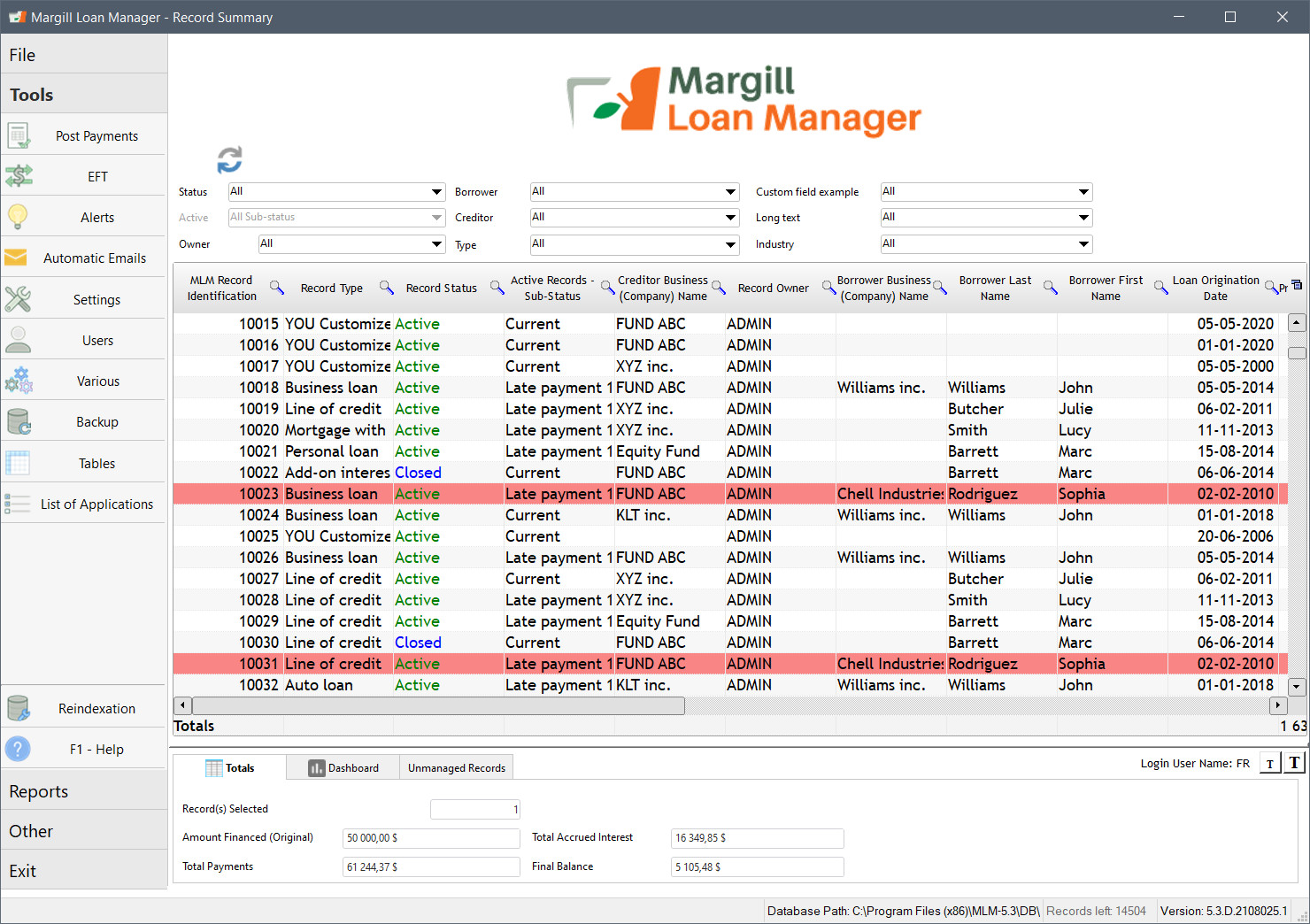

Margill Loan Manager

About Margill Loan Manager

Margill Loan Manager Pricing

Price is based on number of users and number of loans. Ideal for startups, small lenders and larger organisations. One-time cost for installed, on-site licence plus annual billing for updates, support and maintenance. SAAS (Cloud) installation payable on a monthly basis. Special discounts for non-profits and lower income countries.

Starting price:

$3,995.00 one time

Free trial:

Available

Free version:

Not Available

Most Helpful Reviews for Margill Loan Manager

1 - 5 of 47 Reviews

Abneesh

Verified reviewer

Financial Services, 11-50 employees

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

4

Reviewed December 2017

We have been using MarGill for over 4 years and are very satisfied with the services provided.

The software is user friendly and regular updates with new features are provided. It is very flexible to meet your business model and you can customize the reports to what you want to see. Usually there are pre-set reports in other softwares and I personally love this feature. They provide exceptional Customer Service. Questions and concerns are addressed right away. It is the Best cost to value software out there in the industry.

CONSThe only thing I gave 4 stars was at Features and Functionality, the software has improved a lot over the past years and our feedback and is always listened to and added on to the next update. Cust support and the team have been continuously evolving the software.

Michael

Financial Services, 11-50 employees

Used daily for less than 6 months

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

4

Reviewed March 2022

Ease of Implementation and USe

Exceptional - particularly due to the customer service and assistance.

PROSMargill provides our organization with all the functionality we require with the comfort that nothing will wrong. Customer service and assistance is exceptional and provides assurance if there is any questions or clarification required as to usability or functionality.

CONSOur methodology for calculating late interest required a work around. Would be nice to have this as a core capability of the software.

Reason for choosing Margill Loan Manager

Best fit for price

Reasons for switching to Margill Loan Manager

Needed capability to expand without introduction of errors

Vendor Response

Thanks for this Michael. Glad you are enjoying the software. As for the calculation methodolgy, Margill follows laws and regulations and industry and accounting rules. I am convinced your clients and your accountants will appreciate this rigor.

Replied March 2022

Roxann

2-10 employees

Used monthly for more than 2 years

OVERALL RATING:

3

EASE OF USE

3

VALUE FOR MONEY

3

CUSTOMER SUPPORT

4

FUNCTIONALITY

3

Reviewed February 2018

Good product

The developers are easily reached to assist you with any problems with the program. It is backed by it's developer

CONSThe program is really expensive the cost could be lowered significantly though offering a standard fee

Vendor Response

Thank you for the review. I do understand that you being based in Jamaica, the price may seem slightly high because of the currency exchange, but Margill is one the most affordable software out there starting at less than $2000. I'm a little surprised by your 3.5 stars. Seems because of the price...

Replied February 2018

Steve

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed December 2017

Excellent software with great support

We have used Margill for 3 years to monitor our growing private mortgage and auto loan business. We have hundreds of loans under management. We are a family office with our own money at risk. We would not use a software product that didn't deliver the information we need. We have been very happy with the software and the excellent support service and will continue to expand our licence as our business grows. If the software doesn't meet someone's requirement during a demo period so be it. It happens every day. I do have an issue when I read someone posting a negative review on this site and suggesting that my company's satisfaction (after a thousand hours of use) is not real and that other reviewers have knowingly posted positive misleading reviews. Pure nonsense. And it really speaks volumes about the character of that reviewer to frame their comments this way.

CONSWould like more video tutorials as we probably only use a fraction of the software's capability. We find video tutorials more effective than most manuals.

Vendor Response

Thanks for the comment Steve. As for videos, we are starting our little collection which you can see in the Support Center: www.margill.com/en/support-center/. The Support Center also has our blog in which we regularly answer user questions. Many good questions in there!

Replied December 2017

Gary

Financial Services, 11-50 employees

Used daily for less than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed November 2023

Margill Loan Servicing Great Program

I have had a great experience in regard to Margill. Great Staff, Very Responsive, Great Customer Service.

PROSEasy to use, accurate. Great Staff. [sensitive content hidden] has helped migrate all of our servicing needs from our previous provider and has been with us all along the way. He has provided over the top customer service.

CONSEverything has been great. Only wish the due dates for us was a bit easier to manage.

Reasons for switching to Margill Loan Manager

They discontinued servicing their program.

Vendor Response

Hi Gary, thanks for your time and effort in sharing your experience with others. We truly appreciate it and hope you continue to enjoy using our software. Please don't hesitate to reach out if you have any questions or suggestions for us. We're always here to help.

Replied November 2023