QuickBooks Payments

About QuickBooks Payments

QuickBooks Payments Pricing

Pay Monthly & Save $20 per month Swipe Rate: 1.6% Key Entered: 3.2% Transaction fee: $0.25 Pay-as-you-go $0 per month Swipe Rate: 2.4% Key Entered: 3.4% Transaction fee: $0.25

Free trial:

Available

Free version:

Not Available

Most Helpful Reviews for QuickBooks Payments

1 - 5 of 68 Reviews

Nathan

Verified reviewer

Consumer Services, 2-10 employees

Used monthly for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed October 2018

Fast and easy credit card processing

I was using a set desktop solution before that had a long term commitment. This allowed us to take mobile payments anywhere we had a cell phone and get out of those long term contracts. Also it smoothly integrated into QuickBooks so it was a win-win for us.

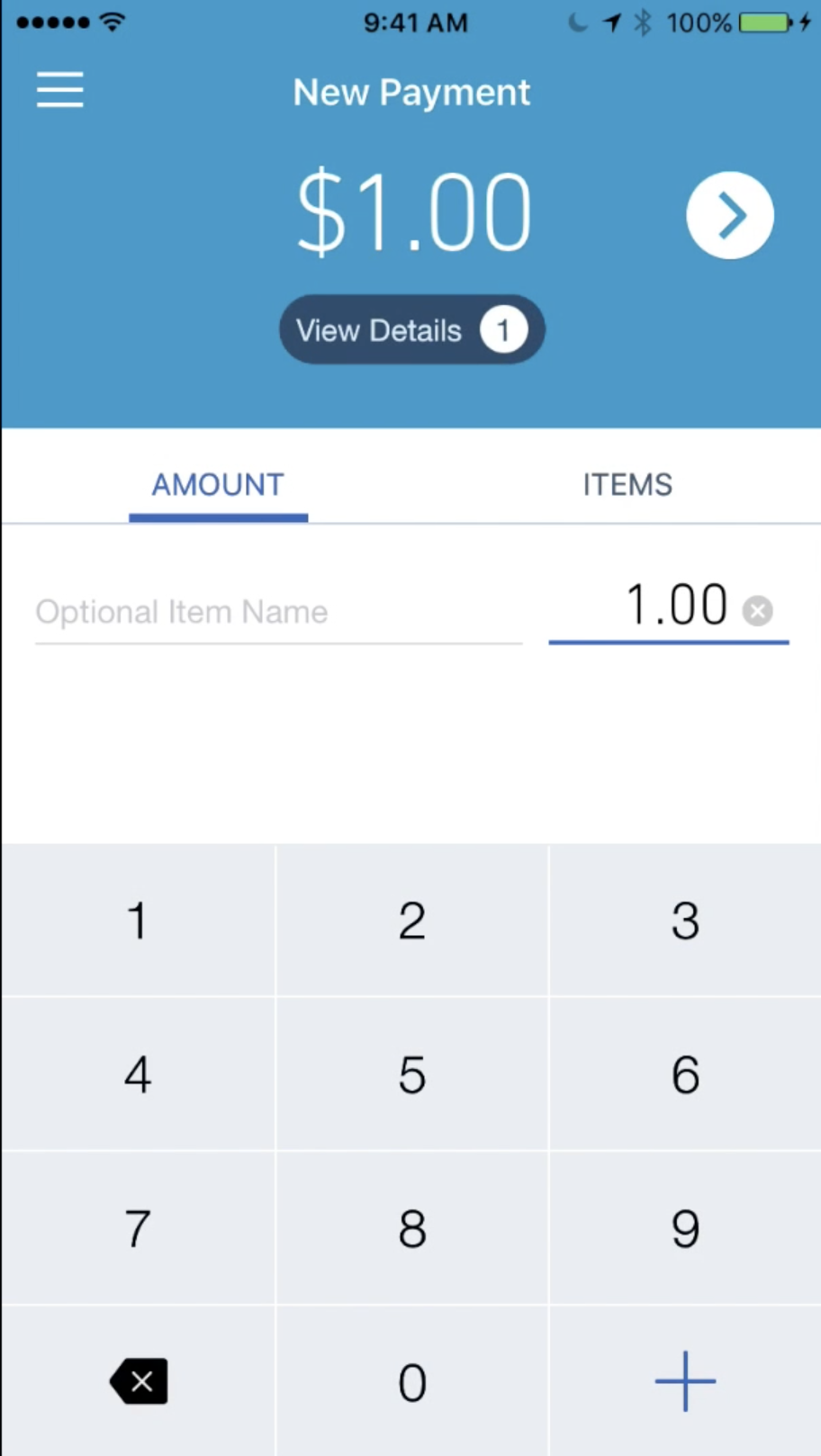

PROSI has many options for taking a credit card payment. Plug in chip reader, take a picture of the card or a Bluetooth card reader is available. I like that it's month to month and if I don't use it I don't have to pay anything. It's simple and easy to integrate into quickbooks. It has a good back end that you can access from a computer to manage your payments and who is taking those payments.

CONSThe cost is cheaper if you pay monthly and high volume but more expensive for the smaller low volume months. When you get logged out it can be a slow process at times to get logged back in while a customer is waiting to give you their payment.

Vendor Response

Hi Nathan. I'm glad the integration options and flexible methods for processing have provided a simple payment management system for Complete Carpet. Thanks for reviewing, and for being a member of the QuickBooks family. If you're running into latency with logins, rest assured I've got you covered. I suggest uninstalling/reinstalling the GoPayment app, which is the easier way to ensure your software is updated. This simple troubleshooting step will get you back up to speed and cut-down on customer wait times. Before you go, I want to ensure you continue to get the most from the payment system. The support landing page for the program has insights into the connection to QuickBooks, as well: https://community.intuit.com/products/quickbooks-payments-help-en-us. As for the price, I'd be glad to discuss your options. There are alternatives for your average volume, and I've got the tools to dig into your account. We'll go from there. Jess, The QuickBooks Team

Replied November 2018

Jenine

Construction, 2-10 employees

Used daily for more than 2 years

OVERALL RATING:

4

EASE OF USE

5

VALUE FOR MONEY

4

CUSTOMER SUPPORT

3

FUNCTIONALITY

5

Reviewed May 2022

Overall a solid payment app! Definitely save you time

Overall I have had a positive experience with QuickBooks Payments. Like I mentioned above we do get paid much quicker which is a plus. It is also super easy to integrate any other payment applications into QuickBooks which saves you a lot of data entry

PROSQuickBooks Payments definitely is convenient if your already using QuickBooks for your accounting software. Payments are automatically matched up with the correct invoice and I find that customers pay a lot sooner since they have the ability to pay straight from their invoice.

CONSThe only real issue I think is that the fees can add up quick!!! If a customer pays with a credit card it's 2.4% plus $.25 each transaction. Although that is typical it just adds up very quick especially if it's a large transaction. What they don't tell you is that if you customers pay through ACH instead of credit card the max you will pay for a fee is $10. If we had known this all along we would have saved a lot of money. Very frustrating

Reason for choosing QuickBooks Payments

We actually used both of them for a while but with QuickBooks overall is easier to use and less expensive.

Amy

Non-Profit Organization Management, 2-10 employees

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

FUNCTIONALITY

5

Reviewed March 2024

Ease of use for Quickbooks Payments

The ease of use for both the business and the customer is by far one of the best things about using Quickbooks Payments. The transactions are smooth and the deposit turnaround time is quick. Makes for a seamless transaction for both parties - literally just a click of a button.

CONSNot much to say about dislikes of this feature

Jesse

Retail, 1 employee

Used weekly for more than 2 years

OVERALL RATING:

1

EASE OF USE

4

VALUE FOR MONEY

1

CUSTOMER SUPPORT

1

FUNCTIONALITY

1

Reviewed July 2021

Quickbooks Payments makes their users vulnerable to FRAUD

This vulnerability is unforgivable. This service should not be used.

PROSI have used QB Payments as a secondary payment processor for nearly 9 years. I use e-invoices to collect payments from customers who want to order modifications that aren't available on our website. So it's not our primary processor (our website uses PayPal and Stripe), but until a recent MAJOR VULNERABILITY was discovered, my experience with QB Payments was fine.

CONSI learned the hard way that QB will "pre-fund" ACH transactions and merchants have no option to toggle this option off. Their back-end payment status (e.g. Pending, Funded....) doesn't differentiate from a "PRE-FUNDED" transaction and one that is actually fully funded. Furthermore, they allow banks to deny payments up to 120 days after posting to the seller's bank account. This leaves sellers extremely vulnerable. If you're not picking up on it, basically, Intuit/Quickbooks will show FUNDED status and actually post the payment to the seller's bank account, at which point the seller has no grounds to withhold goods. Then, if the payment doesn't actually process, they will withdraw the funds from the seller with no 2-way dispute process for the seller to prove they actually fulfilled an order, and that a customer didn't seek return/refund by legitimate means. My small company lost about $3,000 in this loophole. We were not able to reclaim our merchandise or fulfillment costs, and Intuit held us responsible for the sum, including additional service fees (for the generous service of retracting this money they had already posted to our bank account?). Customer service was unwilling to escalate and did not provide me with any opportunity to report fraud. In fact they treated me like the fraudster when they made my business vulnerable to a fraudster in the first place. It comes down to zero's. $3K is enough to make me want to fix this. Add a zero and it would have ruined us.

Reason for choosing QuickBooks Payments

QuickBooks Payments is our backup processor. We primarily rely on PayPal and Stripe, which both provide much better fraud protection and a fair two-way process (and customer service support) in the rare event of a disputed charge. QB Payments completely fails on both fronts. Not a safe service to use.

Lori

Real Estate, 2-10 employees

Used monthly for less than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

4

FUNCTIONALITY

4

Reviewed January 2024

QuickBooks Payments are Easy to Integrate

It allows for simple payment for processing of invoices, and enables quick invoice set up even when on site.

CONSNothing that we didn't like, once past the initial setup, it runs very smoothly.

Reason for choosing QuickBooks Payments

It's integration with our QuickBooks Desktop program that we were already utilizing.