A Guide to Payroll Software Pricing Models

Are you a small-business owner or HR manager looking for payroll software but not sure which pricing plan to choose? Finding payroll software that offers the features you need within your budget isn't the only challenge. Your decision is influenced by many other factors: upfront costs, recurring expenses, hidden charges, and more.

With that in mind, we’ve put together this comprehensive guide to help you compare the pricing plans of top-rated payroll solutions. This guide aims to assist you in determining which plan provides the most value for your software investment. You’ll also learn how payroll tools are licensed and priced by software providers.

How is payroll software priced?

Payroll software tools are priced based on various factors: features available, integrations available, number of user seats, types of deployment options, storage capacity, and more.

Types of payroll software pricing models

The most common pricing models for payroll software include:

Subscription license: You pay a recurring fee—usually monthly or annual—to access the payroll software for a set amount of time.

Perpetual license: You pay a one-time license fee to get permanent access to the software and its features.

Free and open-source license: You get the software license free of charge but have to pay for implementation, integrations, maintenance, and additional user seats.

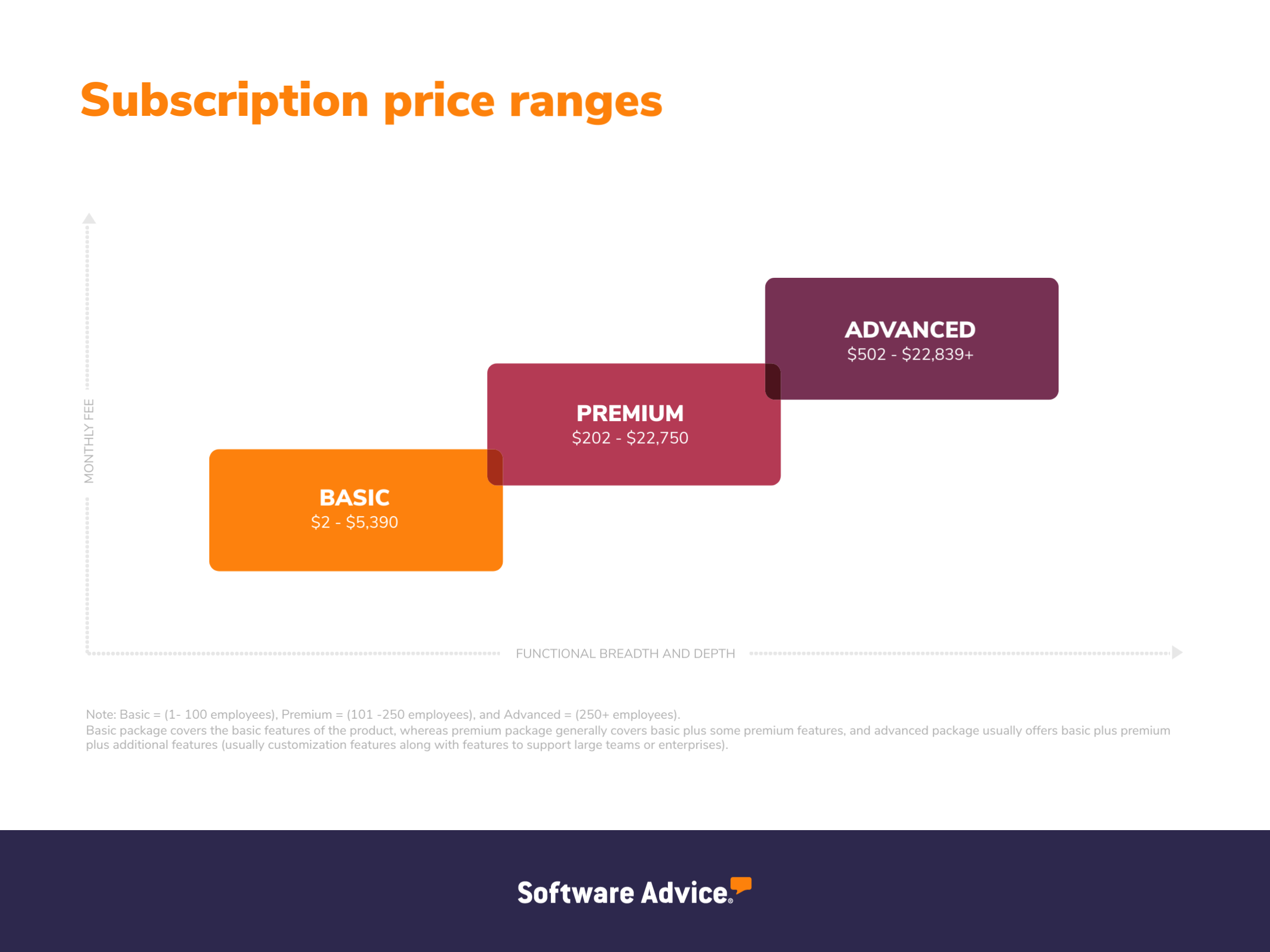

Under the subscription model, per-user pricing is the most commonly seen. You pay a fixed fee for every user seat, and prices increase as the number of user seats increases. Per-user pricing plans are typically of three types, according to analysis by our research team:

Entry-level plans (1-100 users): These plans include limited payroll features such as leave tracking and payroll processing. Their prices tend to start at $2 per user, per month, and they can be a good option for small businesses or teams with simple payroll needs.

Mid-tier plans (101-250 users): Mid-range plans cover everything an entry-level plan offers, plus advanced functionality such as payroll tax filing, automated direct deposit, and compliance management. Their prices typically start from $202 per user, per month, and can go up depending on the number of employees you have.

High-end plans (250+ users): High-end plans include additional premium features such as full-service payroll migration and account setup, compliance alerts, and employee surveys and insights. Per user, per month prices could start anywhere from $502 and go all the way into the thousands depending on the number of employees you have.

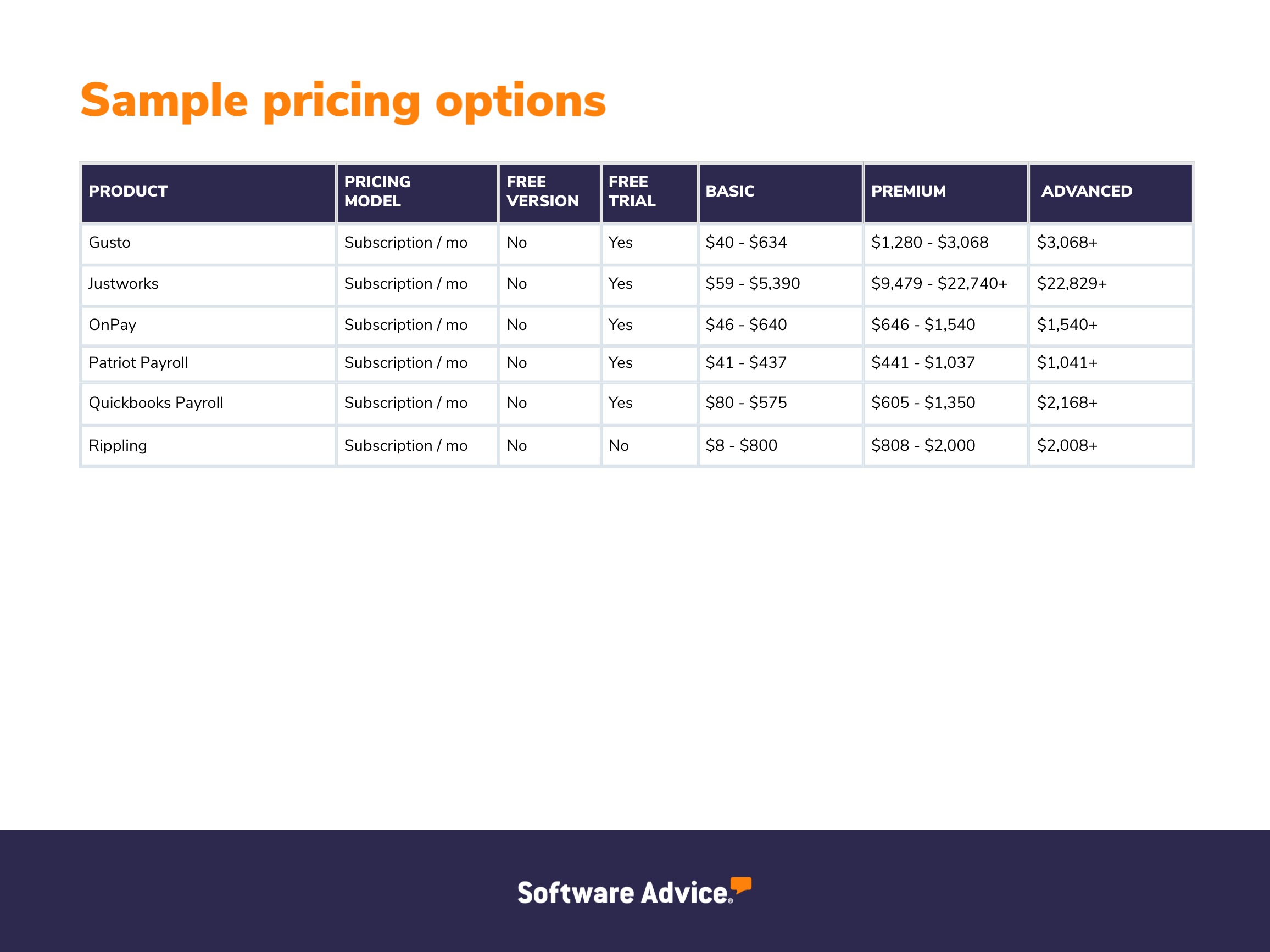

For reference, below is a snapshot of the prices of some popular payroll software tools:

What are the upfront and recurring costs for payroll software?

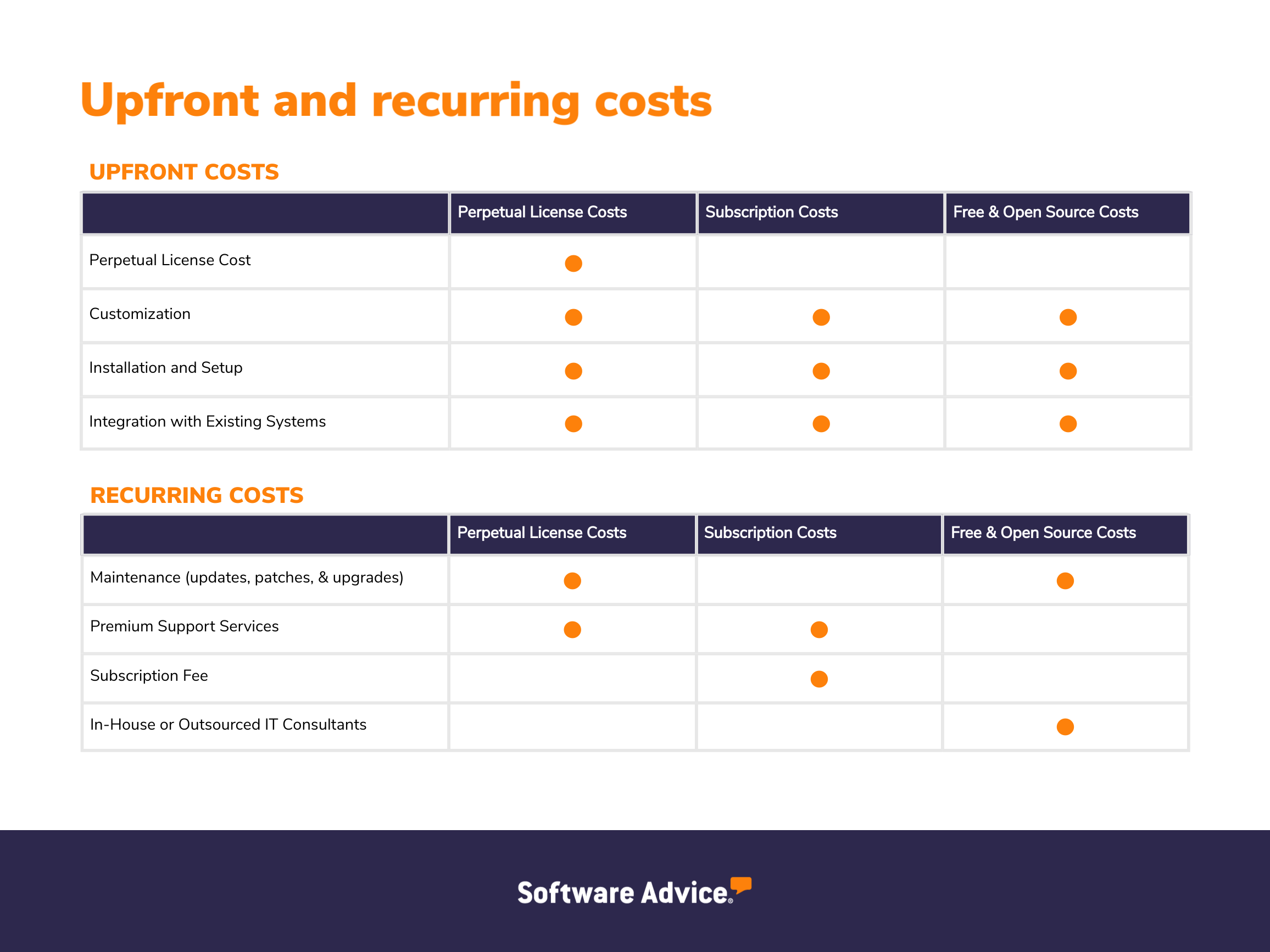

Upfront costs are the initial expenses incurred when you purchase or subscribe to any payroll platform—for example, the cost of a perpetual license, customization, installation, and integration. Ongoing expenses, on the other hand, are associated with using the software, such as subscription fees, customer service fees, and maintenance costs. Ongoing expenses are also called recurring costs. They are typically charged on a monthly or annual basis and can also include the cost of upgrades or additional user licenses.

In the below sections, we discuss, in detail, the upfront and recurring costs for the following payroll pricing models: perpetual, subscription, and free and open source.

Perpetual license | Subscription license | Free and open-source license | |

|---|---|---|---|

What it is: | Under this plan, you pay a one-time fee for a permanent license to use the payroll solution. The fee for a perpetual license can vary based on the number of users. | You pay a recurring fee (usually monthly or annual) to use the software for a set period. The typical subscription pricing plan is based on the number of users per month. You can also choose pay-as-you-go options that allow you to discontinue at any time. | You don’t pay any fee to use basic payroll features in the free software. Open-source software, on the other hand, gives you access to the source code of the software, which lets you modify, use, and distribute the software freely. |

Commonly used for: | On-premise deployments where the system is hosted on your internal servers and maintained by your in-house IT staff. | Cloud-based deployments where vendors host the payroll solution on their servers, giving you access on compatible devices over the internet. | Businesses with limited budget and resources, or businesses looking to try out the software before purchasing. |

Upfront costs: | One-time license fee, hardware (e.g., servers), and installation. | Installation and setup. | Open-source software may involve installation and setup expenses. |

Recurring costs: | Monthly, annual, or ad hoc maintenance (e.g., updates, patches, upgrades). Recurring costs may also include fees for premium support services (e.g., 24/7 phone support). | Software subscription fee and premium support fee (e.g., 24/7 phone support, quick ticket response time). | Open-source software can include costs for server hosting, adding additional features, and IT staff hours to modify the source code. |

Hidden costs: | Customization, integration, and IT staff hours (or hiring more IT staff) to maintain servers. | Customization, implementation of unique company branding, and integration with existing systems such as human resource, ERP, and accounting software. | Implementation, customization, maintenance, integration with existing tech stack, training, and premium support costs could apply to both free and open-source models. |

What are the additional costs associated with payroll software?

While implementing a new payroll software solution, you may incur certain additional expenses that directly affect your overall cost of ownership. These additional costs are common across vendors and pricing models, so it’s important to include them in your budget.

Data migration: Transferring your existing employee and payroll data to a new solution could be time-consuming and expensive. This could lead to additional data migration expenses such as costs for professional consulting, payroll data mapping and validation, hardware or software installation, and data integrity assurance. Therefore, it's critical to assess how much the data migration process costs. Also, check whether the data transfer will cause downtime and, if yes, how much that interruption will cost your business.

Training: Depending on the complexity of the software, the cost of training for a new payroll system can range from zero to several thousand dollars. Employing an implementation professional to educate team members and reduce downtime may be expensive, but it will be helpful in the long term. To help buyers save training expenses, most software providers tend to offer free online resources such as a help desk, a knowledge base, FAQs, and instructional videos.

Hardware and IT: Hardware and IT expenses for a payroll solution include the cost of buying or upgrading servers to host the software, updating employee PCs or mobile devices to conform to the system's technical specifications, and even hiring IT professionals to oversee and maintain the technology. These expenses are in addition to the software purchase cost. Check with the vendor whether the software implementation would require any extra expenses or infrastructure improvements.

Maintenance and upgrades: Maintenance charges are expenses incurred to keep the payroll system running smoothly and up-to-date with the latest features. These ongoing costs typically occur regularly and can add up over time. Therefore, check if maintenance and upgrade services are included in your software subscription or licensing fees. Alternatively, you may have your in-house staff handle software maintenance and support.

How to choose the right pricing model for payroll software

Choosing the right pricing model for payroll tools can be confusing. Here are some considerations to keep in mind when you decide to buy new payroll software:

Determine your budget. You should have a clear idea of how much you can afford to spend on payroll software. If you have a small team, opting for a basic pricing plan or even a free or open-source model would make more sense. If a free or open-source payroll solution meets your needs and has an active user support community, it could be a good option to consider. However, if you have a bigger budget or advanced functionality needs, a mid-range or high-end product would be more ideal.

Evaluate your payroll needs. Ask your payroll team to make a list of must-have software features, such as PTO management, payroll processing, employee self-service portal, time tracking, and payroll tax payments. Determining features that are absolutely critical for your payroll team will allow you to negotiate a better price with the software vendor.

Consider the pricing commitment: perpetual or subscription. A perpetual license is an expensive investment, but it’s more cost-effective in the long term. If your payroll needs are defined and you want to purchase software for the long run, a perpetual license may be a good idea. However, if you’re looking for a flexible and scalable payroll solution, subscription-based pricing would be more appropriate.

Common questions to ask when choosing a pricing plan for payroll software

Below are a few questions you should ask software vendors when evaluating the pricing plans of the payroll solutions you’ve shortlisted:

Does the software offer a free plan?

Most free payroll software plans allow you to use the basic features free of cost. If you have a small team, these free features should suffice your payroll needs. And if you decide to upgrade to a paid plan, you’ll be better equipped to make a decision, as you would have already tried and tested the software.

Besides the software purchase cost, are there any additional expenses?

Some payroll software vendors charge separately for services such as user training, technical support, and maintenance. For instance, if you’re working with a cloud-based solution and don’t have in-house IT experts, technical support would be a priority for your small business. But if support services aren’t included in your package, you’ll have to pay more. Therefore, before finalizing any pricing plan, inquire about the additional expenses. The actual pricing plan could be affordable, but such expenses can quickly add up and increase your liability.

Are there any hidden costs for data migration or integration with other systems?

Some software pricing plans include hidden costs such as data migration and integration fees. Even a free plan may have hidden charges such as implementation, training, and data migration costs. To ensure full pricing transparency, don’t forget to inquire about the hidden charges.

Ready to purchase payroll software?

Now that you know how to choose a pricing plan that best suits your budget, it's time to select a payroll system that caters to your unique business needs. Software Advice has more than 1,000 products listed on our payroll software category page. You can filter the products by their prices, compare their features, read user reviews, and more.

Survey methodology

The products highlighted in the sample pricing options snapshot are shortlisted from Software Advice’s FrontRunners report for payroll software. Only products with publicly available pricing information on their website, as of March 2023, were included in the list. For each pricing tier, we highlight the lowest monthly pricing plan (per user, wherever available) that includes the core functionality of payroll software: payroll management, payroll reporting, and tax compliance.