The Business Impact of MACRA on New, Independent Practices

We’ve talked before about the introduction of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) and how complicated this new bit of legislation is, so it’s not news that practices accepting Medicare are facing a ton of changes.

A lot of providers are also frustrated by the timing here, as they were just getting the hang of requirements from the HITECH Act.

Still, the goal of MACRA is noble:

MACRA aims to incentivize doctors to raise the bar on services they’re providing by requiring them to report on specific measures for improving things like quality of care, patient satisfaction and outcomes.

So, while the service you deliver will probably change due to these measures, the larger impact of MACRA on physicians will be from a business standpoint.

The following areas of your medical business will be most affected by MACRA:

Data gathering and reporting workflows

Technology for you and your patients

Time management

To prepare for these changes and prevent workflow slowdowns or penalties for inaccurate reporting, physicians in small practices must work closely with the team member that can help with all three of these things: their office manager.

Here’s what we’ll cover:

Your Office Manager Knows Everything, So Get Them Involved ASAP

MIPS and APMs Change Reporting, So Work on Your Workflows

Technology Requirements Are Real, So Make Sure You’re Using the Right Tools

This Is All Going to Take Time, So Adjust Your Schedule

Your Office Manager Knows Everything, So Get Them Involved ASAP

Sherlock had Watson, Luke had R2D2, Buzz had Woody—and you have your office manager.

Good office managers already know your business inside and out since they’re in charge of everything from human resources to patient scheduling to billing.

That makes them imminently qualified to help you prepare for the different ways MACRA will impact your practice, so the very first thing you should do is have a meeting with them to plan your approach to this transition.

Last year, 84 percent of independent practices said they weren’t sure what MACRA would change for them, but 85 percent said they were going to try to participate anyway. I’m willing to bet most of that 85 percent were already planning to rely on their office administrators, so you should too.

To help your office manager prepare, share the following resources and give them time to read up on everything:

**[The Quality Payment Program website](https://qpp.cms.gov/).** The CMS home page for all things MACRA.

[The Physicians Advocacy Institute MACRA FAQs](http://www.physiciansadvocacyinstitute.org/MACRA-QPP-Center/FAQs). A thorough collection of common questions with detailed answers provided by PAI officials.

[QPP Participation Lookup tool](https://qpp.cms.gov/participation-lookup). Enter your 10-digit national provider identifier number to check your reporting status.

MACRA and the Transition to Value-Based Care. A quick guide to what physicians need to change for MACRA and how they can do that.

After the initial meeting, you should schedule regular meetings with your office manager (and any other key participants) to check in on progress and assess any strategies that might need tweaking.

Three specific things you want to make sure you’re touching on in these meetings will be your revenue cycle, data collection and reporting workflows and time management.

MIPS and APMs Change Reporting, So Work on Your Workflows

The way MACRA works is it gives providers a choice between two distinct participation tracks:

Merit-Based Incentive Payment System (MIPS)

With MIPS, three previously used CMS programs have been combined: Meaningful Use, Physician Quality Reporting System and the Value-Based Payment Modifier.

To participate in this program, providers will receive scores in four different categories: Quality, Cost, Clinical Practice Improvement Activities (CPIA), and Advancing Care Information (ACI). Many EHRs are able to create and send reports for this reporting track, but practices that don’t use them can still participate.

Advanced Alternative Payment Models (APMs)

APMs are specific programs clinicians can participate in to receive added incentive payments when they provide high-quality and low-cost care.

To participate in APMs, practices must be a part of or form their own APM Entity. In order to receive credit for participating in these models, every member of the APM Entity must meet a certain set of criteria. So if you’re considering joining an entity with other physicians, be sure you trust them to do their part in meeting the specific requirements.

Deciding which track you’ll go with is a big step in this process, so trust your office manager to look into the requirements for both MIPS and APMs and help you figure out which is better suited to your practice.

Both MIPS and APMs require extensive reporting, so MACRA effectively raises the stakes for all of your clinical documentation. You must make sure everything is accurate if you want to get paid, which means you must take the time to ensure data collection processes are perfect.

If you’re using an EHR with MIPS or APM reporting functionality, double check what information it’s gathering with your provider and ask about running reports for yourself to keep track of progress before submitting.

Technology Requirements Are Real, So Make Sure You’re Using the Right Tools

You remember meaningful use, right? It was a massive piece of the HITECH Act that essentially required providers to use an electronic health records system to track patient information, and it did not go away when MACRA was passed.

Instead, it became a more robust requirement as it was rolled into one of the scoring categories of MIPS: Advancing Care Information. Instead of simply requiring the use of an EHR to check a box, this new model will expect providers to use EHR tools that facilitate more involved interactions with patients.

Any time you have to assess existing software, your office manager is a great person to consult. They’re using these systems, so they know what’s needed. Ask your office manager to make sure your existing systems are optimized for MACRA, and put them in charge of looking for alternatives if those systems fall short.

This means you’ll need to find an EHR with functionality to support patient portals, interoperability and mobile access, to name a few feature examples. Security will also be critical, and HIPAA violations are still in full effect for MIPS requirements. Additionally, you’re going to need a system with strong data gathering tools to make it easy to run the reports you’ll be submitting in early 2019.

This Is All Going to Take Time, So Adjust Your Schedule

First of all, you and your office manager will both definitely have to spend a fair share of your time reading up on MACRA’s participation and reporting requirements, so that’s something you should be planning for (and doing) right away.

Beyond the research and prep, though, you’ll find that participation in MIPS and APMs will increase the amount of time you spend counseling, seeing and treating patients, and following-up after appointments.

This makes sense when you realize reimbursement amounts will be tied directly to the success of treatments, so you’re going to be doing everything you can to provide those positive outcomes with every patient—and your office manager will do everything they can to give you the time for that.

Work with your office manager to reassess how much time you’ll need for each of your tasks (seeing patients, filling out notes, follow-ups etc.) and make sure those time adjustments are reflected in your schedule. If you’re not already using some sort of scheduling software, now is a great time to start.

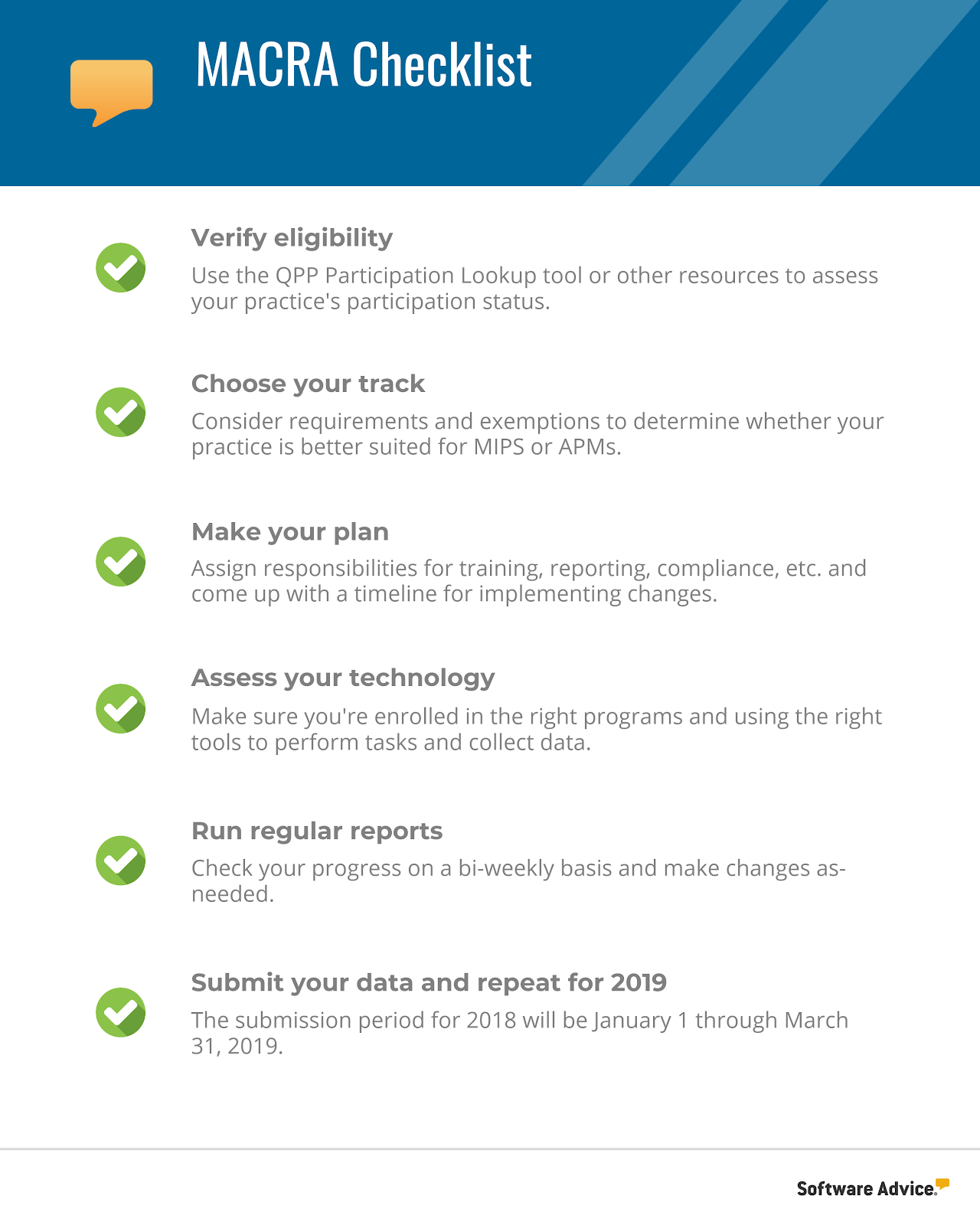

Next Steps: A MACRA Checklist

As you’re preparing to adjust for changes to all of these important business elements, it may be helpful to use a checklist that will guide you through the major steps of MACRA reporting. That checklist might look something like this:

As you get into the specifics of MACRA, you’ll quickly learn that having the right technology will make all the difference. Check out our medical software Buyer’s Guide to learn about your options, and be sure to call our team of experts at (855) 998-8505 when you’re ready for specific recommendations.