Why Risk Management Is Important and How Software Can Help

Cooler heads always prevail, especially when it comes to your business. When things go sideways at work, a risk management strategy can help you keep your cool.

From preparing a mitigation plan for an IT security breach to managing the risk of employee theft, a solid risk management plan is the safest way to reduce the negative impacts of business risks.

In this article we’ll define what risk management is, walk you through how to create a risk management plan, and we’ll hear from our software advisors on the types of businesses that are buying risk management software. With all this info, you’ll be able to plan your risk management strategy and needs.

What is risk management?

Risk management is the process of identifying, assessing, and mitigating or controlling threats, known as risks, that could affect your business’s bottom line. Risks can be internal or external and come from a wide variety of sources, such as your employees, your vendors, leadership decisions, natural disasters, or changes in government policies and laws.

It’d be impossible to eliminate all risks. It’s also impossible to think of all the possible risk factors you could experience. But this doesn’t mean you can’t create an informed, purposeful risk management plan that will help you minimize potential negative consequences of risks.

Let’s go over some definitions often used in a risk management framework:

Risk event: A specific occurrence that serves as the catalyst for the threat that could or will have an impact on your business.

Risk analysis: The action of evaluating a specific risk, identifying the likelihood of its occurrence and the degree of impact it would have if that risk event happened.

Risk factor: Anything that increases the likelihood or susceptibility of an identified risk occurring.

Risk register: The list of threats/risks that is regularly reviewed and updated, adding and altering risks as needed.

Risk assessment: The process of collecting as many risk factors and events as possible and adding them to a risk register. This process is typically led by a risk manager or similar point of contact and involves collaboration with all areas of the business.

These terms can get a bit confusing, so let’s walk through an example to show how they’re all related.

An example of how to create a risk management plan

Let’s look at an electronics store. The owner knows she has many threats to be prepared for and has been working on a risk management strategy in her head for several weeks. But now she wants to consult with a risk manager and write out a risk management plan.

To get things started, the owner and risk manager will perform a risk assessment and start compiling a risk register. Let’s break this process down using an example of employee theft.

Step 1: Identify a threat

As a retailer, our electronics store owner knows that employee theft is always a financial threat, and likely also a security threat. The act of theft is called the risk event and gets written down as the first identified threat in the risk register document.

Tip: If you find it difficult to focus on the details of one risk while you have a whole list running through your head, that’s OK. Take the time to get those down on paper and then circle back to tackle the details one at a time.

Step 2: Assess the risk

Next, the identified threat needs to be evaluated to determine just how great of a risk it is. The owner and risk manager will assess the threat of employee theft and determine the probability of the risk event happening and also the impact to her business.

Here, two new aspects of risk management come up:

Risk factors: For employee theft, the number of employees given the potential to steal money or items is a risk factor. The more employees, the higher the risk factor.

Risk exposure: Increasing or decreasing the number of employees with theft potential respectively increases or decreases the risk exposure.

Tip: One risk can have multiple and myriad risk factors.

Step 3: Define the risk response and mitigation plan

Now, the store owner and risk manager will come up with the preventative and corrective actions, known as the mitigation plan and risk response, respectively. Preventative actions help mitigate, or decrease the likelihood of, the risk event. Corrective actions will define the steps she takes as her response to the risk when it actually happens.

A preventive action could be to install security cameras throughout the store and at the cash register.

A corrective action could include defining specifically who examines the recordings when theft is suspected.

Tip: This is the part of your risk management plan that will help you keep a cool head under stress. Employee theft can feel like a personal attack and emotions run hot, but having a plan of action that was created under calm circumstances helps ensure you react appropriately.

Step 4: Repeat steps 1 through 3 for each threat identified

This step is pretty straightforward. But keep in mind this process isn’t a one-and-done event. Threats, risk factors, and mitigation plans all can and do change throughout the year.

Tip: Make a plan to review and update your plan regularly.

Internal vs. external risk

The above example focused on one type of risk, employee theft, which would have financial implications, possible risk to the business reputation, and other negative implications. But there are many types of risk, so let’s take a moment to break them down into two categories: internal and external risk.

Types of internal risks

These risks occur internally in your business. One example of an internal risk is the financial risk an employee exposes the business to when they share financial information with third parties, aka third-party risk or vendor risk. While it may be necessary to share sensitive data in order to do business together, it’s possible the information could be stolen from the vendor’s IT system if it’s not properly secured.

Identifying risks such as this one can be a good way to start down the path of good risk management, but not all threats are so obvious.

Other internal risks are technical risk (such as an outdated IT system), financial mismanagement, risky leadership decisions (aka strategic risk), operational risk, a labor shortage, and employee theft.

Read more: Here’s another resource that dives deeper into the types of internal risks faced by businesses.

Types of external risks

External risks are events or changes that happen outside your business but that have an impact on the way you operate. An example of an external risk is the COVID-19 pandemic. It was a risk event that had a low probability of occurring but a high impact if it did; the odds of it being on many risk management plans outside of the healthcare system were very low. But now, such events that affect employee health and safety will likely take a more prominent part in future risk assessments.

Other types of external risks are regulatory compliance changes, changes and impacts of financial institutions, new employee or patient safety requirements, and environmental risk.

Read more: This guide on external risks from EY goes into great detail if you’re looking for that now.

Now that we’ve covered why risk management is important, and the main types of risks that need to be considered in your risk management process, let’s talk about how businesses are using software to help support their efforts. Knowing what other leaders are doing can help you determine your software needs.

Businesses are looking for risk management software—should yours be one of them?

At Software Advice, our advisors speak with risk managers and other roles looking to purchase software to help support and elevate their risk management efforts. But knowing when to invest in a software solution can be a difficult decision.

So to help, we’ll break down the types and sizes of businesses looking for software and the budgets they’ve set aside to provide you with some insight into what people like you are looking for.

The bigger the numbers, the greater the need

Ryan Groblewski

Senior software advisor at Software Advice

“Risk management systems help a company monitor specific risk factors for their industry and create a concrete plan for resolving any issues that do arise.”

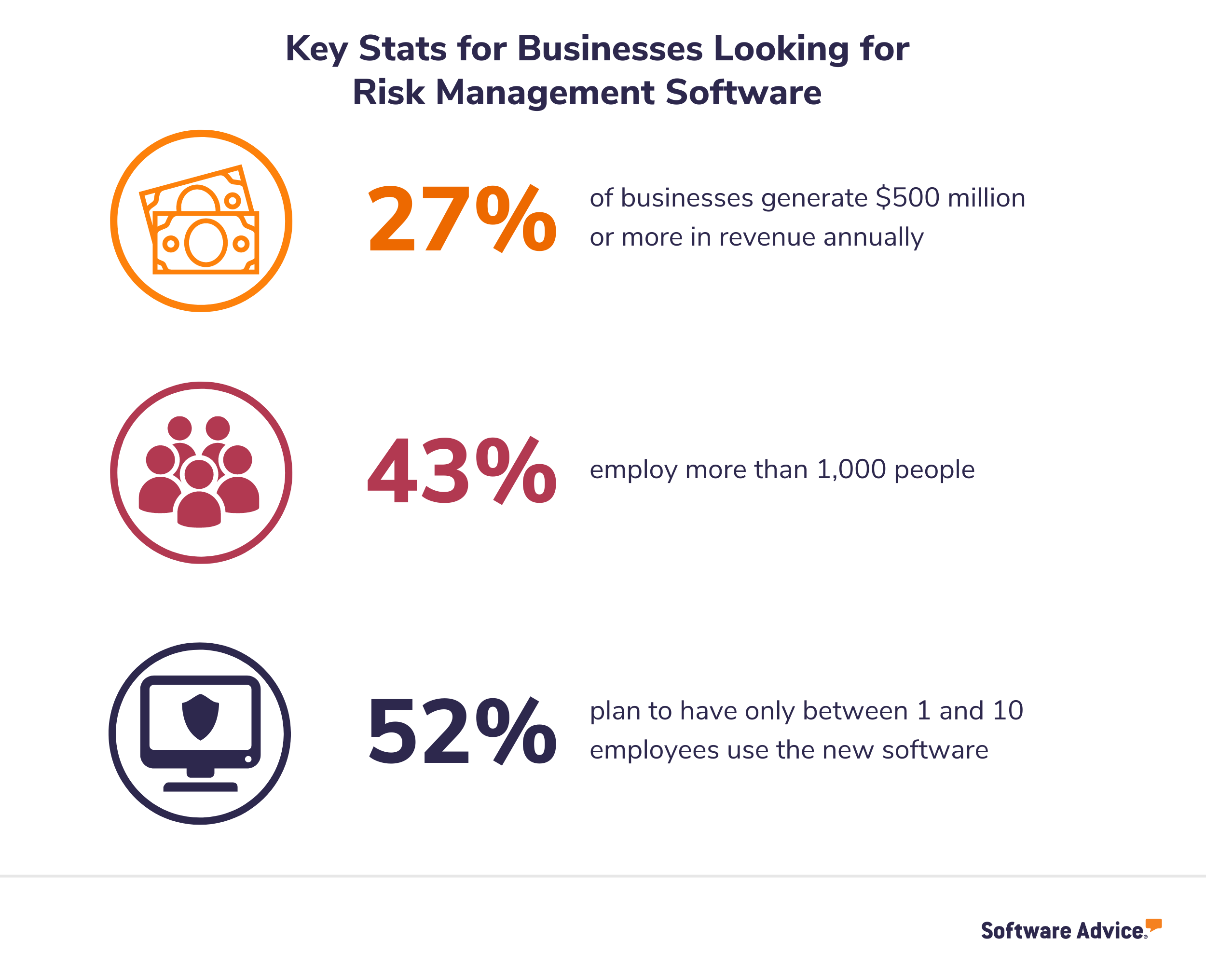

Ryan also says that, in general, we see that larger businesses are the ones looking for risk management software. Oftentimes, the larger the revenue and the more employees means the greater the levels of risk exposure and this is where software can come in to help manage the efforts.

Of the total number of businesses our advisors have spoken with over the past year, over a quarter have annual revenues of over a billion dollars and almost half have more than 1,000 employees. And their annual revenue is in the top tiers of small businesses.

But while the business types are on the larger side, the number of users that are expected to use the software remains relatively low. This means that the risk management team tends to be a group focused specifically on the risk management practices.

Some industries hold more risk than others

The industry a business is in is a significant factor, too, as some have regulatory compliance to follow with some severe impacts if they fail to do so.

Steve Burlison

Senior software advisor at Software Advice

“Banking/finance and manufacturing are the two industries where we see the most need for a risk management solution. These two types of businesses tend to have regulatory laws and compliance standards they must meet.”

Burlison adds that at least a third of the software buyers they speak to are risk managers or leaders in these fields.

How much these risky businesses are planning to spend

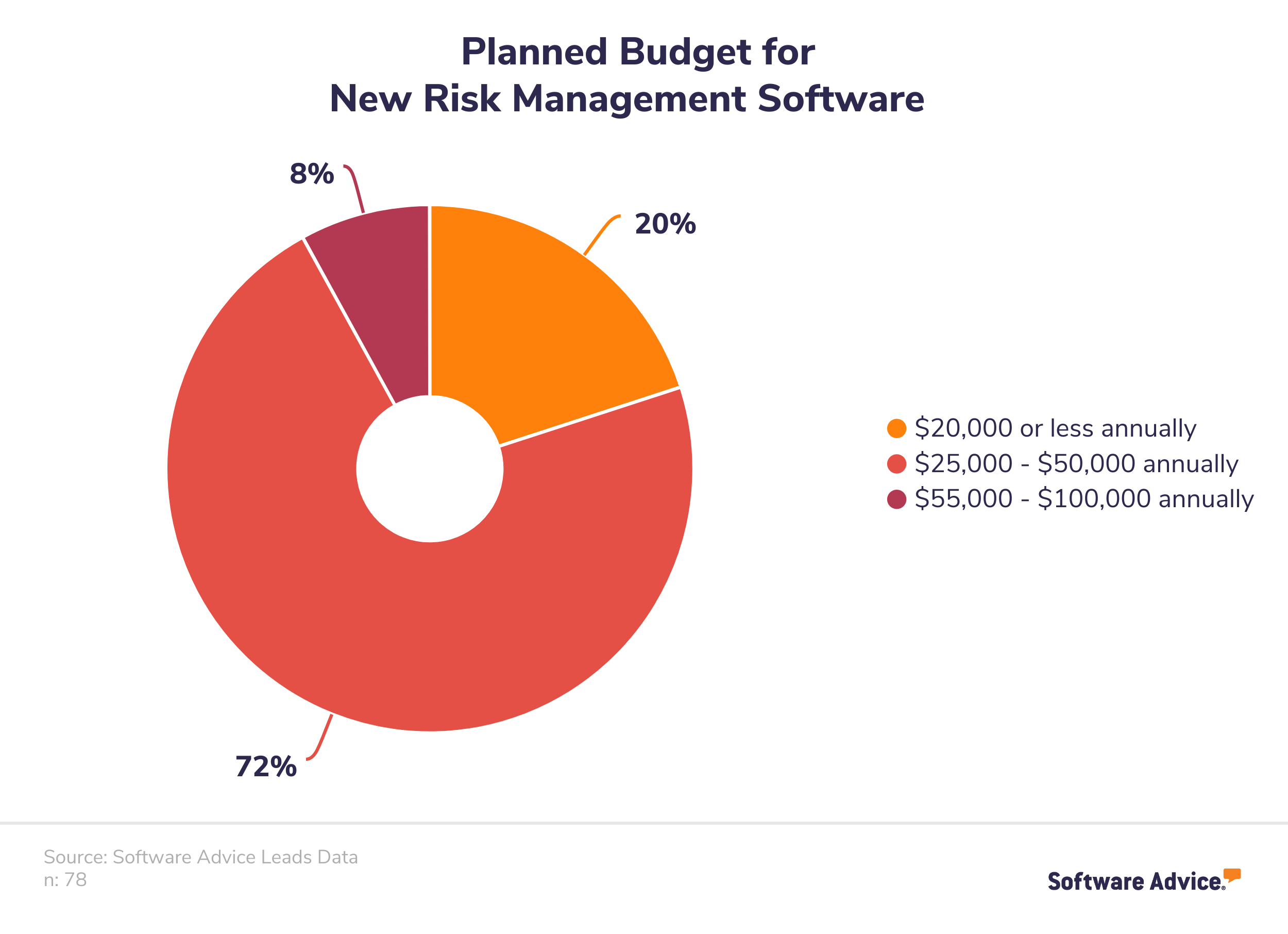

Now that you see the sizes of businesses needing an effective risk management tool, we bet you’re curious as to how much they plan to spend.

We have that info for you, too. Here’s a breakdown of the planned budget businesses have for the total annual costs of a new risk management software solution:

Reduce the risk of picking an ill-suited system

You now know what’s entailed in a risk management plan and you’ve seen what other types and sizes of businesses are investing in software to help them out with risk management. If you’ve decided you’re ready for risk management software, we’re here to help with several next steps you can take:

Read user reviews on hundreds of popular risk management software tools.

Get more info about buying risk management software.

Start a live chat or schedule a phone call with a real person to get real advice.

Odds are pretty good you’ll get to talk with Ryan or Steve—but we have many knowledgeable advisors—to see which solution is the best fit for your needs.