What is Inventory Accounting, and Why Do You Need It for Your Small Business?

Inventory is a major part of all product-based businesses and one that needs constant monitoring. Most product-intensive small businesses face low profitability or a lack of cash flow due to inventory mismanagement.

Unfortunately, many business owners and accountants don't consider how they will manage their inventory when starting their business. And those that do are less aware of proper practices to employ. A study found that 40% of small businesses with inventory either don’t track it or do so manually with pen and paper [1].

We talked to Pascal Ambrosino, a seasoned CPA, CBV, and CFO for Ontario-based private equity firm Burlington Street Partners [2], to understand how crucial it is to get inventory accounting right from the outset. Pascal has experience managing accounting practices for small and midsize businesses (SMBs) and has exposure to both IFRS (International Financial Reporting Standards) and US GAAP (Generally Accepted Accounting Principles) reporting standards [3]. He says, “If I were to distill the importance of inventory accounting into one factor, it is that: it improves decision-making.”

What is inventory accounting?

Inventory includes all materials, items, and merchandise purchased or manufactured by a business to sell in the market for profit. It is often one of the largest assets on a small business’s balance sheet. Inventory accounting tracks the flow of goods and their value over time, including the cost of goods in stock (also known as ending inventory) and the cost of goods sold (COGS).

For example, assume a small retail business buys 100 units of a product for $10 each, for a total cost of $1,000. When the business sells 50 units of the product for $20 each, while it’ll earn the revenue of $1000 (50 units x $20 per unit), the cost of goods sold will be $500 (50 units x $10 per unit). The remaining inventory value will be $500 (100 units - 50 units sold x $10 per unit), which can reduce if a product expires, gets damaged, or its market price drops.

Expert insight: Role of inventory accounting in small business

Pascal Ambrosino

CFO at Burlington Street Partners

Inventory is a key indicator of business performance. A good inventory turnover (how fast your stock gets sold in a period) often suggests thriving sales and a healthy revenue stream. Let’s examine some of the vital decisions accurate inventory accounting helps SMBs in:

Proper ordering and stocking: Helps you track stock levels and determine when and how much to order while avoiding overstocking of slow-moving items and preventing shortages for high-demand items.

Setting right prices: Provides a complete picture of existing inventory, cost of goods, and sales trends to set the right selling price that covers the expenses and leaves room for a profit. If you have excess stock, you may offer discounts and adjust prices in case of shortages.

Improving cash flow: Ensures money is spent wisely on stock replenishment and working capital is freed for expenses such as wages and rent, thus reducing wastage and identifying areas for cost control.

Getting insurance: Helps obtain adequate insurance coverage and shield business from the risk of unforeseen situations, such as loss due to fire, theft, or natural disasters, by providing proof of the lost inventory’s value.

Planning budget: Informs financial planning and budgeting for future by providing insights into which products are performing well and optimizing investments to capitalize on seasonal spikes in demand.

Valuing your business: Provides reliable, up-to-date inventory records that give a clear picture of a business's assets and financial health to potential buyers and help them make accurate business valuation for the sale of your company.

Leveraging tax deductions: Takes advantage of commonly overlooked tax benefits related to inventory monitoring, such as donations of goods to charitable organizations, losses from obsolete or damaged goods, depreciation allowances for assets, inventory linked with R&D efforts—all varying with the regulations in geographies where you operate.

Bonus tip:

Traditionally, businesses have used manual methods for inventory tracking and management. The tracking feature in a cloud-based inventory management system can help you automate regular checks and offer real-time visibility into inventory levels.

You can start simple by tracking inventory in accounting software and gradually advance to more sophisticated enterprise resource planning (ERP) or inventory management systems with accounting capabilities.

3 things you must know about inventory accounting

To manage inventory effectively, it is important to understand these basics to ensure your inventory accounting practices are appropriate and up to date.

1. Types of inventories

A business's inventory can vary with the type of industry and individual company. Generally, there are four main categories to consider: raw materials used in production, goods that have been started but not yet completed (work-in-progress or or WIP inventory), items ready for sale or distribution (finished goods inventory), and supplies used in the production process (maintenance repair and operating or MRO supplies). While retailers may only carry finished goods, manufacturers usually require a mix of all types.

Classify different inventory items according to their types so you can account for costs at different stages of the supply chain properly.

Pascal [2] says failure to account for work-in-progress inventory is one of the common mistakes he sees around inventory accounting.

“This is a complex area for many SMBs, and they do not have the capabilities or appropriate procedures in place to properly account for work-in-progress (WIP) inventory, which can be a material component for many businesses.”

2. Concept of inventory cycle

Inventory cycle covers all the stages of inventory management—from when goods are acquired until they are sold, including planning, procurement, receiving, storage, counting, shipping, and returns. Keeping an account of a full inventory cycle helps businesses make informed decisions about ordering, pricing, and managing their stock.

The length of an inventory cycle can vary depending on the type of business, the products being sold, and thenature of the supply chain. You can useinventory management software to get real-time visibility into inventory levels, costs, and movements of goods.

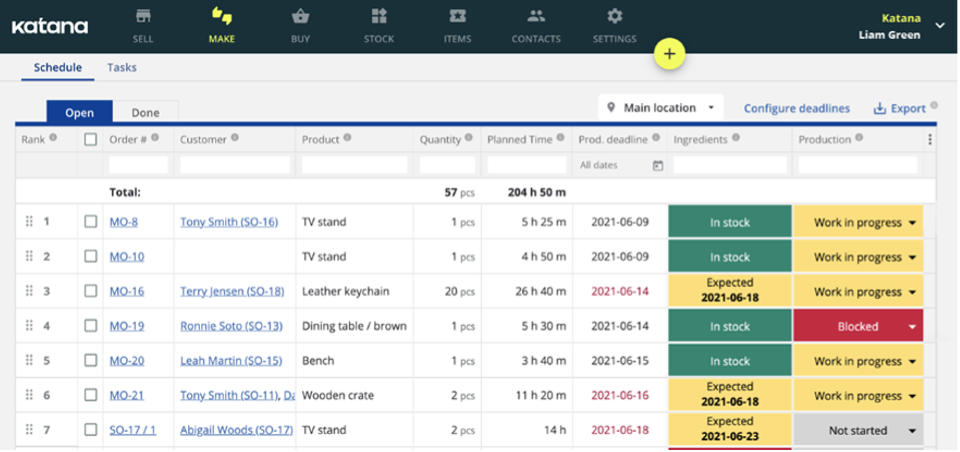

Real-time inventory tracking screen in Katana Manufacturing ERP software (Source)

3. Inventory valuation methods

Accounting for inventories is rooted in cost, which encompasses the sum of all applicable costs incurred in bringing a product to its existing condition and location. Three methods are typically used by businesses to determine the cost of their inventory: first-in, first-out (FIFO), last-in, first-out (LIFO), or average cost.

FIFO assumes that the oldest items in inventory are sold first. Contrarily, LIFO assumes that the most recently purchased items in inventory are sold first. Average cost method assumes that the costs of goods are mixed and intermingled and thus calculates average cost of inventory and assigns this cost to each unit sold.

Pascal says the decision of which accounting method to use will depend on where a business is based, in the US or internationally. “Under US GAAP, you can choose any of the methods. But under IFRS, you cannot use LIFO, but can use the other two methods. Moreover, a lot of businesses adopt weighted average methods because it is simple to use.”

Watch this video to learn which inventory costing method is best for your business.

What’s next? Look out for these signs of poor inventory accounting practices

Here are some telltale signs that it may be time for you to pay extra attention to inventory accounting:

Stock shortages resulting in unfulfilled customer orders.

Excessive buildup of slow-moving or obsolete inventory.

Persistent discrepancies in inventory quantities, costs, and financial records.

Significant changes in profit margins.

Low inventory turnover (measures how fast your inventory gets sold in a period), indicating a sluggish sales rate.

Prolonged reconciliation time between inventory and sales data, resulting in outdated information on accounting books and potential inaccuracies.

Check out Software Advice’s buyers guide for inventory management software to understand how automated solutions can make tracking your stock efficient and maintaining inventory accounts simpler than ever.

Note: The applications selected in this article are examples to show a feature in context and are not intended as endorsements or recommendations. They have been obtained from sources believed to be reliable at the time of publication.

Sources

State of Small Business Report, Wasp Barcode

Pascal Ambrosino, LinkedIn

GAAP VS. IFRS: What Are The Key Differences And Which Should You Use?, Harvard Business School Online