Farm Accounting Software Buyers Guide

This detailed guide will help you find and buy the right agriculture & farm accounting software for you and your business.

Last Updated on November 21, 2023If you’re a farmer, the last thing you want to worry about is making sure your books are accurate and up-to-date. Unfortunately, in the face of growing production demands, dwindling resources and increasing costs, keeping track of every bag of feed and piece of machinery is becoming more vital than ever to not only properly budget for the months and years ahead, but to also take full advantage of valuable government subsidies and tax deductions.

Making matters worse, manual accounting methods like pen and paper or Excel spreadsheets can be incredibly time-consuming and riddled with errors. Hiring an external accountant is also not a viable solution if you can’t afford one. What can you do?

Enter agriculture and farm accounting software—systems built with the specific needs of farms, ranches and other agricultural businesses in mind.

If you’re researching this type of accounting software for the very first time, or simply overwhelmed by the different options and configurations available, this Software Advice Buyer’s Guide is here to help.

Here’s what we’ll cover:

What is agriculture and farm accounting software?

Common features of agriculture and farm accounting software

How much does farm accounting software cost?

How to evaluate agriculture accounting programs?

What is agriculture and farm accounting software?

If you’re a farm, ranch or other agricultural entity, you need accounting software that has more functionality than what’s found in a basic system.

For example, you need to be able to track inventory for perishables and livestock, including births, deaths, birth weights, weaning weights and more. You also need to be able to keep track of inventory in multiple units of measurement depending on the type of crop or commodity you’re selling. If you have more than one farm or plot, these needs are magnified tenfold.

With features for things like inventory management, asset depreciation, purchase orders and budgeting, agriculture and farm accounting software is designed to cater to these specific needs.

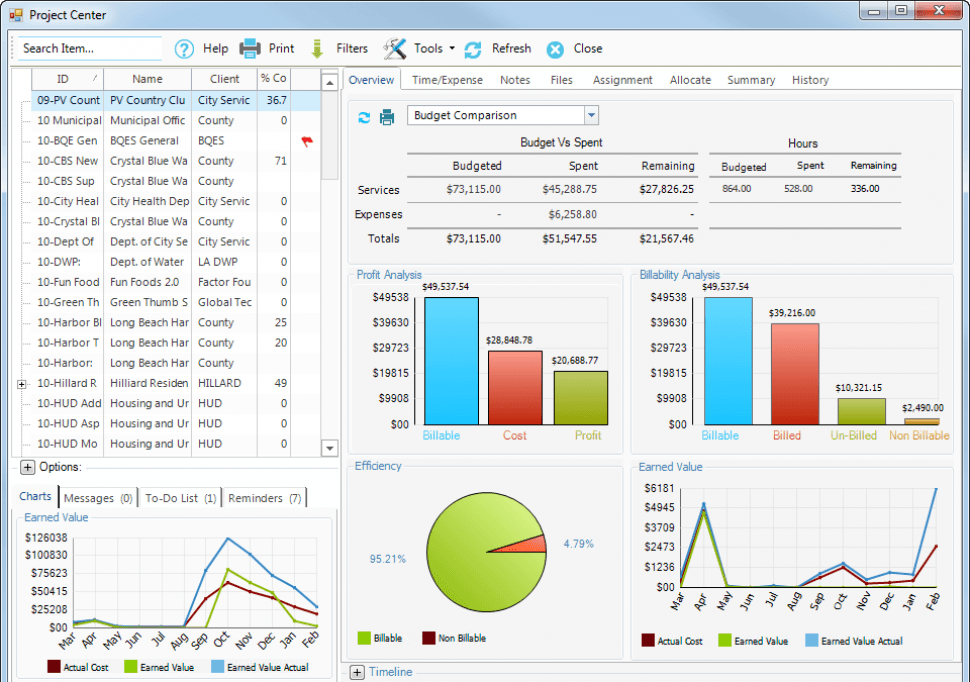

Project Center screenshot in BillQuick

Common features of agriculture and farm accounting software

As well as the core ag modules like payroll, accounts receivable and accounts payable, farm bookkeeping software may have some or all of the following features:

Crop/livestock inventory management | Agricultural software should track the additional data needed for farms and ranches, including seeds planted, fertilizers and chemicals used, livestock parents/birth weights etc. This will in turn support PTI compliance and feed into the sales and grower accounting systems. |

Warehouse management | Farming accounting software should also manage the inventory for fertilizers, chemicals, seeds, heavy equipment, the receiving, pallet and case labeling, re-packing and pick ticket management. |

Ag ratio analysis | Grower reports analyze the percentage of crops planted to yield produced, so you can price accordingly, identify best practices and increase yields for future seasons. |

Breeding & growing calendars | Agriculture is a highly seasonal industry, and so much depends on the time of year, the age of the animal or crop and the products used to support its growth. A farming software solution may include a calendar to track actions like planting, fertilizing, spraying for pests, harvesting, gestation, births, weaning etc. |

How much does farm accounting software cost?

Budgeting properly for farm accounting software is just as important as finding the right system, so buyers need to ensure that they know all of the costs associated with their farm accounting software, and when they must be paid, beforehand. Here are some typical accounting software pricing models that you will run into during your research:

Perpetual license. With these products, you pay one cost upfront and own the software for as long as you want to use it. These systems are almost always on-premise systems that you install directly onto a computer or server, which are becoming increasingly rare due to the growth in popularity of web-based products.

Flat subscription fee. More common among smaller accounting offerings, buyers here pay a flat monthly or annual subscription fee to use the software. Some vendors have one set fee for their accounting system, while others have different tiers with a higher fee as you add more functionality.

Contingent subscription fee. Buyers here also pay a monthly or annual subscription fee, but this fee is contingent on how many users are going to be in the system or how many employees are going to be paid through a payroll module.

Besides the license cost, there may be also be fees for implementation, maintenance, training and data migration. Be sure to ask each farm accounting software vendor about their specific pricing model.

What type of buyer are you?

Before evaluating your options, you must determine what type of buyer you are. We’ve found that more than 90 percent of buyers fall into one of these three categories:

Small business buyers. These small farms are on the verge of upgrading basic systems, like QuickBooks, to support more sophisticated agriculture-specific functions like forecasting, product management and ratio analysis. As ranches and agriculture entities reach a certain size and require advanced functionality to grow, businesses will need to upgrade their systems.

Enterprise buyers. These buyers represent farms and agriculture organizations that need the functionality of a full enterprise resource planning (ERP) suite for a large entity. Seamless integration is usually more important than specific features; however, there is considerable differentiation in both of these areas, and buyers should examine both. Sage and Microsoft Dynamics are two of the largest vendors for ERP and offer sophisticated systems.

Best-of-breed buyers. These buyers need stand-alone software solutions for specific functions. For instance, while agriculture organizations need systems for core functions like payroll, they also need programs with specific features for inventory management or crop/livestock ratio analysis. These buyers may seek a product that has deep functionality in one of these application areas rather than a full financial planning suite.

How to evaluate agriculture accounting programs?

Agriculture-specific solutions should be able to handle the wide variety of agriculture costs. Providing crop break-even analysis in consideration of fertilizer, chemicals, seed and rent on land by individual field, acre or bushel is crucial for a precise agricultural accounting resource. The appropriate solutions package will also come equipped with farm industry standard ratios to gauge financial efficiency with respect to the agriculture industry.

When evaluating these systems, buyers should consider the following:

Does the system support agricultural inventory types?

Are the appropriate industry standard ratios included in the software?

How many different farm operations can the program support?

Can the system forecast based on hypothetical environmental conditions?