How To Do Payroll for Your Small Business in 7 Steps

Note: This article is intended to inform our readers about business-related concerns in the United States. It is in no way intended to provide legal advice or to endorse a specific course of action. For advice on your specific situation, consult your legal counsel.

One of the necessary evils of running a small business, payroll processing may also be one of the most perilous tasks you do. With 17% of employees[1] saying they’d quit their job over just one late or inaccurate paycheck, the potential for doing major damage with a single payroll error is real. Not to mention the costly fines the IRS imposes on 40% of small and midsize businesses[2] every year for payroll tax mistakes.

Despite how important it is to get small business payroll right, many small-business owners don’t actually know how to do payroll themselves. We’re here to help.

Below, you’ll find a step-by-step guide covering processing payroll for a small business. We’ll also make the case for why an affordable payroll service is a worthwhile investment.

Here’s what we’ll cover:

Step 1: Apply for an employer identification number (EIN)

Step 2: Decide on a payroll schedule

Step 3: Have every employee fill out Form W-4

Step 4: Calculate gross and net pay

Conclusion: Why a payroll service is worth it

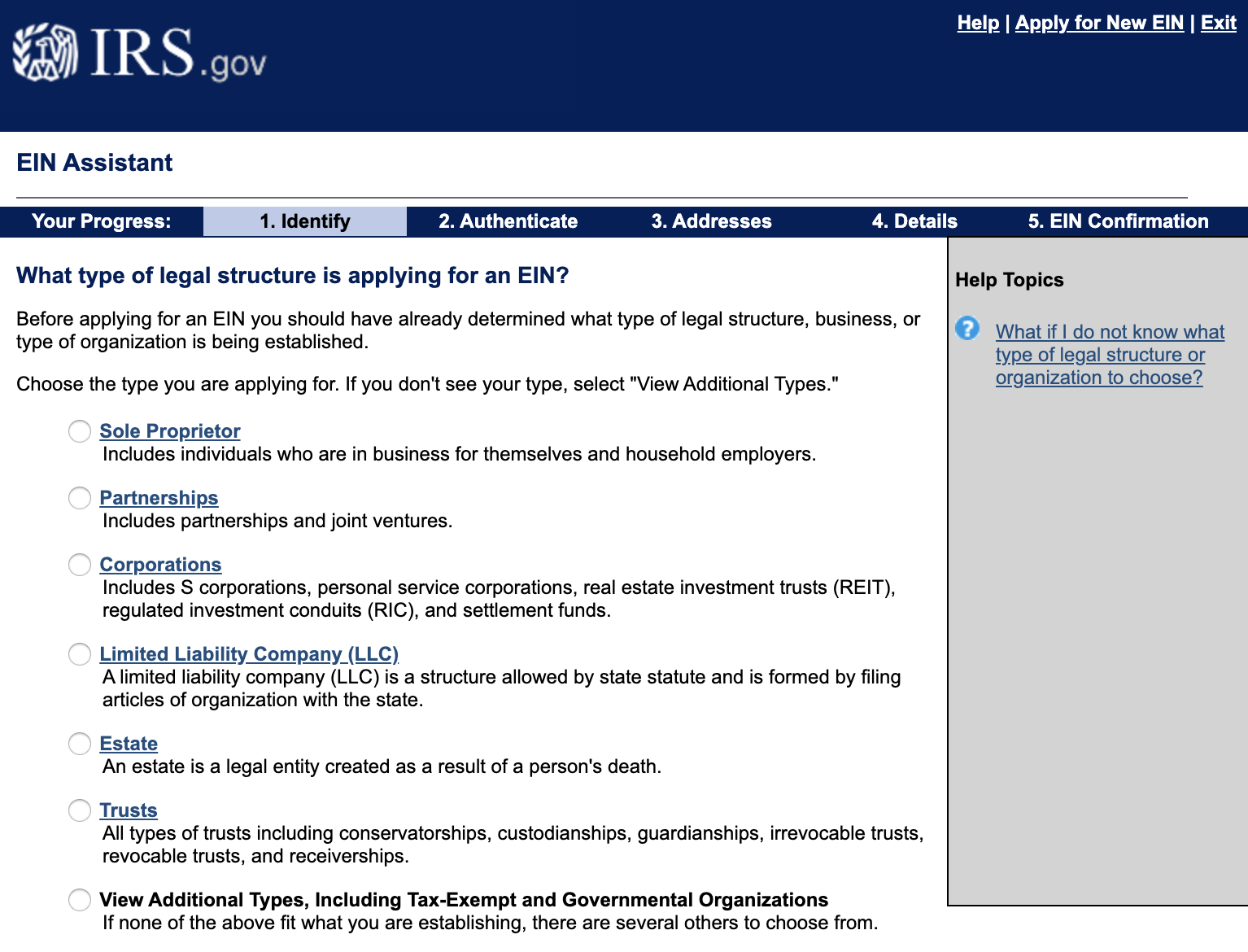

Step 1: Apply for an employer identification number (EIN)

Think of your employer identification number (EIN) as the social security number for your business. It’s the unique identifier that the IRS will use for payroll tax filing.

Luckily, this step is easy. You can apply for an EIN for free and receive one in minutes.

The EIN Assistant walks applicants through the process of receiving an EIN[3]

Step 2: Decide on a payroll schedule

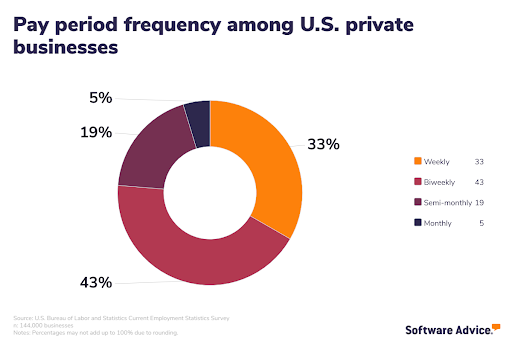

Your payroll schedule (how often you pay employees) will affect how you calculate income tax withholding amounts in the next step, so now is the time to figure that out. Most states have laws that require a minimum frequency with which you have to pay your employees, which you can find here.[4]

As long as you’re meeting the legally required minimum, how often you run payroll is up to you, though you should factor in employee preferences, administration needs, and costs. For comparison’s sake, the Bureau of Labor Statistics[5] found that most private businesses in the U.S. opt for a biweekly or weekly schedule.

Step 3: Have every employee fill out Form W-4

Every employee in your company needs to fill out Form W-4 from the IRS, also known as the “Employee’s Withholding Certificate.” This form will tell you how much in federal income taxes you need to withhold from every employee’s paycheck, depending on their income, marital status, number of dependents, and other factors.

If an employee is having trouble filling out the form, you can direct them to the tax withholding estimator on the IRS website. If you live in a state, county, or city that levies additional income taxes, employees need to fill out those forms too.

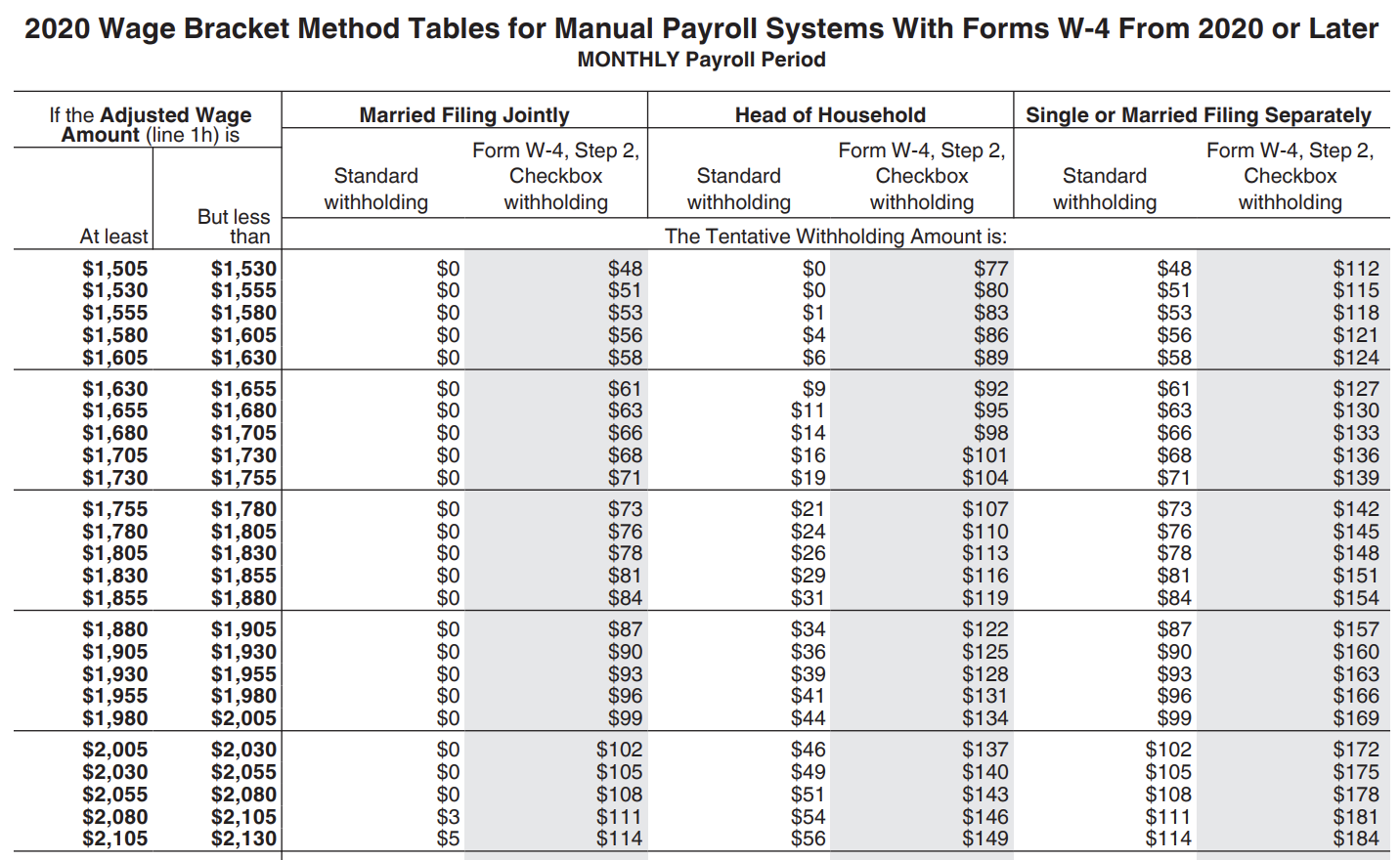

Once you have everyone’s W-4s, you should use Publication 15-T to calculate everyone’s withholding amounts. Follow the instructions for either the percentage method or wage bracket method (the wage bracket method is easier), and refer to the table that corresponds to each employee’s filing status.

One of the tables in Publication 15-T used to calculate income tax withholdings[6]

Step 4: Calculate gross and net pay

Next, you need to calculate how much each employee will take home on their paycheck and how much you need to withhold for taxes, benefits, and other deductions.

Make sure you’re setting aside enough time every pay period to do this math to ensure employees are paid on time. It’s also wise to create a spreadsheet with this information to automate some of the math and keep secure payroll records over time.

How to calculate gross pay

Gross pay is the amount of money an employee makes before taking out taxes and deductions for things like insurance. For salaried employees that make at least $35,568 a year, the gross pay math is simple. Simply divide their annual salary by the number of pay periods each year.

Pay schedule | Number of pay periods per year |

Weekly | 52 |

Biweekly | 26 |

Semimonthly | 24 |

Monthly | 12 |

For salaried employees that make less than $35,568 a year, the math is complicated somewhat by a new rule[7] requiring these workers to be paid overtime for any hours worked over 40 per week.

To calculate a salaried worker’s overtime pay:

Divide their annual salary by 52 weeks to get a weekly rate

Divide by 40 hours to get an hourly rate

Multiply by 1.5

Multiply by the number of hours worked over 40 per week during the pay period

To calculate gross pay for hourly workers, simply multiply the number of hours worked during the pay period by their hourly rate. Don’t forget to factor overtime pay for hours worked over 40 per week for this group too, as well as any paid time off (PTO) they used.

Lastly, if you’re awarding workers a bonus as part of their paycheck or dispersing any tips they earned, add that in now.

Example: How to calculate gross pay

Assume you have a biweekly pay period and an employee who makes $14 an hour. They worked 55 hours the first week of the pay period, and 43 hours the second week of the pay period. That would mean they worked 80 normal hours and 18 overtime hours (hours over 40 per week) total.

Their gross pay would be:

(14 x 80) + (14 x 18 x 1.5) = $1,498

How to calculate net pay

Net pay is the amount of money an employee actually takes home once all deductions are accounted for. This is the amount that will appear on their paycheck.

To calculate an employee’s net pay, first subtract any pre-tax deductions from their gross pay, the most common of which is payment for health insurance. Other possible pre-tax deductions include disability insurance, life insurance, commuter benefits, and traditional 401(k) contributions. If you’re not sure if a benefit you offer is a pre-tax or post-tax deduction, consult the IRS’ Employer’s Tax Guide.

With pre-tax deductions taken care of, it’s time to subtract the amount you’re withholding for taxes. Take the employee’s gross pay minus any pre-tax deductions and subtract the following:

Federal, state, county, and city income taxes (use Publication 15-T from Step 3).

FICA taxes for Social Security and Medicare (7.65% of gross pay minus pre-tax deductions*).

*This number is also what you owe as an employer for FICA, which we’ll cover in Step 6

Lastly, take care of any post-tax deductions and credits. Wage garnishments and union dues, for example, are post-tax deductions that should be subtracted from net pay. Expense reimbursements are post-tax credits that should be added.

Your final number is an employee’s true net pay.

Example: How to calculate net pay

Let’s use our employee from the gross pay example again. They pay $80 per pay period for health insurance. They also owe $116 in federal income taxes and $60 in state income taxes, but they’re due a reimbursement of $80 this pay period for office supplies.

Their net pay would be:

$1,498 – $80 = $1,418

$1,418 – $116 – $60 – ($1,418 x 7.65%) = $1,133.52

$1,133.52 + $80 = $1,213.52

Step 5: Pay your employees

Whether through direct deposit, paper checks, or whatever other method you and your employees have agreed upon for payment, ensure every employee gets their net pay on the correct day according to your payroll schedule.

In addition, most states require employers to provide employees with a pay stub that breaks down the various deductions. Check your state’s labor office website to learn more about your specific requirements.

Regardless of which state you live in, make sure you keep detailed records of each paycheck (who it went to, the amount, when it was issued, etc.).

Step 6: Pay payroll taxes

This step is a big one: paying Uncle Sam. And it can get complicated, so let’s break it down into parts and see which tax forms businesses should use in which context.

When you pay payroll taxes

How often you make payroll tax deposits depends on how much in payroll taxes you’ve owed previously during what’s called the “lookback period.” Your “lookback period” depends on if you use Form 941 (“Employer’s Quarterly Federal Tax Return”) or Form 944 (“Employer’s Annual Federal Tax Return”) to report your company’s taxes to the IRS.

Most businesses will use Form 941. Only those with a $1,000 or less in annual federal tax liability, or those who have been told to use Form 944 by the IRS, will use Form 944. If you use Form 941, your “lookback period” is the 12 months preceding June 30. For 2020, for example, your lookback period would be July 1, 2018 through June 30, 2019.

If your total payroll taxes during this lookback period were $50,000 or less, or you’re a new employer that didn’t have employees during this lookback period, you pay payroll taxes monthly. Your taxes are due by the 15th day of the following month.

If your total payroll taxes during this lookback period were more than $50,000, you pay payroll taxes semiweekly. Taxes from payrolls paid on Saturday, Sunday, Monday or Tuesday are due by the following Friday. Taxes from payrolls paid on Wednesday, Thursday, or Friday are due by the following Wednesday.

If any single payroll run results in a payroll tax obligation of $100,000 or more, you must deposit payroll taxes the next day and you must continue to make next-day deposits for the rest of that year and the following year.

Redo this math before the beginning of the year every year to ensure you’re using the right payment schedule.

The only payroll tax payments that fall outside of this schedule are for federal unemployment taxes (FUTA) and state unemployment taxes (SUTA). FUTA is due by the last day of the first month that follows the end of the quarter. SUTA is generally due quarterly, but that is not the case in all states, so check your state’s website.

How much you owe in payroll taxes

When it’s time to deposit payroll taxes, here is how much you owe:

The amounts you withheld from employee pay for federal income taxes, and state, county or city income taxes if applicable (see Step 4).

The amounts you deducted from employee pay for Social Security and Medicare (FICA) (see Step 4).

The amount you owe as an employer for Social Security and Medicare (FICA) (equal to the FICA amounts you deducted from employees).

The amount you owe in federal unemployment taxes (FUTA). If you don’t pay SUTA (see below), it’s 6% of the first $7,000 of every employee’s annual taxable wages. If you pay SUTA, this rate is reduced to 0.6%.

The amount you owe in state unemployment taxes (SUTA) (rates and wage bases vary).

How to pay payroll taxes

You can pay federal payroll taxes online through the Electronic Federal Tax Payment System (EFTPS). Each state, county, and city has their own website through which you can deposit the taxes you owe to them.

Step 7: Report payroll taxes

The last step is to report your payroll tax payments to the IRS. Here’s the breakdown:

Form 940 (“Employer’s Annual Federal Unemployment (FUTA) Tax Return”) is due by January 31 for the previous year.

Form 941 (“Employer’s Quarterly Federal Tax Return”) is due every quarter by the last day of the month following the end of the quarter (e.g., April 30 for Q1).

You can print and mail these forms to the IRS using the instructions found in each form, or deliver them electronically using the IRS’ e-file service.

That’s it. You did it. Congrats on doing payroll for your small business!

Why a payroll service is worth it

If the entire payroll process seems too complicated to do manually, it’s because it is. And this is as simplified as we could make it!

In reality, every step in this process has caveats, exceptions, and nuances that can impact how you do payroll at your small business. We didn’t even cover what to do if you pay independent contractors, or if you have employees in multiple states.

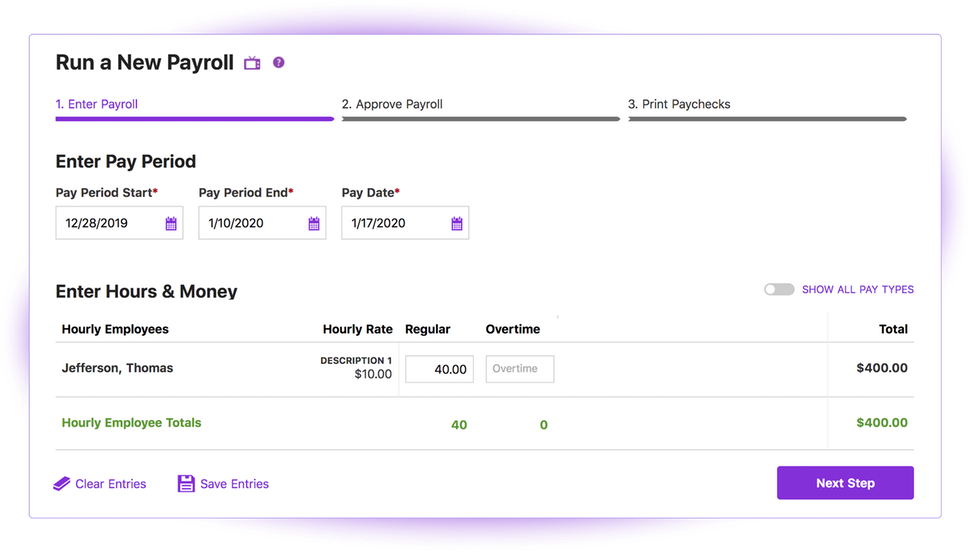

With so much work involved, having a payroll system is a must. Not only will it keep your pay records organized and secure, but it will also automate a lot of the calculations and deposits for you—saving you precious time. Click that link above to quickly compare prices of different top-rated, best payroll software options in Software Advice’s directory. Compare plans and payroll features to find the platform that will benefit your business the most.

Running payroll in Patriot Payroll (Source)

If you really want to offload your payroll stress, though, you should consider outsourcing payroll to an affordable payroll service. For a few extra dollars per employee, per month, you get the benefits that come with payroll software, combined with a payroll expert that will take care of everything—payments, filing, reporting, etc.—while ensuring accuracy and compliance.

If that sounds good to you, chat with one of our knowledgeable advisors to get a free shortlist of employee payroll services that best fit your needs today. Or set up an appointment for a free phone consultation when it works best for you.

Note: The applications mentioned in this article are examples to show a feature in context and are not intended as endorsements or recommendations. They have been obtained from sources believed to be reliable at the time of publication.

Sources

7 things you need to know about the all-american payday, QuickBooks Blog

Image of the EIN Assistant walking applicants through the process of receiving an EIN, Internal Revenue Service

State Payroll Requirements, U.S. Department of Labor

Current Employment Statistics, U.S. Bureau of Labor Statistics

An image of a table in Publication 15-T used to calculate income tax withholdings, Internal Revenue Services

Final Rule: Overtime Update, Department of Labor