AMLcheck

About AMLcheck

AMLcheck Pricing

Contact for pricing information.

Starting price:

€5,000.00 per year

Free trial:

Available

Free version:

Not Available

Most Helpful Reviews for AMLcheck

2 Reviews

David

Verified reviewer

Financial Services, 11-50 employees

Used daily for less than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

4

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed May 2019

AML - DM

I work for an investment management company and AML is hugely important to ensure the money coming is safe and not laundered. This software is by far the best and integrates well with our firm. We have tried multiple others and this is the best in regards to interface and tracking of clients.

CONSCostly but well worth it. I recommend getting one license and sharing it across different users if possible.

Gema

Security and Investigations, 10,000+ employees

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed November 2021

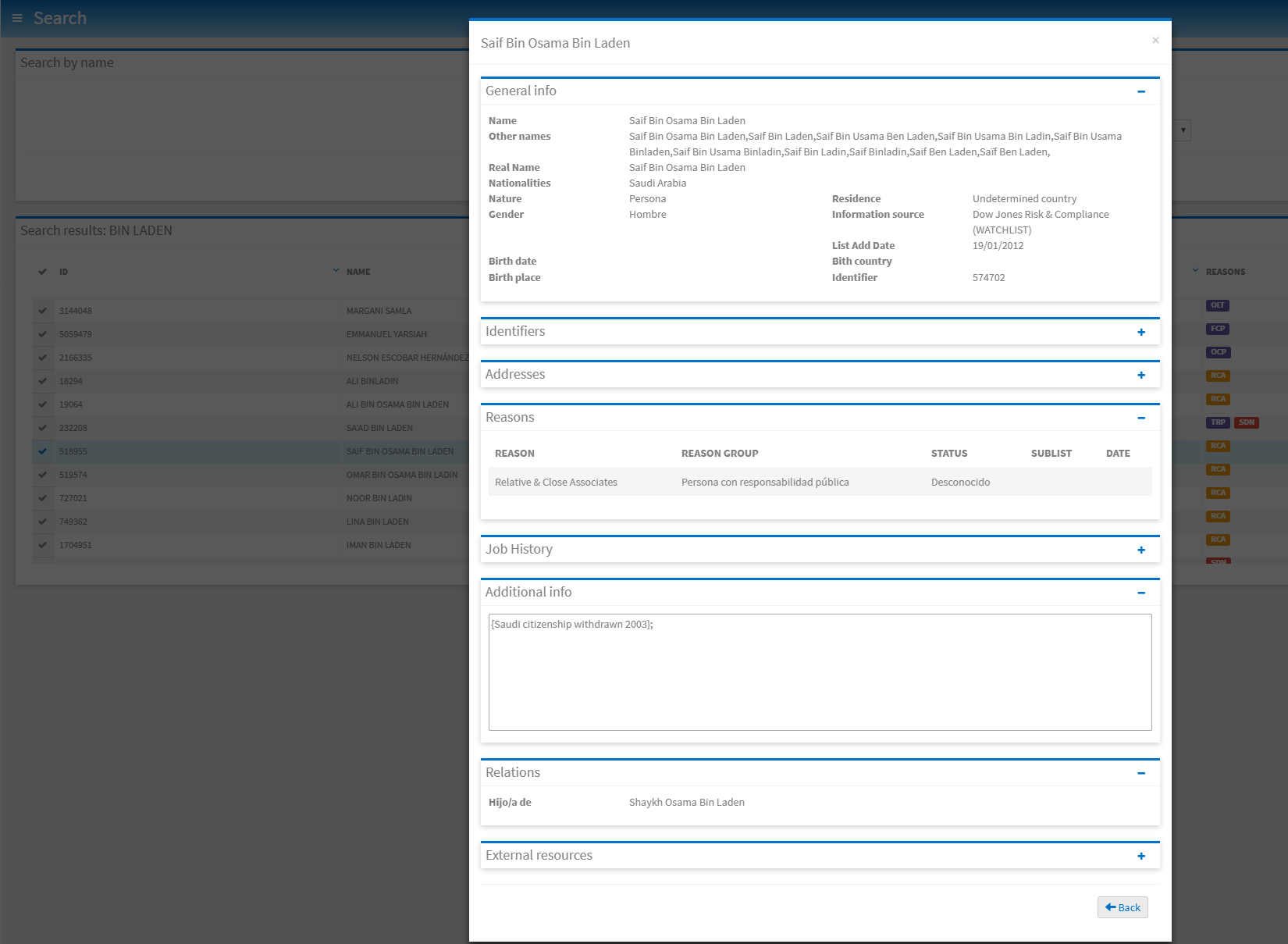

AMLcheck es el software AML más completo del mercado

Tras varios años en el mercado, AMLcheck se ha consolidado como uno de los software para la Prevención del Blanqueo de Capitales y Financiación del Terrorismo más avanzados del mercado. Permite el chequeo de bases de datos con listas de sancionados, de forma puntual o periódica. Además, con AMLcheck, el sujeto obligado puede establecer perfiles de riesgo de cada cliente y, en el caso de entidades financieras, instaurar reglas de control que le permitan detectar operaciones sospechosas. En la última versión, han evolucionado el dashboard para hacerlo más visual, intuitivo y con mayor peso del reporting. Además, han mejorado el algoritmo para afinar más el proceso de screening y reducir el porcentaje de falsos positivos. De esta manera, el departamento de PBCFT es más eficiente.

CONSAMLcheck está diseñado para grandes sujetos obligados, con un volumen de clientes y una necesidad de chequeo importante para obtener el máximo partido de la plataforma.