The 3 Challenges You’ll Face Opening an Independent Medical Practice

In just 12 months, between July 2015 and July 2016, hospitals bought out 5,000 independent medical practices that employed a total of 14,000 physicians.

While selling their practice may not be a bad thing for all owners, this stat is an indication of how difficult it’s become for small medical offices to survive and maintain their independence in a market that’s increasingly favoring larger institutions.

For the doctors out there who are interested in opening their own small practices, this might be fairly off-putting—but it shouldn’t be.

Over half of physicians in 2016 worked at practices with 10 or fewer doctors, and patients still prefer the more personal touch that small practices can provide.

Patients also tend to fare better after visiting independent physicians who can afford more focused and personalized care, as their readmission rates tend to be lower.

All that is to say that physicians who want to open their own office should not be deterred … but they should be ready to face certain challenges. To help you prepare, we’re going to cover the three biggest obstacles physicians typically face when opening their own independent medical practices.

Physicians who overlook the business aspects of their practice are five times more likely to close within a year than their peers who avoid these three mistakes:

Underestimating how much start-up capital they need

Investing too much too quickly in technology

Neglecting the business side of their practice

You’re Going to Need More Cash Than You Think

THE CHALLENGE: Determine exactly how much capital you’re going to need to get your practice off the ground.

Independent medical practices cost a lot more to open than other types of businesses, and not starting with enough money is one of the leading reasons small practices close soon after opening.

What makes anticipating how much you’ll need so difficult are all the variables. Specialty, location, equipment, insurance—the amount you’re going to pay for all of these things depends entirely on you and your needs, so every individual practice owner has to assess and plan for those costs for themselves.

THE SOLUTION: Don’t slack off while creating your business plan.

A business plan, or the lighter version known as a pro forma, will be a valuable tool for acquiring funding. In either type of document, you want to account for three things:

Expenses

Debt

Projected revenue

Your expenses should include everything from rent and payroll to equipment and insurance, so you’ll want to think about things like where your office will be, how many employees you’ll hire, what kind of equipment you’ll need and what level of insurance coverage you want before you start this process.

There are a number of services that offer medical practice business plan templates to help you format your document, but most will start with a few summary sections that look like this:

Executive Summary[Overview of the practice. Include things like specialty, target patient base, services you’ll offer, hours of practice etc.]

Market Summary

[Include regional market information as well as any competitive advantages that will differentiate your practice from others like yours in the area and how you plan to promote your practice.]

Customer Base

[Explore and explain your intended patient base in greater detail here. How many live in the area, population projections etc.]

Staffing

[Overview of your planned staffing structure. What your employees’ titles will be, how many employees you intend to hire and when, summary of benefits you’ll offer employees etc.]

Start-Up Summary

[Deep-dive into all expenses you anticipate related to opening the practice. Include things like your first few months of rent, licensing and legal fees, equipment costs etc.]

Objectives

[List of your practice’s defining objectives, either related to a specific time frame after opening or indefinite.]

Mission

[Explain the broader goal of your practice and how you’re going to achieve it.]

You may also want to meet with a consultant who specializes in opening new medical practices to help make your projections as accurate as possible and provide additional marketing information that could be useful.

Once you’ve finalized your business plan, submit it to multiple banks so you can increase your chances of receiving multiple offers. That way you’ll have options.

Also consider submitting to banks with specialized loan departments for health care, as they’re more likely to understand the unique risks and benefits of the medical industry.

Don’t Cut Your Budget Just to Be Cutting Edge

THE CHALLENGE: Find the balance between technology that offers all the things you’ll need initially and technology that will allow you to grow, without spending too much on features you don’t need.

Electronic health records, practice management suites, scheduling systems, patient portals etc.—there is so much tech out there for doctors of all specialties and all practice sizes.

I understand the impulse to front-load all the IT purchasing so your practice will be as modern and cutting edge as possible, but you just don’t need all that in the first few years after opening.

THE SOLUTION: Chill out and focus on the basics.

When you open your practice, you have to establish your foundation first. That means finding software to handle three things:

Scheduling

Patient information

Billing

To cover these bases, you’ll want a scheduling system, an ONC-ATCB certified EHR system and a billing system.

Scheduling software will be incredibly useful for getting your days organized as you’re starting out.

Digital records will help you meet meaningful use requirements as well as keep your new patients’ information ordered and secure.

Billing software will let you get paid for your work.

You’ve got some options when shopping for these systems. You can either purchase each as stand-alone software—which will sometimes offer integration capabilities to let you link them—or you can look at a practice management suite that will offer all of the same functionality in one cohesive system.

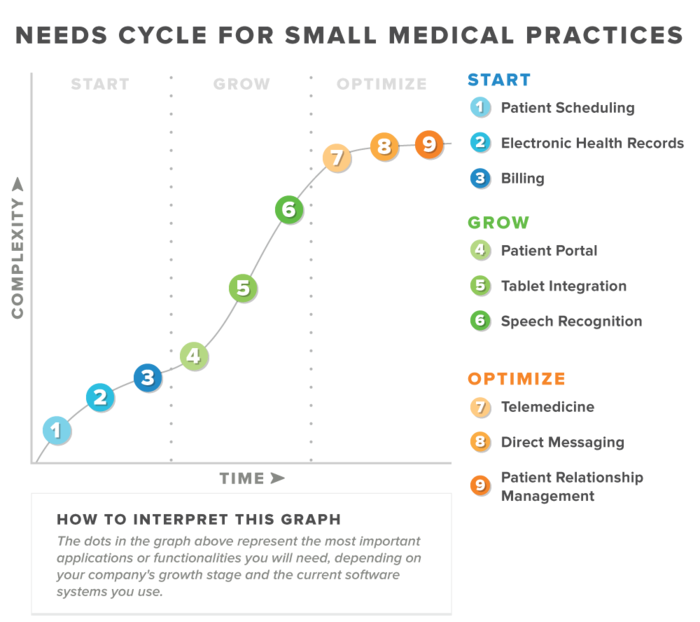

We’ve done some more extensive research on what software features practices should invest in and when. You can find that information in our Medical Needs Cycle.

One thing to remember when researching software at this stage is to look for systems that will allow you to grow. You should weigh the difference in cost and time between paying more for software with advanced functionality now and switching to new systems in the future.

Serving Patients Should Be Personal and Business

THE CHALLENGE: Be both a doctor and a business owner all at once, while only having formal training in one of those things.

Physicians who own their own practices have always walked a fine line between doctor and business owner, and more often than not the former identity takes priority.

That’s as it should be; physicians are first and foremost healers, and ignoring that has some significant ethical and moral implications. With that said, owners of independent medical practices must strike a more even balance between the two roles.

That solution offers its own challenges, though, as most doctors lack the formal training required to run an efficient and productive business.

THE SOLUTION: Find people who are trained on how to run a business.

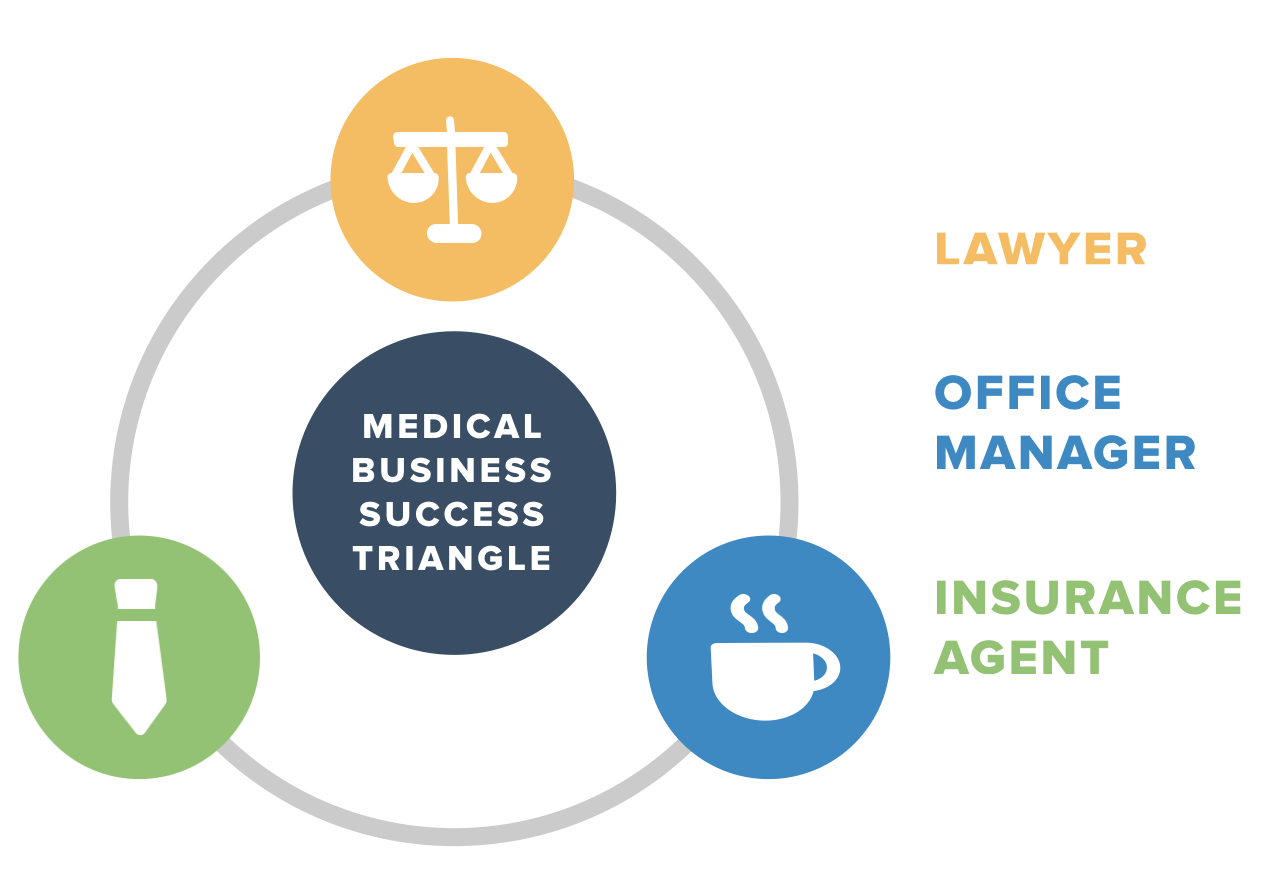

You simply cannot ignore the business elements of your practice, but you can make managing them easier on yourself. There are three people who will help you do this:

The Software Advice Medical Business Success Triangle

First, your lawyer is going to help you by protecting your practice. That means incorporating as a legal entity to ensure your liability is limited in the event that you are sued for malpractice. It also means ensuring you qualify for the tax benefits associated with whichever type of legal entity you opt for.

Next, your office manager is going to help you establish policies and structures that will keep your employees safe and happy as well as protect you from making any mistakes as an employer. Look for an office manager with HR experience for additional help in this area. An office manager can also help you come up with workflows and strategies for office efficiency, which is an added bonus.

Finally, your insurance agent is going to help you find a malpractice plan that offers an appropriate level of coverage at the right cost. A lot of insurance agents don’t specialize in medical plans, which makes them poor representatives when dealing with claims. Do your research, ask around and talk to different agencies to increase your options before selecting an agent and a plan.

Next Steps

Once you’ve headed off each of these challenges, you’ll still have a lot to do to get your practice ready for opening day. To get you through those next steps, take a look at our checklist for opening a new practice.

Also, take a look at our guide to writing medical job postings so you can bring in the very best team to support you and the other providers at your new practice.

Finally, once you’re ready to explore the software solutions that will best serve your practice as it’s getting off the ground and growing, give our team of medical advisors a call to discuss software pricing and options.