Calyx Point

About Calyx Point

Calyx Point Pricing

Contact Calyx Software for pricing details.

Free trial:

Not Available

Free version:

Not Available

Most Helpful Reviews for Calyx Point

1 - 5 of 50 Reviews

Raymundo

Real Estate, 11 - 50 employees

Used unspecified

OVERALL RATING:

4

Reviewed December 2023

Calyx Point Review: Calyx is the Industry Standard that Does the Work!

R. Curtis

Verified reviewer

Civil Engineering, 51-200 employees

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

4

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed November 2018

Mortgage Loan Management Made Easy

I am a user and administrator. I have integrated stand alone and hosted systems on many occasions. I love the completeness of this application. I have not seen any other that has so much in one place. As a team manager Calyx Point makes my job easier.

PROSCalyx Point has every single aspect of the mortgage loan process integrated into one application. I have used others in the past but none compare. They offer stand alone and hosted applications. This software can support a 2 person organization to 100s of loan processors with ease. Single point management makes managing the application seamless.

CONSThis is a large application and you have a lot of users you will need in house IT to support all of the integration. Although Calyx has great support you need someone to be there for day to day computing issues.

Gregory

Verified reviewer

Used daily for more than 2 years

OVERALL RATING:

4

EASE OF USE

4

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

4

Reviewed January 2018

I shopped for better value (price and feature) systems, and didn't find any.

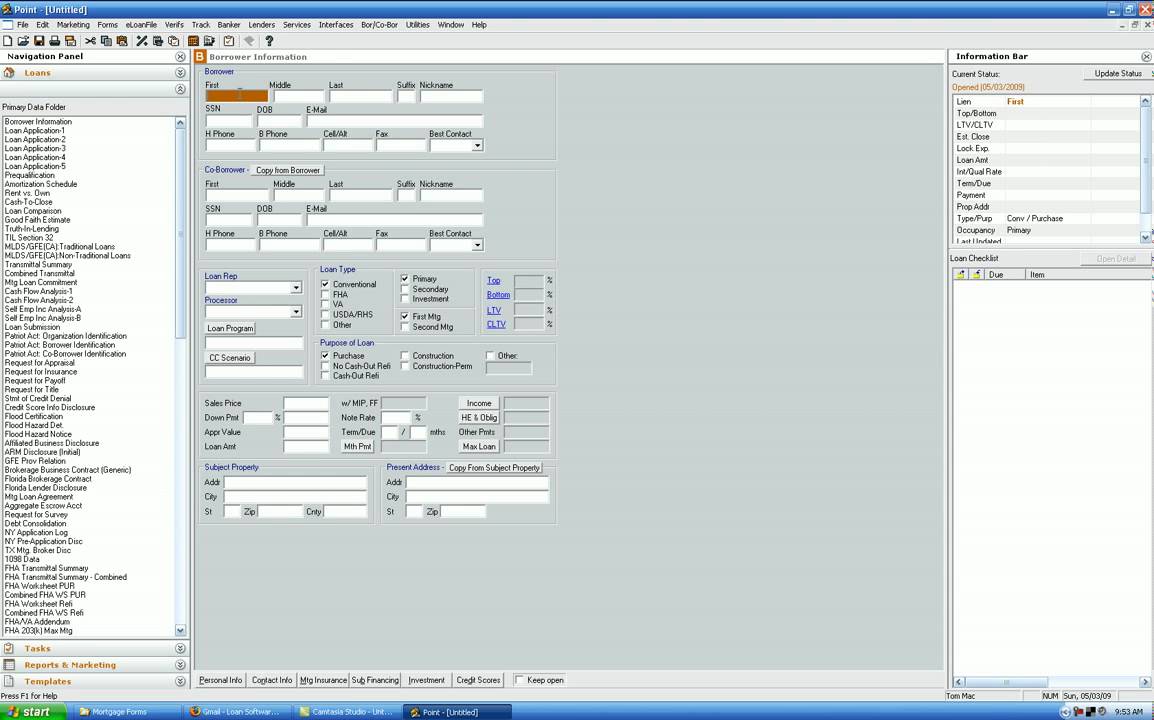

Point has been a mainstay of Loan Origination Systems for years. I've used several of the biggest name products (Encompass, Genesis, LendingQB) and Point offers some of the best feature/price balance available. It does NOT try to be all things - it's an LOS. Other sytems attempt to include CRM, and advanced marketing, and rules and engines, but for a small mortgage brokerage, there are better 3rd party tools to do all of that, and Point does a good job at playing well with others. Combined with a hosted server, it's very secure, easy to navigate, and integrates with all the major players in the space. It does have all of the necessary loan origination tools, it updated regularly to keep pace with changes in the industry, and it FEELS like you're entering data directly onto a paper loan application, so there is very little learning curve.

CONSThe interface hasn't been updated since 2004 - maybe longer, so it looks like software from the Windows XP era. It also doesn't know how to handle custom forms other than Word, or custom views or custom much of anything else. It's an installed application, with a lot of function, but if you're looking for something cloud-based, or infinitely flexible, this isn't it.

Jason

Real Estate, 1 employee

Used daily for more than 2 years

OVERALL RATING:

4

EASE OF USE

5

VALUE FOR MONEY

3

CUSTOMER SUPPORT

4

FUNCTIONALITY

2

Reviewed March 2024

Don’t love Point

Easy system to navigate even if it’s an old look

CONSHaving to install on each computer is horrible. Makes zero sense

Lauran

Financial Services, 2-10 employees

Used daily for more than 2 years

OVERALL RATING:

2

EASE OF USE

4

VALUE FOR MONEY

3

CUSTOMER SUPPORT

1

FUNCTIONALITY

2

Reviewed March 2024

Moving Away From Calyx Point Was One of Our Best Decisions

We only regret that we didn't leave sooner. We are sooooooo incredibly thrilled with LendingPad and would recommend it to any and every mortgage broker, lender, and anyone in the industry. We put off the move for a long time since it's such a big undertaking - especially with a small team. It was easy, quick, and painless to make the move to LendingPad and we are ridiculously glad we did. We were so ready to be done with Calyx Point after how they handled the new URLA rollout. We were dead in the water, unable to run AUS, unable to preapprove clients, unable to PRINT an application!! They had MONTHS to prepare for the changes and it was a complete disaster. We tried to hold on for awhile and finally decided that it was beyond time for us to make a move to a faster and more adaptable web-based platform. LendingPad is agile, user friendly, simple, quick to deploy, and their customer service is spectacular!

PROSFor most of our team, we'd worked in the software before and it was familiar. It was easier to customize and personalize than Encompass (our prior software), because Encompass was more built for giant lenders. Calyx was more adaptable (and affordable!) for us as a small broker. I really appreciated being able to create custom rules and be able to create a very personalized experience for our team. We had pretty good experiences with the Zip online application process - clients seemed to have a positive experience.

CONSThey handled the new URLA rollout so poorly, it was unbelievable. They weren't prepared, the software changes weren't ready, and it was a disaster. Our company was dead in the water and we couldn't function for far too long. It was a technical nightmare and we lost faith in and respect for Calyx really quickly. It's a bit of a dinosaur of a software and isn't at all easy to update, adapt, or keep up with industry changes. There's some work-arounds, but that isn't always efficient. It's often band-aids on top of band-aids because the software is too clunky for them to actually fix and improve. We were really disappointed in customer service. I honestly still have technical support tickets I opened 7 years ago that I never got a response on. There were a lot of ongoing issues and we decided we weren't willing to stay any longer.

Reason for choosing Calyx Point

We chose Calyx Point because it was much more affordable for the size of our company than Encompass. It was more customizable and you didn't need a dedicated IT person to run it. The other main reason that we selected it was because it was familiar - most of our employees had used it before at prior companies. The devil we know.

Reasons for switching to Calyx Point

Encompass was too big for our organization, too complicated, and not easily customizable without a dedicated and trained person who was a full-time Encompass manager. Getting customer service was next to impossible.