Lending & Leasing as a Service (LLaaS)

About Lending & Leasing as a Service (LLaaS)

Lending & Leasing as a Service (LLaaS) Pricing

Please contact DecisivEdge for pricing details

Free trial:

Not Available

Free version:

Not Available

Most Helpful Reviews for Lending & Leasing as a Service (LLaaS)

1 Review

John

Financial Services, 51-200 employees

Used daily for less than 2 years

OVERALL RATING:

5

EASE OF USE

4

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

4

Reviewed March 2020

Review

We've had bumps along the way. Our integration partner, DecisivEdge is exceptional and true partners with our business.

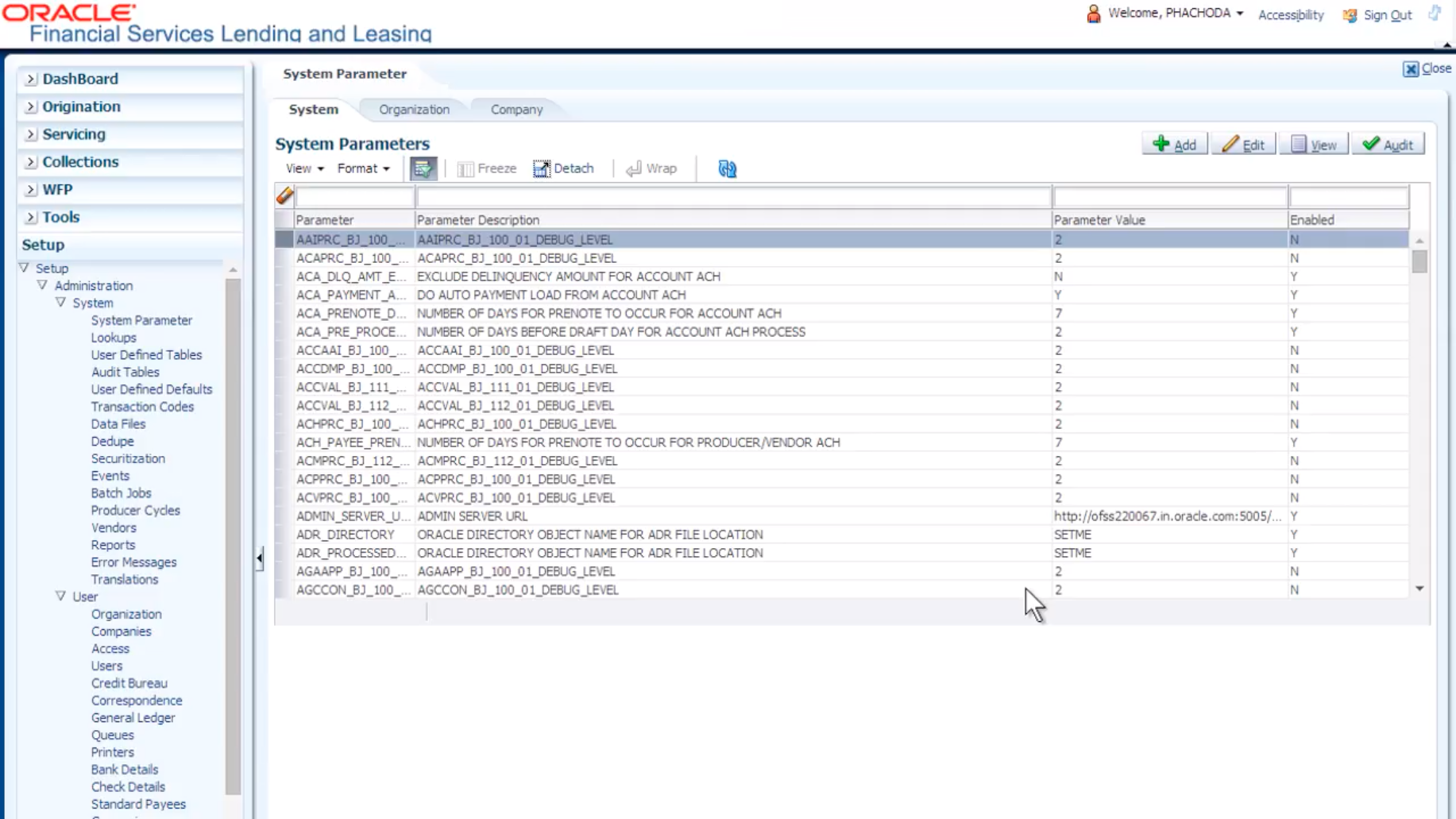

PROSOur ability to customize tracking attributes and maintain system properties and interfaces.

CONSWe had to customize the system significantly to adhere to lease to own laws across the 50 states.

Reason for choosing Lending & Leasing as a Service (LLaaS)

It won our formal RFP process. It had the most functionality for the price point we wanted to pay.

Reasons for switching to Lending & Leasing as a Service (LLaaS)

Salesforce had numerous issues managing rent to own leases.