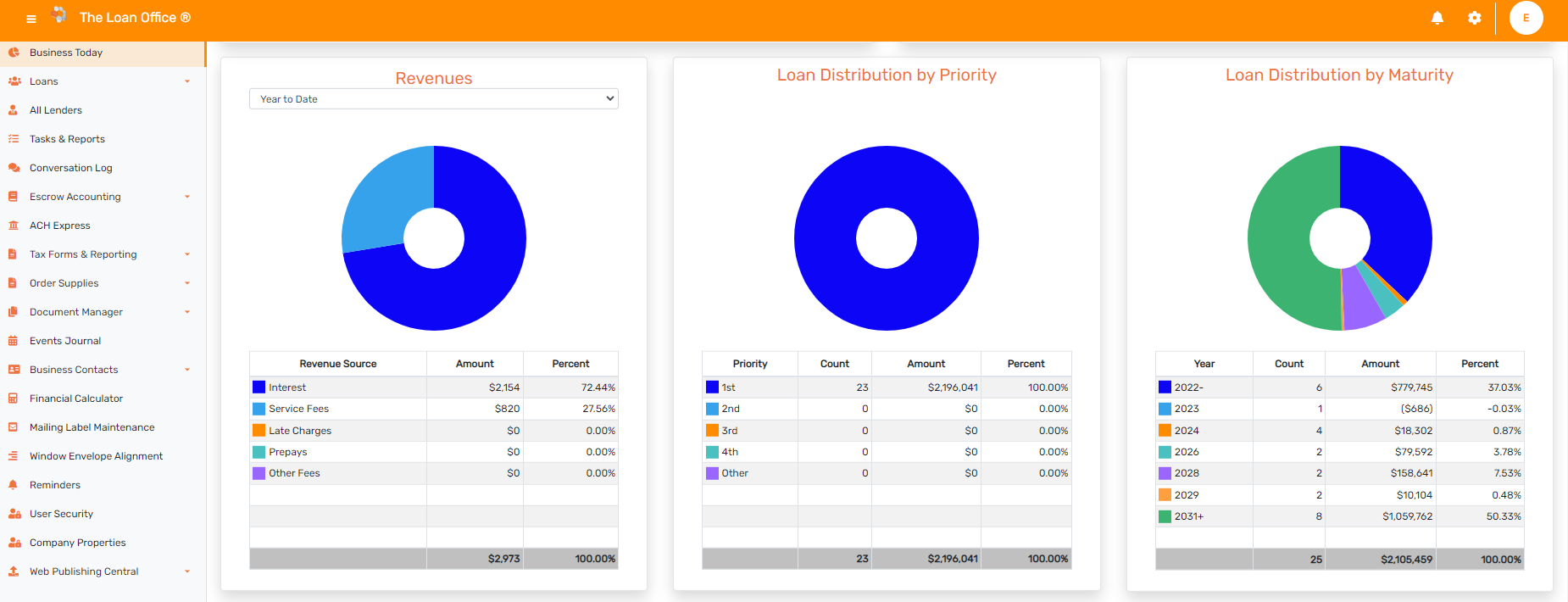

The Loan Office

About The Loan Office

The Loan Office Pricing

Starting price:

$389.00 per month

Free trial:

Not Available

Free version:

Not Available

Most Helpful Reviews for The Loan Office

1 - 5 of 40 Reviews

Jorge

Verified reviewer

Real Estate, 11-50 employees

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed October 2018

Great loan software

I really like that you can have separate databases for customers depending on what company you're using. The ability to edit the letters , the reports, and the price

CONSThat it doesn't integrate with an online account for the customer to view their balances and make their payments

Bruce

Banking, 2-10 employees

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed October 2019

W're thrilled we left a full service servicer to switch to The Loan Office

We're a family office that manages approx 50 loans. We outsourced the back office functions to a major service provider for many year. We used to spend many hours monitoring all activity and then hours getting them to correct mistakes. The mistakes became so painful that we decided to take the chance to do it ourselves. Fortunately, we found The Loan Office. As it turns out, it takes no more time for us to enter the data ourselves into The Loan Office than it took to monitor and correct the outside service. Therefore, we're saving a lot of money without any downside. We feel better having more control. As a "small loan servicer", the reporting is less than was necessary because we were serviced to a large loan servicer. While we'd recommend that you do your homework to understand the features of The Loan Office, we're confident that The Loan Office will successfully do what it says it will do - what more can we ask.

PROSThe software does all of the paper work that we need done to manage the loans. We have full data at our fingertips whenever a borrower has a question.

CONSThe company sells a software program, the Mortgage Office, that's many many times more expensive than the Loan Office and has has more feature and capabilities. I guess the "con" of the Loan Office we purchased was that it doesn't include all of those features. However, the reality is that for our company, we didn't need any of those feature and we're very happy with The Loan Office as is.

Reasons for switching to The Loan Office

We switched to save money but the real benefit was far more control with really no more effort than it took to closely monitor the outside service.

Toni

Food & Beverages

Used less than 2 years

OVERALL RATING:

3

EASE OF USE

3

VALUE FOR MONEY

4

CUSTOMER SUPPORT

4

FUNCTIONALITY

3

Reviewed September 2016

Equipment purchases - Loan

We are still getting use to the software. I have a new supervisor on board who is reviewing the equipment program at this time. We may decide to remove the old items and get on board/better handle with new items coming in year 2017

PROSreporting

CONSnot understanding one section of loan program

Terri

Financial Services, 11-50 employees

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed October 2019

Mortgage Office Review

We use the Mortgage Office to service the commercial mortgages for our loan department. The software provides the necessary tools to service our loans. The customer service department is excellent and has always done a superior job making sure that our needs are met.

PROSThe software is very easy and simple to use. It doesn't matter if you are a new user or a long time user the training to use the program is very minimal. The reports are easy to find and prepare.

CONSIt would be nice if we could make custom reports if we only want to pull specific data. I would like to be able to keep track of our UCC filings in the software in addition to property insurance. I don't like that there is a separate fee for the amortization feature. I feel like this should come with the software.

Bonny

Banking, 2-10 employees

Used daily for less than 12 months

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

4

Reviewed September 2016

Glad we made the switch!

We have been very happy with our installation of TLO. The support from Wyatt Gilbert, Ramiro Ruiz and JoAnn was fantastic. They answered endless questions while we were making our decision, and supported us every step of the way during implementation. Our processes are much more efficient, our information on files is more consistent and easier for staff to access. Since bringing TLO online, we have been able to successfully expand our territory without any added staffing expense. Loan Office was easy for staff to learn to use, and the integration with Quick Books is nearly seamless.

PROSEase of use, ability to store & organize attached files, multi user capability. The integration with Quick Books for exporting payment transactions is smooth.

CONSThe Reminders section is not as flexible, or visible as we would prefer. The custom reporting component is not user friendly, even with an experienced Crystal Reports user. We use the custom fields extensively, but find it difficult to report on those fields