Financial Reporting Software Small Business Buyer Report – 2014

Every year, Software Advice is contacted by thousands of organizations looking for the right accounting systems for financial reporting—which gives us unparalleled insight into the needs of today’s software buyers. We recently analyzed a random sample of these interactions to uncover the most common pain points for small businesses (companies with annual revenues of $100 million or less) and buyers’ reasons for purchasing new software.

Key Findings

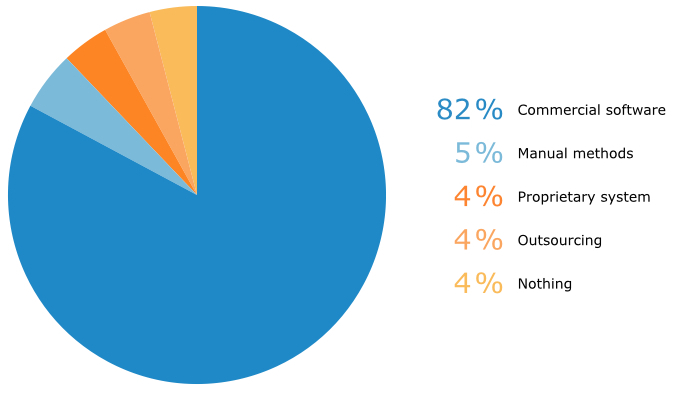

The vast majority of prospective buyers (82 percent) wanted to replace an existing accounting software system.

Software replacement was most commonly driven by businesses outgrowing their systems (35 percent).

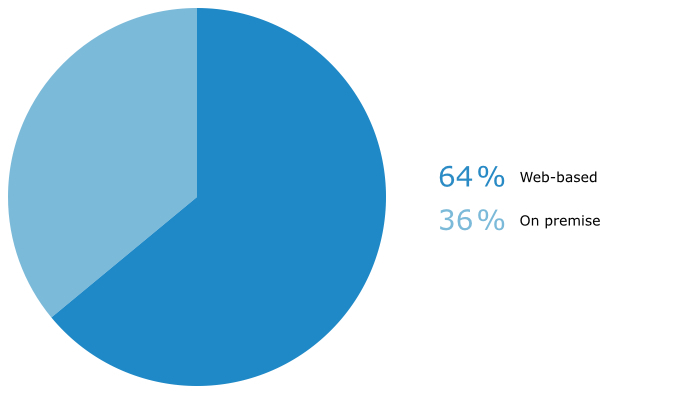

Among buyers with a deployment preference, the majority (64 percent) wanted a Web-based financial reporting system.

(https://software-advice.imgix.net/wordpress/other_pages/Accounting/Financial Reporting SMB BuyerView 2014/Financial-Reporting-BuyerView-2014.zip)

Majority of Buyers Use Commercial Accounting Software

The vast majority of buyers in our sample—82 percent—said they were currently using commercial accounting software. This is a much greater proportion than we have seen in many other software markets: By comparison, our recent point of sale (POS) software report showed 37 percent of POS buyers using commercial software.

Prospective Buyers’ Current Methods

Indeed, only 5 percent of buyers in this sample were using manual methods alone, such as spreadsheets or pen and paper. Four percent were using a proprietary system, meaning in-house, custom-built accounting software. The remaining were outsourcing their accounting (4 percent), or had no formal system in place, often because they were a new business (an additional 4 percent).

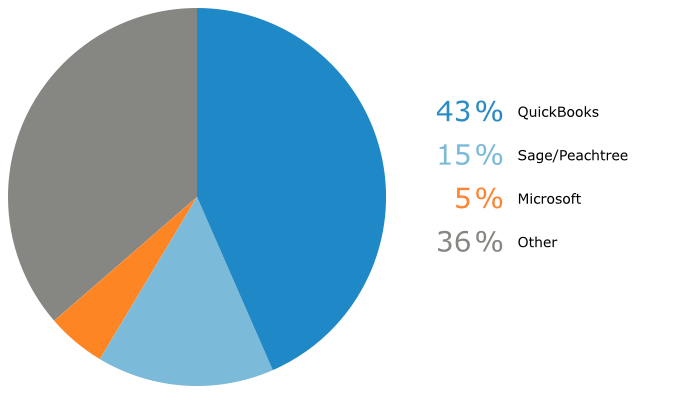

Prospective Buyers’ Current Software (Among Software Users)

For those buyers who were using commercial software, we drilled further into the systems they were using, and found the majority were using either QuickBooks (43 percent), a Sage/Peachtree product (15 percent) or Microsoft Dynamics (5 percent). The remaining 36 percent reported using “other” software, none of which, on its own, amounted to a significant percentage of the total.

Along similar lines, we found in a previous report that of the small-business accounting software buyers who were replacing existing software, many were using QuickBooks (25 percent). While small-business users tend to initially adopt solutions that are less specialized and designed for smaller companies, once their organizations begin to grow, many find their needs extend the limitations of these systems.

It is important to note that some companies in our sample had not purchased the available updates for their current software solutions; for example, one buyer said they hadn’t updated their software “since the early 2000s.” This suggests that small businesses may be postponing any and all software purchases until their system becomes completely untenable and they have to start from scratch.

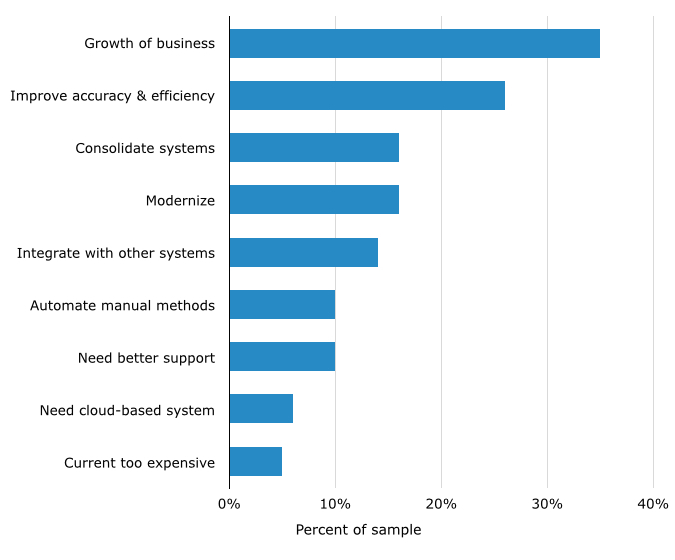

Growth Is Leading Reason for Replacing Software

Of those replacing an existing software system, most buyers (35 percent) said they were seeking a new solution due to the growth of their company. Some of these buyers were missing functions necessary to scale up their business, such as the ability to keep separate ledgers for different locations or to process multiple currencies.

Others needed a more powerful system, such as one buyer who said they “had maxed out” their current system’s storage, or another who said their “[general ledger] file was so big that the system runs slow.”

Top Reasons for Replacing Existing Software

Another top reason for seeking new software, cited by 26 percent of buyers, was that they needed greater efficiency and accuracy in their accounting processes. Sixteen percent of buyers cited the need to modernize an outdated system. Finally, 16 percent mentioned needing to consolidate data from multiple systems into a single software solution. Further evidence of the importance of integration for these buyers was the fact that nearly all of them were seeking an integrated suite.

An “integrated suite” is a set of related applications sold as a package by the vendor (for example, core accounting, billing and invoicing and financial reporting). Alternatively, buyers can choose to purchase single applications on a stand-alone basis. As for our sample, almost every single buyer (97 percent) wanted an integrated suite.

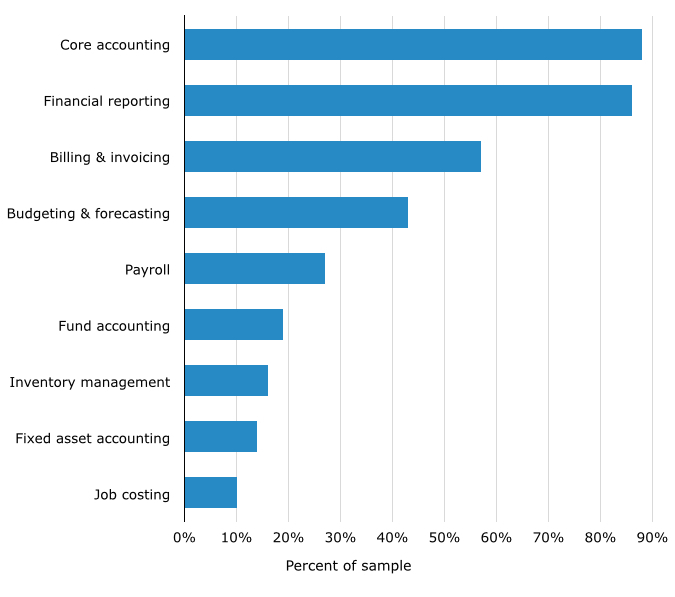

Core Accounting, Financial Reporting Are Top-Requested Functions

Not surprisingly, core accounting was the top-requested functionality (requested 89 percent of the time), while buyers mentioned wanting financial reporting 86 percent of the time.

One buyer requested “robust financial reporting based on scenario planning, budgeting and financial forecast.” Others mentioned needing to create reports for multiple offices within the same organization (or, in some cases, for multiple companies). And many requested “drill-down” features to view financials on both a more granular level, by company segment, as well as on a company-wide level.

Top-Requested Functionality

It makes sense that our buyers were seeking software with these types of reporting capabilities; as a study by the International Integrated Reporting Committee (IIRC) shows, companies, consumers and government entities are increasingly demanding that businesses provide more—and more advanced—reporting on their financials.

While buyers commonly requested software with billing and invoicing or budgeting and forecasting capabilities (57 percent and 43 percent, respectively), payroll was requested less often (27 percent of the time). That’s because many companies were either outsourcing payroll or using a best-of-breed solution, such as Paychex, ADP payroll services or Paycor.

Most Buyers Prefer Web-Based Financial Reporting

The majority of buyers did not indicate a deployment preference (75 percent). However, of the 25 percent who did express a preference, the majority wanted a Web-based system.

Deployment Preferences

Generally, Web-based deployment is requested at lower rates in accounting than in other software markets—but it appears slightly higher for the financial reporting software buyers described here. A possible reason for this lies in the fact that, instead of installing software on a local server, Web-based solutions can be accessed remotely on any device with Internet access. Given that many of our buyers said their businesses were growing, this could be an essential capability for companies with multiple offices and departments that need to access the system.

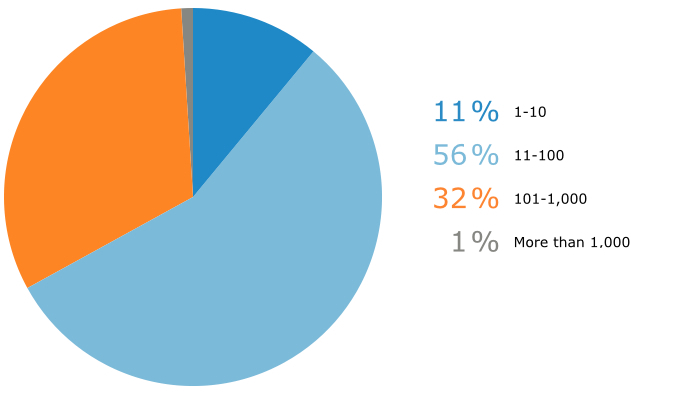

Buyers From Small Businesses in a Variety of Industries

Our sample was isolated to small businesses with annual revenues of $100 million or less. Looking at the demographic data, we decided to drill down even further, looking at the number of employees these businesses had.

Demographics: Prospective Buyers by Number of Employees

The majority of financial reporting software buyers (56 percent) were from companies with 11-100 employees. Meanwhile, 32 percent were from businesses with between 101 and 1,000 employees. Eleven percent were from small businesses with 10 or fewer employees.

It is likely that the lower number of very small businesses seeking financial reporting software is due to those companies having fewer departments, assets and projects, and thus, having less complicated financials.

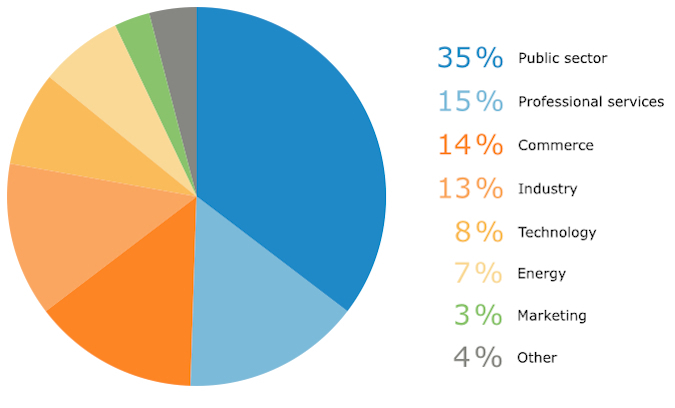

Demographics: Prospective Buyers by Industry

When we compared the industries represented by the buyers in our sample, we found that there were six main segments: the public sector, professional services, commerce, industry, technology and energy. These six industries made up a combined 92 percent of our sample.

It’s likely that many buyers from these industries need financial reporting because they are accountable to shareholders or institutional bodies. For example, the public sector and professional services industries are regulated, thus requiring businesses to have transparency in their financials.

Marketing/advertising made up 3 percent of the sample. Four percent represented “other” industries that each, on their own, accounted for less than 2 percent of the sample.

Conclusion

According to the IIRC, companies have a growing need to “represent their value-creation process.” In other words, they need a way to track the profitability of their business and its appreciation in value. Indeed, the majority of the small businesses in our sample were looking for software with financial reporting functionality to consolidate financial information and paint a more accurate picture for making important decisions as their companies grew.

Susan S. Coffey, senior vice president of the American Institute of CPAs (AICPA), recently wrote a discussion paper on her organization’s approach to integrated reporting. In a post-industrial economy where businesses have fewer tangible assets, she claims, financial reporting needs to change.

Coffey says that the current financial reporting model “was not designed to describe the vast array of new business models that companies now follow in the knowledge economy—business models that, in many cases, rely heavily on the employment of intangible assets to create value and drive profitability.”

While shifting needs for reporting are being addressed for larger businesses, AICPA also sees a need for “scalable” practices of integrated financial reporting for small and midsize firms. For these businesses, accounting software with robust reporting functionality is becoming more necessary. Such systems can track the appreciating value of non-financial and non-physical assets, analyze data from a variety of global departments and create detailed reports to share with stakeholders or regulatory bodies.

Methodology

To create this report, we isolated a random sample of 385 interactions with small-business buyers (those from companies with annual revenues of $100 million or less) from 2014 to analyze. It should be noted that these findings exclusively represent those buyers who contacted Software Advice for guidance on software selection; they may not be indicative of the market as a whole. Chart values are rounded to the nearest whole number.

If you have comments or would like to obtain access to any of the charts above, please contact noelradley@softwareadvice.com.