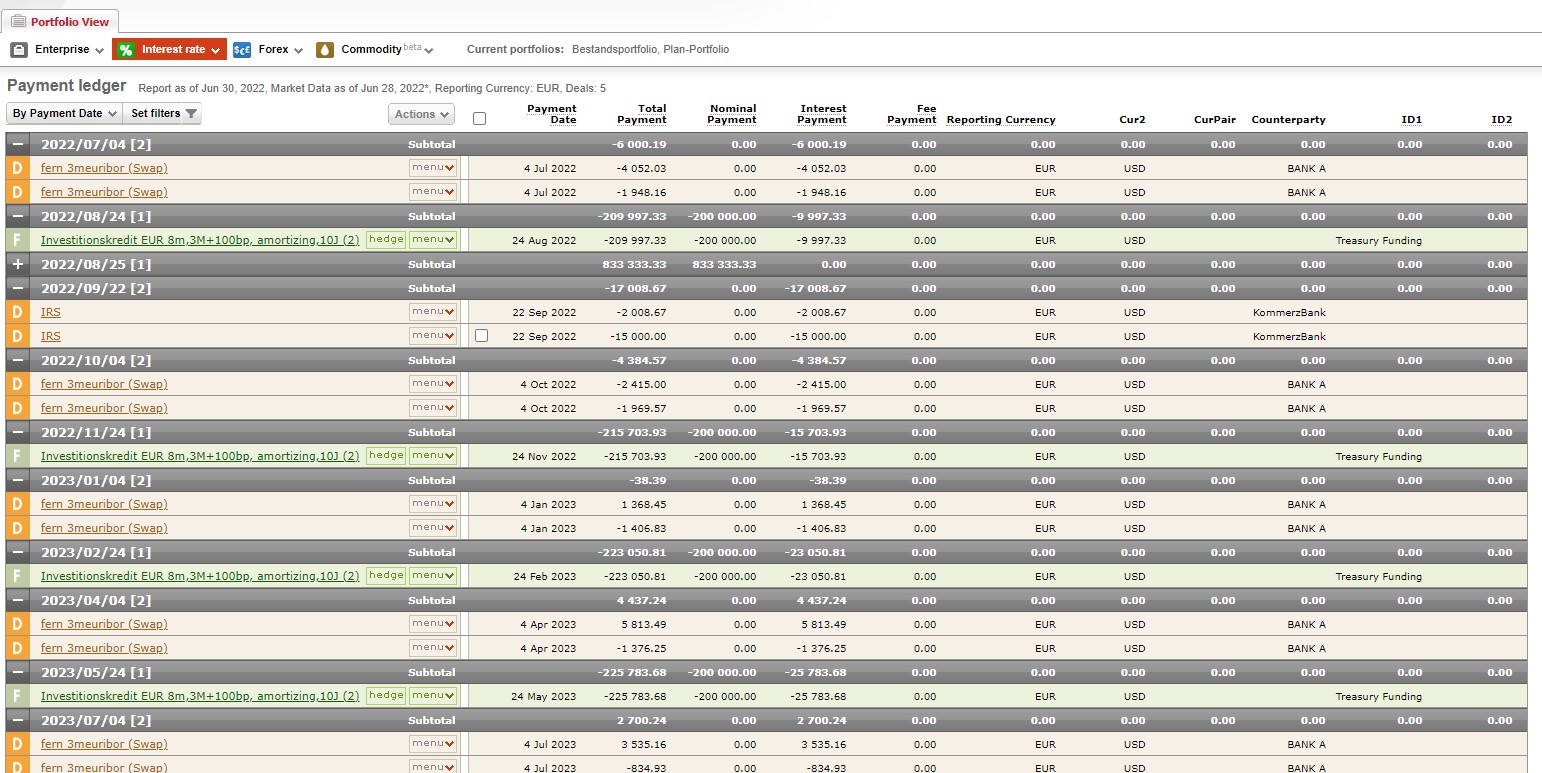

TreasuryView

About TreasuryView

TreasuryView Pricing

TreasuryView offers 14 day free trial, no credit card needed. Tiered pricing starting from €99/month (time-limited special offer), 12 months contract. Typical treasury team set-up for debt and IR hedges management starts from €330/month, including up to 5 users, add-on's: extended functionality and intraday market data +API portal access. Base currency EUR (othe base currencies or multicurrency add-on upon request). No IT integration project, spot start.

Starting price:

€250.00 per month

Free trial:

Available

Free version:

Available

Most Helpful Reviews for TreasuryView

4 Reviews

Sven

Financial Services, 11-50 employees

Used daily for less than 12 months

OVERALL RATING:

5

EASE OF USE

4

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed June 2023

Professional and affordable application

Fulfilling all the needs for the administration of our loans, forecasting interests and repayments, automation bookkeeping with imports

CONSDue to the extent of calculations one must be aware of the time which is needed to generate a report, so selections must be carefully done.

Reason for choosing TreasuryView

some were integrated in a larger application, some didn't meet our requirements

Miguel Angel

Retail, 201-500 employees

Used weekly for less than 12 months

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed December 2023

One of the most compelling tools you might want to use if you are a treasurer

My experience so far with Treasury View could not be better. I have been an intensive user from the beggining and it is been a great buddy to my to day to day job.

PROSIt is very intuitive tool to use with enought capabilities to get a clear understanding of your company's treasury status. I also really value the support I get from their team setting it up for my company.

CONSI think the layout of some menus could be improved but it is just estethic.

Silver

Government Administration, 10,000+ employees

Used weekly for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

4

Reviewed February 2023

My review

Simplicity and ease of use, access to real time data

CONSDifficult to bring out anything special, everything we use works fine and is easily usable

Nico

Real Estate, 11-50 employees

Used weekly for less than 6 months

OVERALL RATING:

4

EASE OF USE

4

VALUE FOR MONEY

4

CUSTOMER SUPPORT

5

FUNCTIONALITY

4

Reviewed November 2023

Die Finanzierung im Überblick

Das Produkt ist leicht verständlich, übersichtlich und gut strukturiert.

PROSIch kann alle laufenden Darlehen und Zinsderivate übersichtlich darstellen

CONSFinanzprodukte lassen sich beim Kopieren nicht in andere Produkte wandeln.