Account Ability

About Account Ability

Awards and Recognition

Account Ability Pricing

Network Ready Server License. Includes 500 concurrent users. Order before October 1 and save $100.

Starting price:

$499.95 one time

Free trial:

Available

Free version:

Not Available

Most Helpful Reviews for Account Ability

1 - 5 of 129 Reviews

Stephanie

Accounting, 2-10 employees

Used monthly for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed December 2022

Great software

Overall our experience with AA has been wonderful. They are available for any help you need and since they can access your software with your permission, they can look directly at anything you are needing help with and solve your issue.

PROSAccount Ability is very easy to use. We use it in our office every year to provide our clients with W-2s and 1099s. The help team is very knowledgeable and so willing to help with any issues or questions. They give wonderful advice and are very helpful. Last year while submitting our 1099s Charles was able to see that I had something incorrect with my electronic submission file which would have caused it to be rejected. He located the error and fixed our submission file. Absolutely wonderful service.

CONSThe only function I would like to have that it doesn't is a printable report of W-2 recipients. I believe we can only do a report of 1099 clients. Since we have multiple clients that we provide forms for, it would be nice to access all W-2s we have prepared. We have used the 1099 recipient list to find data needed for another client. A report for W-2 recipients would be helpful as well.

Vendor Response

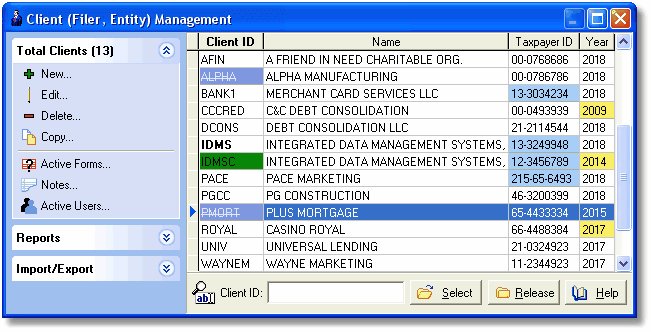

Thank you for your wonderful review. We do include various employee listings of W-2s entered for either a single employer or all employers. For a list of employees for all employers, see the "Employee Master" on the "Reports" sidebar of the Client/Filer Management module. For a list of employees for a specific employer, see the "Register Listing" selection on the "File" menu of the employer's W-2.

Replied December 2022

Sonya

Accounting, 51-200 employees

Used more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed January 2020

Satisfactory

I am able to overall get my work done faster.

PROSWhat I like most about the software is that, I am able to transfer previous vendors over from last year to the new year. This helps me to more efficient in completing my yearly task in getting the appropriate forms out to vendors in timely manner. I love that I can export a file after I have to create it, this also helps to be efficient.

CONSThe least about this software is that when I select the 1099 C options, I don't have that same availability. I am can export a file which is awesome. And also the template changes almost every year. The help section is a little confusing. Sometimes its not giving the help that I need. Or I am not using the correct verbiage to find what I need. It can be a little complicated at times. The previous year taxes when I have to go back and correct or I have to issue in the previous year is a pain. When I go to send a file to the IRS most of the time I get an error from the IRS.

Reason for choosing Account Ability

Better quality for Accounting needs.

Reasons for switching to Account Ability

the overall company switch to get a better outcome of the what we needed to prepare taxes for our customer.

Lesha

Automotive, 11-50 employees

Used monthly for more than 2 years

OVERALL RATING:

3

EASE OF USE

1

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

3

Reviewed June 2022

Confusing program but GREAT Support

The customer service department is great.

CONSThe program is too confusing. I have used this for several years because of government requirement to transmit W2s electronically and I still have issues of following the program and I have to call support. The Customer support is great, however, I should be able to process everything without contacting support every time!

Vendor Response

Thank you for your review.

Replied June 2022

Allen

Wholesale, 51-200 employees

Used more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed December 2018

The Best Choice for Filing State and Federal Taxes

I tried 2 other tax data programs before I found IDMS. There were others that were nice, but incomplete. For example, the end of the predecessor of Account Ability came when they didn't have the feature to submit corrected W2's. I was especially appreciated of IDMS support during the first years of Obamacare. The cost of the software is extremely reasonable for the completeness and a level of support where they remote desktop when the question cannot be answered simply. Account Ability, IDMS, is the software that will get your job done.

PROSLogically structured interfaces with interfaces to import data from our accounting program and easily bring the data into the Account Ability Program where all mission critical activities from W2, CORRECTING W2, 1099, Obamacare data submission, etc., are made possible. They pay attention to details. For example, they have an interface browser available to connect to SSA where your password for SSA is encrypted and saved in the browser interface. There are many more creature features that make the very tedious job an effective process.

CONSMy complaints are less with the software than the requirements and definitions of the Government agencies.

Irwin

Accounting, 2-10 employees

Used more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed June 2021

Easy and Accurate Software for Generating Information Returns

Our experience with Account Ability has been excellent and I believe we have been using it for over 15 years. The help and support that is available in the event that it's needed is unbelievably good. If you need support you wind up talking with someone who truly knows the software and is not just working from a manual. Help response time is quick. However, help is hardly ever needed--the software works pretty seamlessly.

PROSThis software is extremely easy to use to get the job of producing information returns done. Little time is required to learn the software and you can be up and running in less than 2 hours the first time it's used. The interfaces are pretty intuitive. We have been especially happy with how easy it is to find and generate information returns for clients who have mislaid the forms that were sent to them.

CONSThe only thing I can think of is integration of information from other software, i.e. if you have client lists in other software integrating that into the program. This may already be available.