Is On-Demand Pay The Next Big Thing In Employee Benefits?

On-demand pay is the latest trend in compensation-related benefits for employees, and according to the Society for Human Resource Management, more than 60% of U.S. workers would like to be able to access their earnings before their regularly scheduled paydays [1].

Offering this benefit can help your organization attract and retain talent, but you need to understand the pros and cons of on-demand pay before making a decision.

If you’re a benefit administrator in the process of updating your total rewards offerings to better suit your employees' needs, this guide will educate you on the ins and outs of on-demand pay in an effort to help you decide whether this benefit is right for your organization.

With insights from Marcin Zielinski, vp of human resources at Cornerstone Building Brands, as well as research from Gartner [2], we’ll explain how on-demand pay works, the pros and cons of providing this benefit, and the next steps you can take to determine whether this perk is something your workforce wants.

Continue to the end of this article to download our free Employee Benefits Feedback Questionnaire.

What is on-demand pay?

On-demand pay, also called earned wage access (EWA) or payroll on demand, is an employee compensation method that allows workers to receive some or all of their wages as they earn them (as opposed to on a traditional weekly or monthly basis).

As is stated at the the top of this article, the majority of workers would like to be able to access their wages before payday. There are many factors driving this; an obvious one being the recent rising cost of living due to inflation. Further, in 2022 the Federal Reserve reported that one in five US adults incurred major, unexpected medical expenses in the prior 12 months—just one more example of why providing instant access to earned wages can alleviate financial stress for your workforce [3].

How does on-demand pay work?

To offer this benefit, businesses have to partner with payroll service providers or human capital management software vendors whose systems are built to allow employees to access their wages the same day they earn them.

Marcin Zielinski, vice president of human resources at Cornerstone Building Brands, explains how he implemented on-demand pay at his organization [2]:

Marcin Zielinski

Vice president of human resources at Cornerstone Building Brands

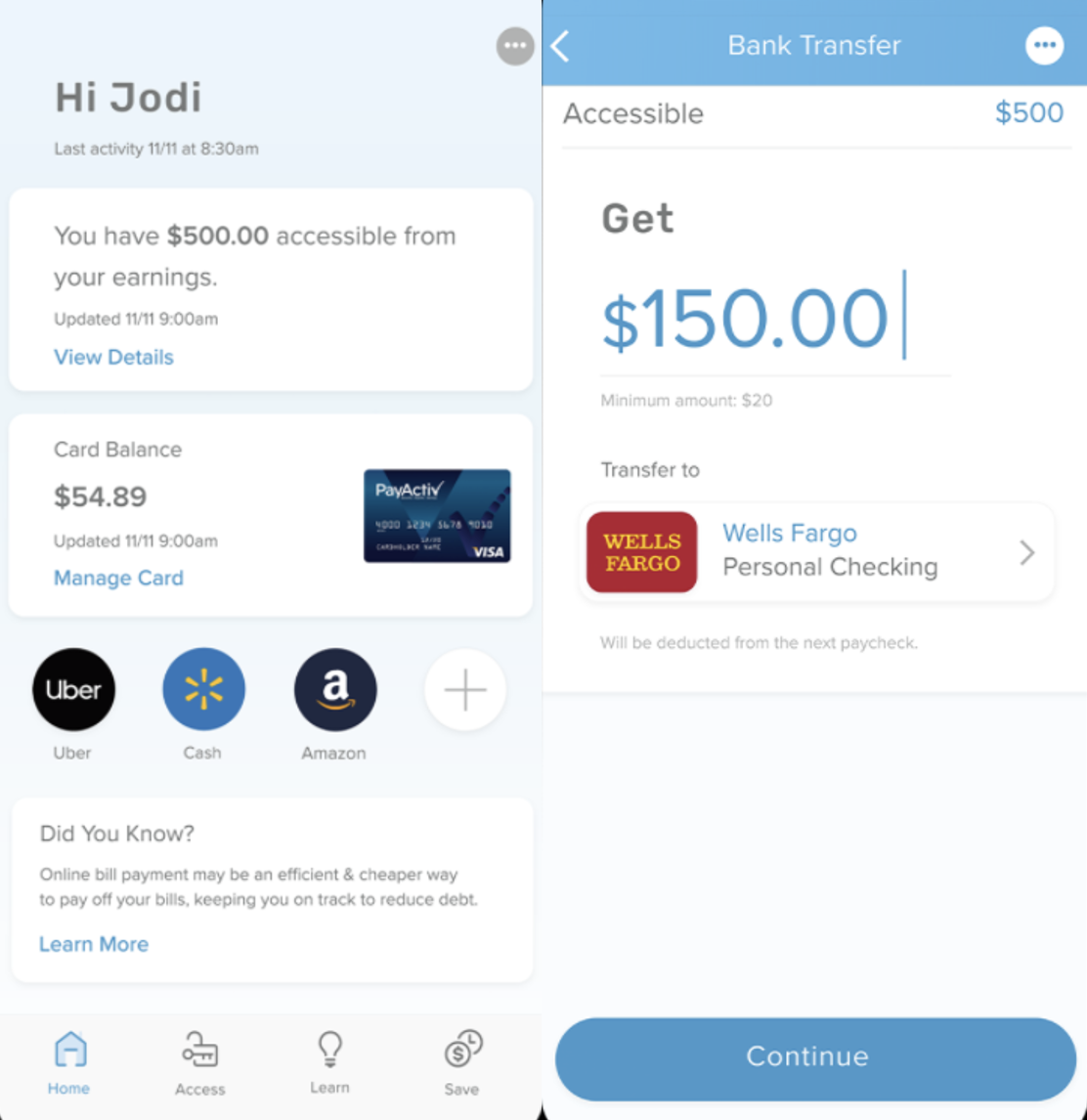

Accessing earned wages in PayActiv (Source)

Tip

Ask your payroll software vendor, payroll service provider, or a human resources software vendor whether they can enable on-demand pay for your workforce. If they can’t, you may need to invest in a separate tool that integrates into your current payroll process. For help finding a solution, chat with one of our software advisors.

The pros and cons of on-demand pay for businesses

Ahead, we break down three advantages and disadvantages of offering this benefit to your workforce.

Pros | Cons |

|---|---|

Reduced voluntary turnover There’s proof that offering early wage access can improve retention. Case-in-point: The executive VP of a company that owns 53 McDonald’s franchises started offering on-demand pay to employees and saw a 10% drop in their turnover rate [4]. | Per-use fees In some cases, employees may be charged a per-use fee to access their wages ahead of payday. This penalty is counterproductive to the benefits of on-demand pay. If you’re serious about offering this option to your workforce, make sure you review the fine print around fees associated with using the service. |

Improved recruiting efforts Advertising this benefit during the recruiting process can help bring more talent through the door. Zielinski says: “...the highest engagement with the program has been from new hires. We think this suggests that on-demand pay was an influential factor in their decision to accept the job.” | Constructive receipt The IRS’s constructive receipt doctrine states that an employee’s wages are taxable once they’re set apart for the employee [6]. Depending on how your organization processes withholdings, this could mean that employees who withdraw their pay on the day they earn it will owe significant taxes later on in the year. Ensure the on-demand pay provider you work with has a system for including taxes and other withholdings in their net wage calculations in order to reduce the disruption this doctrine may cause. |

Improved employee productivity Financial wellbeing has a direct effect on mental health, so it shouldn’t come as a surprise to hear that when employees feel their finances are in order, this can lead to employee engagement. Gartner found that frontline employees in the retail banking industry who are highly financially empowered in their personal lives are over 50% more likely to feel enabled to deliver high levels of financially-empowered support (FES) to customers [5]. | Ethical considerations Hidden fees and interest rates applied to early accessed wages can cut into employee’s net compensation. This can be just as damaging as a payday loan and create a cycle where an employee consistently has to take out money ahead of their scheduled payday to cover expenses. Once again, ensuring that the provider you work with is not enabling payday loans in disguise is the way to avoid putting your workforce in this position. |

Still having trouble deciding whether on-demand pay is right for your business? Read our case study below to learn about Zielinski’s experience.

Case study

Cornerstone Building Brands

Zielinski’s motivations for rolling out on-demand pay to his workforce were twofold: First, he wanted to offer benefits that differentiated his organization from others, and second, he wanted to do something that would help employees manage their financial wellness

He says: “There’s a lot of data around how many people live paycheck to paycheck and have to take out payday loans. We thought if there’s a way for us to help them bridge that gap, we would love to do that.”

Fortunately, Cornerstone Building Brand’s human capital management software vendor already had the functionality in place to enable employees to access their earned wages—and at no extra cost to the business. All that Zielinski’s team had to do was ensure that managers approved timesheets on a daily basis (as opposed to weekly, which was the standard before).

Participation in this benefit has been surprisingly high. According to Zielinski, 21% of employees immediately became active users, and after the first three months, data showed that those employees were able to access over $20,000 on-demand via 298 transactions.

Notably, offering on-demand pay isn’t the only action Zielinski’s team has taken in order to support their employees’ financial wellbeing. They also decided to increase wages and promote other resources available to their workforce such as their employee assistance programs (EAP) and financial coaching initiatives.

He says: “Overall, we’re very excited about all of these positive developments. Our excitement spans across our leadership teams. They take a lot of pride in the fact that they can do something for our employees by utilizing this highly desired and innovative tool.”

Is on-demand pay right for your workforce?

In this guide, we’ve covered how on-demand pay works, the benefits it can bring to your business and the consequences to look out for. You’ve also heard from a business leader who’s had success with on-demand pay at his organization.

Next, in order to determine whether your workforce wants this benefit, we recommend asking them in the form of a survey. You can do this with employee pulse survey software, or download our free employee benefits feedback questionnaire.

Additionally, two next steps you should take after reading this content include:

Ask your payroll and HR software vendors if they can enable on-demand pay and what the consequences of doing so would be for employees.

Consider providing financial literacy training to employees. Founding a financial wellness employee assistance program is a great way to do this. Learn more about EAPs through the link at the end of our sources list [7].

Looking for more? You might like:

Sources

On-Demand Pay, SHRM

Implementing On-Demand Pay to Meet Employees’ Needs: An Interview With CBB’s Marcin Zielinski, Gartner

The Fed - Dealing with Unexpected Expenses, US Federal Reserve

Pay: New service allows U.S. workers to get paid daily instead of weekly, USA Today

Case Study: Employee-Centric Support for Improved Wellness and Productivity, Gartner

Constructive receipt, Internal Revenue Service

Everything You Need to Know About Employee Assistance Programs, Capterra