Lendsqr

About Lendsqr

Lendsqr Pricing

Lenders may pay a one-off implementation cost, and then monthly subscriptions. Additional charges may be incurred for extra services

Free trial:

Available

Free version:

Available

Most Helpful Reviews for Lendsqr

1 - 5 of 12 Reviews

Faithful

Verified reviewer

Banking, 2-10 employees

Used daily for less than 6 months

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

4

FUNCTIONALITY

5

Reviewed May 2023

Lendsqr Product Review

My overall experience with lendsqr was exhilarating and very satisfying. It solved majority of my lending problems!

PROSWhat i like most about lendsqr is the safety assurance it comes with and the easily accessible technology it offers to me as a Lender

CONSWhile they have an impressive customer support system, an artificial intelligence feature could be added for better customer support.

Yinka

Financial Services, 2-10 employees

Used daily for less than 2 years

OVERALL RATING:

4

EASE OF USE

3

VALUE FOR MONEY

4

CUSTOMER SUPPORT

3

FUNCTIONALITY

5

Reviewed March 2023

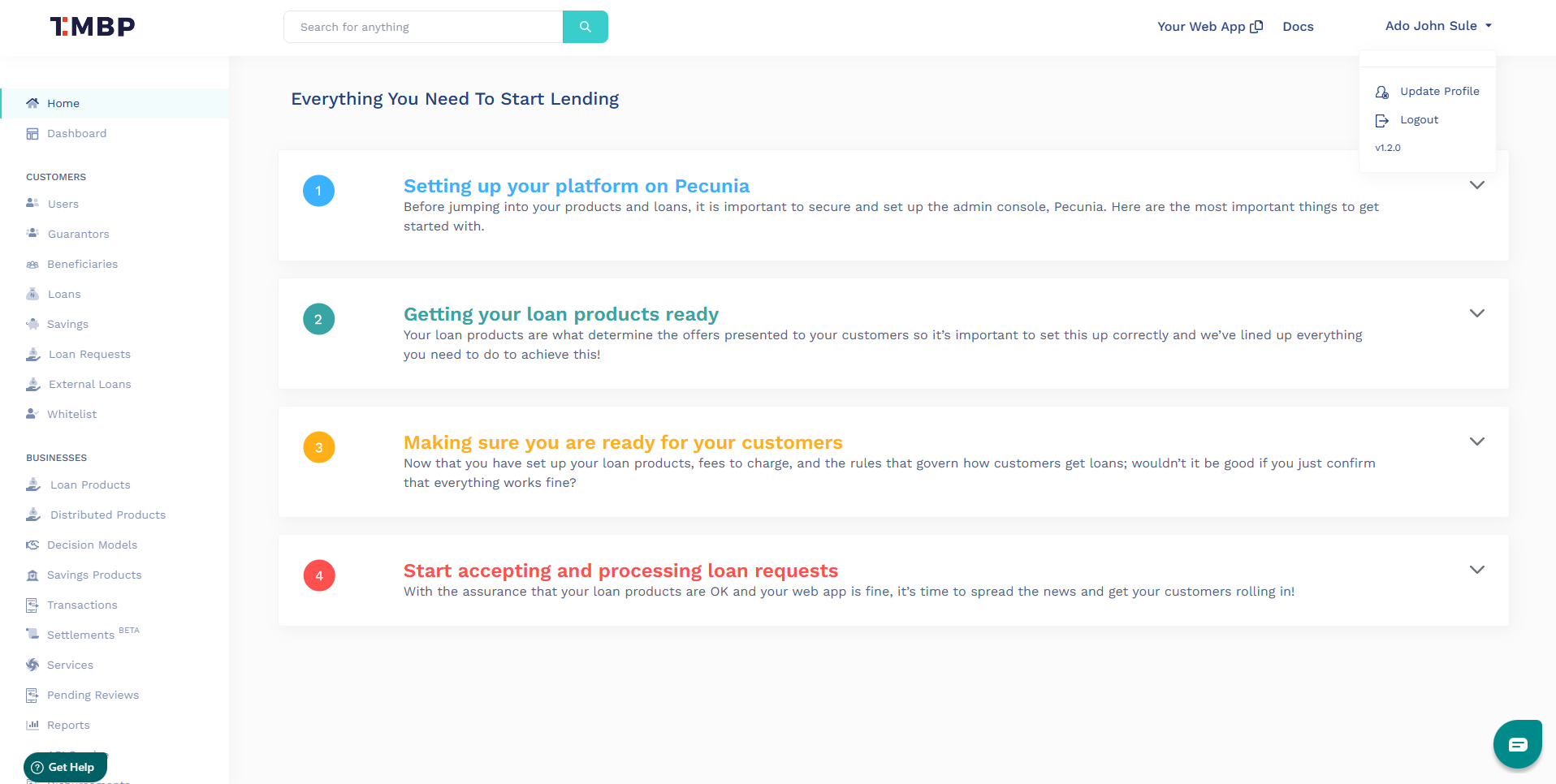

We launched our lending quick and cost-effectively

You can set up your lending business with access to the best features in minutes. There are tons of world-class features available out of the box.

CONSLendsqr can be complex for non-tech. The reports also need to be more dynamic and interactive.

Reason for choosing Lendsqr

Offers instant set up. The most cost effective

Martins

Information Technology and Services, 2-10 employees

OVERALL RATING:

3

EASE OF USE

3

VALUE FOR MONEY

3

CUSTOMER SUPPORT

3

FUNCTIONALITY

3

Reviewed June 2023

Service Review

User interface very interactive and responsive

CONSMost features are available compared to other similar SaaS solutions

Vendor Response

Thanks for your review. However, I would be glad to get a better insight into your "cons" as they not sound like a con.

Replied April 2024

Ayodeji

Accounting, 1 employee

OVERALL RATING:

5

EASE OF USE

4

VALUE FOR MONEY

3

CUSTOMER SUPPORT

5

FUNCTIONALITY

3

Reviewed August 2023

Jegede Ayo’s Review

It is been great so far. Although some hiccups were experienced but the support from the helpdesk made the integration easy for me.

PROSThe loan products and then support I get from the support officer has been the most impactful thing about lendsqr

CONSThe bank/card addition can be improved by the inclusion of different means of getting the loan paid to a bank account or perhaps, payment setups by a borrower to the lender.

Reason for choosing Lendsqr

Because so far and by record, Lendsqr has been the best and will still continue to be the best years to come.

Vendor Response

Thanks for your review of Lendsqr. We have improved the bank and card additions. We have also provided other payment channels such as direct debit.

Replied April 2024

David

Financial Services, 2-10 employees

Used daily for less than 6 months

OVERALL RATING:

4

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

3

FUNCTIONALITY

5

Reviewed March 2023

Review by Ezfunds

It made running a loan company easy

PROSThe seamlessness ie the ease with which I can manage my loan and the security put in place so lenders can pay back

CONSThe customer support service response time fell few and far between