Alloy

About Alloy

Alloy Pricing

Please contact Alloy directly for pricing details.

Free trial:

Not Available

Free version:

Not Available

Most Helpful Reviews for Alloy

4 Reviews

Doug

Financial Services, 10,000+ employees

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

4

CUSTOMER SUPPORT

4

FUNCTIONALITY

4

Reviewed October 2022

Proactive identity risk mititgation

My overall experience with Alloy has been very positive and effective. I will continue to work with them to solve risk mitigation.

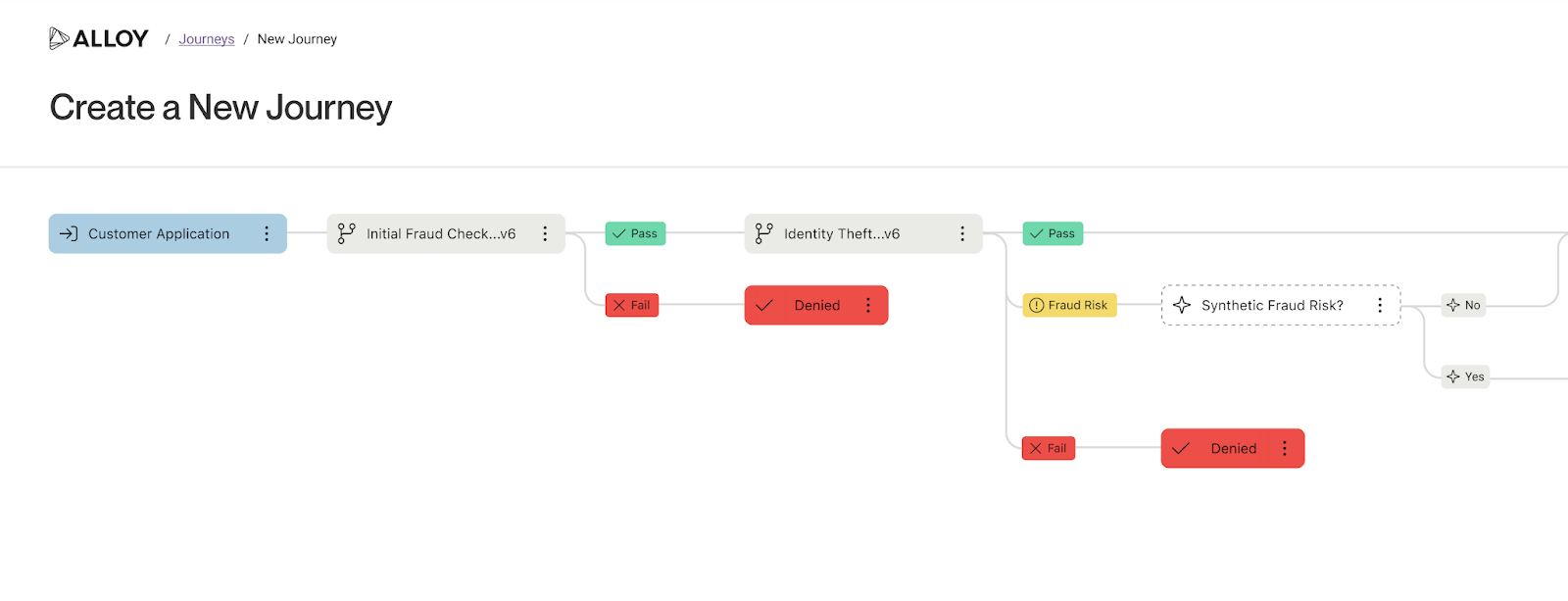

PROSAlloy allows for quick deployment. The ability to create strategies at a moments notice to avert fraud trends, and be proactive in risk mititgation are both essential benefits. The intial set-up was seamless, and Alloy's customer service allowed the ability to move quickly and effectively. Alloy also allows an opportunity to overlay multiple data sources to create an efficient and effective flow.

CONSThere is an opporuntity to improve reporting capabilities.

Reason for choosing Alloy

I chose Alloy do to the capability to provide access to multiple data sources for screening purposes. Also, because it allowed us to develop various strategies to be proactive.

Rebecca

Financial Services, 1,001-5,000 employees

Used daily for less than 2 years

OVERALL RATING:

5

EASE OF USE

4

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed November 2022

Commercial Banking Game Changer

Alloy is a game changer and absolutely the future of banking. Excellent team, partnership, and support.

PROSVisualization of data flow and data sources is better any other low code software I've seen or used which makes it easier to understand quickly. API integrations are vital. Ease of Use for compliance teams.

CONSIts a powerful tool but can be complex to master. Testing can be limiting due to the nature of KYC and requires a lot of flow configuration.

Russell

Financial Services, 501-1,000 employees

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed October 2022

Alloy Optimizes Your Agent Experience

Full control over your workflows and data sources. Codeless implementation allows you to respond to a fraud attack quickly and confidently.

CONSImplementing through a 3rd party partner makes it difficult to take advantage of everything Alloy has to offer.

Billie

Financial Services, 11-50 employees

Used daily for less than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed October 2022

An investment in your security

Wonderful, they're an awesome company.

PROSWith Alloy, I feel as though our services are kept safe from fraudsters. We've had no major incidents with fraud and I attribute that to Alloy's KYC and transaction monitoring software.

CONSIt's a pretty lengthy integration and pretty expensive for small companies.