Double-Entry Bookkeeping 101: A Practical Guide for Small Businesses

Almost all small businesses (90%) choose to keep their bookkeeping in-house rather than outsourcing it*. This means that a significant majority of these business owners must manage their own financial records, which can be incredibly challenging without the right knowledge and tools.

Whether you are planning to serve as your own bookkeeper or hire someone on payroll or get an accountant on a self-employed basis, it’s important that you follow the double-entry accounting method to enter daily business transactions into your financial records. Double-entry accounting gives a clear view of the profit or loss of your company, simplifies doing your taxes, and records information needed to impress investors and lenders.

Pascal Ambrosino [1], a CPA and CFO at a private equity firm that invests in SMBs, says, “Without double-entry bookkeeping, you cannot have the information you need to make actionable business decisions.” Leveraging Pascal’s experience and insights, this article will help you understand why double-entry bookkeeping is important and when to best use this system for your business.

What is double-entry accounting?

Double-entry accounting is a bookkeeping method. It is so called because in this system each business transaction is entered twice in the financial records. To put it more accurately, each transaction has a corresponding and equal reaction. Before we get into the technicalities, let’s look at an example.

Suppose you receive cash of $1000. One way to record this transaction is by saying you received $1000. That would be called single-entry bookkeeping, which only records cash transactions. But a few months later when the memory of the transaction fades, you may ask where the money came from, whether you borrowed it, or sold something for cash.

Turns out you received $1000 cash as a loan from James. In this case, the transaction will be entered into the cash account and loan payable account as follows:

Account | Debit | Credit |

|---|---|---|

Cash | $1000 | $0 |

Loan payable (James) | $0 | $1000 |

In double-entry accounting, you present complete information for a transaction. To do that, it’s recorded into two accounts. Double-entry bookkeeping not only tracks an increase or decrease in money but also where it came from and what it converts into. It ties back to a simple balance sheet formula or accounting equation as you may know:

Assets = Liabilities + Equity

This means all the assets that you own are either borrowed (generating liability) or outright owned by you (generating equity).

Wondering how to know when to debit and when to credit something? We break these difficult concepts down in a simple, easy-to-understand way below.

Debits and credits: The foundation of double-entry accounting

You may associate debit with a reduction in your bank balance, and credit with the addition of money in your account. But when it comes to bookkeeping, whether a debit or a credit will increase or decrease an account balance depends on the type of account you are dealing with.

Did you know?

Most small businesses use five basic accounts [2] to record financial transactions. They cover all aspects of business activities and make using the double-entry accounting method easier. They include:

Assets to record anything owned by the business, such as cash, machinery, property, and outstanding payments owed to you.

Liabilities to record anything owed by you to other individuals or institutions, such as loans.

Equity to record ownership interest in the business, such as shares sold to investors and proportion of profits reinvested in the business.

Revenue to record income earned by business through sales, services, or interest.

Expenses to record costs incurred to generate revenue, such as rent and salary.

Beyond this, you can have other types of accounts (or sub-accounts) within this overall chart of accounts, depending on the number of transactions or your business needs. One example is accounts receivable under assets.

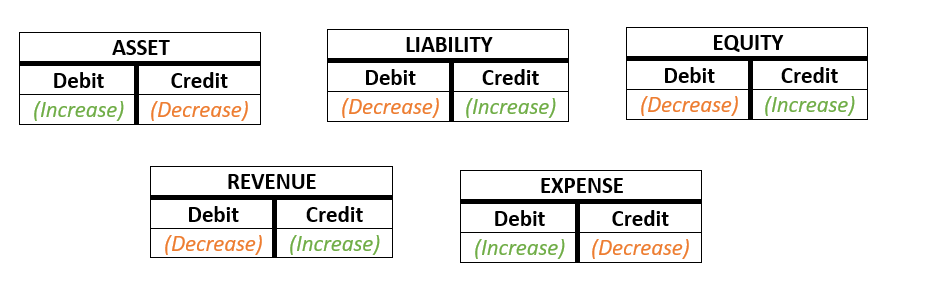

To understand what to debit and credit, remember the three key rules:

A debit is always recorded on the left side of a transaction and a credit is always recorded on the right side.

For asset and expense accounts, you debit to increase them and credit to decrease.

For liability, equity, and income accounts, you credit to increase and debit to decrease them.

If it’s not making a lot of sense yet, follow the chart below for a quick and easy reference. With time and practice, navigating these rules will become second nature to you.

Let’s understand the concept of double entry with examples!

Here are some real-world business situations to simplify this concept further. In all of these, you’ll apply the above rules to do double-entry bookkeeping.

Situation 1: Your business purchases a laptop for $1000 and pays in cash.

In this transaction, you buy an asset (laptop) with another asset (cash). Since you debit the asset to increase it and credit to decrease it, you’ll debit “Computers” to reflect an increase, and credit “Cash” to show a decrease:

Account | Debit | Credit |

|---|---|---|

Computers (Asset) | $500 | $0 |

Cash (Asset) | $0 | $500 |

Situation 2: A customer purchases an ice cream machine from you for $9000 in cash.

Here you sell an ice cream machine (revenue from sale) and your cash (asset) increases. Since revenue is entered in the credit column to show an increase and asset is entered in the debit column when it’s increased, this transaction will look like this:

Account | Debit | Credit |

|---|---|---|

Sale (Revenue) | $0 | $9000 |

Cash (Asset) | $9000 | $0 |

Situation 3: Your business takes out a loan for $50,000 from a bank.

Here loan is a form of liability, which is recorded as a credit when it’s increased, and cash is an asset, which is recorded in the debits column when increased, this transaction will be recorded as follows:

Account | Debit | Credit |

|---|---|---|

Cash (Asset) | $50,000 | $0 |

Loan payable (Liability) | $0 | $50,000 |

Situation 4: A customer purchases an ice cream machine from you for $20,000 on credit.

Here you make a sale of an ice cream machine, but the payment remains outstanding. Since a sale is recorded under a revenue account, and it’s credited to show an increase, and outstanding payments or accounts receivable are assets and you debit the asset account to increase it, this transaction will be recorded as follows:

Account | Debit | Credit |

|---|---|---|

Accounts receivable (Asset) | $20,000 | $0 |

Sale (Revenue) | $0 | $20,000 |

Situation 5: You pay $10,000 salary to employees.

Paying salary is an increase in business costs (expense) incurred to produce sales or services, and a decrease in cash (asset). Thus, this transaction will debit the expense account to reflect an increase, and credit the asset account to show a decrease.

Account | Debit | Credit |

|---|---|---|

Salary (Expense) | $10,000 | $0 |

Cash (Asset) | $0 | $10,000 |

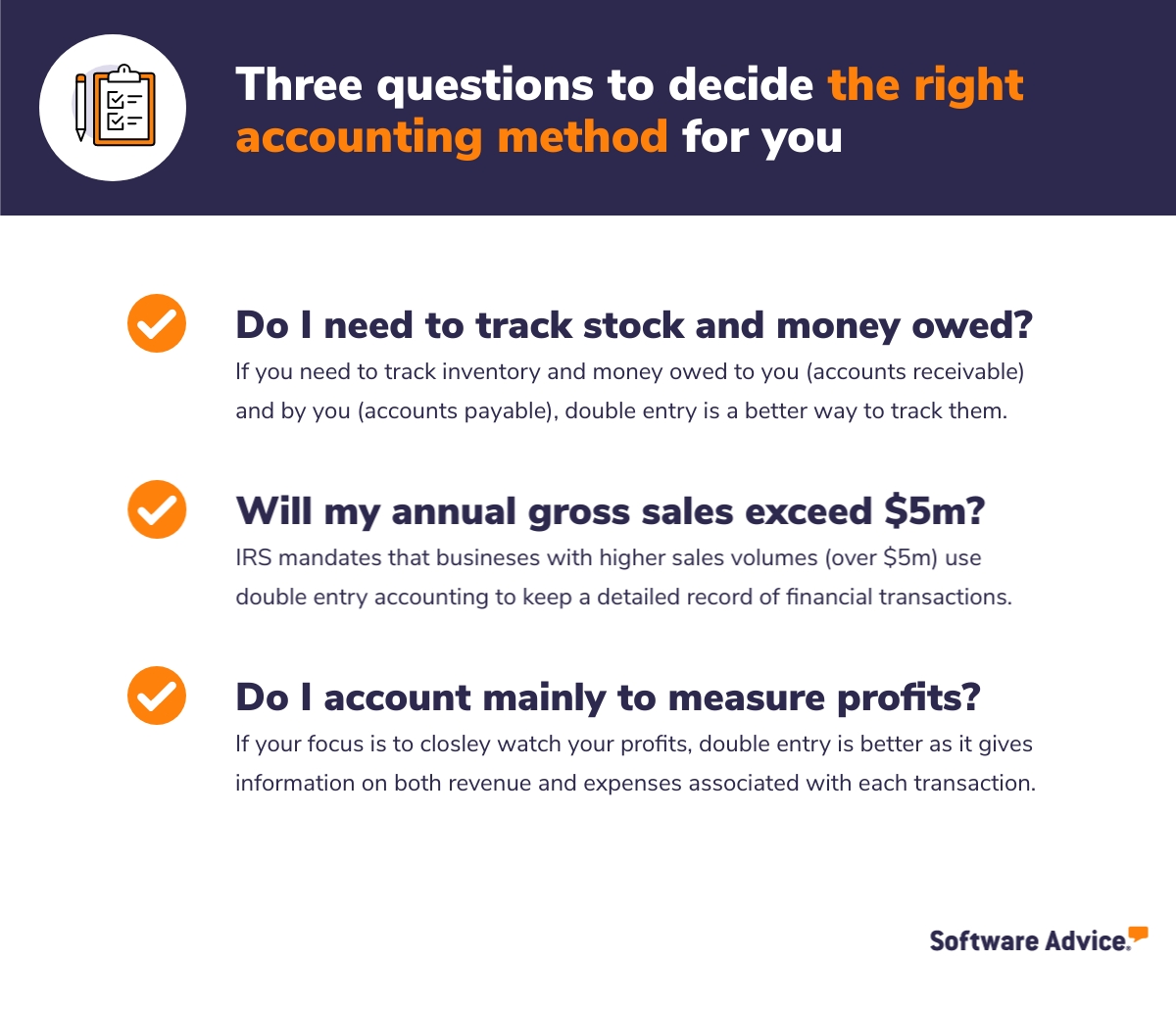

When does double-entry accounting make the most sense for a business?

Pascal Ambrosino [1]

CFO at Burlington Street Partners

According to the IRS [3], if you’re a business with annual gross sales of less than $5 million, you can use single-entry accounting. This method only records cash transactions and doesn’t track the amounts given or received on credit. It’s ideal for new, small, and less complex businesses, such as not-for-profit organizations (NPOs) and sports clubs, which aren’t responsible to shareholders, or where the primary focus of doing accounts is not measuring profits. That said, complications can arise even for them as they grow, requiring a shift to double-entry bookkeeping.

Double-entry accounting is a more preferable method of bookkeeping by most because:

It provides a complete view of business transactions resulting in accurate and reliable financial data.

It prevents errors by recording every transaction in at least two accounts, making it easier to identify mistakes and correct them. It reduces the risk of presenting inaccurate financial performance reports.

It makes taxes easier to file and less prone to errors as all data is accessible in one place.

It makes it easier to prepare financial reports, such as balance sheets, income statements, and budget reports for businesses—all of which are critical to making informed business decisions.

It helps secure funding from lenders or investors who usually ask for detailed financial reports before extending credit.

Still unsure which accounting method to choose? Take a quick test with this checklist. If your answer to any of these questions is yes, you should seriously consider using the double-entry bookkeeping method for your business.

Final notes on using double-entry accounting to keep your books

Pascal [1] says the concept of double-entry bookkeeping often proves tricky to many. The good news is most accounting or bookkeeping software can now perform double-entry accounting, meaning you need not memorize these rules and information. All you need is to develop a basic understanding of bookkeeping and how it works in order to make sense of it all.

Pascal Ambrosino

If you’d like to apply this accounting method to your business, use these quick best practices to get started.

Get an accounting tool. Even non-accounting experts can keep their own books with bookkeeping or accounting software that’s intuitive and easy to use.

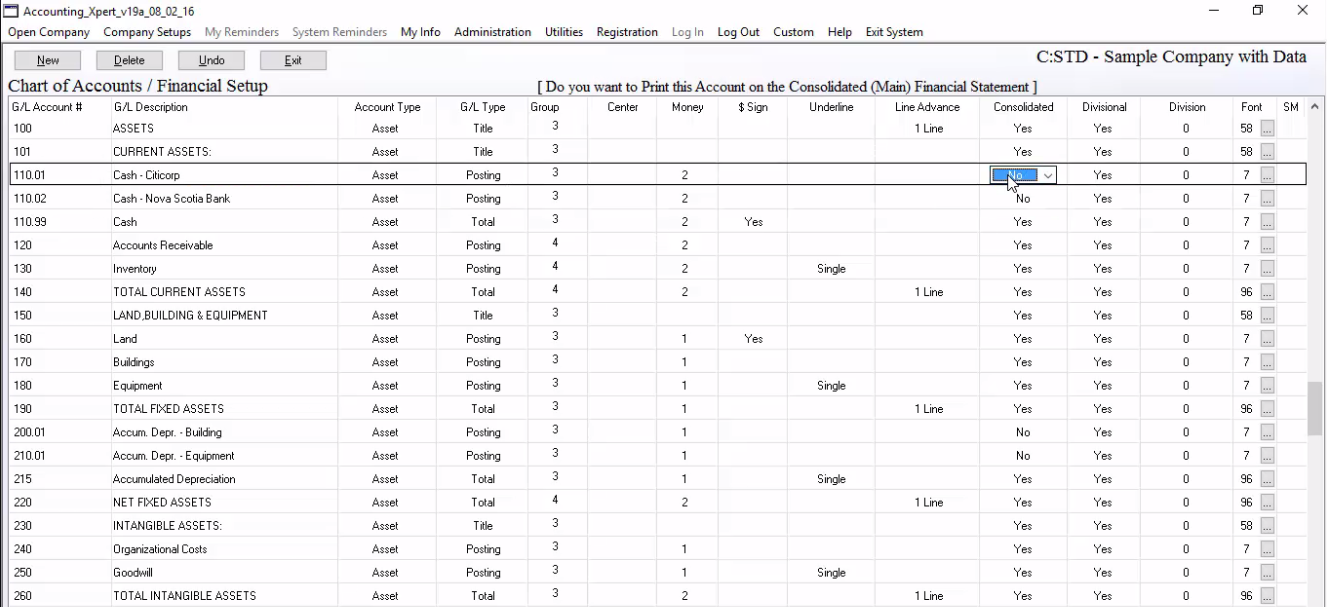

A screenshot of the list of asset accounts recorded in an accounting tool (Source)

Begin with five basic accounts, including assets, liabilities, equity, revenue, and expenses.

Keep a bookkeeper or accountant for periodic consultation. Send a summary of your financial records to a professional accountant at the end of each month or quarter for review and to prepare for you.

Note: The applications selected in this article are examples to show a feature in context and are not intended as endorsements or recommendations. They have been obtained from sources believed to be reliable at the time of publication.

Survey methodology

*Software Advice’s 2023 Financial Planning Survey was conducted in February 2023 among 270 respondents to learn more about how businesses determine and adjust their business plan based on developing tax changes, accounting needs, and more. All respondents were screened for involvement in financial planning within their organization.

Sources

Pascal Ambrosino, LinkedIn

Chart of Accounts: Why It’s So Important For Your Business, The Ascent