Trust Accountant Cloud

About Trust Accountant Cloud

Trust Accountant Cloud Pricing

Contact Delta Data for pricing information

Starting price:

$100.00 per month

Free trial:

Available

Free version:

Not Available

Other Top Recommended Legal Software

Most Helpful Reviews for Trust Accountant Cloud

4 Reviews

Robin Ann

Law Practice, 11-50 employees

Used weekly for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

FUNCTIONALITY

3

Reviewed August 2020

A Non-Accoutant can use it

This law firm works with a number of estates in which estate assets are used to fund trusts under a Will. Some bills are paid: professional fees, taxes, trust expenses. These trusts do not pay day to day living expenses for the beneficiaries. Each trust has a brokerage account with a large firm, and we receive monthly statements. As far as what is happening in the brokerage account, the monthly statements are fine. I am expected to make a financial snapshot by keeping tract of real estate values and brokerage statements.

PROSAs someone with no accounting experience, after reading the manual, I was able to get Trust Accountant up and running.

CONSI have found it difficult to begin a new file, depositing new assets with their values. I once set up a number of asset categories that were unique for the file, but now that the trust has paid out, I will never use them again, and don't know how to eliminate them.

Reason for choosing Trust Accountant Cloud

It was the only program found that would do trust accounting.

Vendor Response

Thank you for the feedback. Someone will be contacting you regarding your concerns about unused asset categories

Replied September 2020

Steven

Financial Services, 2-10 employees

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed August 2020

Adaptable platform for Retirement Accounts

Excellent platform with ease of customization.

PROSPlatform allows for non-traditional retirement assets. Price is far more affordable than non-adaptable platforms. Service response has been exceptional.

CONSLearning curve for software a little longer.

Reason for choosing Trust Accountant Cloud

Price and reliability.

Penny

Law Practice, 51-200 employees

Used daily for more than 2 years

OVERALL RATING:

4

EASE OF USE

4

VALUE FOR MONEY

4

CUSTOMER SUPPORT

3

FUNCTIONALITY

3

Reviewed September 2020

Good Trust Accounting Software

Overall this is a good software for smaller firms.

PROSThe software is easy to use and great for small fiduciary services businesses to be able to do trust accounting accurately and draft checks, etc.

CONSThe lack of ability to fix a transactions before posting; causes a lot of extra steps. Also, not printing the trust name on the top of the checks; I created a work around so banks will accept but it is a manual process.

Reason for choosing Trust Accountant Cloud

All the other software we looked at in our price range was more for business accounting and not fiduciary accounting. And since we was just starting out, we needed an affordable software

Vendor Response

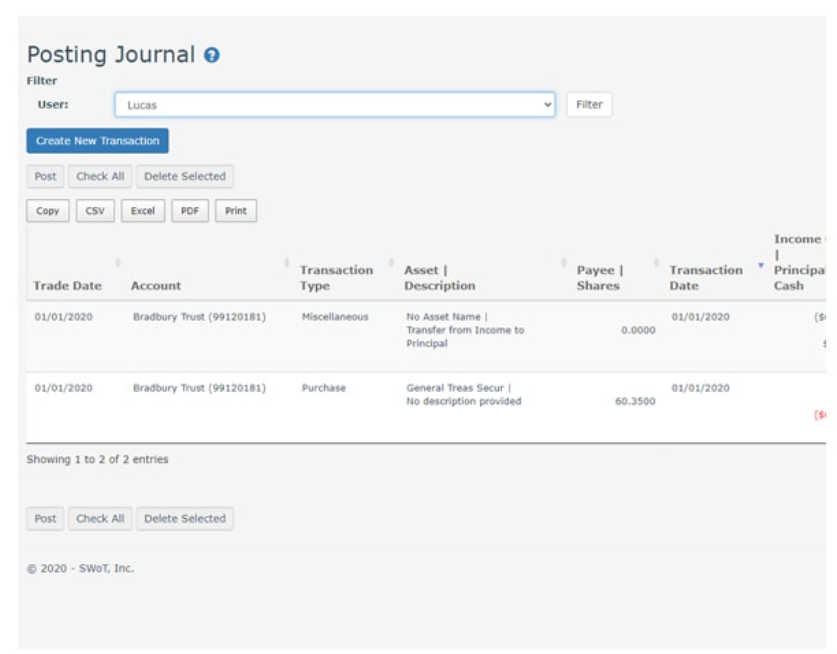

Thank you for the feedback. Transactions in Trust Accountant are initially recorded to the posted journal, where they can be fully edited or deleted prior to posting. We will contact you to review the feature. Our Trust Accountant Cloud product also allows transactions to be corrected in the posting journal prior to posting. In addition, Trust Accountant Cloud allows the trust name to be printed at the top of the check. We'd be happy to provide you a demonstration that and all the other features of Trust Accountant Cloud

Replied September 2020

Johnathan

Banking, 51-200 employees

Used daily for less than 12 months

OVERALL RATING:

5

EASE OF USE

4

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

4

Reviewed June 2020

Reliable, Cost-Effective Trust Accounting Software

Technical support has been very responsive to our requests as we are learning the software. Most of our calls have been related to learning the software and the best way to enter transactions. The couple of "bugs" were fixed in a timely manner and to our complete satisfaction.

PROSPricing and features were a good fit for our Trust Department's size and needs. The software capabilities and functionality will expand and adapt as our Trust Department continues to grow.

CONSData entry at this point is a bit cumbersome. I anticipate this will become easier as we integrate importation of data from Charles Schwab into the program.