Enterprise Resource Planning Software Buyer Report – 2016

Software Advice consults with hundreds of buyers of ERP suites every year. We collect information about these buyers’ needs and businesses that yields crucial insights into the state of the ERP market.

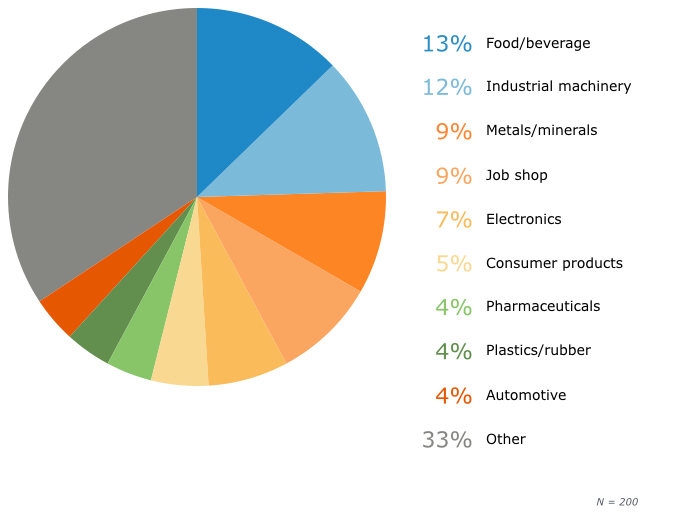

Our ERP buyers are primarily distributors and manufacturers across dozens of verticals (pharmaceuticals, food/beverage, industrial machinery etc.). While retail ERP is a large software market unto itself, few retailers contact us for advice on ERP purchases.

Key Findings

2016’s analysis reveals some striking trends:

Distributors are prioritizing lot tracking as a “must-have” feature, with 44 percent requesting this functionality as opposed to only 13 percent of manufacturers.

Nineteen percent of food/beverage buyers cite the need to improve inventory tracking as a motive for an ERP purchase, but only 3 percent of the overall sample share this motive.

Thirty-three percent of distributors need improved barcoding from their ERPs, but only 11 percent of manufacturers cite this need.

Eighteen percent of distributors are looking to improve warehouse location management and slotting practices via software, but only 1 percent of manufacturers are looking for this.

Fifteen percent of food/beverage buyers are experiencing growing pains with QuickBooks, but only 4 percent of the overall sample cite this as the reason for moving to an ERP.

Let’s now take a detailed look at these trends. We’ll cover the following topics:

• Many Buyers Migrating to ERP From Excel, QuickBooks and In-House Platforms

• ERP Buyers Motivated by Functional Needs in Areas Like Traceability and Barcoding

• Distributors Moving to Advanced Inventory Management Practices

• Food and Beverage Manufacturers and Distributors Experiencing Tracking Headaches

Many Buyers Migrating to ERP From Excel, QuickBooks and In-House Platforms

Last year, we reported that two-thirds of ERP buyers don’t yet have an ERP system in place. This number has remained roughly the same:

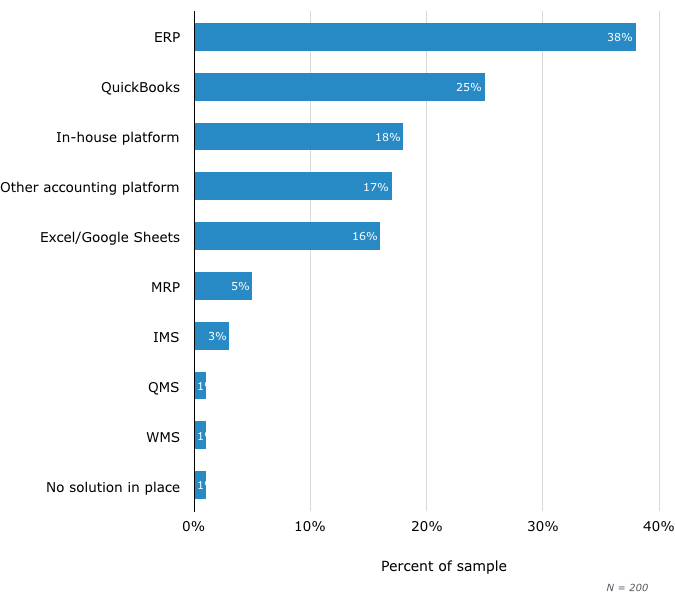

Buyers’ Existing Solutions/Methods for ERP Processes

For the most part, these buyers aren’t new businesses, and instead have used other solutions for some time. Only 1 percent of our sample consists of businesses that are buying an ERP because they’re just opening their doors.

A notable 25 percent of our buyers currently use QuickBooks as their go-to accounting platform. Many are using QuickBooks Enterprise, some with the Advanced Inventory module for enhanced inventory tracking (see our report on this module’s benefits and limitations).

One hundred percent of these buyers say that they’re okay with moving to an ERP platform that doesn’t integrate with QuickBooks.

We’ll see below that some buyers report issues with the scalability of QuickBooks. For now, it’s worth noting that many buyers haven’t even reached the level of sophistication of using a dedicated accounting platform, and rely solely on Excel and Google Sheets for inventory tracking and financial accounting.

ERP Buyers Motivated by Functional Needs in Areas Like Traceability and Barcoding

Buyers are expecting more out of their ERP systems than a mere group of loosely integrated supply chain management, CRM and accounting modules. It’s fairly common for businesses to encounter issues with a certain module, such as a warehouse management system (WMS) or quality management (QM) module, and seek out a stand-alone solution to replace it.

Of course, this is costly and complex. Thus, we see buyers expecting ERP vendors to handle niche functional areas themselves, without integrating additional systems.

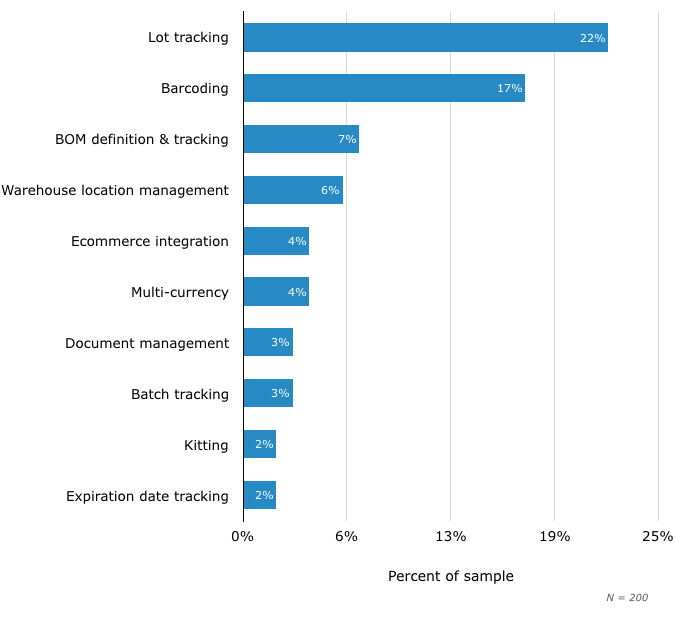

Top Functionality Needs of ERP Buyers

Fascinatingly, lot tracking is the top functional need among ERP buyers. Lot traceability is increasingly mandated by the FDA in verticals such as food and beverage distribution, as we’ve explained in our report on ERP systems with lot tracking features.

Additionally, lot tracking can help manufacturers in recall scenarios—even manufacturers of components and subassemblies. By defining and tracking bills of materials (BOMs), downstream manufacturers can identify whether a bad component or subassembly made it into a given product. Seven percent of manufacturers explicitly request this functionality.

Indeed, nearly all the functional needs we saw in the past years’ data had to do with inventory tracking: kitting, batch tracking, expiration date tracking etc. Even warehouse location management (e.g., the tracking of bins in which items are slotted) is to some extent an inventory tracking capability.

One of the most striking differences between buyers with ERP systems in place and those without is in the area of inventory tracking. Eight percent of buyers without ERP systems in place cite inventory tracking problems as limitations of their existing solutions, but only 1 percent of buyers with ERP systems report issues in this area.

Distributors Moving to Advanced Inventory Management Practices

We can further understand these trends when we segment our sample into distributors and manufacturers. In this analysis, we’re defining a manufacturer as an ERP buyer who is specifically requesting modules such as manufacturing resource planning (MRP), manufacturing execution systems (MES) and QM systems.

It turns out that far more distributors than manufacturers are looking for ERP systems that can support advanced inventory management practices:

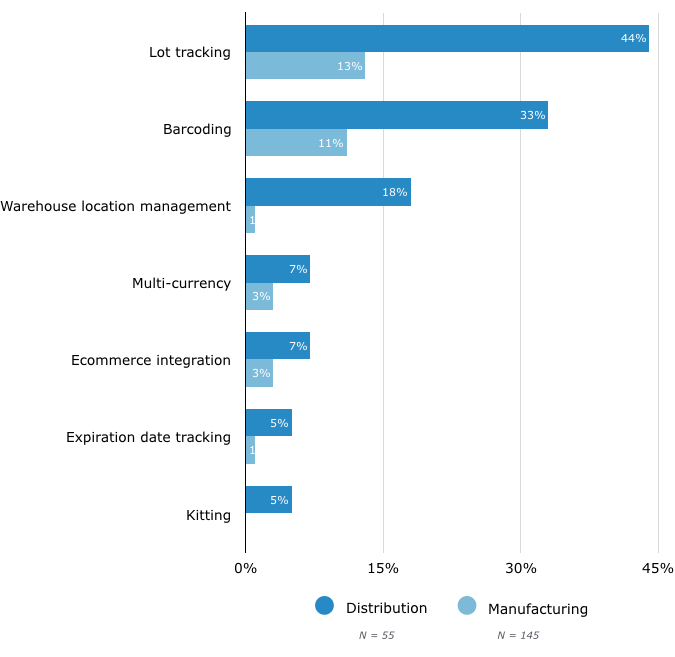

Top Functionality Needs of ERP Buyers: Distributors vs. Manufacturers

The most striking trend evident in this chart is that nearly half of the distributors in our sample are specifically requesting lot tracking functionality up front. This finding is especially notable, given that manufacturers have been early adopters of lot tracking in the past.

Distributors are increasingly being forced to comply with manufacturer and retailer pressure for end-to-end supply chain visibility. No longer can the middle man between Wal-Mart and a major frozen food manufacturer, for example, expect exemption from the inventory tracking requirements that affect more visible players in the supply chain.

Distributors aren’t just moving to advanced inventory management, but also more effective warehouse management. We see 18 percent of distributors requesting warehouse location management (i.e., bin tracking), but only 1 percent of manufacturers are interested in such capabilities.

ERP systems with full-blown slotting modules are increasingly providing a value proposition for distributors looking to future-proof their business models.

Food and Beverage Manufacturers and Distributors Experiencing Tracking Headaches

Food and beverage is the largest industry vertical in our sample, representing 13 percent of the buyer interactions we analyzed. Because such buyers face unique compliance issues and tracking challenges, we segmented them out from other industries:

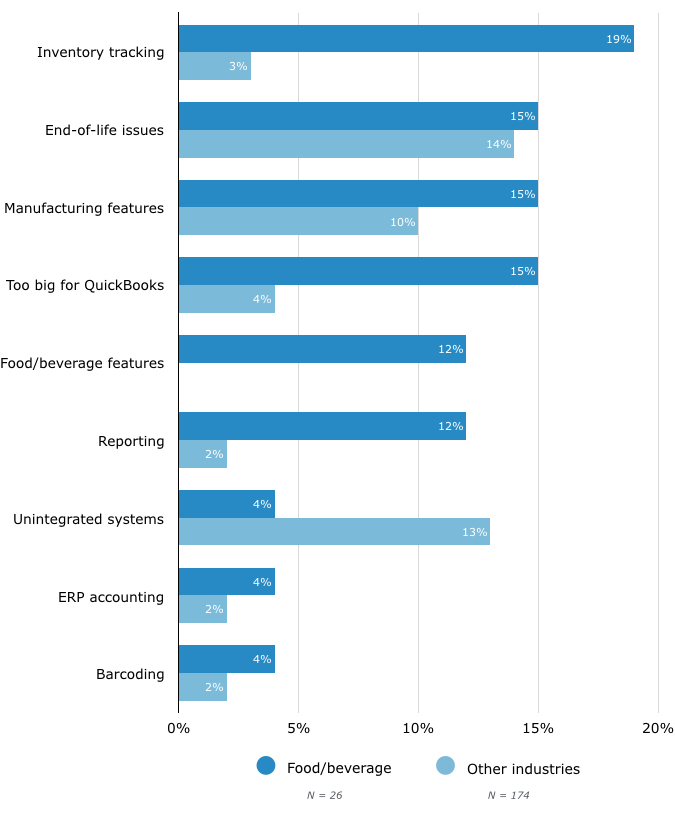

Top Problems With Existing Solutions: Food and Beverage vs. Other Industries

This chart shows a number of notable trends. First of all, food and beverage buyers report problems with inventory management more than six times as often as buyers in other verticals. Even basic expiration date tracking can be a rare and difficult-to-implement feature, as we explain in our report on how food distributors can use such software functionalities to better manage shelf-life.

Both distributors and manufacturers also complain about other functional limitations specific to their industries, such as batch tracking of ingredients and management of recipes.

Finally, it’s worth noting that buyers in this vertical seem to be experiencing the worst problems with leveraging QuickBooks effectively. Fifteen percent report problems with scaling QuickBooks, whereas this drops to 4 percent for buyers in other industries.

This suggests that the limitations of QuickBooks, with respect to inventory management, cause particularly severe problems for businesses handling foods and beverages.

Sample Demographics

All buyers in our sample specifically expressed interest in integrated ERP suites, not just stand-alone supply chain management and manufacturing applications (e.g., WMS software, MRP software etc.)

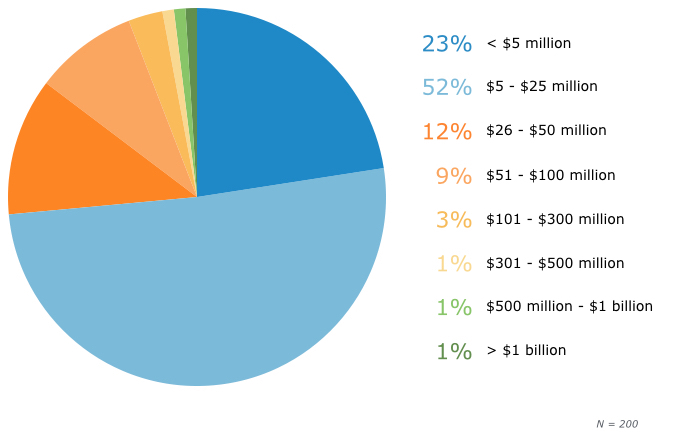

For the most part, our sample consists of fairly small businesses, with 75 percent making $25 million or less in annual revenue.

Buyer Size by Annual Revenue

We’ve already mentioned that food and beverage buyers are the largest segment in our sample. Other industries are listed below. Please keep in mind that our focus is exclusively on buyers of distribution and manufacturing ERP systems, not buyers of retail ERP systems:

Top Buyer Industries

If you have questions or comments about any of the findings we discuss here, please email me at danielharris@softwareadvice.com