CreditOnline

About CreditOnline

CreditOnline Pricing

We have two licences: CreditOnline - Startup - 12,000 EUR with frontend template. CreditOnline - Core - starting from 25,000 EUR

Starting price:

€900.00 per month

Free trial:

Not Available

Free version:

Available

Most Helpful Reviews for CreditOnline

1 - 5 of 11 Reviews

Oriol

Verified reviewer

Financial Services, 2-10 employees

Used daily for less than 12 months

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed July 2019

CREDITONLINE

Easy to use. Powerful tool for daily use. Great design and features. Best quality/price choise.

PROSThis software has a lot of tools that you need to use in loan business. It has great customer support service 24/7. Best quality/price choise.

CONSPersonalized reports must be programmed separately.

Reasons for switching to CreditOnline

End-to-End lending process, you can easily personalize it for your company needs.

Petr

Financial Services, 2-10 employees

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

4

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed December 2022

Creditonline - The power of loan business

Overall, I would rate the work with the system as very good. The functions of the system correspond to the requirements for credit management. "Step by step" introduction of new functions or products is not a problem.

PROSA very comprehensive product for credit management, in which you can set almost everything that is needed in this line of business. I would highlight the availability and willingness of support. Once the system is implemented, credit management is already very simple. The advantage is certainly the very high level of automation of the entire loan management process and the consequent saving of human resources. The description of the API is very well done. The possibility of quick implementation of legislative changes is also an advantage. The system is in constant development, which brings improvements and new functions.

CONSOne of the disadvantages of the system is certainly the outdated and minimalistic help system. The complexity of the system can also be perceived as a certain disadvantage, mainly due to the need to initially "set everything up".

Jelena

Banking, 51-200 employees

Used daily for more than 2 years

OVERALL RATING:

4

EASE OF USE

3

CUSTOMER SUPPORT

5

FUNCTIONALITY

4

Reviewed December 2022

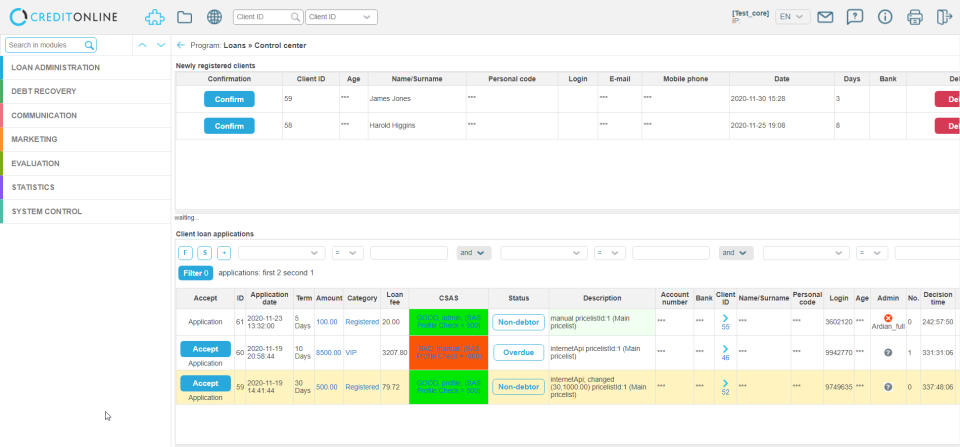

good system for loan application check

we can, by yourself, change the CSAS reject/ accept/manual check rules

CONStrigger conditions form, request the external database only "IF"we implemented a simple filter for a very long time (almost a year), a very inelastic system in this point

Vilma

Financial Services, 11-50 employees

Used daily for more than 2 years

OVERALL RATING:

4

EASE OF USE

5

VALUE FOR MONEY

4

CUSTOMER SUPPORT

4

FUNCTIONALITY

4

Reviewed November 2022

Long time user of the system

I have been working with the creditonline system since 2016. Since then, many different projects have been implemented, from very simple to very complex and very time-consuming. The functions of the system have been fully adapted to the needs of company. The system is periodically updated, additional new functions appear, which make everyday work easier. It would be great if the queues of requests were reduced a bit and some requests would be done faster.

PROS*The system is simple*It is easy to adapt to a specific business*The system provider always creates additional necessary functions/processes*A significant number of changes can be made without the intervention of a developer.*The system works smoothly, interruptions are very rare.

CONSFor some seemingly very simple tasks, the deadlines seem quite long. Waiting 60 days for a request to be processed sometimes seems really too long.

Ioan

Financial Services, 11-50 employees

Used daily for less than 12 months

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed September 2020

We used Creditonline’s solution to launch our system.

The product is oriented for the profitable loan business portfolio scaling. Creditonline’s main attribute was integrity – it allowed our company to go into the market quickly and the solution offered by them was appropriate. What is especially useful is that we only pay for what is needed in our particular case and therefore we did not acquire additional unnecessary expenses. The solution allowed our businesses to grow by adapting it's processes to our requirements. It also reduced staff costs and unnecessary human error and improved bottom line. Creditonline’s team has been great to work with.

CONSThis software impproved a lot the management of our loans portfolio, I guess the only downside, if we can call it a downside, is the learning curve of our agents.