Finflux

About Finflux

Finflux Pricing

Free trial:

Not Available

Free version:

Not Available

Most Helpful Reviews for Finflux

1 - 5 of 21 Reviews

Atul

Verified reviewer

Financial Services, 201-500 employees

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed March 2023

Fabulous Product | Highly Configurable

Highly motivated team and leadership. Stable and scalable product.

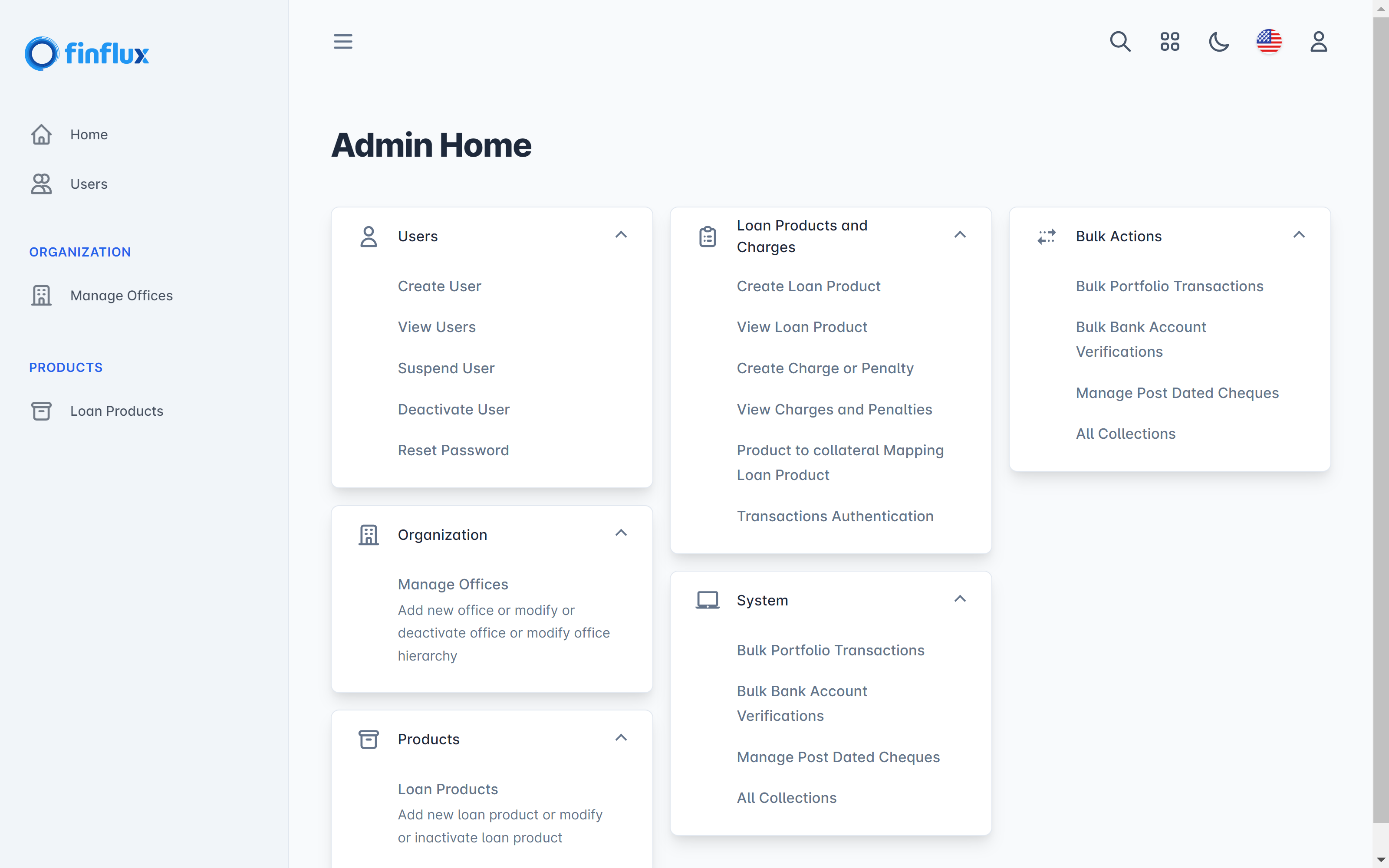

PROS1. Highly configurable.2. Good UI3. Data accessibility is well defined through API's and DB calls.4. Manages the compliance part for user Management, Accounting and trails.

CONSNothing as such... I didn't find anyshortfall.

Reason for choosing Finflux

Scalable, Configurable, Reasonable Price and most important the leadership team.

George

Verified reviewer

Financial Services, 201-500 employees

Used daily for less than 12 months

OVERALL RATING:

4

EASE OF USE

4

VALUE FOR MONEY

5

CUSTOMER SUPPORT

3

FUNCTIONALITY

4

Reviewed January 2018

I have been using finflux sincen 2016 and had the experience of implementing the system on premise

1-Direct integration with our external system using Finflux's API 2-Easy flow of data entry process 3-Improving the speed of our overall business processes

PROSThe overall functionality of Finflux delivers a stable and efficient environment. During the implementation i didn't find difficulties during migration nor implementation of the system Users never had any complains about the easiness of flow while working and using Finflux on a daily basis So as an overall we are satisfied with what Finflux provides as services

CONSThe UI is kind of standard with its design, so a little improvement with the design would be a good touch. There are some challenges with the bulk transaction usability in the system. especially for MFIs who import daily bulk transactions like al Majmoua. The system lacks proper documentation. Sometimes when a version is released you have to find your way in understanding how some features work. The configuration part of the system also needs detailed documentation to be more understandable. Along some documentation about database optimization for large institutions would be good too

Jonna

Banking, 11-50 employees

Used daily for less than 2 years

OVERALL RATING:

3

EASE OF USE

3

VALUE FOR MONEY

3

CUSTOMER SUPPORT

2

FUNCTIONALITY

2

Reviewed January 2018

mostly standard software which needs a lot of tweaking for non-standard products and reports

easy to use and navigate for standard users, everything in one place (operations and accounting), flexibility to include new/customized reports

CONSsometime too standard (meaning a lot of work around for adjusting to non-standard loan products); sometimes inflexible for requirements (software made for SHG and JLG approach in India becomes often visible); better customization options would be appreciated; MIFOS lacks behind with features like offline / app / sms functions etc and it long delays in developing them; many troubleshooting is required and we have to scale up issues to the service team nearly weekly

Anupama Devi

Banking, 501-1,000 employees

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

4

Reviewed February 2020

Finflux, banking platform for NBFC, Lending institutes and Micro-finances

FInflux helped our operation team to reduce the TaT for disbursing the loans, faster onboarding of JLG and Centers. helped in reducing manual data entry error by digitizing the entire loan origination process, Aadhar based on KYC and data capture, automated CreditBureau inquiry and rule engine to make better decisions. Highly recommend the Finflux system for NBFCs, MFI and Lending FinTechs

PROS1. Ease of use 2. Less manual intervention to complete most of the tasks 3. Reporting and Analytics features 4. Out of the box third-party integrations like Credit Bureaus (Highmark, Cibil, Equifax), IndiaStack, CYCK, Banking API, UPI

CONS1. The mobile app has limited functionality 2. User manuals

David

Verified reviewer

Computer Software, 11-50 employees

Used daily for less than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed January 2018

Fast Implementation and outstanding customer support.

- Fast implementation - Cloud-based on reliable servers - we receive customer supports withing 24 hours. - When we mess with something they don't find fault they find a remedy. - Always available customer service (Sometimes we get supports even late night.) - Lots of Features & Functionalities - Monthy updates and enhancements to the system. - If you ask them to walk with you 1 km, they will come with you 2 or more Km. That's how they win trust. - Affordable

CONS- Some functions (2 or 3)need more localization specially CRIB and other interrogations. But we have a great hope this also will available soon.