Find the best Online Payment Software

Compare Products

Showing 1 - 20 of 472 products

Sort by

Reviews: Sorts listings by the number of user reviews we have published, greatest to least.

Sponsored: Sorts listings by software vendors running active bidding campaigns, from the highest to lowest bid. Vendors who have paid for placement have a ‘Visit Website’ button, whereas unpaid vendors have a ‘Learn More’ button.

Avg Rating: Sorts listings by overall star rating based on user reviews, highest to lowest.

A to Z: Sorts listings by product name from A to Z.

Worldpay

Worldpay

Worldpay is a cloud-based online payment processing solution designed for businesses of all sizes. The product enables users to collect both in-person as well as online payments via desktops, smartphones and tablets. Worldpay...Read more about Worldpay

MoonClerk

MoonClerk

MoonClerk is a cloud-based online payment processing solution designed for small and midsize businesses. It offers invoicing, mobile payments, online payments and recurring billing within a suite. MoonClerk supports different...Read more about MoonClerk

Recurly

Recurly

Recurly’s all-in-one, integrated platform removes the complexities of automating subscription billing at scale by enabling teams to manage and optimize their subscriber lifecycles with ease. Category-defining companies including...Read more about Recurly

PaySimple

PaySimple

PaySimple is the leading payments management solution for service-based businesses, powering the cashflow of over 20,000 companies nationwide. PaySimple builds long-term partnerships with companies to drive growth providing flexib...Read more about PaySimple

Tipalti

Tipalti

Tipalti is the world's leading finance automation solution for managing accounts payable, procurement, expenses, card, and global payments. Eliminating 80% of manual work and accelerating financial close by 25%. Tipalti allows yo...Read more about Tipalti

PDCflow

PDCflow

PDCflow offers secure delivery and capture of payments, esignatures and documents through the channels consumers prefer – payment portals, SMS and email. Patented Flow Technology empowers companies to connect with their customers ...Read more about PDCflow

eBizCharge

eBizCharge

EBizCharge offers a suite of payment processing, billing and invoicing solutions. It includes payment integrations to accounting, enterprise resource planning, customer relationship management, e-commerce platforms, mobile solutio...Read more about eBizCharge

Fortis

Fortis

OmniFund is a cloud-based PCI-compliant online payment processing solution designed for small and midsize companies. It offers card payments, invoicing, recurring payments and reporting functionalities within a suite. OmniFun...Read more about Fortis

Payzerware

Payzerware

Payzerware is a cloud-based field service management solution which assists contracting firms with technician scheduling and dispatch. Its key features include invoicing, call management, e-payments and reminders. The applica...Read more about Payzerware

Stripe

Stripe

Stripe is a cloud-based solution that offers a varied set of unified APIs and tools that enable businesses to manage and accept payments online. Stripe handles key payment functions, such as subscriptions, storing cards and d...Read more about Stripe

PayPal

PayPal

PayPal is a digital payment platform that enables businesses and individuals to pay and accept payments through an online portal without revealing any financial details. The solution is suitable for businesses of all sizes. P...Read more about PayPal

Tap2pay

Tap2pay

Tap2pay is a cloud-based platform for accepting payments in messengers and social networks to open new sales channels for e-commerce. It allows e-commerce and online-business accept payments via Facebook Messenger, Telegram and V...Read more about Tap2pay

TUIO

TUIO

TUIO is the top-rated School Management System that centralizes all enrollment, waitlisting, reporting, billing and payments in one online portal to help you save more time and streamline your processes. With our new free version,...Read more about TUIO

SecurionPay

SecurionPay

SecurionPay is a cloud-based online payment solution that allows users to send and receive funds. Key features include debit and credit card support and recurring billing. SecurionPay supports multiple billing models that inc...Read more about SecurionPay

Pushpay

Pushpay

Pushpay is a cloud-based online payment solution that helps organizations like schools, churches and education providers to centralize donation data and manage payment operations. Key features include transaction import, donation ...Read more about Pushpay

QuickBooks Payments

QuickBooks Payments

Quickbooks Payments is a mobile payment gateway best suited for small to midsize organizations. The system comes with transaction software, a card reader plugin and a mobile application, which provide instant processing of all maj...Read more about QuickBooks Payments

LawPay

LawPay

LawPay is an online payment technology that caters to the law industry, where it offers law professionals a secure and easy platform for making payments anywhere, anytime. The software guarantees user's payment acceptance in compl...Read more about LawPay

Dwolla

Dwolla

Dwolla offers digital payment technology that helps businesses of all sizes organize, scale and automate account-to-account payments in a secure environment. Dwolla’s payment platform powers billions of dollars for millions of en...Read more about Dwolla

Wave

Wave

Online accounting software that provides features including invoicing, billing, payment tracking, payroll management, finance management, credit card processing, and receipt scanning. Wave Accounting is designed to help businesses...Read more about Wave

Chargebee

Chargebee

Chargebee is a cloud-based accounting solution for businesses of all sizes across various industries such as telecommunication and media, e-commerce and IoT. The solution is PCI Level 1 certified and offers features such as subscr...Read more about Chargebee

Buyers Guide

Last Updated: March 16, 2023Any business that accepts payment via credit or debit card, i.e., nearly every business, requires payment processing software. Those that have an online presence* in addition to a brick-and-mortar store require online payment processing.

The right online payment processor for your business will largely depend on the payment methods your customers typically use. With recent technology advances, including mobile payments and digital wallets, there are several factors you need to consider when selecting online payment software.

Whether you're looking to invest in an online payment processing system for the first time or looking to upgrade your current software, this guide can help you make a more informed purchase decision.

Here's what we'll cover:

What is Online Payment Software?

Common Features of Payment Processing Software

*If you aren't set up for ecommerce, you should be. Head over to this article detailing why every store should have an online component and read our tips for how to get started.

What Is Online Payment Software?

To understand the role that online payment software plays in payment processing, you need to first understand the payment processing value chain, and second need to know how payment processing works.

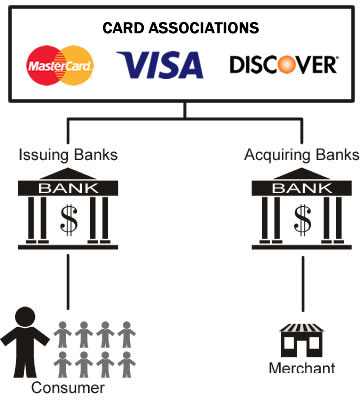

There are several parties involved with the payment processing value chain:

Issuer: Bank that provides the cardholder with a credit/debit card. The bank approves/denies any transactions, bills the customer and collects the owed funds.

Cardholder: Consumer who initiates a sale at a business with their bank-issued card

Merchant: Business owner who submits transaction authorization request to an independent sales organization (ISO)/acquirer

Acquirer: Or, merchant service provider (MSP). Owns the merchant account enabling the merchant to process transactions, i.e., payment gateway

Card associations: E.g., Visa, MasterCard and Discover. Govern bank cards, monitor processing, manage clearing and settlement/funding of transactions.

Payment processor: Organization/vendor that partners with acquirer to open merchant accounts. Provide technology and support and oversees payment processing for acquirers.

Source: Fidelity Payments

There are four key stages in how online payments are processed when businesses use a traditional merchant account:

Authorization: Customer initiates the sale; merchant requests authorization from customer's issuing bank via payment processor. This request route is known as the payments value chain (see above).

Batching: Merchant compiles daily sales and submits transactions in a batch to the acquiring bank for payment. Batching is important to allow time to manually review orders to check for fraud.

Clearing: Acquirer/MSP accepts batched transactions from the payment processor, forwards them to the card networks, who then distribute payment to the corresponding issuer. The issuer then debits the funds from the cardholder's bank account, routing the funds back to the acquirer through the card network.

Funding: The acquirer/MSP deposits the funds into the merchant's account.

Fees accrued during this process are subtracted from the funds the merchant receives: The issuer collects an interchange fee; the card network collects an assessment fee; and, the payment processor collects a processing fee.

Online payment processing software plays a pivotal role in this process, helping to pass authorization from the merchant to the issuing bank, payment through the card network from the issuing bank and settlement between the merchant site and the MSP.

Common Features of Payment Processing Software

While features will vary from system to system, online payment software should contain some or all of the following capabilities:

Common Capabilities of Payment Processing Software

Online payments | Payment pages, merchant accounts and payment gateways allow merchants to accept payments for ecommerce, membership drives, event registration and more. |

Market your business, showcase and sell your goods or services online. Link online shopping cart to inventory, report on sales and manage customers. Mobile store (m-commerce) enables customers to access an ecommerce website from a mobile browser or app. | |

POS transactions | Allows sales staff to process transactions for customers and ensures pricing is correct, inventory is adjusted and receipts are printed/emailed. Ability to accept multiple payment types, e.g., cash, check, electronic funds transfer, credit/debit cards (swipe and chip/EMV cards and both card present and card not present) and mobile payment apps. |

Gift card management | Merchants can purchase gift cards through their POS vendor, or through a third-party supplier, depending on the POS provider. Merchants have several options for setting up a retail gift card program, from using them in brand marketing or in a loyalty program (read more about that here). |

Collect customer information including contact information, billing and shipping information, purchase history and recent searches. Use key dates like birthdays and anniversaries to target marketing efforts and tailor deals and loyalty programs to customers. Encourage customers to create and maintain user accounts. | |

Recurring billing | Set up customers on subscription plans for products or services, save payment information and bill them on a recurring basis, e.g., weekly or monthly. |

Reporting and analytics | Track business performance and sales. Manage cash flow, automate invoicing and gain customer insights. |

What Type of Buyer Are You?

Traditional business (with an online store): The ecommerce payment process referenced above will be the norm for most businesses with an online component. Customers can shop in the brick-and-mortar or visit their online marketplace, and inventory will be the same across both. Business owners require online payment processing to handle online purchases/returns.

Ecommerce business: A fully ecommerce business will follow this payment process as well. E-businesses will require online payment software to connect them to a merchant account and payment gateway and to process transactions, and won't require an in-store POS to handle card-present POS transactions.

Subscription economy business: Subscription economy businesses are relatively new. Examples include Blue Apron and Netflix. This business model is based on membership and recurring subscription fees. Most will be E-businesses without a brick-and-mortar. The focus is on marketing the brand, improving the customer experience and retention.

Key Purchase Considerations

Implementing POS software: If you're considering opening a retail shop, you'll need to implement a POS system to help you manage sales, inventory, accounting and customer management. Download our POS implementation checklist to help you as you get started.

Setting up an online business: Once you have your retail store set up and your POS system in place, you need an online presence. It's important to align your ecommerce strategy with your POS platform. Jordan Brannon, president at Coalition Technologies (a leading provider of online marketing services to small and midsize ecommerce retailers) says that if either the POS or ecommerce platform lacks an API, or pre-built integration, business owners should walk away.

Retail technology disrupters: On-demand services and support, i.e., subscription-based businesses such as Uber, Instacart and Stitch Fix, are considered to be the number one technology disrupter in the retail industry. This business model reflects how consumer expectations have changed regarding their retail experience. This includes a heavier focus on building relationships, creating memorable experiences and emphasizing personalized services.