Airwallex

About Airwallex

Airwallex Pricing

Only pay for what you use! Open Global Accounts, create virtual cards and more, free free. We only charge a small markup on FX when converting funds (between 0.3% and 1%, depending on the currency). Get started today with no signup fees and zero monthly account fees.

Free trial:

Not Available

Free version:

Not Available

Most Helpful Reviews for Airwallex

1 - 6 of 6 Reviews

Trevor

Verified reviewer

E-Learning, 10,000+ employees

Used monthly for less than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed September 2021

Airwallex has significantly cut down on payment fees

For those willing to wait -- a great cost-cutter.

PROSAfter switching from PayPal, my fee of 4 % was reduced to $ 4 for the same service.

CONSThe service can take longer than receiving or sending a payment through PayPal.

Reasons for switching to Airwallex

Fees

Anonymous

1 employee

Used daily for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed November 2023

The best transaction account for digital business owners.

The best of all the business accounts we've had so far. We use this conjunction with Wise and eliminated traditional bank accounts saving us tons on FX fee and payouts.

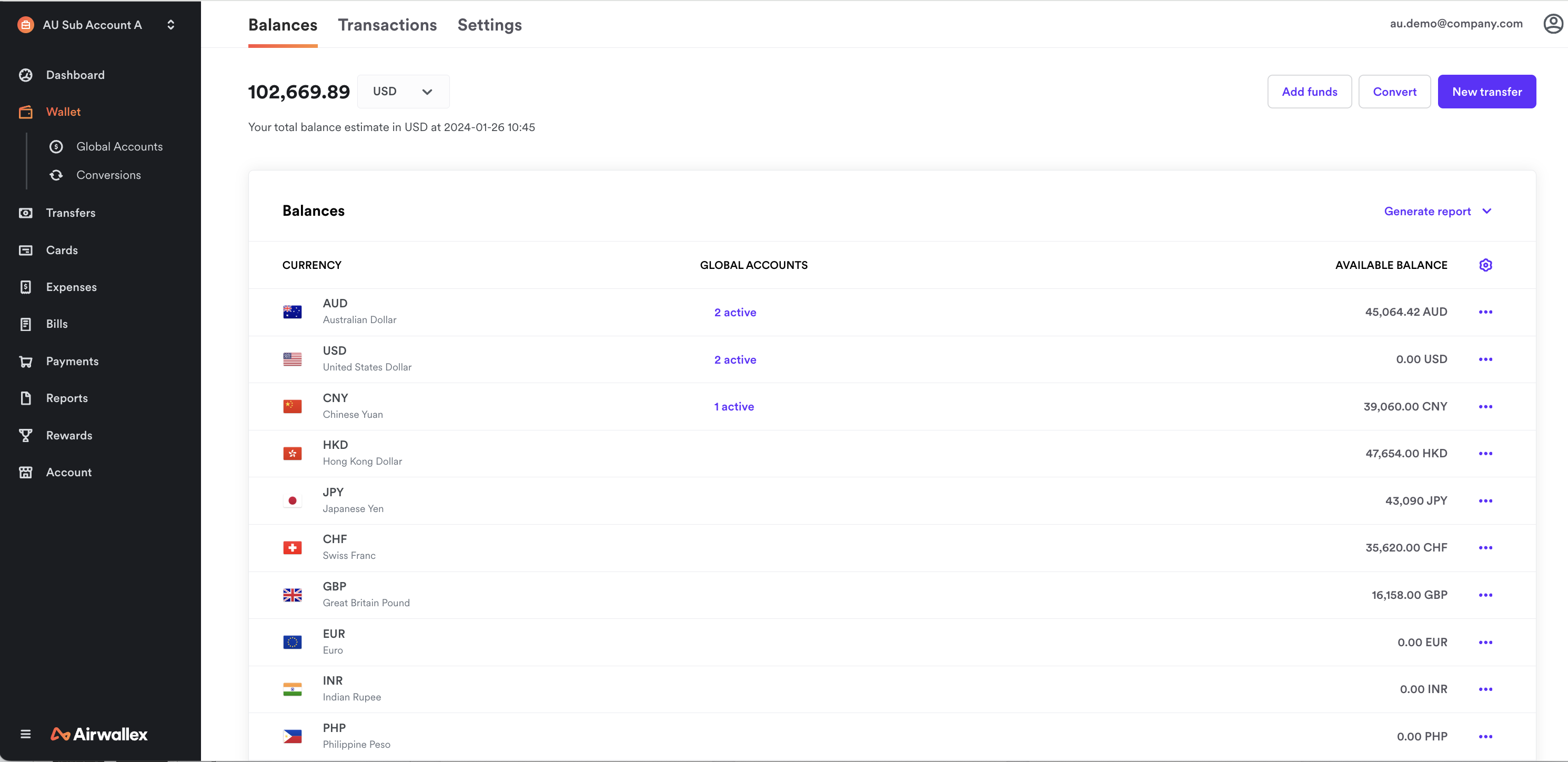

PROSA simple and everyday business transaction account. Integrates with Stripe, Zapier and Xero for simple end-to-end workflow customisation and management. Can issue multiple spend cards for different categories and competitive FX rates but super quick conversion. Best for users who charge in USD but also have freelancers working globally to manage multiple currencies.

CONSNothing as such. Partner offers could be expanded.

Christian

Marketing and Advertising, 2-10 employees

Used weekly for less than 6 months

OVERALL RATING:

1

EASE OF USE

2

VALUE FOR MONEY

3

CUSTOMER SUPPORT

1

FUNCTIONALITY

2

Reviewed April 2024

Airwallex – Not a fan of their onboarding and decision-making

Disappointing, and I'm frustrated by their lack of transparency, and arbitrary process. It feels unfair, biased, and lacking in credibility.

PROSIt's a lovely interface, and they support a lot of currencies. Their UI is really strong, and it feels like a nice modern service.

CONSI went through the KYC and business sign up process for my consulting business which has a 6 year operational track record with no issues. They rejected my application, provided no reasoning why, and I'm entirely within their acceptable use policy. So you can judge for your self, I provide marketing consulting services. It's mystifying, and disappointing. It also took then less than 10 minutes to process but they claim to follow a thorough review process. I am dubious about their claims, and reasoning.

Reasons for switching to Airwallex

Compatibility with our other systems for invoicing and billing, along with currency support.

Stacey

Internet, 10,000+ employees

Used daily for less than 12 months

OVERALL RATING:

4

EASE OF USE

4

VALUE FOR MONEY

4

CUSTOMER SUPPORT

4

FUNCTIONALITY

4

Reviewed June 2022

Accelerate global payments and transfers with Airwallex

Excellent way to manage multiple currency transactions and transfer and make payments across globe with less fee and with great security to wired money.

PROSEasy to open foreign currency account and synchronize your multi-currency transactions into one platform and transfer funds across globe with less fee.

CONSNothing to dislike about Airwallex. Easy to get started and easy on integration to streamline global financial operations.

Stella

Verified reviewer

Marketing and Advertising, 11-50 employees

Used monthly for less than 6 months

OVERALL RATING:

5

EASE OF USE

4

VALUE FOR MONEY

5

FUNCTIONALITY

5

Reviewed May 2021

Fast global payments

Good overall

PROSMy company uses Airwallex for payroll and the team receive their money within 10 hours since the file has been uploaded. Fast.

CONSThey do not provide an option to verify with a national ID in order to get a virtual card. My employer tried to add a new card in the company account and link it to my personal details but Airwallex only accepts a passport for verification (which in my country costs a lot). I sent them my national ID but they could not accept it (I live in the EU).

Reasons for switching to Airwallex

Slightly cheaper fees/currency rates

Anonymous

1,001-5,000 employees

Used weekly for less than 2 years

OVERALL RATING:

3

EASE OF USE

4

VALUE FOR MONEY

4

CUSTOMER SUPPORT

3

FUNCTIONALITY

3

Reviewed June 2022

Payment software that has a lot to improve

Overall it is a simple tool for making foreign currency payment. But the simplicity is both the pros and cons. Cons is the lack of control detail like a bank website, pros then is its simplicity to setup.

PROSSimple installation, easy to setup, simple choices of user roles.

CONSLack of control and ability to set up multiple approval roles for users. There is a OTP one time password feature, but it is needed for each payment, cannot apply for batch payments. Bank feed to Xero is also not stable.