MoneyLine

About MoneyLine

MoneyLine Pricing

Lifetime License - Home License

Starting price:

$39.95 one time

Free trial:

Available

Free version:

Available

Other Top Recommended Accounting Software

Most Helpful Reviews for MoneyLine

4 Reviews

Lorraine

Writing and Editing, 1 employee

Used daily for less than 12 months

OVERALL RATING:

4

EASE OF USE

4

VALUE FOR MONEY

5

CUSTOMER SUPPORT

3

FUNCTIONALITY

3

Reviewed February 2018

An inexpensive option for easily and efficiently managing personal finances

Makes managing personal finances a breeze.

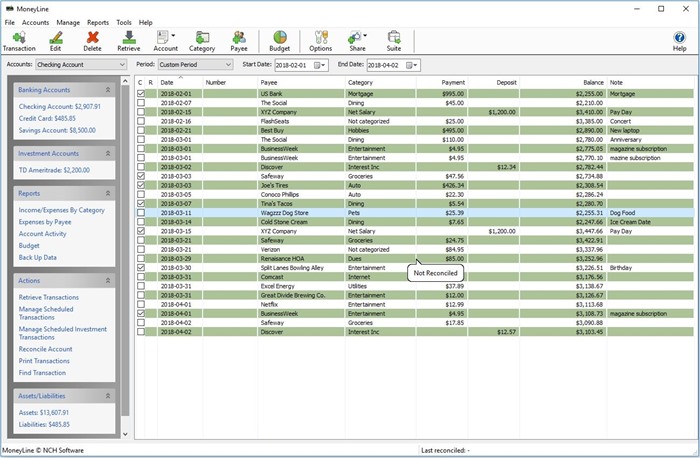

PROSManaging personal finances isn't a task you want to invest heavily in - either in time or monetary terms - but it's important to manage efficiently. There are some good free web-based apps out there, but many fear that using a web-based application may compromise their privacy or security. Moneyline is a great little tool that makes tracking income and expenses and monitoring balances in bank accounts and on loans and credit cards super-easy. It operates off-line, although it has the option to link to your bank account and import transactions automatically if you prefer to avoid manually entering every transaction. It gives a clear overview of your financial status, with balances in every account clearly displayed, and you can easily track account history and transfer between accounts. It lets you set up as many categories, sub-categories, suppliers and income sources as you wish to make classifying transactions super-easy, and the interface is user-friendly and easy to work with. It even lets you set up a budget and, if you like, can alert you to over-spending in any expense category. NCH is a very user-responsive developer that produces a wide range of excellent, low-cost software tools and supports an active user community. Moneyline is MS-Windows-compatible and appears to be robust, bug-free, quick to load, and fully usable without risks of conflicts with other software on your system. Just a great little tool.

CONSAccount reconciliation seems rather quirky and I note from forum comments that many users avoid reconciling and just check their displayed balance against statements periodically. The notion of assigning an imbalance as an unidentified transaction seems odd to me. I would rather it be saved as an imbalance and be able to go in and fix it when inspection of account history exposed the problem. The issue I've had is that once an account goes out of balance for any reason, it's difficult - if not impossible - to rectify the problem. That said, I find reconciliation entirely unnecessary given the ease of comparing the displayed balance with your statement balance. Reporting is good, but not great. I'd like to see a wider range of reporting options. But it's inexpensive software, so that's probably an unreasonable expectation. The facility to link to your bank seems to be limited to US banks. Us Australian users are at a disadvantage there. For me, these are all minor issues, but given NCH's approach to software development, I wouldn't be surprised to see improvements in these areas before too long.

Patricia

Accounting, 1 employee

OVERALL RATING:

1

EASE OF USE

1

VALUE FOR MONEY

1

FUNCTIONALITY

1

Reviewed April 2021

Security issue

Never got to use it due to it asking for my bank account details and passwords in a way that did not feel would be limited to just my use.

PROSI didn't try to use it due to the security issues

CONSIt asking me for bank account details and passwords before you even get to know if it is safe to do so.

Reason for choosing MoneyLine

Captera article

Vendor Response

Hello, We are sorry for any inconvenience this may have caused. Your feedback is very important to us. We are constantly working to improve our products and greatly appreciate any feedback that you can offer. Share directly with our Development Team here: http://www.nch.com.au/suggestions/index.html

Replied May 2021

Malcolm

Retail, 2-10 employees

Used daily for less than 2 years

OVERALL RATING:

1

EASE OF USE

2

VALUE FOR MONEY

1

CUSTOMER SUPPORT

1

FUNCTIONALITY

1

Reviewed February 2020

Poorest software & support I have ever encountered

It is do-do.

PROSEasy to use, can enter as many accounts as you want.

CONS1) Cannot trust the numbers. Moneyline comes up with entries/balances that are just plucked from thin air 2) An "update" was offered; I installed it. Then Moneyline shut down the software and demanded I pay a fee for the "update." I could not use Moneyline at all, so I decided to buy someone else's program. 3) Once an entry is reconciled it cannot be revised; if an error was made, you are stuck with it. 4) I emailed Moneyline several times for help; not once did they respond. 5) Once reconciliation of an account is begun, any small error, such as an entry that was not properly entered, requires that the reconciliation process begin all over again. Reconciliation can go on for hours! 6) All in all, one of the worst experiences I've ever had with software.

Reason for choosing MoneyLine

I am an idiot.

Reasons for switching to MoneyLine

No support from MS Money

Vendor Response

Hi Malcolm, Thank you for contacting us. We are sorry for any inconvenience this may have caused. Our updates are optional, if you didn't want to update and you accidentally did, Our Registration Support Team will be happy to re-send your registration code and installation file to the software you previously purchased. You can contact our Registration Support Team here: http://www.nch.com.au/support/regcontact.html We are not sure who you spoke to, but our Support Team is always available to take your questions here: https://www.nch.com.au/support/index.html -NCH Software Team

Replied February 2020

Paula

Accounting, 1 employee

Used weekly for less than 6 months

OVERALL RATING:

1

EASE OF USE

1

CUSTOMER SUPPORT

1

FUNCTIONALITY

1

Reviewed August 2021

Moneyline is not an integrated accounting system

There is NO customer support. I contacted Customer Service twice. Last time was [SENSITIVE CONTENT] and I still have not received a response. I am definately getting another accounting system. I will take responsibility for not investigating the program more thoroughly. I purchased it personal use, I sure am glad it's not for a business because I can't see how you could retrieve accurate income statements WITHOUT a lot of work,.

PROSNothing. it is hard to like an accounting program that does not give you accurate reports.

CONSYou cannot reconcile credit card accounts to statements You cannot produce an accurate income statement