QuickBooks Payroll

No reviews yet

Overview

About QuickBooks Payroll

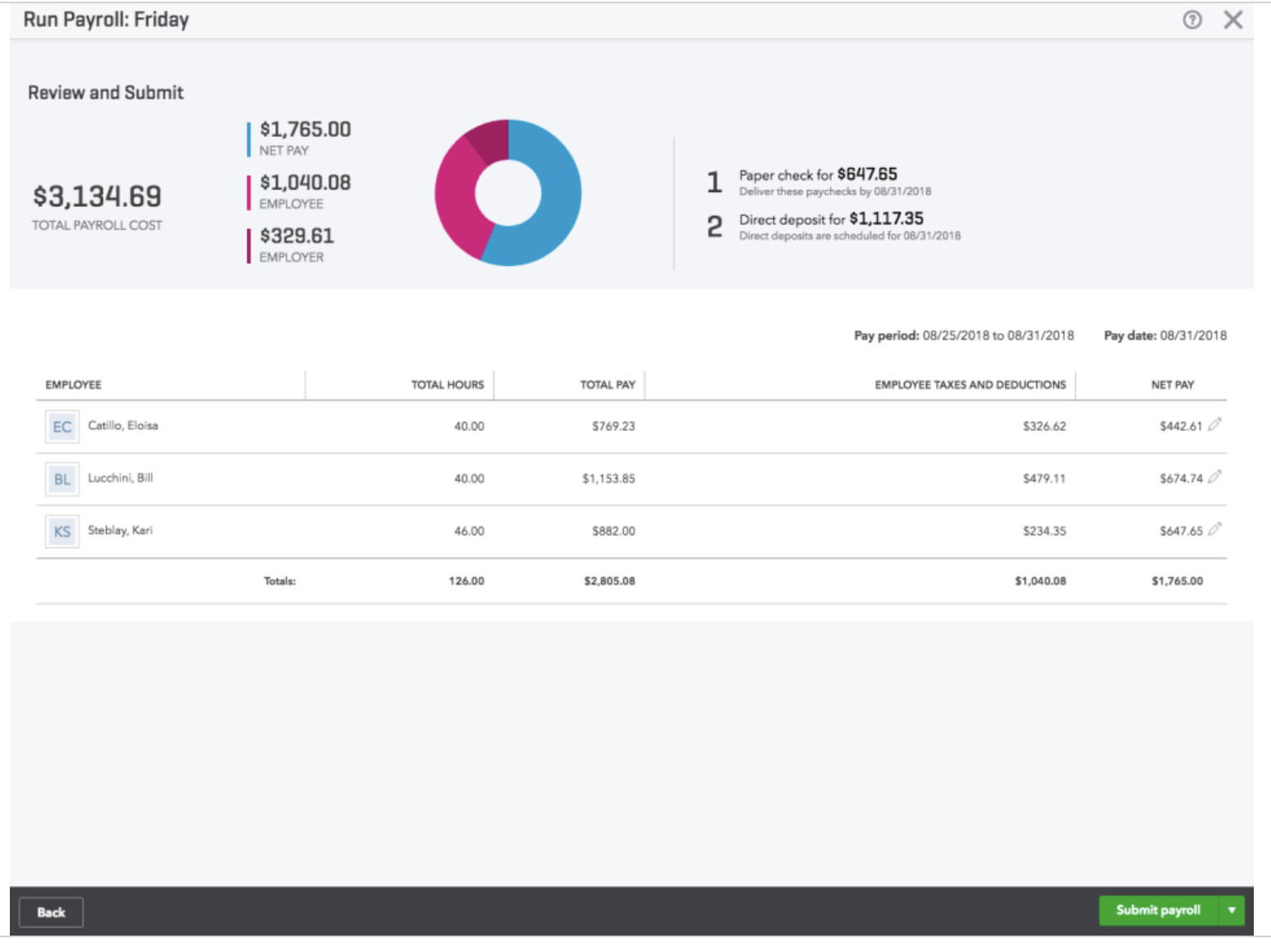

QuickBooks Payroll is a technology-enabled HR services platform that offers human resource (HR) and employee management services for small businesses. Serving clients across multiple geographical regions, it helps organizations manage processes for onboarding, compensation calculation, attendance tracking and benefits administration.

The HR advisory team provides consultation on topics such as compliance management, hiring best practices, creating job descriptions and more. With its tax penalty protection, QuickBooks Payroll can resolve errors and automatically reimburse penalty charges or interest costs while filing federal or state payroll taxes. Additionally, it offers one-on-one legal guidance on state and federal laws for employee compensation or overtime rule...

QuickBooks Payroll Pricing

Payroll only: Self Service Payroll: $17.50/month for the first three months ($35/month thereafter) + $4/employee/month. Full Service Payroll: $40/month for the first three months ($80/month thereafter) + $4/employee/month. Payroll with QuickBooks Simple Start: Self Service Payroll: $27/month for the first three months ($55/month thereafter) + $4/employee/month. Full Service Payroll: $50/month for the first three months ($100/month thereafter) + $4/employee/month.

Starting price:

$70.00 per month

Free trial:

Available

Free version:

Not Available

Other Top Recommended HR Services

Be the first to review QuickBooks Payroll

Share your thoughts with other users.