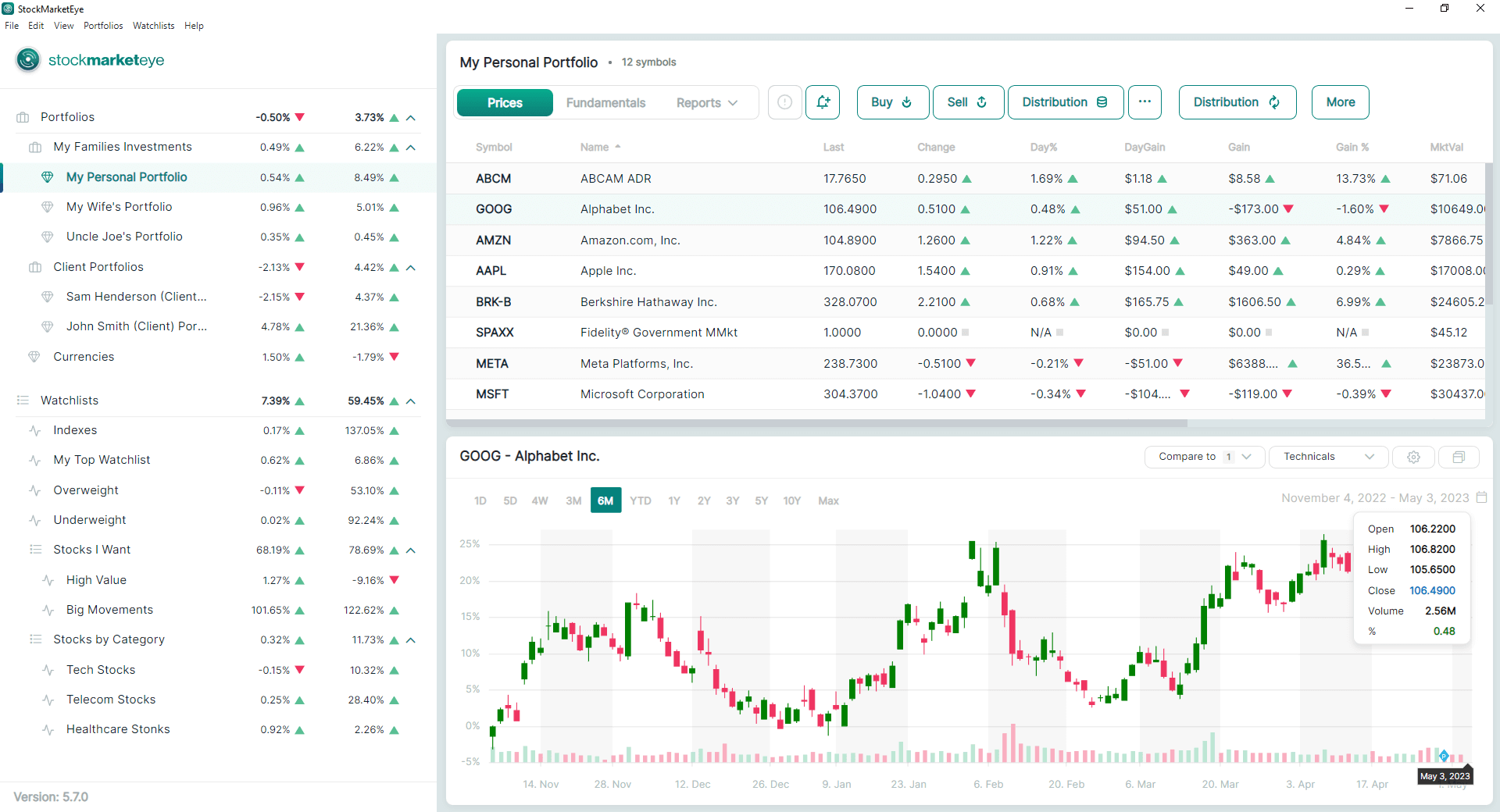

StockMarketEye

About StockMarketEye

StockMarketEye Pricing

Free, 14-day trial - no signup or credit card required. $74.99 / year

Starting price:

$74.99 per year

Free trial:

Available

Free version:

Not Available

Most Helpful Reviews for StockMarketEye

1 - 5 of 102 Reviews

Anonymous

2-10 employees

Used daily for less than 12 months

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed July 2018

Better than expected or any other such investment management programs I've seen

Very quick and informative response from support when I had a question on getting set up. That whole process went smoothly.

PROSI like that it's on my computer and not in some amorphous "cloud." I was looking to replace Google Finance after it turned into a mess, found this and can't be happier plus it is way more useful. It's fast, comprehensive, and makes a load of information easy to find. I've only been using for about 6 months and it's now an important go-to tool for all my investing decisions. We have about 60 holdings of more than 40 stocks, CEFs, ETFs in 6 accounts (SEPs, ROTHs, etc.) with 2 brokers. I was just able to easily complete a total overview analysis that I've been straining to try and do for a long time. It's easy to update with transactions, divis, etc. and is alway right on with Quicken & broker statements.

CONSNo complaints about SMEye at all. In fact, I'm still learning about tools and info it includes.

William

Design, 1 employee

Used daily for less than 12 months

OVERALL RATING:

5

EASE OF USE

5

FUNCTIONALITY

3

Reviewed February 2019

I well designed, easy to use, but basic portfolio management tool

I'm enjoying the tool, and it beats what I've used before. If you could add the two features I listed under cons, I would be very happy.

PROSIt is reliable which is the main reason I switched from my other tool. Nothing is worse than sitting down to check your portfolio and finding your tool is offline. The user interface is simple and intuitive, for the most part. It does provide a very useful range of fundamental metrics and ratios through the "Configure Columns" command, although the command is hard to access (you need to right click on the column header). All in all, though, I find the tool solid, reliable, and well-designed.

CONSThere are two improvements I would like: 1. Currently, there are two views on portfolios: Prices and Fundamentals. These can be configured. I would really like to create as many views as I want for each portfolio or watchlist (e.g. valuation, growth, performance . . .). Currently, I'm finessing this by creating duplicate watchlists for each view I'd like, but that is a pain if I add, delete, or change entries in a portfolio. So, user created/defined views would be great. 2. I would like to be able to chart the overall performance of my portfolio, and display it in comparison with indices, moving averages, etc.

Vendor Response

Thanks for your feedback. For your improvement request #2, have you tried clicking on the "Total" line of your portfolio? This will generate the market value chart of your portfolio (i.e. the end-of-day value of your portfolio over time). You can then add any comparison symbols you want to the chart as well as any of the supported technical indicators.

Replied February 2019

Gerard

Financial Services, 2-10 employees

Used daily for more than 2 years

OVERALL RATING:

1

EASE OF USE

3

VALUE FOR MONEY

1

CUSTOMER SUPPORT

1

FUNCTIONALITY

3

Reviewed August 2023

Don't buy it!

Unable to adjust to Yahoo's operating changes. No support. Even after 3 weeks of service interruption they are not able to give an idea of when the application will be functional again. Does not provide service but refuses to refund.

PROSEasy to use, but useless if you can't have any data.

CONSVery poor technical service. They doesn't seem to care about customers.

Reasons for switching to StockMarketEye

Unable to adjust to Yahoo's operating changes. No support. Even after 3 weeks of service interruption they are not able to give an idea of when the application will be functional again. Does not provide service but refuses to refund.

David

Retail, 2-10 employees

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

FUNCTIONALITY

4

Reviewed February 2023

StockMarketEye is the perfect 'Watch Dog' on stocks

I think StockMarketEye is a great software for tracking a multitude of stocks and being able to see at a glance what a stock is doing. You can monitor those stocks to see percentage of performance over a given time span and can invest in them at your discretion.

PROSIts easy to enter new stocks and even put in the price you paid for the stock. It will then keep up with the fluctuations in the market for that stock. You have the ability to increase the number of stocks you have.

CONSWhen you add new stock purchases of the same stock you already have and are watching, you must take the original price of the first stocks and the new higher or lower price of the added stock and find the exact average of your investment per stock. Then change the cost to the new average. It would be nice if that could be done in StockMarketEye instead of with a calculator and entered manually. Would also be nice to be able to see what the current stock market averages are doing.

Anonymous

1 employee

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed October 2018

Useful app to check your stock portfolio

Great little app, highly recommended..

PROSThis affordable app is an inexpensive way to track your stock portfolio, and keep an eye on the market prices. You can set specific alerts to buy and sell specific stocks, and use it to calculate your profitability.

CONSThere are more comprehensive cloud based systems, but at this price point you won't find anything better.