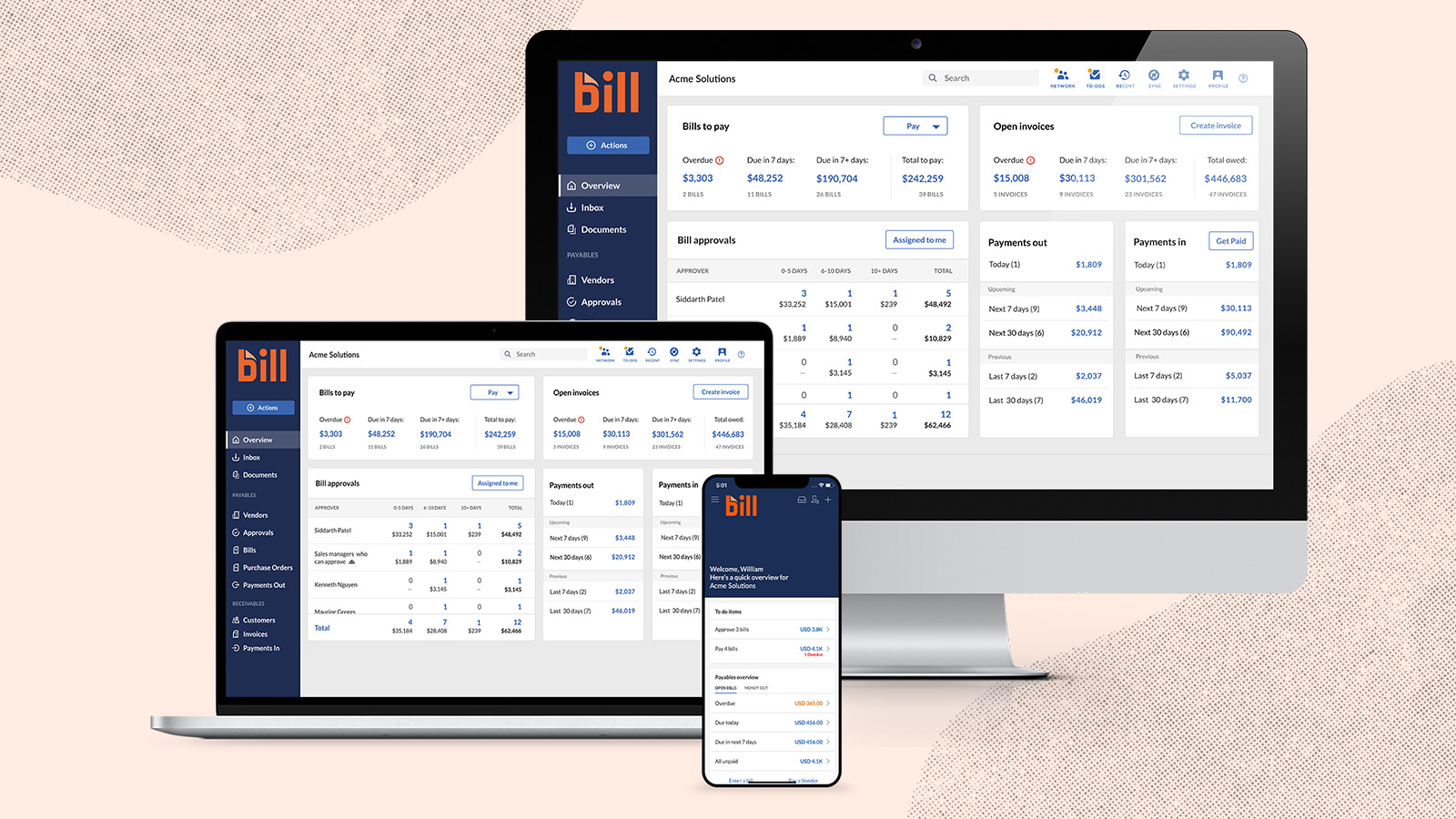

BILL Accounts Payable & Receivable

About BILL Accounts Payable & Receivable

BILL Accounts Payable & Receivable Pricing

ESSENTIALS $45 user/month TEAM $55 user/month CORPORATE $79 user/month ENTERPRISE custom pricing

Starting price:

$45.00 per month

Free trial:

Available

Free version:

Not Available

Most Helpful Reviews for BILL Accounts Payable & Receivable

1 - 5 of 486 Reviews

Thomas

2 - 10 employees

Used unspecified

OVERALL RATING:

5

Reviewed December 2023

Implemented BILL in 15 Companies So Far!!!

Jennifer

Verified reviewer

Real Estate, 501-1,000 employees

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed February 2018

Bill.com is THE BEST software for managing accounts payable!

No mailing invoices/checks! The software prints the first page of the invoice on the bottom two stubs of the check. You can also pay your vendors electronically with a simple invite email AND the system emails your vendors to let them know payment is on the way!

PROSI started using this software solely for its accounts payable function. You send your bills directly to the inbox, attach the document to the bill, then pay! You can even record bills paid outside of bill.com (credit card payments for example). You can also save vendor documents (contracts, W9s) within the vendor files. This software keeps us incredibly organized over multiple locations. HIGHLY recommend! (And it syncs seamlessly with QuickBooks!)

CONSNo cons! Great product! Keeps us organized and allows timely and effective bill payments to our vendors.

Vendor Response

Jennifer, your comment made our day! We're going to share with our product team, who always enjoy hearing positive feedback :)

Replied November 2022

Serguei

Computer Software, 51-200 employees

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed June 2020

Great Accounts Payable Software

Overall, great software for managing accounts payable. There are all kinds of dashboards where you can see the status of your payables on one screen which is convenient. Also, the reporting features are great. Very easy to pay company bills. Would definitely recommend to small/midsize business.

PROSThis is a great solution for processing accounts payable in a small/mid-size business. Bill.com has approval workflows which makes it easy to control your payables and avoid fraud. It is super easy to pay bills with a few clicks. The company takes care of all check mailing and ACH processing. Also, vendors can see the status of their payment easily which is convenient and saves you time answering payment status requests from vendors.

CONSThe company recently implemented a new interface which is confusing at times. Also, now screens load very slowly with the new features that they implemented. Also, there is no option to switch back to the old interface which I prefer.

Reason for choosing BILL Accounts Payable & Receivable

I've had prior experience using Bill.com and enjoyed using it.

Vendor Response

Thank you for your review, Serguei. We're glad to hear that you're enjoying our app and we'll be sure to get your feedback up to our product team!

Replied November 2022

Craig

Verified reviewer

Business Supplies and Equipment, 2-10 employees

Used daily for less than 6 months

OVERALL RATING:

1

EASE OF USE

2

VALUE FOR MONEY

1

CUSTOMER SUPPORT

1

FUNCTIONALITY

1

Reviewed July 2023

Bill.com is the slowest invoicing and funding provider of them all.

Worst ever. It takes a minimum of 45 minutes for an answer from chat support. It doesn't feel like anyone really cares about our time.

PROSBill.com is secure and it integrates with most accounting platforms.

CONSThe customer (not us) has a lot of control in scheduling the payment amount and date. The customer can also change the scheduled date even after it looks like its been paid. Whereas from our shoes we need to know we have been paid before we ship the product. After the invoice shows as paid the funding takes 7-8 business days or longer by ACH. This just isn't competitive. Its obvious that in addition to the 79 fee for use of the software that most of their revenue is generated by float on both our receivables and our payables. We don't want anyone to wait. It's important that all parties get paid as immediate as possible.

Reason for choosing BILL Accounts Payable & Receivable

Brandname

Reasons for switching to BILL Accounts Payable & Receivable

We hoped to have faster funding and some sort of chargeback protection.

Vendor Response

Thank you for your feedback, Craig! I'm sorry to hear that you had a frustrating experience with receiving payments. If you still need assistance, please visit our website at https://help.bill.com/hc/en-us to request a call, chat, or email with our customer support team. We are here to help and want to assist you promptly.

Replied July 2023

Jennifer

Non-Profit Organization Management, 51-200 employees

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

4

FUNCTIONALITY

5

Reviewed December 2023

AP made easier

Over all I love using BILL daily for AP processing.

PROSThe interface of BILL is easy to navigate and user-friendly compared to QB.

CONSI occasionally get frustrated with the AI auto-populating feature while processing invoices.

Vendor Response

Thank you Jennifer for your five star review of our software! We love that you find our interface easy to navigate and user-friendly. We are sorry for any frustrations caused by our IVA system when processing invoices. We appreciate all feedback as we are always trying to improve our customer's experience with our software.

Replied December 2023