Revelock

About Revelock

Revelock Pricing

Please contact Revelock directly for pricing details.

Starting price:

$40,000.00 per year

Free trial:

Not Available

Free version:

Not Available

Most Helpful Reviews for Revelock

3 Reviews

Anonymous

501-1,000 employees

Used less than 12 months

OVERALL RATING:

5

EASE OF USE

4

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed August 2020

Project Delivery

I supported one of our clients implementing the product, running a small team to perform its integration to complement the current inhouse AML and Cyber platforms. We helped the client select this product during RFP and specifically it was chosen due to its unique features with ATO and behavioural metrics

CONSNothing in particular, data of course is generally the pinch point - however, we performed the integration with full support from Buguroo thus ensuring success and a timely delivery

Reason for choosing Revelock

As mentioned above, due its strength (and ease of use) around behavioural and multi channel protection coupled with the deep learning aspects to enhance the anomaly detection within these channels. These elements and its price point helped us advise the clients as to which product better suited their requirements

Gareth

Financial Services, 501-1,000 employees

Used monthly for less than 12 months

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed August 2020

Excellent Solution

excellent company, very good solution.

PROSVery user friendly, quick to value, very accurate.

CONSthe solution delivered as expected without any major issues

Anonymous

10,000+ employees

Used daily for less than 2 years

OVERALL RATING:

4

EASE OF USE

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

4

Reviewed August 2020

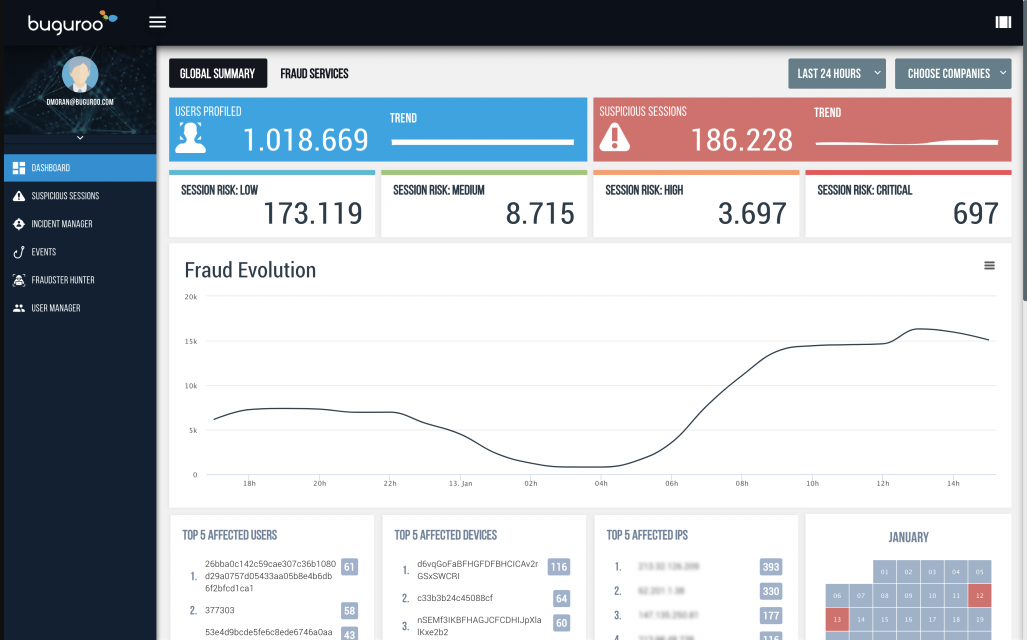

BugFraud is a high-performance fraud solution to prevent online banking fraud

We use the alerts to improve the rules including the biometric user profile, and the environment. It permits us to detect delicate users who could be victims of fraud. Furthermore, with the use of Fraudster Hunter, we've found devices and users related with a case of fraud which our controls hadn't detected.

PROSBugFraud is an expert solution to prevent online banking fraud as detect all fraud use cases, including unknown malware. It creates a unique profile for each user by gathering thousands of parameters relating to their behavioral biometric, environmental and device information. The solution uses deep learning to analyze anomalies and to detect fraudulent threats involving identity theft or customer manipulation across the entire banking session, and therefore detecting malware on the device. The way we have integrated the product is transparent for the users and enhance their customer experience. Information is available via API and a web management console to receive alerts and risk score per session in real time. The GUI has a lot of information about the sessions and all the alerts that it'd had. Buguroo is continuously evolving and releasing improvements that make the product and the detection of anomalies and fraudster behaviors more accurate.

CONSThe product needs to be fine-tuned and customized for our needs before it reaches its higher fraud detection rate and lower F/P Ratio. Also the retention period should be increased, thus it has lead to some late detection, as alerts can only be consulted via GUI.