Trends in Call Center Performance and Quality Management

If you’re operating a contact center, your key competitive advantage is the quality of your customer experience, no matter your size.

And, at the end of the day, your customer experience is only as good as your agents. This is why quality management (QM) systems and performance management (PM) systems have become some of the most important tools in the push to improve customer experience, even in the smallest contact centers.

Call center software vendors are now integrating QM, PM and closely related workforce management (WFM) systems, which have traditionally been stand-alone offerings, into workforce optimization (WFO) suites.

WFO is still an emerging software category, and the benefits aren’t yet fully understood, particularly in the small business space.

Since Software Advice consults with small businesses looking to buy these systems on a daily basis, we’ll examine trends in our recent buyer interactions to help you decide whether to commit to a WFO suite, or whether to restrict investments to best-of-breed systems for the time being.

We’ll also look at some tips on how to leverage these tools from Gartner’s Hype Cycles on contact center infrastructure and customer service/engagement.

Here’s what we’ll cover:

Buyers Gravitating to PM Over QM and WFM

Interest in Integrated WFO vs. Stand-Alone Systems

Issues Buyers Are Trying to Solve With QM, PM and WFM Systems

Innovative Features of the Latest QM/PM Solutions

Buyers Gravitating to PM Over QM and WFM

If you’re not quite sure yet where quality management ends and performance management begins, you can take a look at our buyer’s guide on the subject.

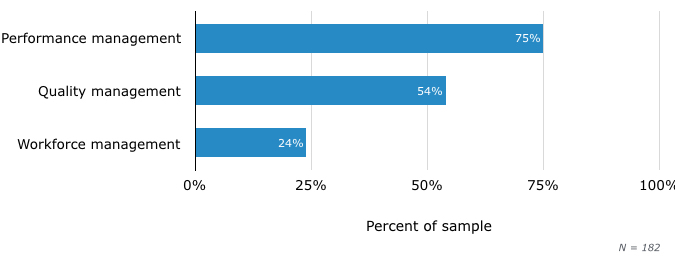

Among our sample of QM, PM and WFM buyers at smaller organizations, PM is easily the most popular:

Overall Buyer Interest in PM, QM and WFM

Why is PM leading the pack in buyer interest?

Rahul Zutshi, general manager and head of corporate strategy at Ameyo (a major vendor of call center infrastructure in the APAC and EMEA regions), explains that typically:

“Smaller and midsize contact centers are asking for performance management [PM] in cases where they want to increase agent productivity. People are exploring how to include the notification piece within the contact center system so that agents can see their own dashboards, which motivates agents to hit their goals.”

Rahul Zutshi, general manager and head of corporate strategy at Ameyo

We’ll break down the demographics of our sample and explore the use cases for PM and QM in more detail below. First, let’s look at whether contact centers are currently taking a stand-alone or integrated approach to deploying these systems.

Interest in Integrated WFO vs. Stand-Alone Systems

Traditionally, vendors have offered QM, PM and WFM systems on a stand-alone basis. However, integrating them enables powerful features.

For instance, you can use performance data agent scheduling, and feed call quality scores from a QM system into KPI dashboards, along with more basic metrics on call duration, abandonment rate etc.

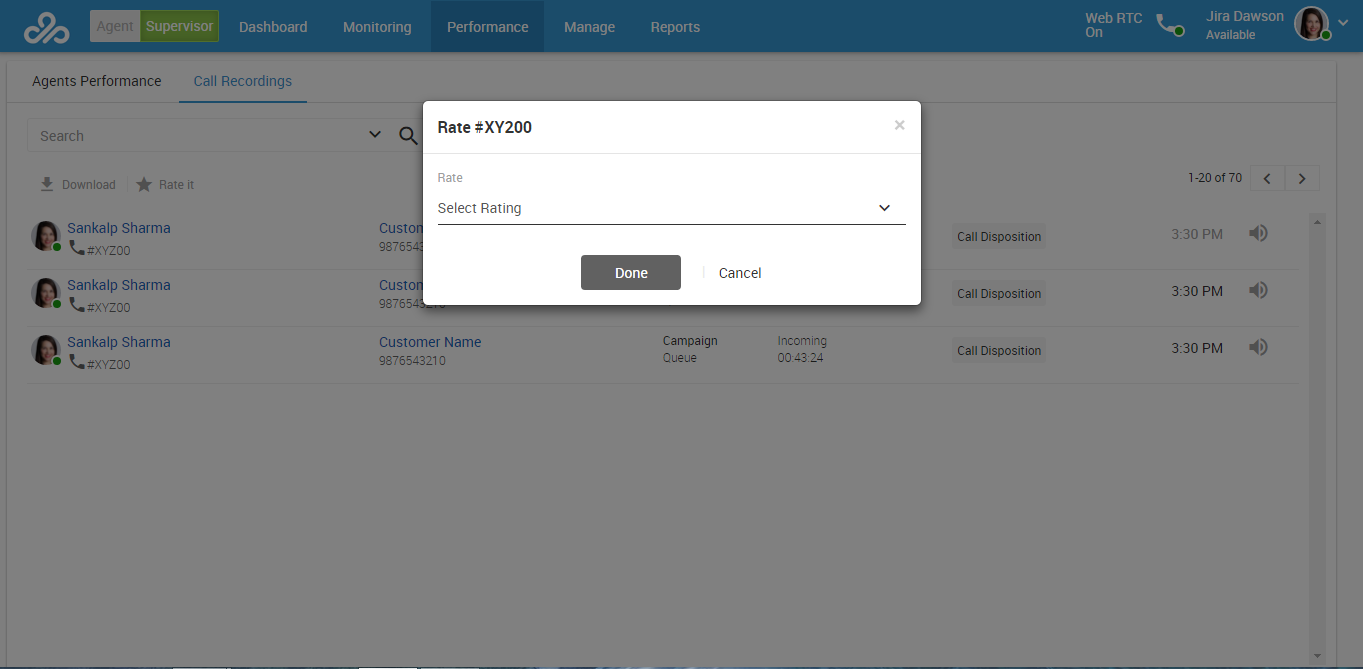

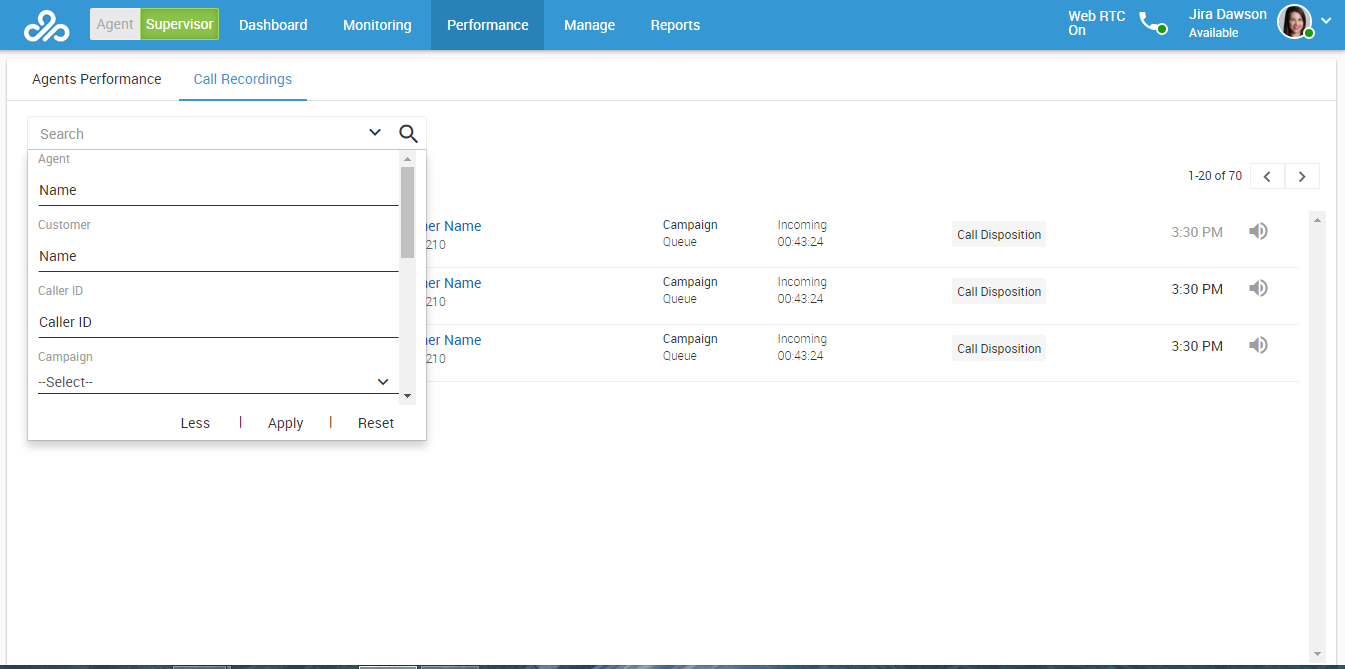

Assigning scores to call recordings in Ameyo

Now, a new software market is evolving for WFO suites that offer integrated modules for performance, quality and workforce management.

According to Gartner’s Hype Cycle for CRM Customer Service and Customer Engagement, 2015, by Michael Maoz and Jenny Sussin, WFO is defined as “the unification of complementary quality monitoring, workforce management, e-learning, performance management and speech analytics tools.” (This content is available to Gartner clients.)

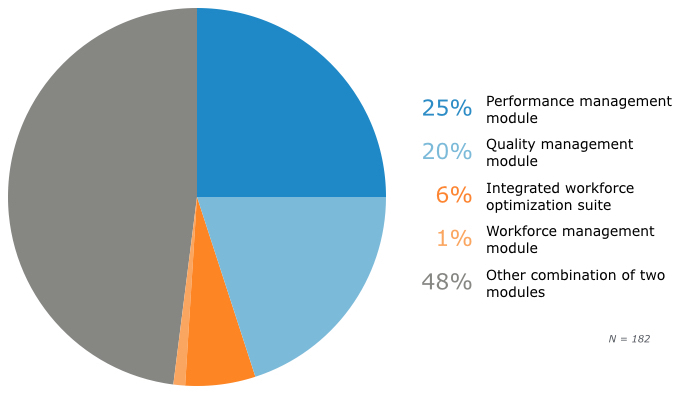

The question, of course, is how many contact centers are currently interested in deploying a WFO suite, rather than stand-alone tools for QM, PM and WFM. We dug into our internal research to find out:

Integration Preferences for PM, QM and WFM Modules

We can see that most buyers in our sample expressed interest either in stand-alone solutions for QM, PM and WFM, or in some combination of two modules that falls short of full WFO.

As we’ve discussed, our sample primarily consists of smaller organizations—nearly all of the contact centers in our sample are under 250 seats, and most are under 50.

That said, the same trends we see here are also evident in the enterprise space. Gartner’s Hype Cycle for customer service/engagement puts adoption of full WFO in large contact centers at less than 10 percent.

The current unwillingness to invest in full WFO can be attributed to the fact that investments in this space are usually motivated by local operational needs, rather than a unified strategy.

For example, Zutshi notes that “I was talking with a customer recently with about 250 seats about how they do performance management, and they replied ‘We do performance management with Excel.’ They don’t have a burning need at this point in time.”

However, a unified approach to WFO will become increasingly common in time. According to Gartner’s Hype Cycle for customer service/engagement, you should continue to let local operational needs drive investment for the time being.

But you also need to discuss roadmaps to WFO with vendors on your shortlist:

“During a workforce management or quality management investment project, explore the opportunity to source this capability from a complementary customer engagement center technology vendor with whom you have a relationship.”

Issues Buyers Are Trying to Solve With QM, PM and WFM Systems

We don’t just track buyer interest in various systems in our interactions, but also the issues that they’re trying to solve with new software:

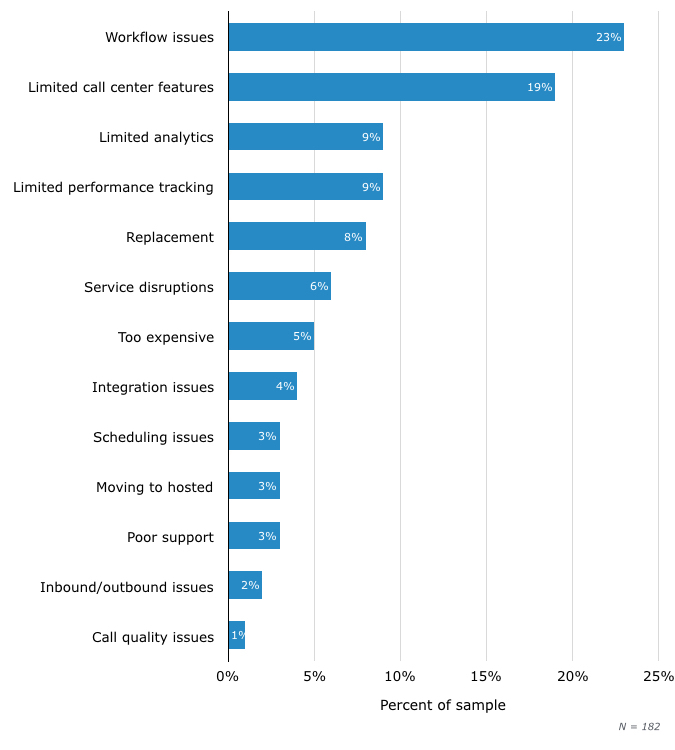

Top Pain Points Buyers Are Addressing via QM, PM and WFM Investments

The most striking trend evident in the chart here is the fact that buyers are primarily motivated in this space by the need to streamline operations through expanding the features of their systems.

In general, smaller organizations are more prone to replacement-cycle buying than larger organizations. The attitude at a small business without an IT department is generally “if it ain’t broke, don’t fix it.”

We can see here, however, that the group of buyers seeking to streamline operations or to expand features in the areas of performance tracking, analytics and call center-specific telephony dwarfs the number of replacement buyers.

Moreover, the specific interest in analytics and performance tracking shows that these buyers’ attempts at streamlining operations go beyond solving simple workflow issues.

Zutshi observes that “In the lower end of the market, the clients have begun to expect one thing: the recording piece, as well as analysis of any such recording, has to be there.

This can be as simple as a report of the recordings you want to pull (using criteria such as pre-call durations, whether the customer was greeted or not, etc), which can be used in a basic quality monitoring process.”

Pulling call recordings in Ameyo

Integrating advanced quality management, which frequently depends on automated analysis of interactions, can be crucial for improving performance tracking. This is because traditional QM solutions are based on manually scoring a handful of calls, an approach which has its limitations.

Scott Kendrick, VP of marketing and product management at CallMiner (a best-of-breed vendor of interaction analytics solutions for QM in contact centers), observes that:

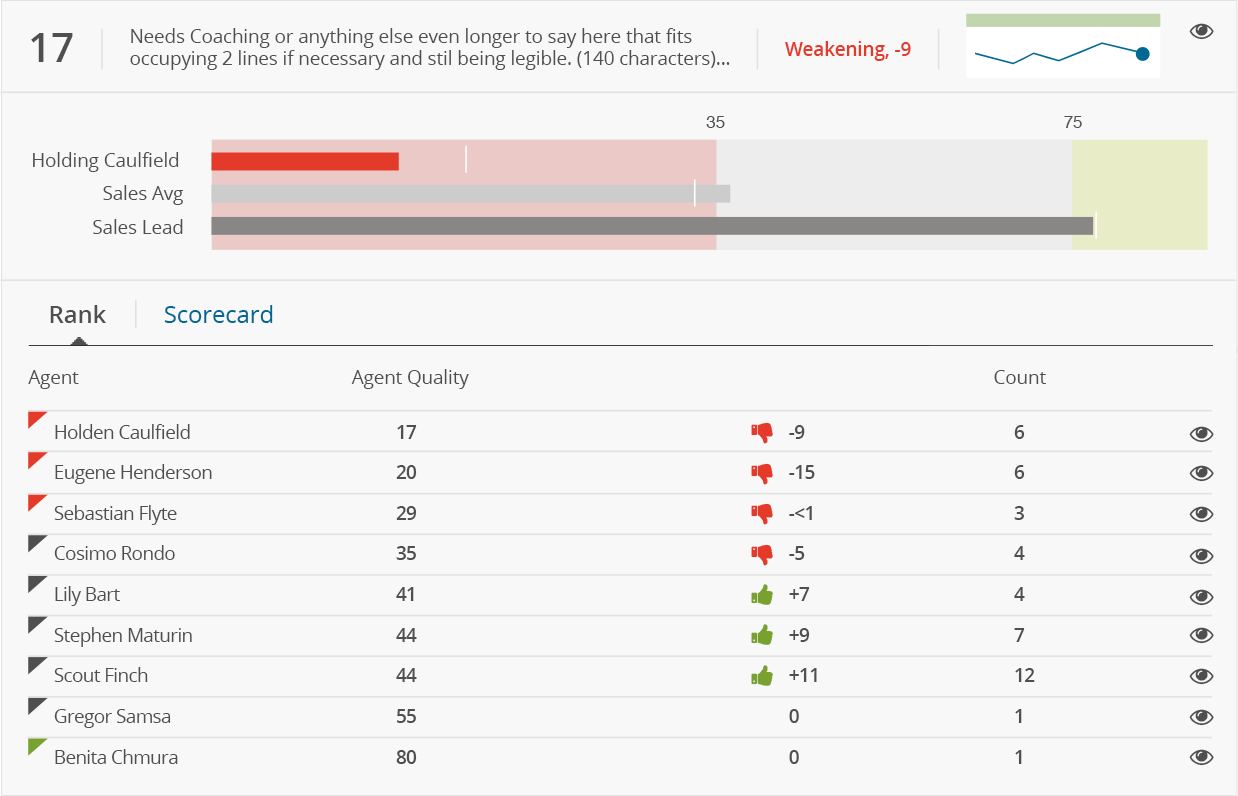

“We compared scores that were evaluated manually using a sample of calls by plotting them on an axis. This showed that there was basically no correlation between agent scores from one month to the next—the correlation coefficient was .1, which is almost random.”

So what? Well, randomly assigned scores mean that agents won’t always feel that their performance is evaluated fairly, and this can lead to agent churn. To reduce this problem, you can move to speech analytics-based QM.

Call scores based on speech analytics in CallMiner

Indeed, Kendrick explains that speech analytics can be key to getting a quality monitoring program off the ground in the first place at a smaller contact center, as these organizations frequently “don’t have the bandwidth or the people to do the quality monitoring.

Instead of creating a team to do a manual process, they can jump that step and move straight to automation.”

Innovative Features of the Latest QM/PM Solutions

Other advanced quality and performance management features that are helping contact centers to transform the customer experience include:

Expanded QM that handles non-voice interactions. Gartner’s Hype Cycle for Contact Center Infrastructure, 2016, by Drew Kraus, explains that “as customer engagement centers evolve to support multiple communication channels, such as social media and video chat, their ability to record and evaluate these channels is just as important as it is for the phone channel.” (This content is available to Gartner clients.)

Kendrick notes that “Probably about 80 to 85 percent of our customers are doing voice-only right now, but as many as 50 percent have asked us if we support more than just voice during the sales process.”

Desktop analytics. Most contact center agents spend all day working in applications, so if you’re only recording their interactions with customers, you’re only getting part of the picture. Desktop analytics allows you to record how agents use applications, which can obviously help to boost productivity and identify workflow problems.

Unified reporting. PM systems need to pull in more data than ever before, and not just from call center systems, but also CRM systems that track sales and revenue goals.

According to Gartner’s Hype Cycle for customer service/engagement, “centralized reporting has become more difficult because of the different channels and metrics now associated with a customer engagement center. This has slowed the adoption of these tools but at the same time increased the need for them.”

The newest generation of PM solutions offer robust data integration capabilities to provide a unified view of agent performance using multiple data sources.

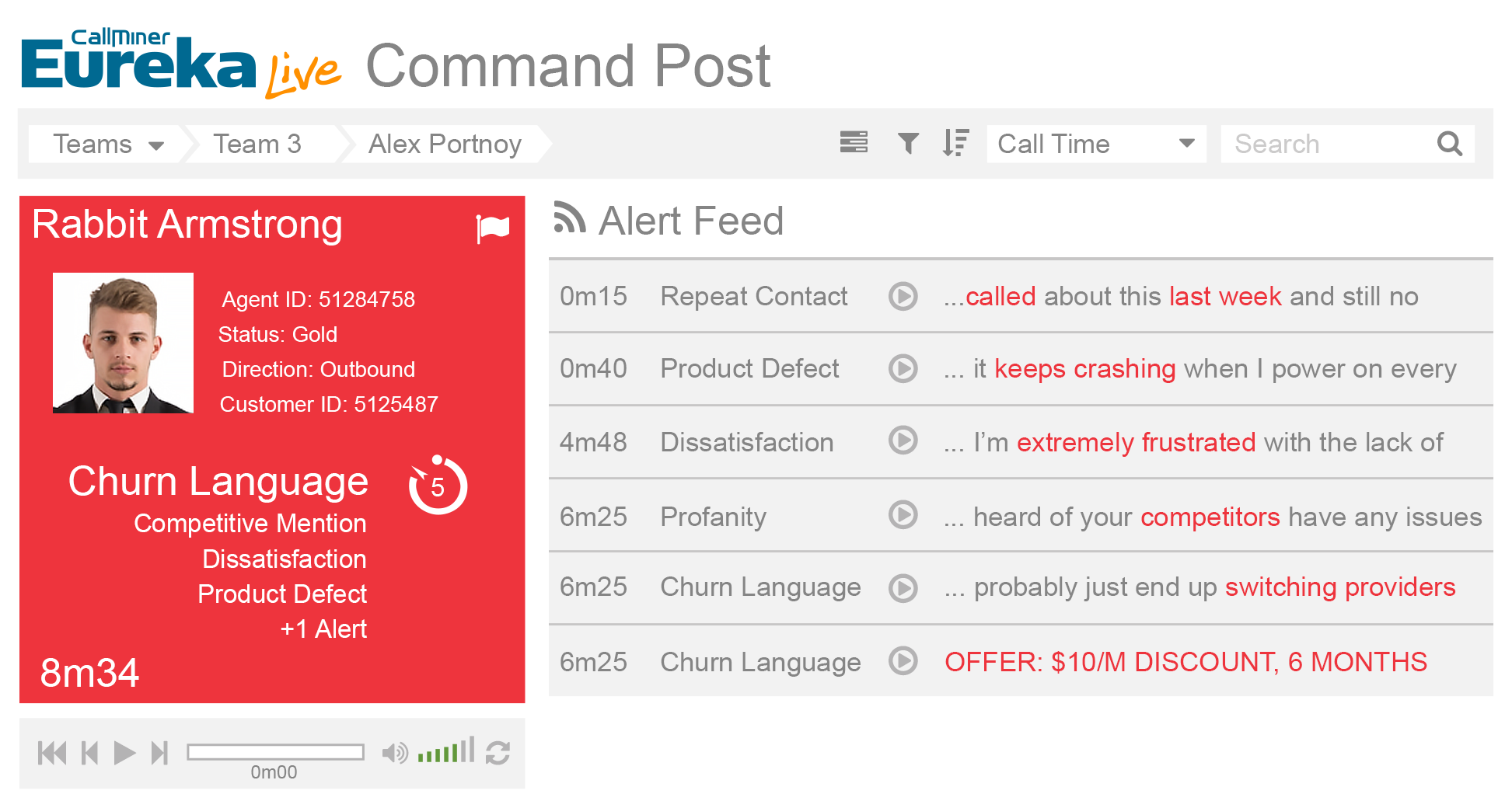

Real-time alerts based on speech analytics. Quality management is no longer limited to analyzing recorded calls. Real-time speech analytics can inform supervisors of problems as they’re happening.

Kendrick notes that even small contact centers are using automated speech analytics for this purpose:

“In the smaller contact center, the supervisor can sit in the middle of the floor and literally hear one side of what’s happening on the call. But we actually have deployments of real-time alerts in 40-seat contact centers, because they can’t hear what’s on the other side of the call, and also because they can quickly see whether a call is heading in the wrong direction.”

Scott Kendrick, VP of marketing and product management at CallMiner

Audio snippets triggering alerts in CallMiner

These are just some of the areas in which QM and PM solutions are evolving. For a full overview of this subject, see Gartner’s Key Functional Capabilities for Contact Center Workforce Optimization by Jim Davies (This content is available to Gartner clients.)

Sample Demographics

Software Advice provides phone consultations to businesses looking to invest in call center software on a daily basis. For this report, we only considered interactions with buyers of QM, PM and WFM systems from the past year.

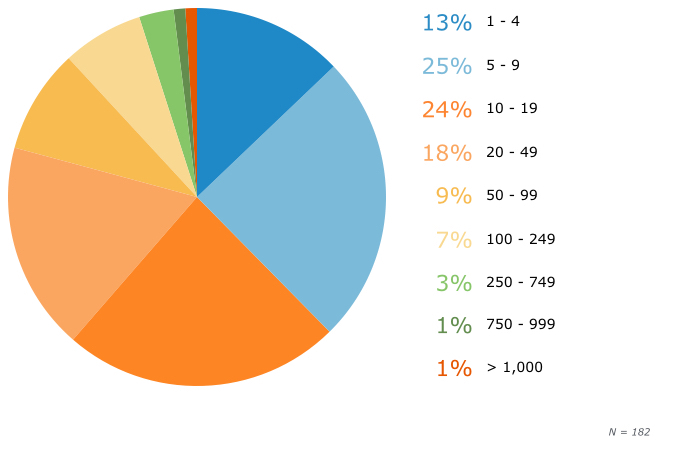

In terms of agent seats, the size of the businesses in our sample skews significantly toward the smaller end of the spectrum. Only five percent of the sample consists of contact centers with 250 or more seats:

Size of Contact Centers in Sample (Agent Seats)

The fact that so many contact centers with fewer than 50 seats are considering PM, QM and WFM systems testifies to the vitality of the SMB market for WFO solutions.

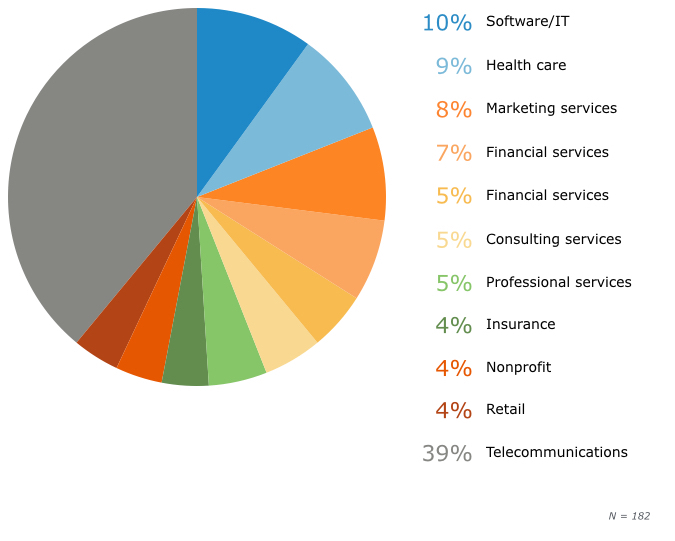

Industry verticals break down as follows:

Industry Verticals of Contact Centers in Sample