Small Businesses Are Being Left Behind in the Retail Supply Chain Crisis

If your small business is scrambling to deal with ongoing and ever-changing supply-chain issues, you’re not alone. Nine out of ten small and midsize business (SMB) retailers feel that larger companies have an advantage over them in their ability to procure inventory.

While larger businesses can afford to pay for entire cargo ships and even planes to receive materials quicker, and are prioritized by suppliers focused on fulfilling large-scale orders, SMBs are forced to place larger orders at higher cost with limited space for extra inventory. And some are even being dropped by their vendors altogether.

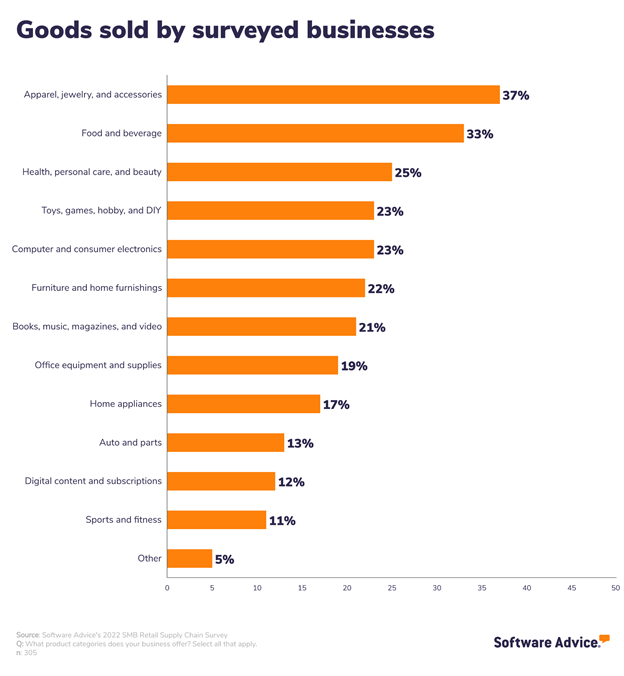

To understand more, we conducted an SMB Retail Supply Chain survey where we asked 305 logistics and inventory professionals about their experiences procuring inventory over the past 12 months. The purpose of this survey was to learn how SMB supply chain pros are managing the current supply chain crisis, expected to last through 2023.

In this report we’ll provide you with insights based on their responses, compare the results against what we found last fall, and share recommendations to help you rethink your vendor management strategy in order to gain more market share.

Key findings:

86% of SMB supply chains have already been impacted or expect to be impacted by the war in Ukraine.

91% of SMB retailers feel that larger companies have an advantage over them in their ability to procure inventory.

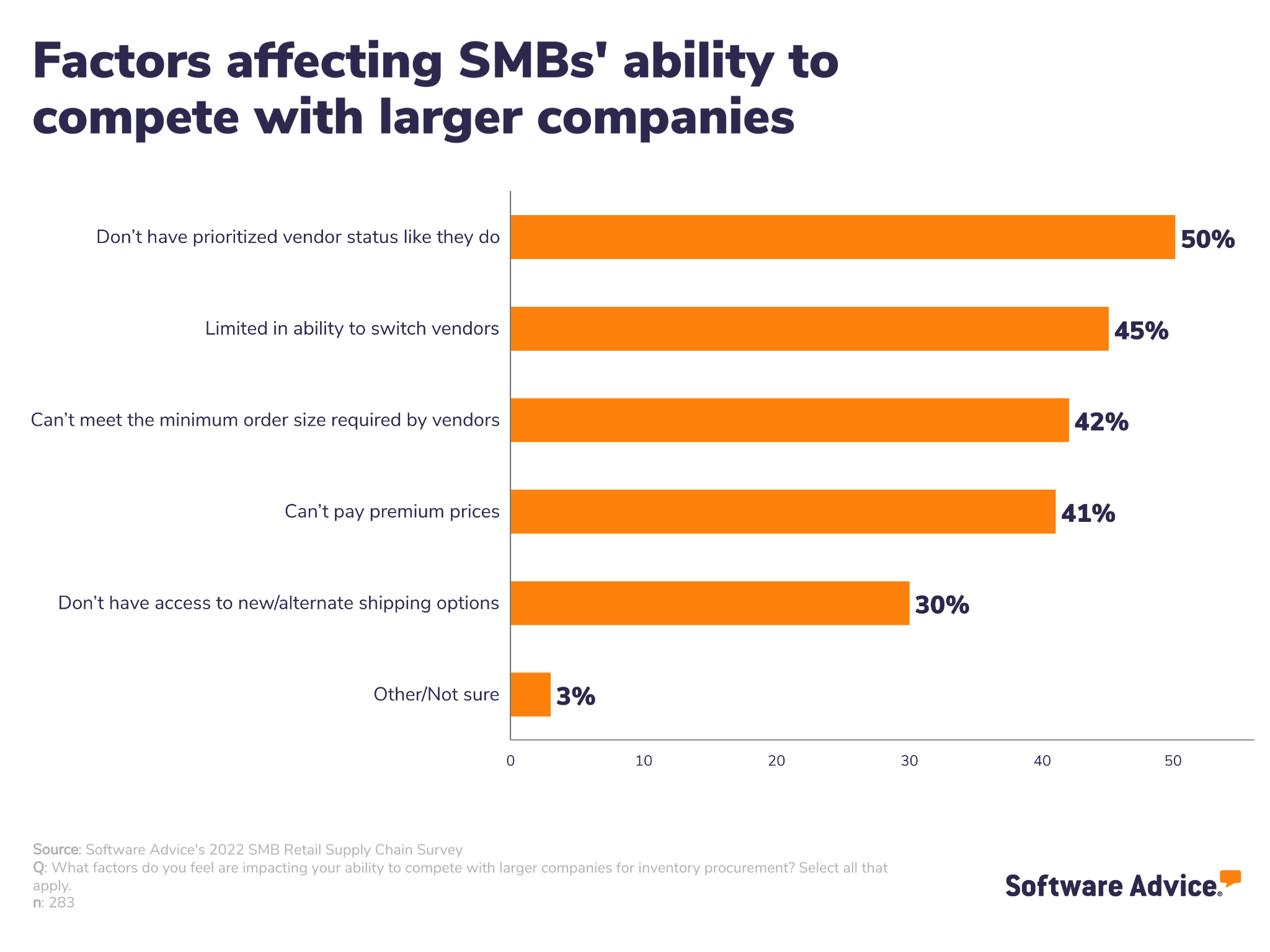

Of these retailers, 50% say this advantage exists because they don’t have prioritized vendor status, and 45% say it’s because they’re limited in their ability to switch vendors.

46% have had at least one vendor drop them for reasons specifically related to being a small business. Another 23% are expecting to be dropped in the near future.

59% of respondents say it’s taking somewhat to much longer to procure inventory than in 2021.

50% of respondents have increased their retail prices to offset the increased supply chain costs. Of them, 35% plan to increase retail prices again if costs continue to increase.

35% of SMB retailers are paying more than 20% more for shipping now than 12 months ago. But 22% have decided against paying shipping premiums.

Here’s what we’ll cover:

Nearly all SMB retailers are struggling to compete for inventory with the big guys

Relying on a single vendor has become riskier

Raising prices is practically a must now

What’s to come: D2C shipping, deglobalization, and inflation

Survey respondents demographics

Nearly all SMB retailers are struggling to compete for inventory with the big guys

No one is immune to the ongoing disruptions, but larger companies tend to place larger orders and essentially are less risky for suppliers than small businesses—91% of SMB retailers feel that larger companies have an advantage over them in their ability to procure inventory.

We asked these respondents to share the factors that impact their ability to compete with larger companies for inventory procurement:

The top factor hurting SMBs (50%) is that they lack the prioritized vendor status that bigger businesses often get. A prioritized status means that the supplier will work harder to fulfill the orders placed by their preferred partners first, and can end up canceling orders placed by non-prioritized partners. To get prioritized status, businesses need to have a long and in-good-standing relationship and also meet minimum order requirements. Two things most SMBs just can’t offer.

In fact, 42% of respondents say their inability to meet minimum order sizes set by vendors is a key challenge. And 41% say they’re unable to pay premium prices, which can sometimes help a company earn prioritized status and reduce the likelihood of canceled orders.

Unfortunately, just switching vendors isn’t a great option—45% of respondents say they’re limited in their ability to switch vendors and 30% report they don’t have access to alternate or new shipping options (e.g., switching from ocean freight to planes as some major companies such as Home Depot and Lululemon have done).

Our recommendation: Openly discuss your goals and challenges with your current vendor(s) and strategize together on how to address them. Also, be open to cooperating with other nearby small businesses if they use the same vendor(s) or get the same products. The supply chain is a network, (not really a “chain” as the name implies), so reach out in as many different ways as possible to find creative solutions.

Relying on a single vendor has become riskier

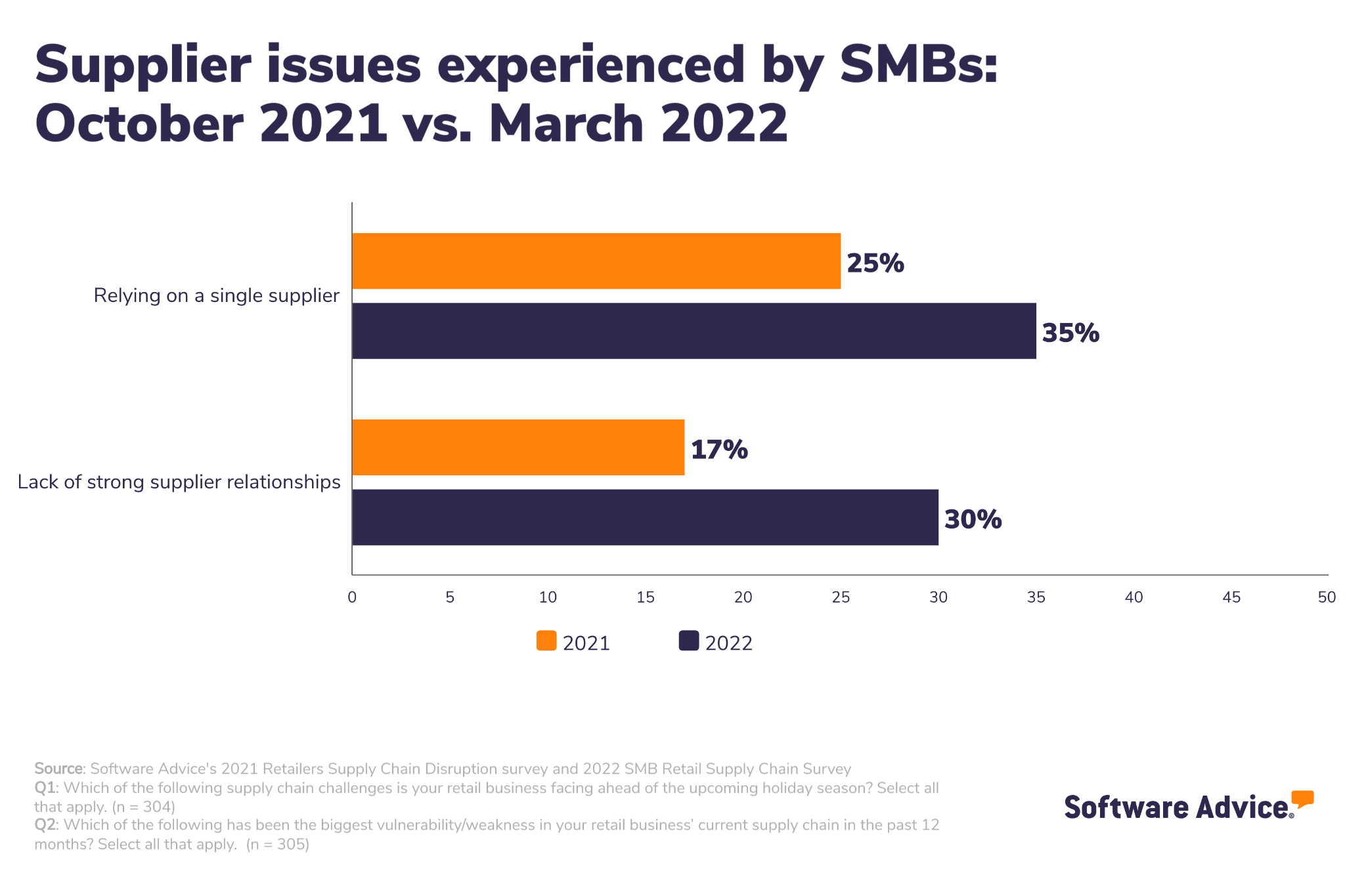

Last October, we asked SMB retailers about their main supply-chain challenges ahead of the 2021 holiday season—25% said relying on a single supplier and 17% said lack of strong supplier relationships were top challenges (read the full report here).

Today, those numbers jumped to 35% and 30%, respectively.

Suppliers themselves are struggling to secure raw materials and transportation, which makes reliance on a single vendor even more riskier than ever. If you don’t have a strong relationship with your supplier(s), you risk being deprioritized and some vendors may even drop you as a customer altogether.

In fact, 46% of SMB retailers say they’ve had at least one vendor drop them for reasons specifically related to being a small business. And another 23% are expecting to be dropped in the near future.

Our recommendation: Having vendor diversity, or at least having backup vendors, helps mitigate supply chain disruptions. Schedule time to check in with your current vendor(s) and discuss ways to improve your relationship with them, but also take the time to find at least one backup vendor.

Raising prices is practically a must now

The global supply chain is constantly being disrupted by outside forces, from Putin’s invasion of Ukraine to new lockdowns for COVID-19 outbreaks to increasingly tense trade agreements with China (more on this later). All this means that supply is down but demand is still up, which means higher prices.

Small companies have to work even harder to keep up because they are not only affected by supply chain disruptions but higher prices squeeze them out of competing with larger companies. Larger companies have an advantage because when it comes to price changes, they tend to have a larger loyal customer base more willing to accept a price hike and are better able to absorb increased costs without passing the pain on to their customers.

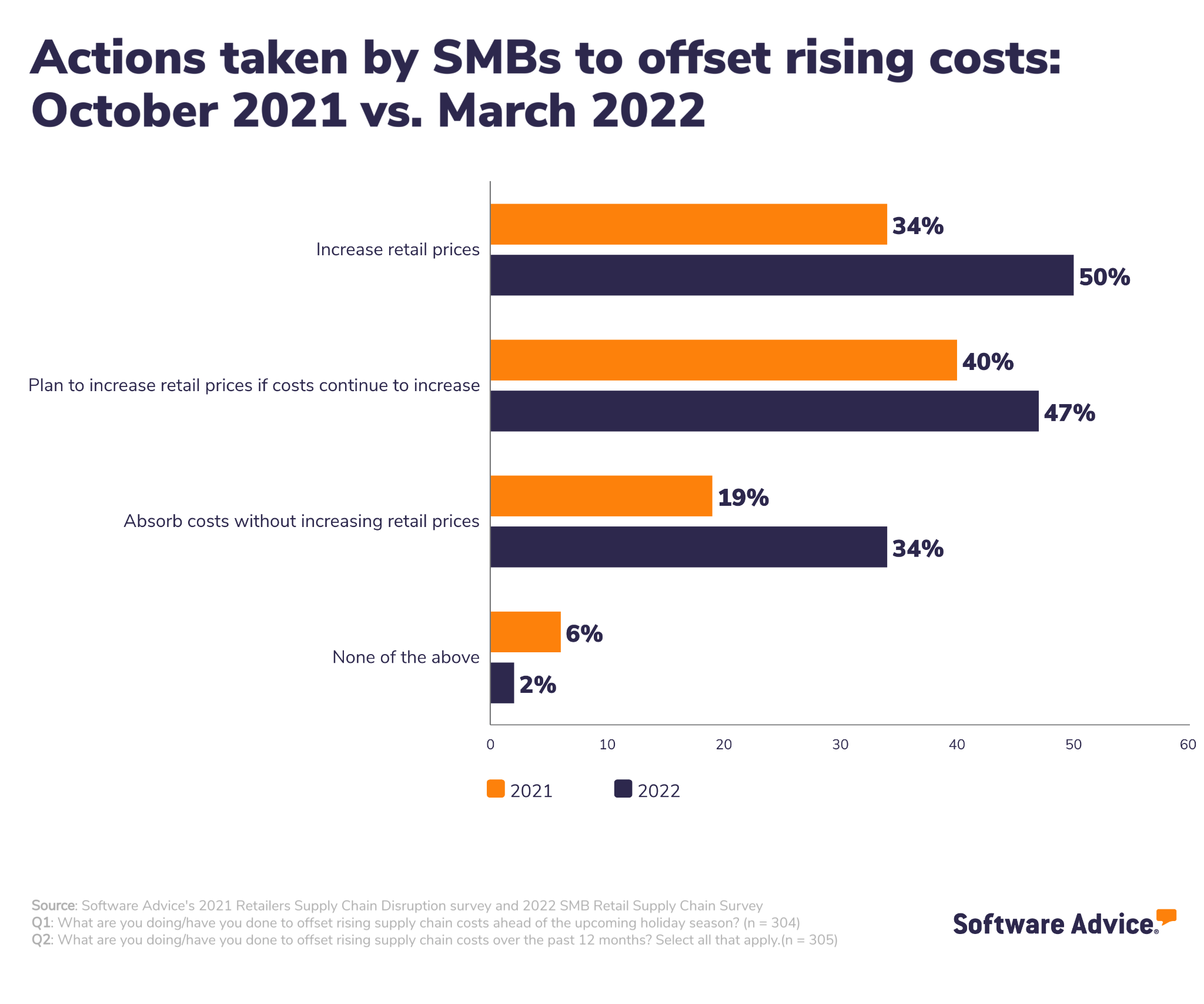

SMB retailers are taking a number of actions to combat these two new realities. Here’s a comparison of the actions SMB retailers took/are taking to offset the rising costs across their supply chain in October 2021 versus March 2022.

Last October, 34% of SMB retailers had increased retail prices to offset the increased supply chain costs, and now that number jumps to 50%. And of that 50%, 35% plan to increase retail prices again if costs continue to increase.

The number of SMB retailers not raising their prices and instead trying to absorb the increased costs themselves jumped from 19% to 34% since October. This could be due to the sudden and dramatic recent events (mainly the war in Europe) from which the true fallout is still to be experienced—retailers are trying to mitigate the short-term effects, taking a “wait and see” approach before risking alienating customers with even higher prices.

Our recommendation: If you haven’t already raised prices, it’s time to think about it to keep pace with your small-business competitors. Be transparent with your customers about why and how much the prices are increased. While some established brands, such as AriZona Iced Tea, might choose to not raise prices out of principle, don’t feel pressure to do the same. Make the smallest increase necessary and your customers will likely understand.

Price increases aren’t the only action being taken—retailers have worked to reduce their direct (39%) and indirect (29%) costs. If you’re looking to reduce direct costs, look into purchasing less expensive materials and/or find a supplier closer to you to reduce shipping costs. It can take longer to make adjustments to reduce indirect costs, but moving to a cheaper, closer warehouse and/or partnering with another small business to share the space and employees can help.

Pro tip for non-pros: Switching to or adding a new warehouse? Focus on the freight in-and-out costs, not the rent. While rent may seem like the biggest factor, it’s not. According to CBRE’s Supply Chain Advisory report: “transportation costs typically account for half of an occupier’s total logistics spend but can easily rise to 70%, while fixed facility costs (including real estate) account for only 3% to 6%.”

What’s to come: D2C shipping, deglobalization, and inflation

Supply chain disruptions aren’t stopping anytime soon, but the amount of change can leave your head spinning. Here, we share what we predict to be the most destabilizing trends that will continue to disrupt supply chains and retailers like you:

B2B shipping moves to D2C

Logistics giant Maersk is moving from being just a business-to-business ocean freightliner to re-inventing themselves to be direct-to-consumer and last-mile delivery services. We fully expect other logistics companies and major retailers to continue to reposition and expand their offerings to accommodate more direct-to-consumer deliveries.

What to watch for: This trend could improve your logistics capabilities and offer more flexibility for where and when you get inventory, so keep an eye out for new offerings from both your current and potential partners.

Increasingly tense global trade

The post-WWII trade trends toward globalization are becoming increasingly more risky as the suspicion and distrust between democratic and autocratic governments grows. Supply chains see the effects when Western and Eastern countries swap trade barriers/tariffs and enact sanctions and physical blocks of established trade lines.

And it’s not just the transportation barriers that impact retailers. Many raw materials are in short supply, such as aluminum, sand, and food products. So even if the trade line is open, it’s likely there’s no product that could be delivered.

What to watch for: If your product(s) rely on international trade, it’s a good time to focus on redesigns or other changes you can make to reduce your reliance on overseas materials. A pivot to nearshore/local production might seem too expensive now, but this trend will only accelerate as it curries favor with environmentalists, consumers, and governments.

Inflation

According to Gary Friedman, CEO of luxury home furnishings brand RH (formerly known as Restoration Hardware), retailers raising prices and the resulting inflation have no end in sight. On RH’s latest earnings call he said, “I don’t think anybody really understands what’s coming from an inflation point of view, because either businesses are going to make a lot less money or they’re going to raise their prices. I don’t think anybody really understands how high prices are going to go. I think it’s going to outrun the consumer.”

(I’d like to note that Mr. Friedman’s candor on the earnings call was met with a severe dip in RH’s market value. This could mean we won’t see many other CEOs be as open with their pessimism in the future.)

What to watch for: While there’s not much small-business owners can really do about inflation, you need to protect your business and ride out this wave. Raising your prices and pivoting to nearshore production/procurement if possible are the two actions we recommend considering for both short- and long-term protection.

What action will your small business take?

We hope you found this report helpful as you continue to manage retail supply chain disruptions and compete with bigger businesses.

From diversifying your suppliers to partnering with other small businesses to secure inventory, we hope you learned more about the actions you can take to help your small business stay ahead of the ongoing supply chain crisis.

For more information on supply chain management, check out these recent pieces:

How SMBs Are Creating More Sustainable Supply Chains in 2021

Your Entire Supply Chain Strategy Explained On Just One Page

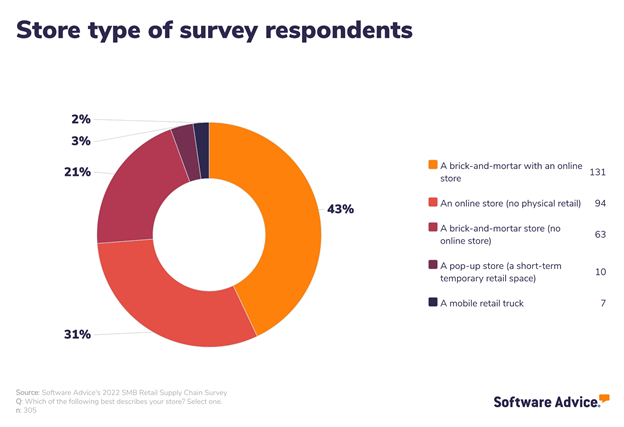

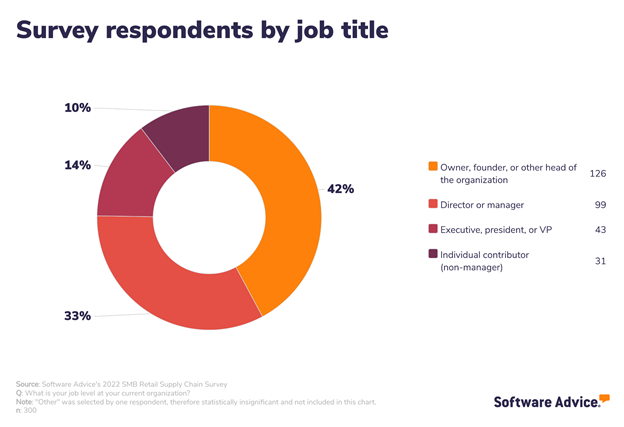

Survey demographics

Just in case you’re like me and want to know more info on the people who took this survey:

Note: All numbers have been rounded to the nearest whole number. “Other” responses were recategorized when appropriate.

Survey methodologies

*Software Advice conducted the SMB Retail Supply Chain Survey in March 2022 of 305 U.S-based supply chain/inventory management managers in retail small/midsize businesses. Respondents were screened for size of business (1 – 1,000 employees), involvement in procurement and inventory management at their retail company (very to extremely involved), and that they had experienced at least minimal supply chain delays in the past 12 months.

**The Retailers Supply Chain Disruption survey from October 14 – 26, 2021 of 304 retailers in the United States with 500 or fewer employees to learn more about how they are experiencing and managing disruptions to supply chains. Respondents were screened to confirm that they were part of a team or solely involved in procurement and/or inventory management at their company and have experienced a moderate or more severe level of supply chain disruption.