PayJunction

About PayJunction

PayJunction Pricing

$0.00 monthly fee. Fees are calculated as: Cost + 0.75% for credit cards and 0.75% for checks.

Starting price:

$50.00 one time

Free trial:

Not Available

Free version:

Not Available

Other Top Recommended Retail POS Systems

Most Helpful Reviews for PayJunction

1 - 5 of 107 Reviews

Nathan

Mental Health Care, 1 employee

Used more than 2 years

OVERALL RATING:

5

Reviewed May 2021

Great Support

Anonymous

2-10 employees

Used daily for less than 6 months

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

3

FUNCTIONALITY

5

Reviewed September 2018

Great Credit Card Processing, Especially for a Business with Multiple Locations

So far, so good. It provides much better back end access for running returns or adjustments for clients. It allows me to remotely see what my employees are doing as everyone has their own login. Setting up recurring payments or running future transactions on a card (securely) on file is a breeze. The client always gets an emailed receipt, so it's easy to prevent fraudulent charges by employees and charge-backs from customers. The smart terminal is easy to use and helps save a ton of paper by sending e-receipts.

PROSIt's all a virtual terminal, so I can access everything from wherever I am. Having three locations, it's imperative I have one login to check on statements, transactions, etc. With our previous processor I had eight different logins for this. With PayJunction it's all in one place. It also enables me to run a transaction for any location from whichever office I'm in. I don't need direct access to the physical terminal to run a payment. I can even run a payment in person for someone for a different location than I'm currently at to help keep my accounting correct. Handling remote transactions is amazing with PayJunction. For any remote transaction the client gets an email requesting a signature for the payment, so there's no need for authorization forms to protect us - everything gets signed! All signatures are stored digitally as well, whether as a remote transaction or in person on the PayJunction smart terminal, so there's no need to keep a giant collection of paperwork for credit card transactions. It's all stored digitally and easy to search through/run reports. Setting up a payment page on our website as a hosted checkout was easy as well. It gives our clients an easy way to pay if we're not in the office and they know their balance due. Everything about PayJunction has made our credit card processing easier and more streamlined.

CONSCustomer support. There's no support on weekends! They lost Shopify integration and do not have a mobile card reader yet, so I have to use separate companies for those two things.

Vendor Response

Hey, thank you for this review! We're glad that our system has improved your day-to-day payment processes! Our support team has extended its hours over the last year to offer 10 extra hours of support every week. They're now available Monday-Friday from 6 a.m. to 5 p.m. PT. Our team is dedicated to supporting your needs, and we do provide extended, emergency support during select holidays and weekends. Shopify, unfortunately, ended its partnership with us. We apologize for any inconvenience this decision caused. Lastly, our mobile app is still in development and we would never want to promote a product that wasn't 100% ready. We will hopefully have this out to you in 2019 with the functionality you've come to expect from PayJunction's products and services.

Replied September 2018

Nathan

Mental Health Care, 1 employee

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed March 2021

Great Support

Customer service has been great. Very easy to use the software once cards are uploaded.

PROSI loved that I was able to get a competitive rate. Once the cards were in the system, it is easy to set up payments and re-occuring payments also. When I have had issues, customer service has been very helpful.

CONSSwitching companies means uploading all the cards again. That is a very long process that I don't believe is unique to this company. So outside of that, I really can't think of what I don't like about this software.

Reasons for switching to PayJunction

Cheaper rates.

Amanda

Information Technology and Services, 2-10 employees

Used daily for less than 12 months

OVERALL RATING:

4

EASE OF USE

5

VALUE FOR MONEY

4

CUSTOMER SUPPORT

4

FUNCTIONALITY

2

Reviewed February 2018

Very straight-forward software. Easy to navigate and use even for first-time users.

Lower credit card processing fees.

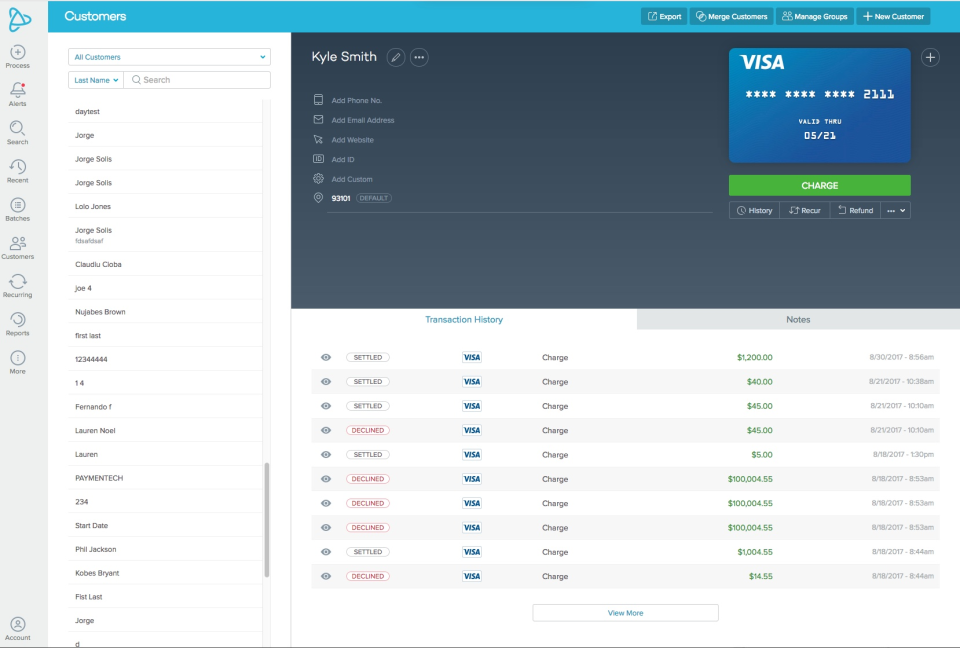

PROSVery easy to use with minimal training. Interface looks clean, simple, and organized. Also like how the payment methods actually look like the physical item (e-check looks like an actual paper check, Visa card has the Visa logo on it, etc.) which makes distinguishing between multiple payment options very simple.

CONSNo easy way to sort/view customers by the company name instead of the cardholder name. Wish VERY MUCH that there was an option to customize the customer list so we could add a column to view the cardholder name AND company name, and then also sort the columns. Also want to see the company name in the data fields when viewing the Recurring Accounts list. I have to cross-reference this EVERY time I have to verify which of our customers are on auto-pay as we don't refer to them based on cardholder name, but by the name of their company. Example: Joe at Smith Masonry calls and asks to update the card we have on file for their recurring payment, but the current card we have isn't under Joe's name and he doesn't know offhand which name it IS under. I have to export the full Recurring Accounts list to an Excel file in order to see the company name each account is associated with, JUST so I can tell Joe that the old card was under his assistant Jenna's name. Then I have to cancel the recurring payment under Jenna's customer account name, create a whole NEW customer account since the new cardholder is now Joe, and set up the recurring payment once more under Joe's name. Not even done yet! Because when creating new recurring payments, entering the company name isn't even an available field yet! You have to save it first, go back to the Recurring Accounts list, reopen it, hit Edit, and THEN type in the company name. TOO MANY STEPS for something so simple.

Vendor Response

Hi Amanda, Thank you for sharing your feedback. We have two workarounds to share with you. 1) To view the companies in the customer list, you simply need to export the list. Here's some information about that: https://support.payjunction.com/hc/en-us/articles/214407668-How-do-I-export-my-contacts- 2) The field names that appear in the recurring accounts are based on the columns set in the 'Recent' section. You'll want to edit the columns to have "Company" as one of them. You can do this by navigating on the top right corner of the Recent page. There, you'll find an "Edit Columns" button.

Replied August 2018

Laura

Medical Practice, 2-10 employees

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed January 2018

Signing up for Payjunction was so easy and our representative was very helpful.

quick transactions, easy to use

PROSPayjunction is very user friendly. Simply enter your information for the client along with the amount and you are done. I love that we can void transactions or edit transactions. Payjunction chip reader is so quick our clients are continually commenting about not having to wait! It is much quicker than our previous software. I like the internet connection which I believe helps with the speed of our transactions.

CONSThe only thing I like least is that when the power is out or internet is down we are unable to operate,,BUT...that's with any credit card processing.

Vendor Response

Hi Laura, We're glad to hear that your customers are delighted by the Smart Terminal! During power outages we offer phone charge, which allows you to call a number and process a transaction when this occurs. You can learn more about phone charge here: https://support.payjunction.com/hc/en-us/articles/210469378-How-do-I-activate-my-Phone-Charge-account- Additionally, our mobile app, which is in beta, will be usable in lieu of phone charge.

Replied August 2018