What Is QuickBooks Software? A Guide to Choosing the Right Solution

When you hear “small-business accounting software,” you probably think of QuickBooks. Since Intuit launched its flagship product over 25 years ago, the financial management platform has dominated the accounting software marketplace, resulting in an impressive 11 consecutive years of stock gains

Currently, QuickBooks software holds more than 80% of the small-business market share. If you’re researching small-business accounting solutions, QuickBooks is on your list.

But which version is right for you? On-premise or cloud? With payroll or without?

QuickBooks has a product for nearly all of your accounting needs, but sorting through the options can feel like an insurmountable task.

To simplify your search, we’ve created this QuickBooks comparison report, which outlines the different versions and who/what type of business they’re best suited for.

Are you a solo entrepreneur seeking cloud-based accounting?

Jump to: QuickBooks Self-Employed

Are you a small business seeking cloud-based accounting?

Jump to: QuickBooks Online

Are you a small or midsize business seeking desktop accounting?

Jump to: QuickBooks Desktop

Looking to enhance whichever version of QuickBooks you already use?

Jump to: QuickBooks Apps

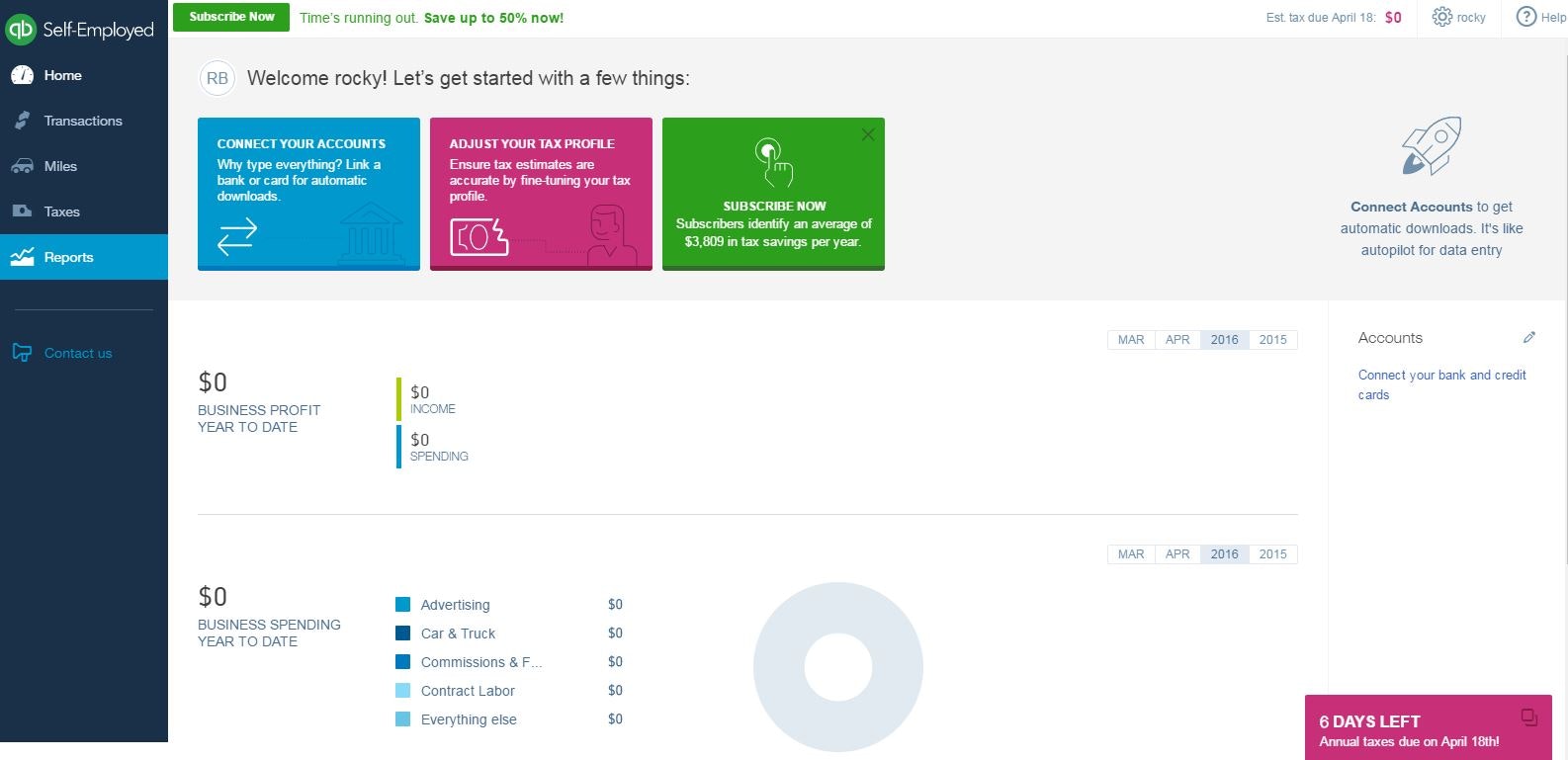

QuickBooks Self-Employed

The newest edition of the QuickBooks product line is a cloud-based financial management service designed for self-employed and/or freelance individuals.

Reports in QuickBooks Self-Employed (Source)

Pricing: Available through a monthly subscription that includes the cost for phone support, data backups, and system maintenance.

The solution comes in three packages:

QuickBooks Self-Employed | Allows users to: ✔ Connect to bank and credit card accounts ✔ Track income and expenses, separating transactions as business or personal ✔ Categorize and track IRS Schedule C tax deductions and expenses ✔ Calculate quarterly taxes |

QuickBooks Self-Employed Tax Bundle | Offers the same functionality as Self-Employed with a connection to Intuit TurboTax, allowing users to: ✔ Pay quarterly taxes online ✔ Export Schedule C deductions to TurboTax |

QuickBooks Self-Employed Live Tax Bundle | Has all the aforementioned features, plus the ability to: ✔ Consult a CPA as often as you need to, year-round ✔ Have a CPA conduct a final review of your taxes before filing |

Benefits: | Drawbacks: |

A mileage tracker—users can log trips by entering the date, purpose, and miles driven. The software calculates the deduction automatically. | Lack of invoicing capabilities with no connection to a payment gateway. |

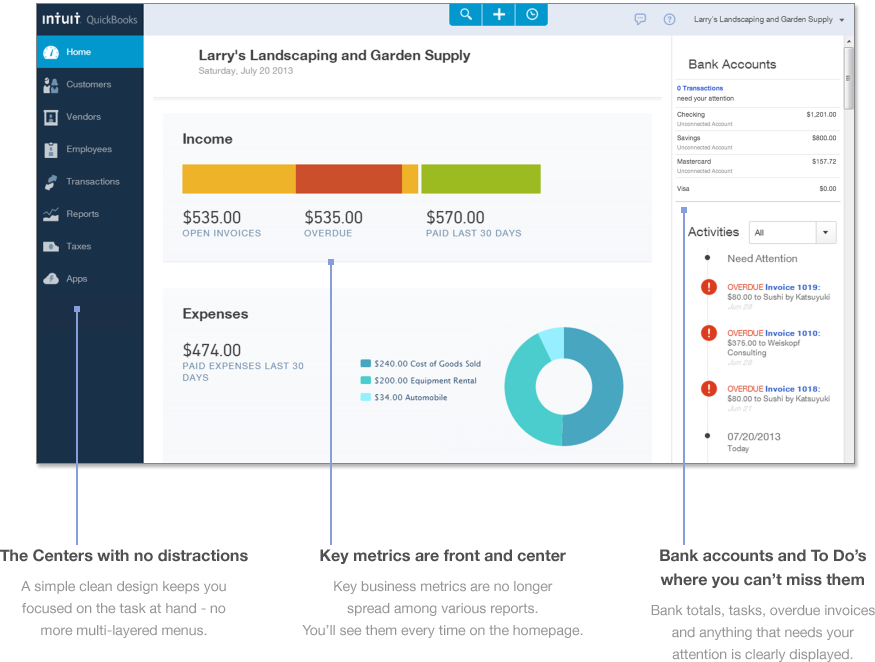

QuickBooks Online

In 2014, Intuit reported a major turning point for QuickBooks products. For the first time, more new customers chose QuickBooks Online over desktop versions.

Since then, QuickBooks Online has grown to over 1 million subscribers, signaling that small businesses are growing more confident hosting their accounting solutions in the cloud.

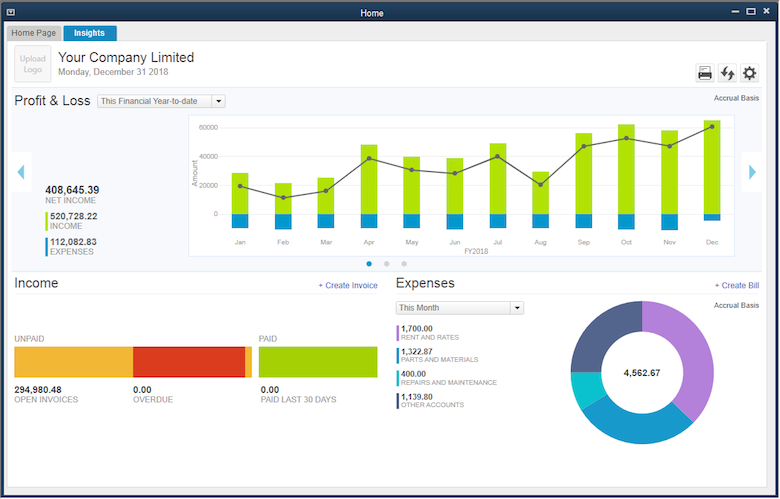

Dashboard in QuickBooks Online (Source)

Pricing: Available through a monthly subscription that includes the cost for support, automatic data backups, and upgrades.

QuickBooks’ cloud-based solution is designed for small-business users and comes in four packages: Simple Start, Essentials, Plus, and Advanced.

QuickBooks Online: Common capabilities

Accounts payable and accounts receivable: Monitor and manage income and expenses.

Billing and invoicing: Send unlimited estimates and invoices. Essentials and Plus also offer recurring invoices.

Expense management: Track and process work-related expenses such as travel and supplies.

Financial reporting: Simple Start has over 20 prebuilt reports, Essentials has over 40, and Plus has over 60 (includes sales and tax reports).

QuickBooks Simple Start | ✔ One user license ✔ Data import from Excel or QuickBooks Desktop versions ✔ Access for up to two accounting professionals (accountant and/or bookkeeper) |

QuickBooks Essentials | Includes the above capabilities as well as: ✔ Three user licenses ✔ Ability to set user permissions (accountant, bookkeeper, etc.) ✔ Ability to postdate bills and payments |

QuickBooks Plus | Includes all of the above and more, including: ✔ Five user licenses ✔ Inventory tracking ✔ Creating and sending purchase orders |

QuickBooks Advanced | Includes, on top of what’s listed above, the following features: ✔ 25 user licenses ✔ Bill payment ✔ Custom user permissions |

Benefits: | Drawbacks: |

Connectivity—mobile apps are available for iOS, Android, and Windows devices. This version also offers easy integration with third-party applications such as PayPal and Shopify. | According to user reviews on Software Advice, QuickBooks Online lacks some functionality available in QuickBooks Desktop products. As one user points out: “The online version does not allow you to run more than [one] company. The PC version allows multiple tax IDs.” – Jeremiah from Camp Curiosity, Curiosity Staples |

QuickBooks Desktop products

It’s important to note: while QuickBooks Online will be the best choice for many small businesses due to ease of use and access, the online version is not identical to the vendor’s desktop products.

They offer similar capabilities, but the breadth and depth of the features differ. For example, with QuickBooks Online, users can automatically schedule and send invoices, a feature absent from the desktop version. QuickBooks Desktop, meanwhile, allows for the calculation of job costs and individual customer discounts.

There are several QuickBooks products under the Desktop umbrella (in this article, we’re discussing the 2019 versions of each. They include:

Mac: Designed for small businesses using macOS (not scalable)

Pro: A good fit for small business just starting out (can scale to Premier and Enterprise)

Premier: Aimed at small businesses with industry-specific needs (can scale to Enterprise)

Enterprise: Designed for small to midsize businesses that need a flexible business and financial management solution

The desktop products have a similar base feature set, with functionalities becoming more advanced as the packages scale.

QuickBooks Desktop: Common capabilities

Core accounting: Accounts receivable, accounts payable, general ledger, and bank reconciliation.

Payroll (limited): Track employee hours and print checks and deposit slips. Enhanced payroll is available for an additional fee (calculates payroll taxes and files tax forms).

Billing and invoicing: Automates invoice creation and sharing, as well as payment collection.

Inventory management: Tracks orders, sales, and deliveries to maintain product supply levels.

Financial reporting: Tracks and visualizes trends, evaluates KPIs, and reports profitability on profit and loss (P&L) statements, balance sheets, etc.

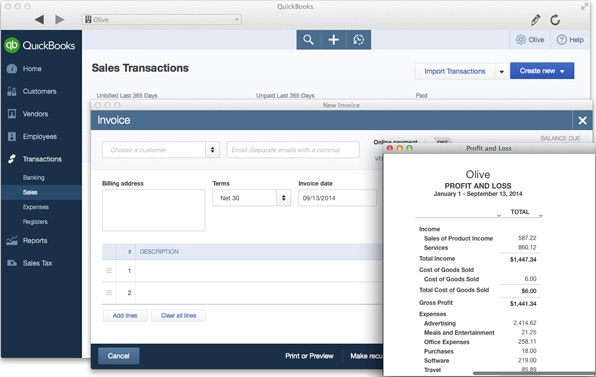

QuickBooks Desktop for Mac

Businesses should note that QuickBooks’ Mac desktop product is not scalable, whereas the Windows versions of Pro, Premier, and Enterprise are.

Sales transactions in QuickBooks Desktop for Mac (Source)

Pricing: User licenses are sold outright for a one-time fee. This package supports up to three concurrent users, but requires a unique user license for each. Phone support is available 24/7 for an additional fee, sold in recurring 90-day support plans.

In addition to the common desktop capabilities listed above, QuickBooks Desktop for Mac includes:

✔ An “Income Tracker” dashboard, which displays unpaid invoices

✔ Project accounting to invoice for projects in phases

✔ Budget management to create fiscal year budgets and track progress

Benefits: | Drawbacks: |

Built from the ground up for macOS, this version gives dedicated Apple users access to QuickBooks in their native Mac environment. It easily integrates with built-in macOS applications such as Contacts and Calendar. | There is no accountant’s copy included in QuickBooks for Mac. Mac users can share data with Windows users through a data conversion processes known to QuickBooks for Mac users as round tripping. |

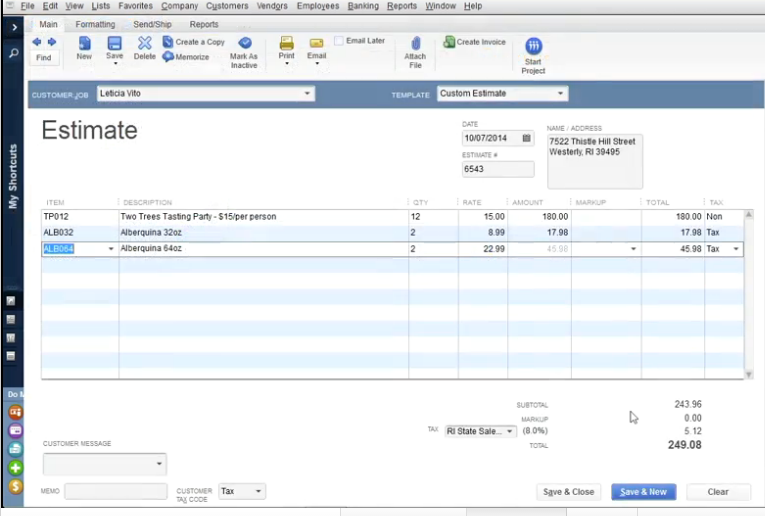

QuickBooks Desktop Pro

QuickBooks Desktop Pro is designed for small businesses that are just getting started. It’s simple enough for business owners who lack advanced accounting knowledge, and makes it easy for them to share files and data with their accountant.

Estimate in QuickBooks Desktop Pro (Source)

Pricing: Businesses with an existing IT infrastructure can purchase Pro for a one-time payment. Phone support, data backups, and product upgrades are available for an additional fee.

Pro can also be purchased as a “Plus” package. With an active annual subscription, businesses receive new features and upgrades as they become available. This package also includes 24/7 phone support and data backups.

Businesses without an existing IT infrastructure—or those who wish to reduce their overall IT costs—can purchase Pro and opt to use a cloud hosting service (for an additional fee). This allows remote access through a virtual desktop, which provides greater connectivity (anytime, anywhere access on any device).

Pro allows up to three users to work within QuickBooks at the same time (however, this requires separate user licenses). The Pro package offers the common capabilities listed in the table above, as well as the following:

✔ A “Bill Tracker” dashboard that shows unpaid bills, purchase orders, etc., in one place

✔ Tracks sales and expenses in multiple currencies

✔ Easy data import from Excel, Quicken, and older QuickBooks versions

Benefits: | Drawbacks: |

Pro can manage over 14,000 list entries—e.g., the number of names/custom fields supported, in lists of employees, customers, inventory, etc. | Automatic downloading of bank and credit card transactions is available, but for an additional cost. This feature is available for free with QuickBooks Online. |

QuickBooks Premier

QuickBooks Desktop Premier targets small-business users that have industry-specific needs. It is especially beneficial for industries such as non-profit, retail, professional services, contractors, and manufacturing.

Homepage in QuickBooks Desktop Premier (Source)

Pricing: Premier can be purchased outright for a one-time payment. Support, upgrades, and data backups are available for an additional fee.

Businesses can also opt to purchase Premier as a “Plus” package through an annual subscription. The annual subscription includes the cost for phone support and automated data backups.

Customers can also choose to purchase Premier and pay an additional fee for cloud hosting. This allows businesses to access Premier remotely through a virtual desktop.

Premier supports more concurrent users than Pro or Mac; Up to five users can work in QuickBooks Premier at the same time (this also requires separate user licenses).

Premier has all the features of Pro, as well as:

✔ Budgeting and forecasting

✔ Industry-specific reports (including the ability to run a P&L by job or client)

Benefits: | Drawbacks: |

With over 150 industry-specific financial reports, business owners can use Premier in whatever way suits their unique needs. | Electronic invoicing and online customer payments (e.g., bank transfers and credit card processing) must be purchased separately through the QuickBooks Payments service. |

QuickBooks Desktop Enterprise

QuickBooks Desktop Enterprise is Intuit’s most comprehensive business and financial management solution, because it includes several applications, such as QuickBooks Payroll (see QuickBooks Apps below). Enterprise is designed for both small and midsize businesses, supporting up to 30 user licenses.

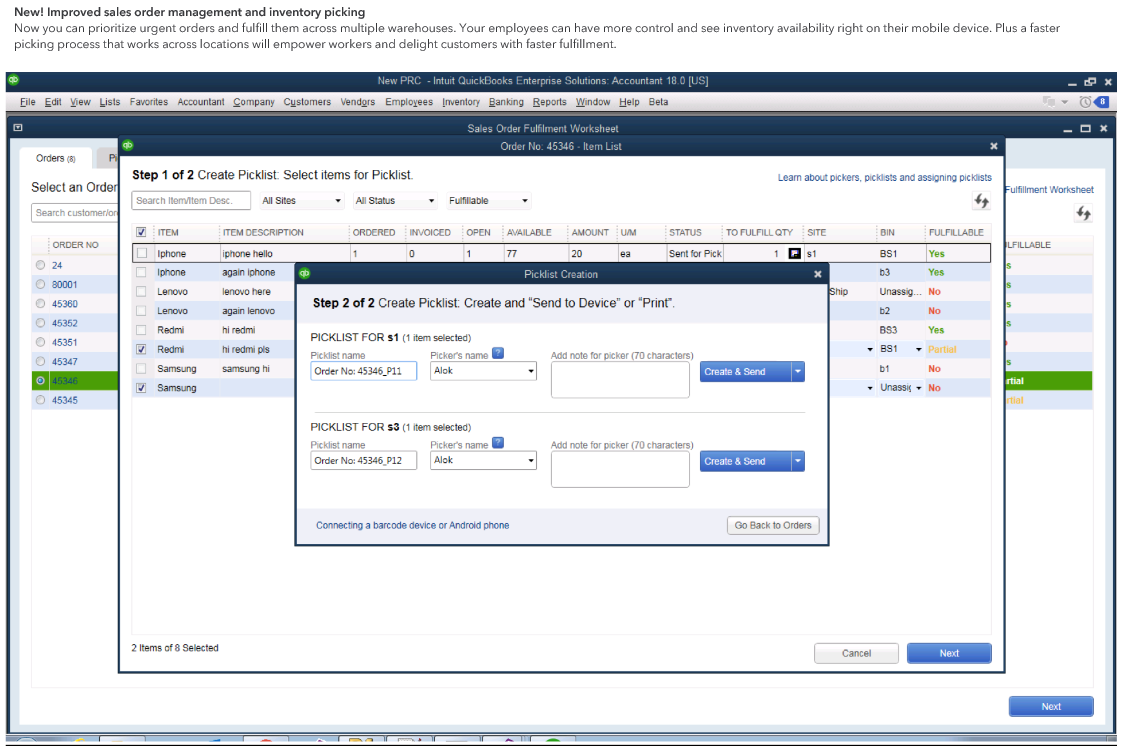

Sales order management in QuickBooks Desktop Enterprise (Source)

Pricing: Enterprise is available as an annual subscription. Users can opt to pay their annual subscription in equal payments over 12 months. The annual subscription includes the cost for support, upgrades, and data backups.

Businesses can also pay an additional fee for the cloud hosting service. This allows access to Enterprise through a virtual desktop, which provides remote access and greater connectivity (users can connect to Enterprise anytime, anywhere, and on any device).

Enterprise is sold in three packages: Silver, Gold, and Platinum. Each Enterprise package includes the same capabilities as the Pro and Premier packages plus several others, including:

✔ Up to 14 predefined user roles (admin, accountant, etc.)

✔ Access multiple files simultaneously

✔ “Expanded list” allows businesses to track over 1 million employees, customers, vendors, and inventory items (Pro and Premier allow 14,500)

Features unique to the QuickBooks Enterprise packages:

Benefits: | Drawbacks: |

It’s a comprehensive solution designed to manage a business’ financial and operational needs. At time of publication, QuickBooks Enterprise has more than 14,000 reviews, making it the most reviewed accounting software solution on Software Advice. | The Enterprise solution is a significant investment. For example, one user license on the Silver package is almost three times the cost of the QuickBooks Online Plus package (which allows up to concurrent remote access for up to five users). In the Enterprise version, remote access and multiple users each require an additional payment. |

QuickBooks Apps

Intuit has several branded applications designed to enhance the functionality of the above-mentioned platforms. Businesses can purchase these add-ons for an additional fee:

QuickBooks Payments: Available via mobile or as an extension to QuickBooks for desktop, this app allows businesses to email invoices and accept payments online via credit card or ACH transfers.

QuickBooks Point of Sale: A cloud-based point-of-sale (POS) system that allows businesses to ring up sales, accept credit cards, and keep track of inventory through a POS dashboard.

QuickBooks Payroll: Allows businesses to pay up to 50 employees by check or direct deposit. Available as a self-service or full-service solution, with the latter offering the ability to file year-end W-2 tax forms and automatically calculate federal, state, and local taxes.

Next steps: Finding the right solution for your business

QuickBooks has established itself as a major player in the small to midsize business accounting market. Whether you’re just starting out or you’re expanding and have more advanced accounting needs, QuickBooks has a solution designed to fit your business.

If you’re looking for more information about QuickBooks products or other leading accounting solutions, here’s what you can do next:

Read our product reviews. Browse through hundreds of accounting solutions with reviews from real, verified users. Find out how your peers have rated each platform’s customer support, ease of use, and more.

Take an online questionnaire. If you’re still not sure if QuickBooks is the right solution for you, answer a few questions online and we’ll provide you with a shortlist of vendors whose financial management solutions can help support and drive your business.

Talk to a software expert. If you still need help choosing a specific accounting system, we’re here to help. Our software advisors provide free, fast, and personalized software recommendations, helping companies of all sizes find products that meet their business needs. Schedule an appointment with an advisor here.