What Is a Merchant Service Provider—And Why Do They Matter?

If you’re serious about opening—or have already opened—a retail store, you’ve come across at least one merchant service provider (MSP). These are the gatekeepers between customers’ credit and debit cards and your cash register.

As such, the relationship between you and your MSP is a critical one because:

They allow you to accept credit and debit cards

They help you meet and maintain security standards

That’s why we’re explaining exactly who these gatekeepers are, and how you and your business fit into this relationship.

What Is a Merchant Service Provider?

The central authority on all things payment-related across the globe is the Payment Card Industry (PCI). They set the standards and best practices that merchants, service providers, banks and card issuers must abide by. According to the PCI, merchants are defined as:

“…any entity that accepts payment cards bearing the logos of any of the five members of PCI SSC (American Express, Discover, JCB, MasterCard or Visa) as payment for goods and/or services.”

The PCI defines service providers as:

“Business entities that are not a payment brand, involved in the processing, storage or transmission of cardholder data on behalf of another entity. This also includes companies that provide services that control or could impact the security of cardholder data.”

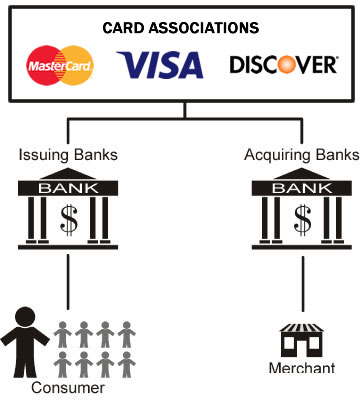

Based on these definitions, all of these stakeholders are considered to be service providers:

The five PCI SSC members listed above

Merchant and consumer banks and their payment processors

Companies managing the servers you’re sending payment info through

The Transaction Process

To understand the role of the MSP, let’s first explain an age-old process that millions of consumers and businesses take for granted daily: the card-based transaction.

You can see a typical transaction process in the chart below.

Card-Based Payment Transaction Flow

Source: Fidelity Payments

Here, we’ve broken this down into a step-by-step process that details each step represented in the flow chart above.

Card-Based Transaction Process

Step 1: Consumer initiates a transaction by swiping or inserting their credit/debit card at a merchant’s point-of-sale (POS) system. |

Step 2: Transaction info (amount, card number, issuing bank etc.) is sent from merchant’s payment software to their MSP. |

Step 3: Merchant’s MSP sends transaction info to the appropriate card association (Visa, Discover, MasterCard etc.) |

Step 4: Card association sends transaction information to the consumer’s bank. |

Step 5: Consumer’s bank checks their available funds/credit limit and approves transaction accordingly. Payment approval is sent back to card association. |

Step 6: Card association confirms approval of transaction with the merchant’s MSP. |

Step 7: The merchant completes the transaction and issues consumer a receipt for the purchase. |

The actual rendering of payment between consumers and merchants can happen automatically upon payment approval, at the end of each business day or whenever the merchant closes out their transactions (daily, weekly, biweekly).

As you can see, MSPs are key to merchants’ completion of transactions. But what do retailers need to know to select the MSP that’s right for their business?

Tips for Selecting a Merchant Service Provider

You can imagine how important it is for merchants to partner with a trustworthy, reliable and consistent MSP. But it isn’t always a “pick-and-choose” scenario, and sometimes previous MSPs aren’t compatible with a new POS system.

Regardless of the situation, there are some best practices merchants can follow to ensure they end up with the best MSP for them. Transfirst, an MSP associated with Wells Fargo Bank, lists some critical tips retailers should follow:

Go into the selection process with a good idea of what you need for your business. For example, which MSPs match your payment processing requirements now, and which MSPs are looking toward the future at adding new and innovative payment options?

Understand the various fees and costs associated with each MSP you’re considering. Some providers slip in hiked up rates after you hit a certain amount in sales. This essentially makes it a system of “the more you make, the more you pay.”

Read online reviews and ask around to learn about an MSP’s customer support. What level of support is included in your contract? Are there additional support costs? Also, keep in mind how effectively you could troubleshoot issues on your own versus how often you’d need to contact customer support.

In addition, the variations of MSPs make it a great idea for retailers to consider multiple POS options when switching to a new system. Some POS systems require you work with a single MSP or have a list of preferred MSP partners. Others give you free reign to choose your own.

At the end of the day, don’t sacrifice POS functionality just to get the ideal MSP, but be sure to consider what type of fees and services your MSP offers.

If you’re interested in switching to a new POS system, take a quick questionnaire to determine the best systems for your business. And if you have any lingering questions about merchant service providers, payment processors and the like, feel free to reach out to me at justinguinn@softwareadvice.com and I’ll do my best to help you.