Mobile Accounting Software: What It Is and Trends to Keep an Eye On

Accounting software used to be simple, almost to a fault: You installed it on your computer and accessed it from your computer. Things changed over the last decade, though—for the better.

Today, we can access accounting software from the cloud and conduct our business on-the-go, through either a mobile browser or downloadable app. This is the essence of mobile accounting software.

But what is mobile accounting, really? The benefits and capabilities of mobile solutions can be hard to pin down, and depending on who you ask, the term “mobility” can mean different things.

To find out what mobile accounting means to modern businesses, we surveyed current accounting software users about their vendor’s mobile offerings, the features they offer, and how often they use them. Use these findings to guide your search for the right mobile accounting solution for your business.

What is mobile accounting?

While cloud-based solutions can improve ease of access, that doesn’t make them mobile; in reality, the two are distinct (though closely related) concepts.

Let’s line them up.

| Mobile Accounting | Cloud Accounting |

What is it? | Native mobile accounting applications specifically designed for a mobile interface. | Software hosted remotely, on the vendor or service provider’s servers, and accessed through any compatible device with an internet connection (including mobile browsers, though not all solutions are optimized for such an interface). |

How is it sold? | Supplements a user’s licensed business accounting software (often free with the purchase of a software license). | Stand-alone business accounting software, sold via subscription license. |

Does this type of software offer full or limited functionality? | Users can perform some or all of the same functions using their mobile devices as they can using their full accounting software from a laptop or desktop computer. | Full software capabilities when logged into the system from any compatible internet-connected device. |

How common are mobile accounting applications?

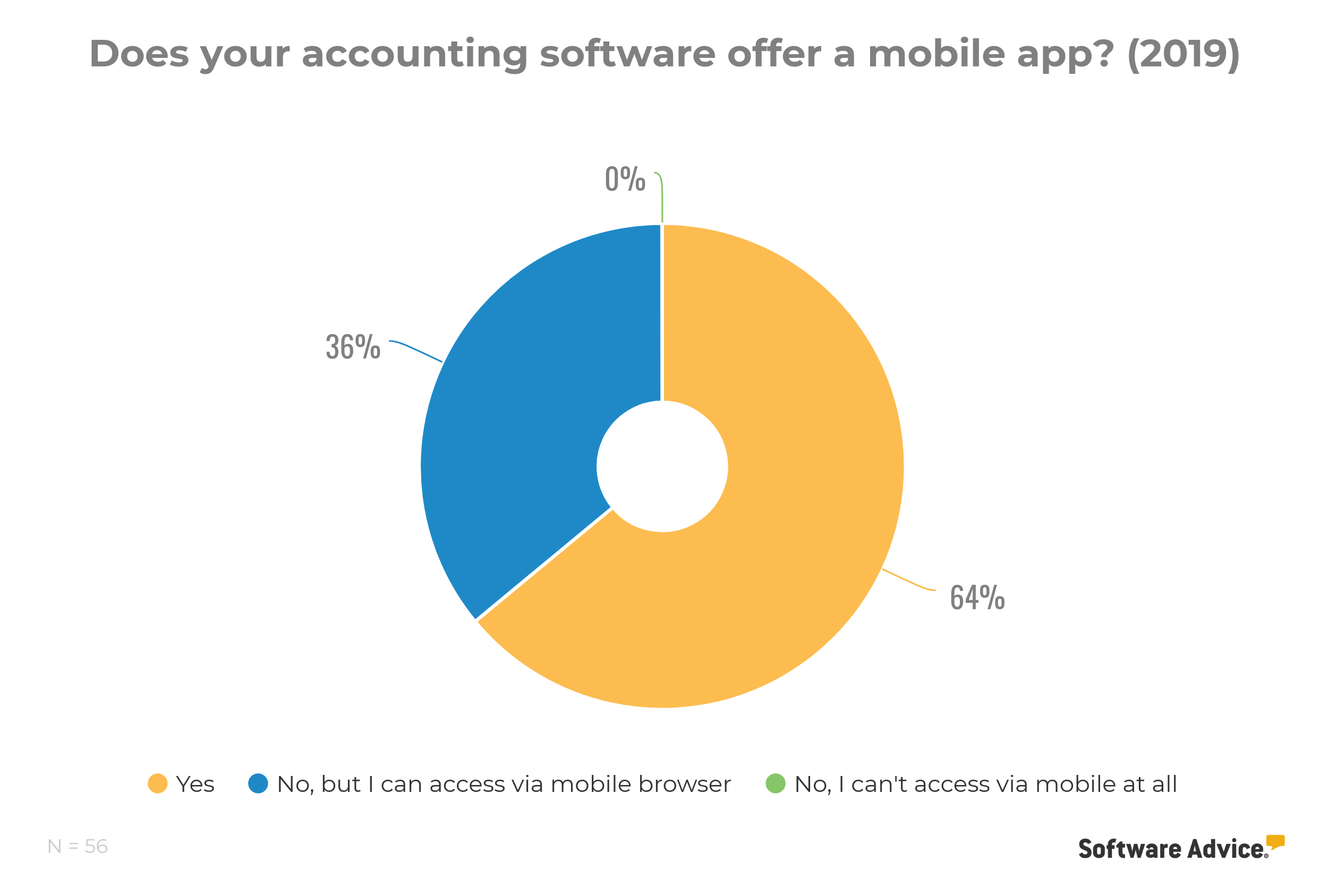

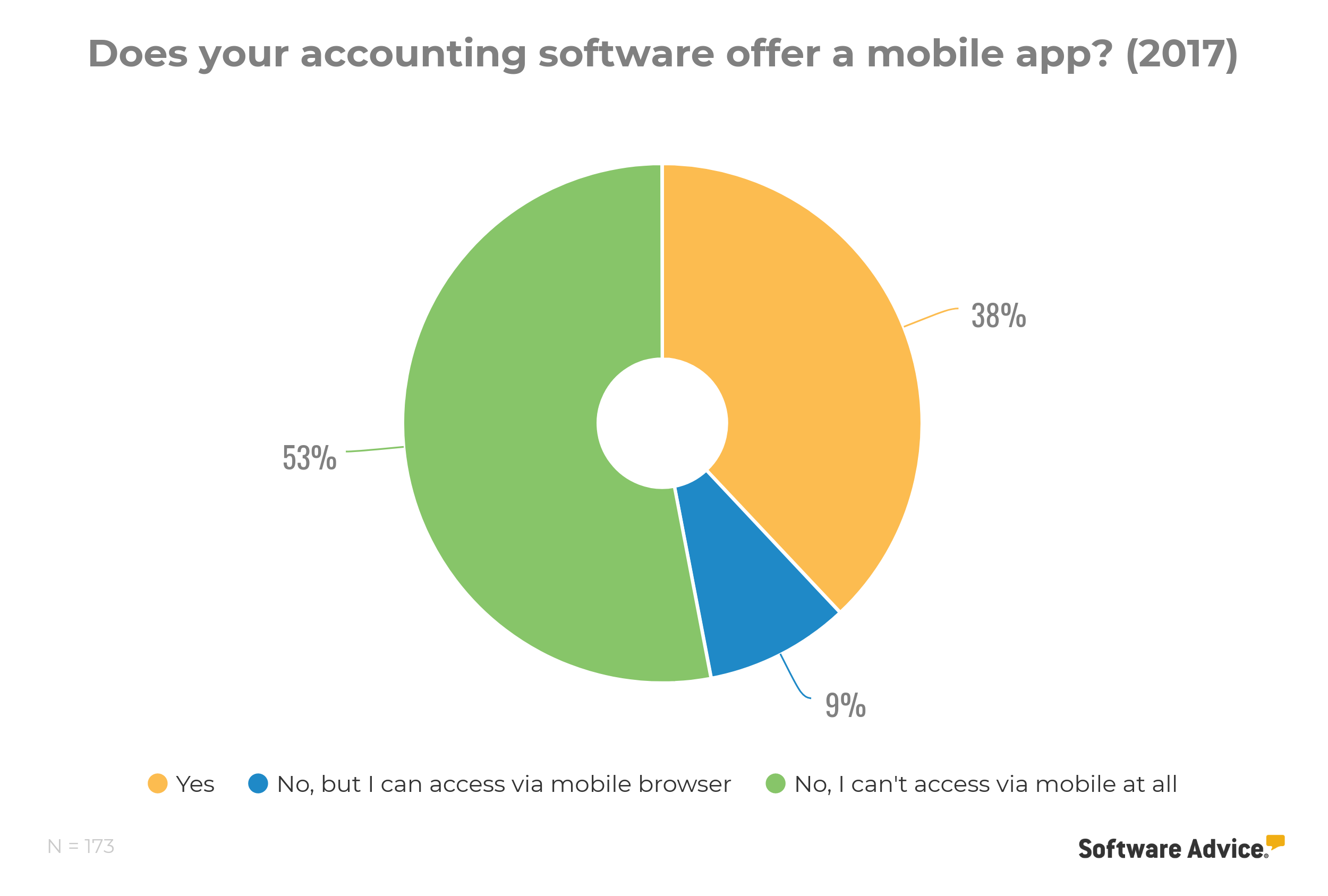

We first asked respondents if their accounting software includes a downloadable app designed for mobile devices. While 36% said their vendors don’t offer a mobile accounting app, 64% said they do. This sharply contrasts our 2017 survey, in which 62% of respondents said their vendor did not offer a downloadable mobile app.

Although some on-premise solutions offer a mobile version, it is less common than with cloud-based solutions.

Intuit, for example, only offers a companion mobile application for the cloud-based QuickBooks Online. Users of Pro and Premier, both on-premise solutions, do not have access to the QuickBooks mobile app.

David Mitroff, founder and chief consultant for Piedmont Avenue Consulting, said that one reason why on-premise solutions often don’t have a mobile app is because non-cloud software must sync with and pull data from a user’s desktop, or wherever the business data is stored. This process depends heavily on the user’s network configuration. As a workaround, some vendors use a third-party hosting service to sync files between mobile apps and desktop solutions.

One key takeaway from our 2017 survey was that vendors were lagging behind the mobile accounting trend. Since then, an increasing demand for mobile access and the maturation of this technology has led to a boom in the availability of mobile accounting apps.

What this means for your business: Though mobile accounting options are increasing, access still isn’t universal.

If you’re in search of an accounting system with mobile access, don’t assume that a cloud-based software will work on your mobile device. Instead, be sure to verify whether or not the vendor offers a stand-alone mobile application that complements the software license—and if they don’t, look for a vendor that does.

Discuss your mobile accounting requirement with vendors prior to investing in an accounting solution to ensure their mobile app runs on the operating system and devices that you and your team use (i.e. iOS, Android, or Windows phones).

Leading mobile accounting trends among businesses

We asked the 64% of respondents with access to a mobile accounting application for specifics on how they use the app. This revealed some interesting mobile accounting trends, including preferred features and its popularity among different age groups.

Let’s take a closer look at each.

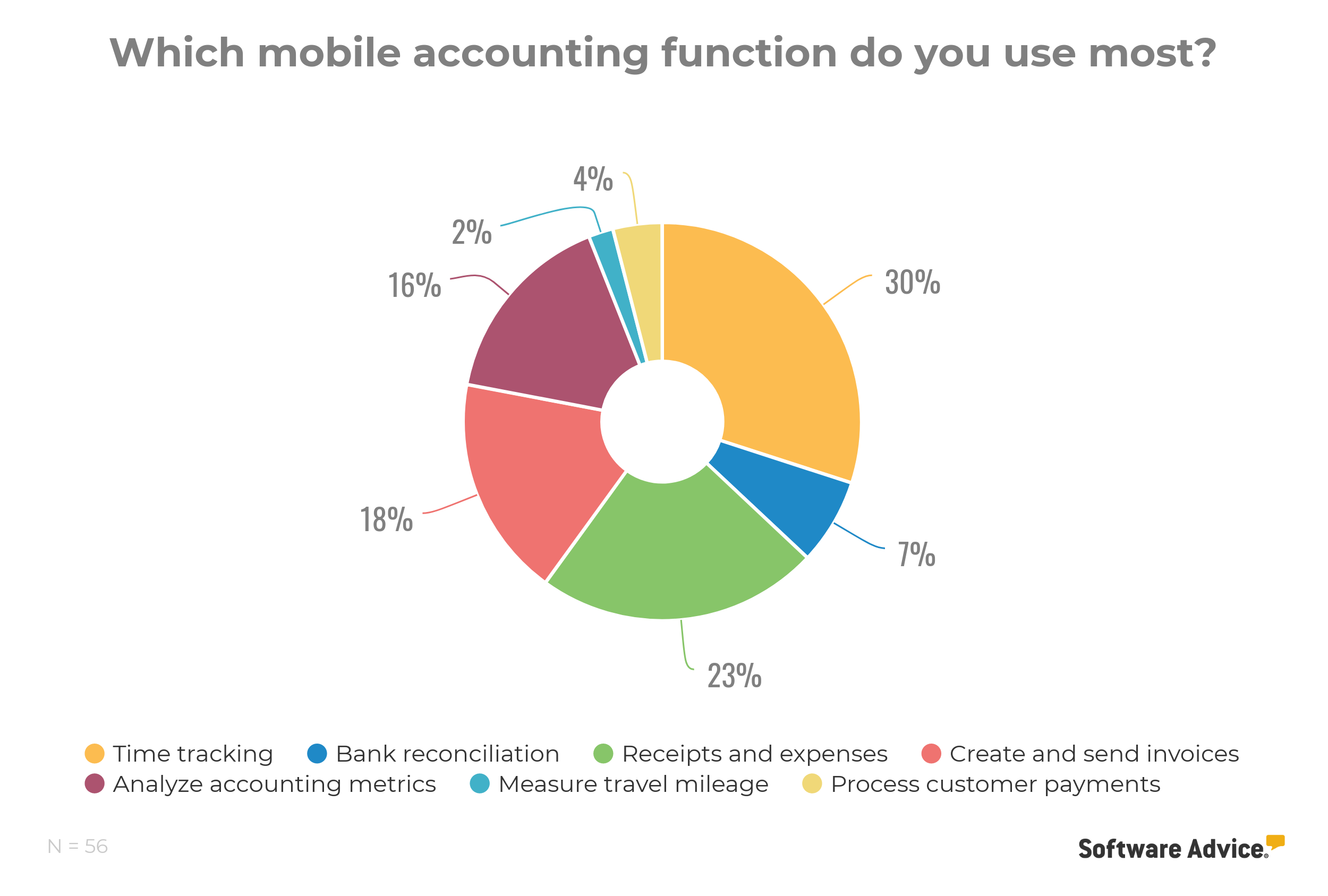

Top preferred features: Mobile application users report that they most often use apps to perform the following accounting functions:

According to Mitroff, convenience is the number one reason people crave mobile accounting functionality—and these top features reflect that desire for expedience. Users can log time while away from the office, reconcile business transactions and bank statements on their commute, take pictures of receipts from business travel and upload them to expense reports, and invoice clients on the spot.

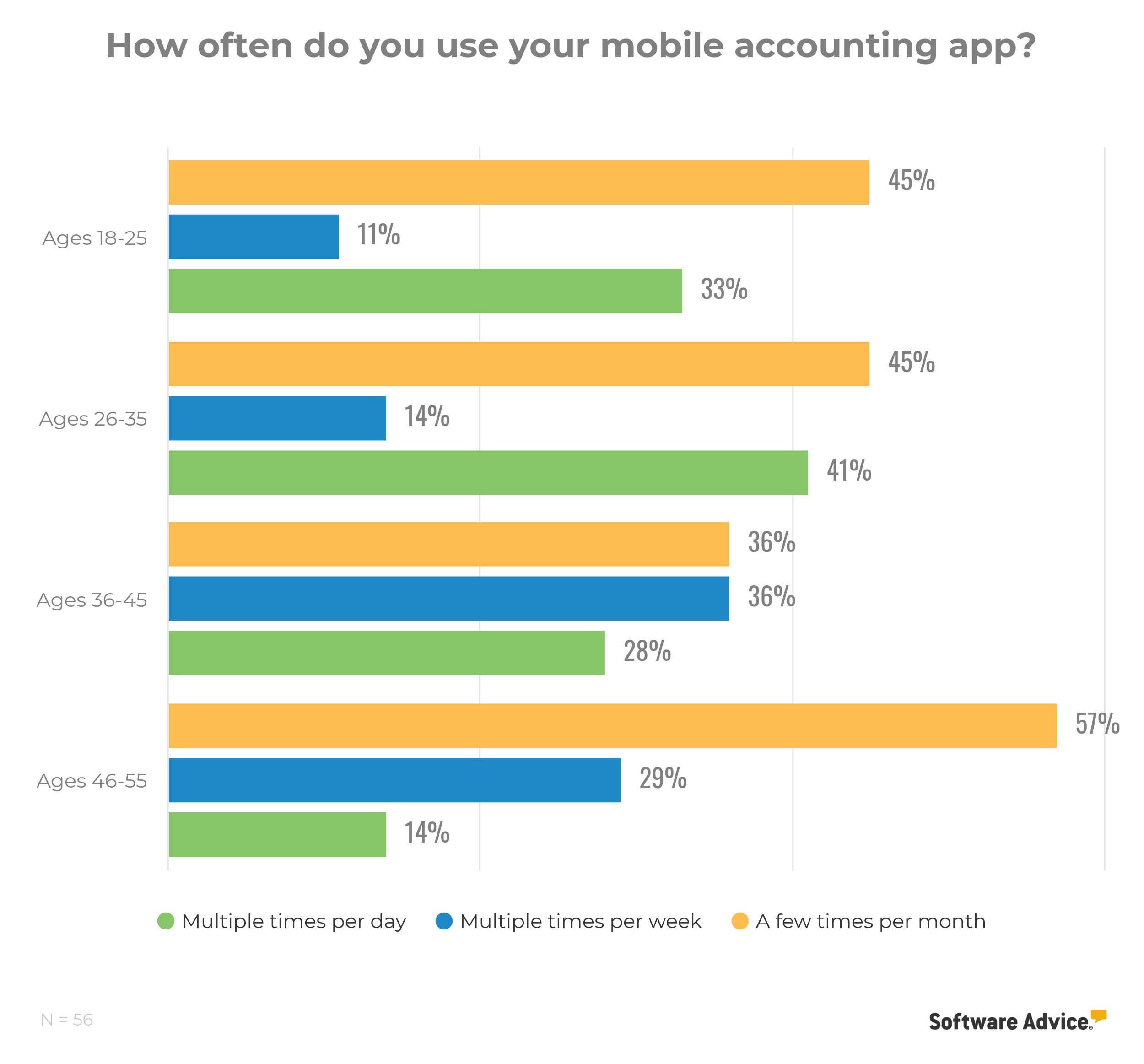

Mobile accounting popularity varies among age groups: Mobile accounting use is highest among users aged 26 to 35. According to our data, not only does this demographic make up the largest percentage of current mobile accounting app users, but they report a higher frequency of use (multiple times per day compared to a few times per week).

What these trends mean for your business: Most mobile accounting apps offer limited functionality compared to the full-featured software licensed for your desktop. For example, a vendor might build an app that allows you to upload receipts and travel expenses but not invoice clients—or vice versa. This means businesses that need mobile accounting will need to find a vendor with an application that supports on-the-go requirements.

Additionally, keep in mind that mobile accounting is more popular with certain age groups than others. If you have a team that spans several age groups, you might need to offer some users more encouragement and training to use their mobile app, while others will have a more natural inclination to use it.

Expected impact of mobile accounting on the industry

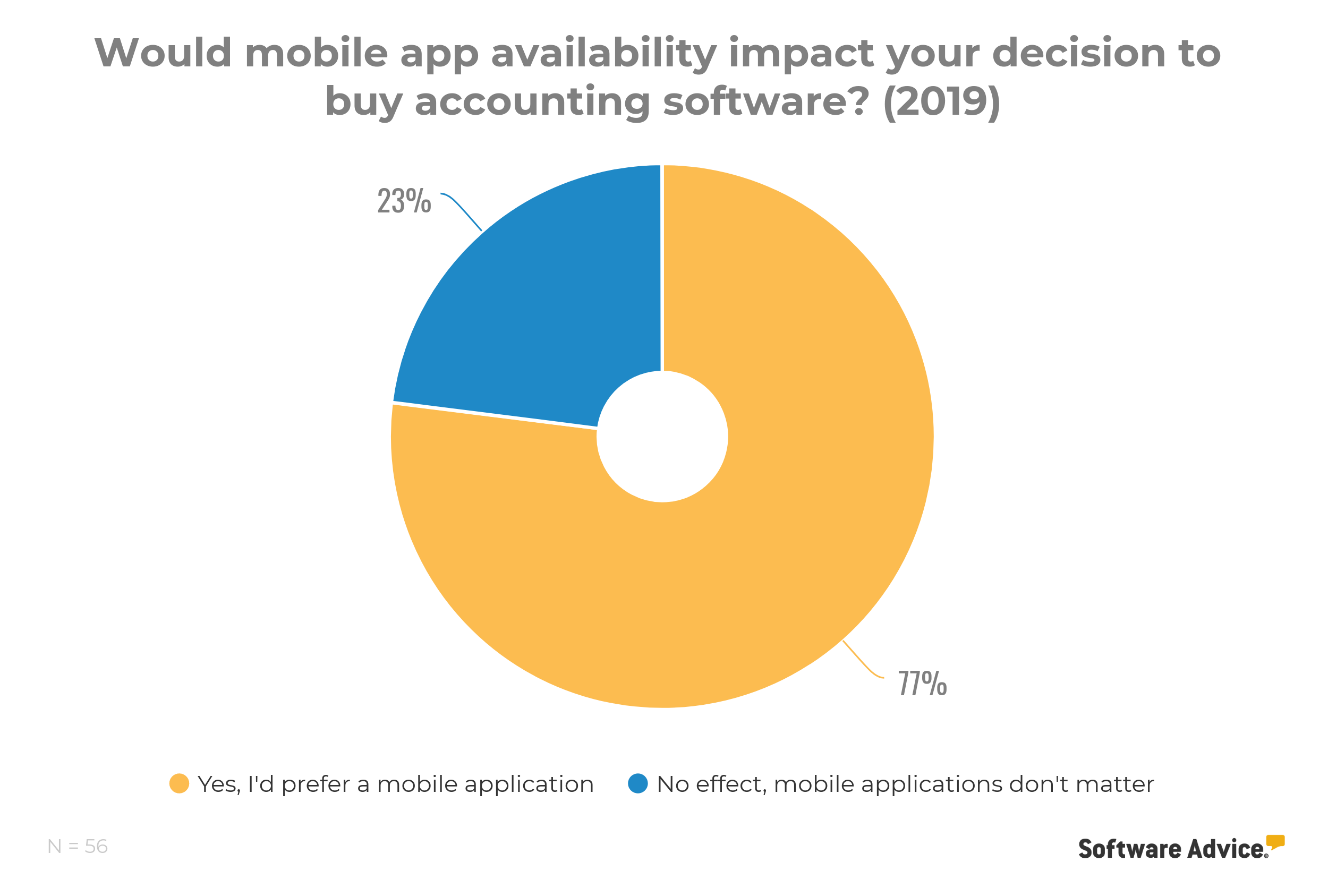

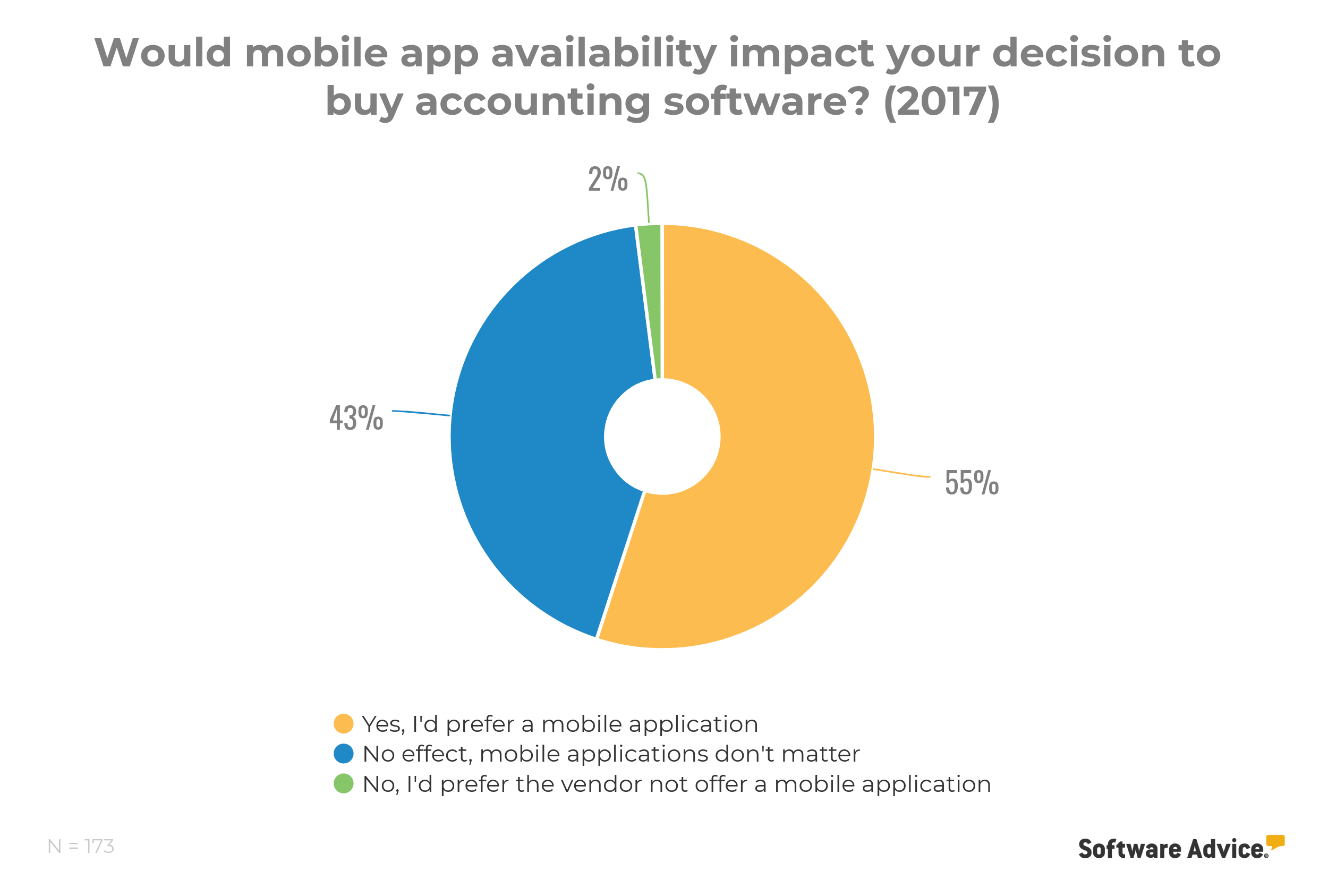

Here’s the most telling statistic from our survey: 77% of respondents said a vendor offering a mobile app would impact their decision to purchase that product over another in future investments. That’s a 13% increase from our 2017 study.

Overall, our survey results indicate that mobile accounting will continue to be a growing trend in the years to come. Vendors looking to stay ahead of their competition should take note and work to improve their mobile app offering—both by improving user experience and increasing depth of functionality.

Next steps: Which mobile accounting software is right for you?

In the meantime, prospective accounting software buyers—especially those who prioritize convenience—should carefully weigh their options and invest in a system with mobile functionality that aligns with their business needs.

Here is how to do that:

Define your needs. Your mobile accounting needs will depend on the size, makeup, and skill set of your organization. How many licenses will you need? How tech-savvy are your users? What features are required versus desired? These are some of the questions you need to ask in the early stages of your search.

Survey the market. Once you’ve determined your requirements, browse our list of mobile accounting apps, complete with a buyers guide and reviews from verified users, then put together a shortlist of vendors that can satisfy your needs. Narrowing your search to a small handful of vendors will make it easier to evaluate the pros and cons of each.

Give us a call. If you’re still on the fence or unsure about what to do next, our software advisors are at the ready with free, fast, and personalized software recommendations, helping companies of all sizes find products that meet their business needs. Schedule an appointment with an advisor here.