3 Loan Management Software Features for Improving Borrower Experience

Taking out a loan often signifies a major life event for consumers—it means you’re buying a home, purchasing a car or attending college. And most consumers will take out loans for these events multiple times in their lives. It’s never stress-free to borrow, so providing borrowers with the best possible experience is crucial for fostering trust and repeat lending.

It’s not easy being a borrower

This is why finding the best loan servicing software for your unique business is crucial. Today’s lending systems support an array of processes, but it can be tough to determine which of these is most important for your business.

We’ve surveyed borrowers to get their take on how their lenders’ software positively impacted their experiences.

Understanding these effects will help you prioritize what types of services your new software needs to support.

Here’s what we’ll cover:

How Loan Application Software Improves Overall Lending Experience

Online Loan Management: The Most Useful Lending Software Feature

Lender Experience Is Critical, But Don’t Sacrifice Operational Efficiencies

Borrowers Want Self-Sufficiency But Still Value Communication Channels

How Loan Application Software Improves Overall Lending Experience

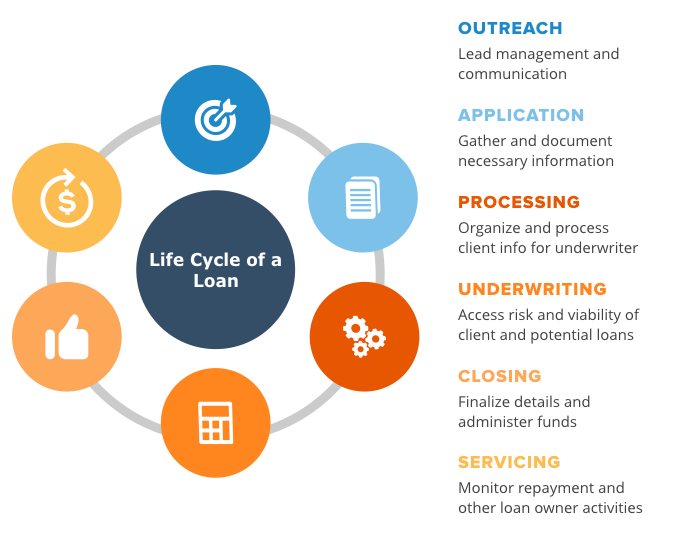

There’s quite a few steps to the lending process, none of which you can’t afford to overlook. These include:

To help you assess which of these stages is most positively impacted by lending software, we asked borrowers about their most recent experience.

Respondents report that the start of their lending journey benefits most from loan servicing software.

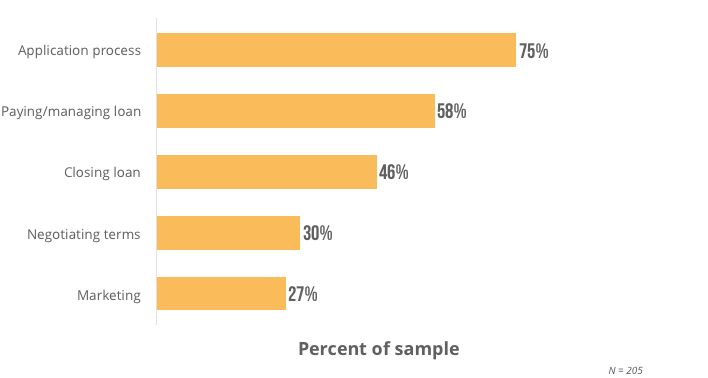

Borrowing Processes Most Aided By Lender Software

Three-quarters of survey respondents say their application process benefited from the lender’s software. The benefits of the application software are amplified by the finding that borrowers listed the application process as the second most important loan process behind the negotiation of terms and rates.

The application process is the first interaction that borrowers have with your lending business and sets the tone for the experience. If the experience is sub-optimal, it will be difficult to stop borrowers from immediately going to another lender.

Take the time to define what you want this initial application experience to be and employ lending software accordingly. For any borrower-facing application, keep it simple.

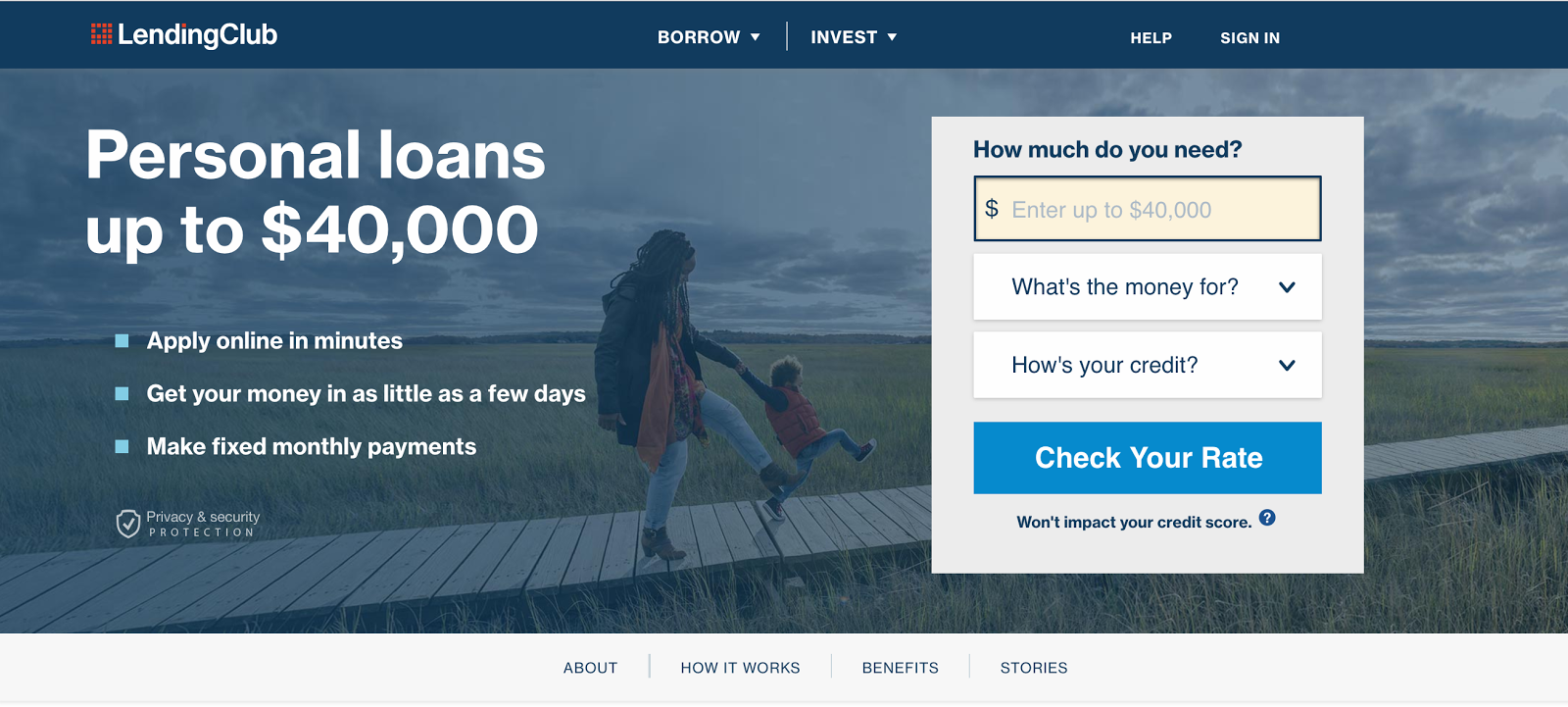

LendingClub’s website with a simple form to kickoff the application process

Take LendingClub’s website for example. They offer a simple, easily understood form box that potential borrowers can complete to get quick estimates on their rates. A form box like this is a likely initial experience for borrowers.

You could take advantage by requiring an email address to see the rates results, putting them into your marketing channel as well as providing them with valuable information.

Online Loan Management: The Most Useful Lending Software Feature

While online application capabilities are beneficially impactful on a lender’s experience, we wanted to determine which features were most useful once they’ve taken out a loan. The common theme we found was that having the ability to service the loan online is a huge positive impact for borrower experience.

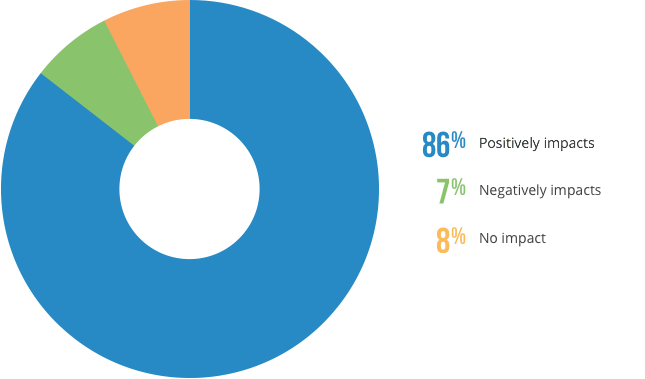

Impact of Online Loan Servicing on Overall Borrower Experience

The overwhelmingly positive impact of online loan servicing should serve as a wake-up call for any lenders not currently offering online capabilities.

If you aren’t offering online loan management, chances are your borrower experience is suffering, which can be poison to a business in the long run.

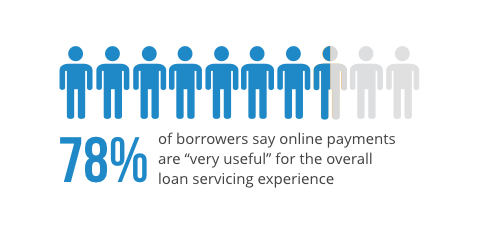

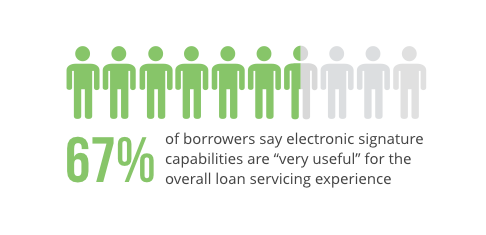

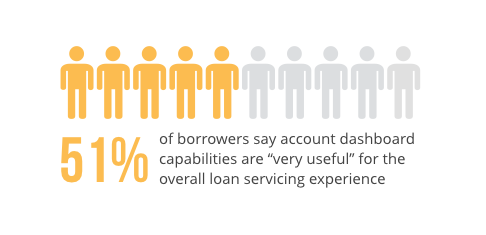

Since “online servicing” is a broad catchall for a bunch of different features, we dug a bit deeper to pinpoint the features borrowers find most useful. The top three include:

Online Payments

Electronic Signature

Informational Dashboard

While there are many operational capabilities that you need in your loan servicing software, the borrower-facing capabilities listed above are crucial to ensure a positive customer experience. Such a combination of services will make a strong dashboard for borrowers to answer most all their questions on their own, saving your borrowers from having to call or email (and saving your team time from the phones).

Borrowers Want Self-Sufficiency But Still Value Communication Channels

While the right combination of online servicing capabilities can cut down on costly communication between customers and your team, borrowers don’t want you to be too hands off. Many borrowers still value online communication tools.

Along with the 45 percent of borrowers saying communication capabilities are “very useful” for the lending experience, another 31 percent said these tools are “moderately useful.”

So while there’s value in providing online tools for borrowers to self service, online communication capabilities also prove useful should borrowers need to reach out to you. For example:

Something as simple as confirming that a payment has been made to an existing balance can improve a customer’s experience.

And then there’s the potential to open another loan and do more business. If an existing customer wants information on another type of loan, they can reach out to you online and you can begin the sales process.

These communication tools also provide a great channel for you to market new services or special rates to current borrowers. As stated in the intro, many borrowers will take out multiple loans throughout their lifetime. Lenders should keep this in mind and work to unlock that repeat value.

Lender Experience Is Critical, But Don’t Sacrifice Operational Efficiencies

Now that you know which borrower-facing lending software features are most valued, you’ll be able to optimize your offerings accordingly. If you’re not already offering online application and servicing tools, that’s where you need to start.

When it comes to choosing loan servicing software, you have to balance the needs of your borrowers with operational and process needs. Luckily, our array of loan servicing software listings can match both needs and provide you with a balanced system to support the back-end operation and offer an improved front-end experience.

Here are three common operational lending software features we haven’t mentioned yet that you’ll want to ensure your system provides:

Loan origination capabilities. This feature supports the back-end of the application process. It enables you to create various types of loans based on differing combinations of payment options, interest rates, and service fees.

Client management. This enables you to complete credit checks and do your due diligence in assessing the viability of potential borrowers. It can also function as a customer relationship management tool, record valuable client notes and contact information.

Analytics dashboard. This highlights the key metrics you are monitoring and articulates them in easy-to-read charts and graphs. You’ll be provided with wonderful insight into your operation.

It’s critical that you match the beneficial online borrower tools with these key operational features so that you have a balanced system capable of growing and sustaining your business.

Next Steps For Lenders

Now that you know the key features your new lending system needs, it’s time to adopt and implement the system and grow the business.

To help you out, we’ve put together a list of top loan servicing software options.

Take a look at these and be sure to read through the user reviews from your peers in the lending space. These reviews provide an unparalleled transparency into each system. Good thing you know exactly what to look for.