PayNet Banking Platform

About PayNet Banking Platform

PayNet Banking Platform Pricing

Per user pricing with fixed monthly minimum users

Starting price:

$1.00 per year

Free trial:

Available

Free version:

Available

Most Helpful Reviews for PayNet Banking Platform

1 - 5 of 13 Reviews

Nader

Financial Services, 11-50 employees

Used daily for less than 6 months

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed March 2021

Excellent software and partnership

Great product and company

PROSCommitment, support, flexibility, cost effective, business modeling

CONSNone to be honest, paynet system gave us more than we expected not only current requirements but also future.

Reason for choosing PayNet Banking Platform

Paynet leadership and wide system features and reliability

Shivaraj

Banking, 1,001-5,000 employees

Used daily for less than 12 months

OVERALL RATING:

4

EASE OF USE

4

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed July 2020

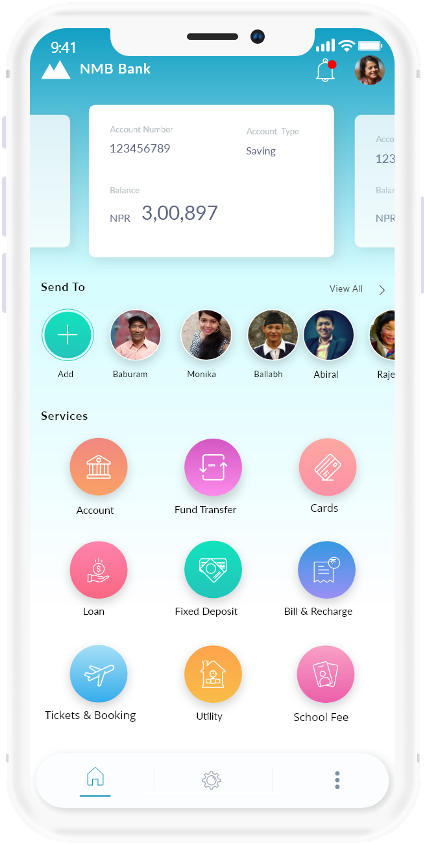

NMB Bank Omni Channel Banking

We are still in the implementation phase, but till date the implementation is as per the requirements of the bank and the scope of work as agreed. we are yet to go public but the feedback from the soft launch is impressive and it has given us more energy to implement this product as a integrated channel for all the banks business offerings.

PROSThe Product is build as per the Scope and is different than the traditional Mobile and Internet banking, the Clients of the banks will get the same experience in all the channels. As the system is still under implementation we have lot to do and the team behind this are working round the clock to make things as per the scope. The team has built the system in such a way that bank can implement any client needs easily.

CONSNo Comments on this, as we have long way to go. but till date what has been delivered is up to the mark and hope the team will delivery rest of the scope as expected.

Reasons for switching to PayNet Banking Platform

Banks Strategic Decision to implement Omni Channel where bank will be enable to provide its clients with new experience with banking services as current mobile banking was more focused on payments only.

Anonymous

11-50 employees

Used less than 12 months

OVERALL RATING:

4

EASE OF USE

4

VALUE FOR MONEY

4

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed March 2021

Personalizing the Banking Experience

Banking before digital transformation is like this huge excel file with hundreds of sheets about millions of people, which carries hundreds of potential patterns & data points of every individual that are not organized and interpreted for business development but duplicated and considered a hassle to manage. But, with an omni channel digital banking solution it not only organizes your data but also identifies patterns and data points to notify and connect you with potential leads/ opportunities. Alongside It gives your team the freedom to innovate & cultivate strategizes in alignment to your organizations values & visions.

CONSIt's a long & tedious process of integration. It requires a lot of time investment and devotion from key people of the organisations, hence finding the hours for already ongoing projects or daily work might be affected.

Archil

Financial Services, 11-50 employees

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

4

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed February 2021

Experienced and responsive

I should stress the architecture, rich functionality and reliability of the system as well as highly professional and responsive team

CONSWe look forward to next iteration of currency exchange functionality

SAM

Banking, 11-50 employees

Used daily for more than 2 years

OVERALL RATING:

4

EASE OF USE

4

VALUE FOR MONEY

4

CUSTOMER SUPPORT

5

FUNCTIONALITY

4

Reviewed July 2020

FEEDBACK

ITS EASY TO NAVIGATE THE PLATFORM I.E IT'S USER FRIENDLY

CONSNOTHING COMES TO MIND AT THE MOMENT, AS STATED ABOVE NAVIGATING THE SYSTEM WAS OK.