Northstar Risk/Performance Software

About Northstar Risk/Performance Software

Northstar Risk/Performance Software Pricing

Starting price:

$40,000.00 per year

Free trial:

Not Available

Free version:

Not Available

Most Helpful Reviews for Northstar Risk/Performance Software

1 - 9 of 9 Reviews

Alexander

Verified reviewer

Financial Services, 2-10 employees

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed June 2019

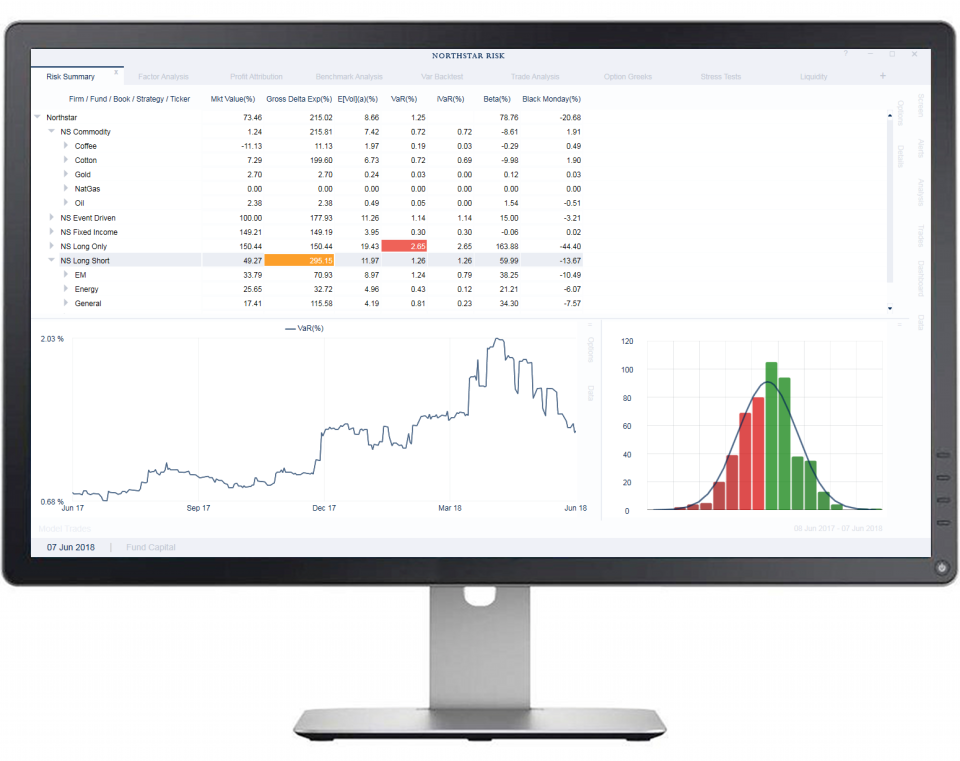

Robust Risk Platform for Hedge Fund Managers

We use Northstar's platfrom daily - it is practical, easy to use, and reliable. The data is presented in a very intuitive and visual way. Northstar has a robust risk engine behind its friendly UX, which precisely monitors risk and performance of our portfolio. It works well on both security level and portfolio level, allowing us to get a great precision on our numbers. This is a day and night difference compared to our previous risk system, a well known product which was overcluttered with useless reports and features and had a simplistic risk engine. We do not see a more compelling product for hedge fund risk management than Northstar.

PROS1. Intuitive design - Easy to use and understand. 2. Detailed reporting - Profit Attribution and Factor Analysis dashboards are highly functional 3. Flexible and customizable - Create your own reports and dashboards 4. Accurate - Data always makes sense 5. Reliable - System has not been down since we implemented it 6. Good integration

CONS1. web / iOS / Android app would be a nice feature 2. testing impact of potential trades on overall portfolio risk should be more automated.

Reasons for switching to Northstar Risk/Performance Software

Northstar is by far a superior product.

Emmanuel

Financial Services, 11-50 employees

Used daily for less than 12 months

OVERALL RATING:

5

EASE OF USE

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed October 2023

Great risk system

Excellent

PROSNorthstar is a comprehensive risk platform which can help asset managers analyze their risk(s) and PnL attribution. It covers a wide range of asset classes and has the huge benefit of coming with independent data. Coupled to its various risk libraries (covering merger arb as well, which is quite rare), it provides insight into your portfolio risk and can easily be used by all stakeholders within the firm, from PMs to Management and Risk. Contrary to many other risk systems, it is set up so that it can provide an accurate PnL of the portfolio, which means that your PnL attribution is realistic and ties back to the PnL that you get from your GL. The team at Northstar is small but very responsive and capable. The product has already many features available, but if you need something customised, it is possible as well. The GUI is easy to navigate and allows for easy grouping/drilling into the portfolio, including time series analysis of various fields. Overall, a great product which solves a lot of issues that would take a lot of effort to build and maintain internally otherwise.

CONSNothing critical, but nice developments for the future would be:- ability to access on mobile devices/web browser- ability for end-user to input data into the app directly (for selected use cases at least)- additional filtering options in the Screens- constituents drill-through sensitivities (without having the full breakdown of indices/ETFs)

Reasons for switching to Northstar Risk/Performance Software

Norhstar is much more cost-effective and requires far less maintenance

Edward

Financial Services, 2-10 employees

Used daily for less than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed October 2019

Great product for hedge funds looking to manage risk and track performance

Support is great, for ongoing or new features. Integration was seamless. The UI is easy to use and straightforward. Built-in risk model for commodity futures was more robust than other more expensive systems.

CONSNo big issues, I have found a great amount of value in the product

chris

Financial Services, 2-10 employees

Used daily for less than 2 years

OVERALL RATING:

5

EASE OF USE

4

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed September 2023

Northstar

We have found the external risk assessments from Northstar to be invaluable and could not recommend it enough.

PROSNorthstar Risk is a comprehensive risk platform that addresses our use case of a portfolio with a wide range of asset classes. Their attention to detail and breadth coupled with their readiness to work through nuances and create bespoke solutions is second to none.

CONSWhile the output from the platform is stellar, the application itself can be somewhat slow on our machines. This is by no means an issue, but if one had to be chosen, this would be it.

Reasons for switching to Northstar Risk/Performance Software

Our previous risk provider was unable to coherently measure risk across the asset classes we cover, resulting in risk numbers that were often a point of dismissal as opposed to accretive to our workflow.

Jeffrey

Verified reviewer

Financial Services, 11-50 employees

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed October 2023

Comprehensive and customizable risk management solution for the buy side

Customizable user interface and reporting package

CONSNot many downsides to mention. When we have suggested new features and pointed out problems they have been dealt with swiftly. A nice improvement would be exposing some of the model parameters and instrument overrides in the user interface.

Stephen

Verified reviewer

Financial Services, 2-10 employees

Used daily for less than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed January 2023

Excellent tool for hedge funds looking to understand both risk and performance.

We needed a CRO function and Northstar is perfectly that. As a matter of fact it is better than having an internal CRO as Northstar is truly independent. I highly recommend their risk consulting services as well as their risk technology offering.

PROSGreat support.Great integration.Easy to use.

CONSNone, I really have nothing negative to write.

Reason for choosing Northstar Risk/Performance Software

I had long known of [SENSITIVE CONTENT] and his deep professional and academic experience in risk management. We were in need of a risk management technology, but even more so risk consulting services to serve as an Outsources-CRO. [SENSITIVE CONTENT] was the only one who could measure up and he has hit the mark.

Joseph

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed July 2017

Have used product for 2 years; excellent tool for understanding risk/performance of a hedge fund

The product allows a portfolio manager to understand in-depth a portfolio's risk and performance by security and industry (and numerous other factors) over any time period. The analytical engine of the software is quite robust, yet the product is easy to use. Moreover, the team at Northstar is extraordinarily knowledgeable, yet very approachable and responsive.

CONSI can honestly say that there is not much that I dislike about the software. I would like to have an IOS app, however.

Michael

Financial Services, 11-50 employees

Used daily for less than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

3

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed April 2021

1 Year On

We use it as the daily deep-dive on risk & return attribution as well as the risk characteristics for a multimanager multistrategy hedge fund. We would not be able to run the business without NorthStar

PROS1) Quality of product - Technical Attribtues 2) Customer Support 3) Easy To Use

CONSNot much to say that I dont like. There are less expensive solutions out there, so if $ is your only criteria, probably not for you. But in terms of value for the $, its the best that I've ever used.

Reason for choosing Northstar Risk/Performance Software

Technical Attributes & Cost

Reasons for switching to Northstar Risk/Performance Software

Technical Attributes of the platform

Thiago

Financial Services, 11-50 employees

Used daily for less than 12 months

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed June 2020

Amazing Plug and Play Platform

Huge optimization of time spent on development of risk reports.

PROSQuick implementation process (our experience was plug and play). Real 24x7 high level professional and technical support. Very user friendly interface. Great reporting and analysis tool. Very easy to be personalized. Overall impressive and very positive experience.

CONSNone until now. Integration with our current system was incredibly easy.

Reason for choosing Northstar Risk/Performance Software

It really works!

Reasons for switching to Northstar Risk/Performance Software

Overall process efficiency, risk metrics confidence and high level of automation.