3 Key Performance Indicators That Show the Health of Your Practice

We’ve recently covered how important electronic health records data points can be for tracking patient satisfaction metrics, but keeping your patients happy is just one area of focus in a much larger medical business model.

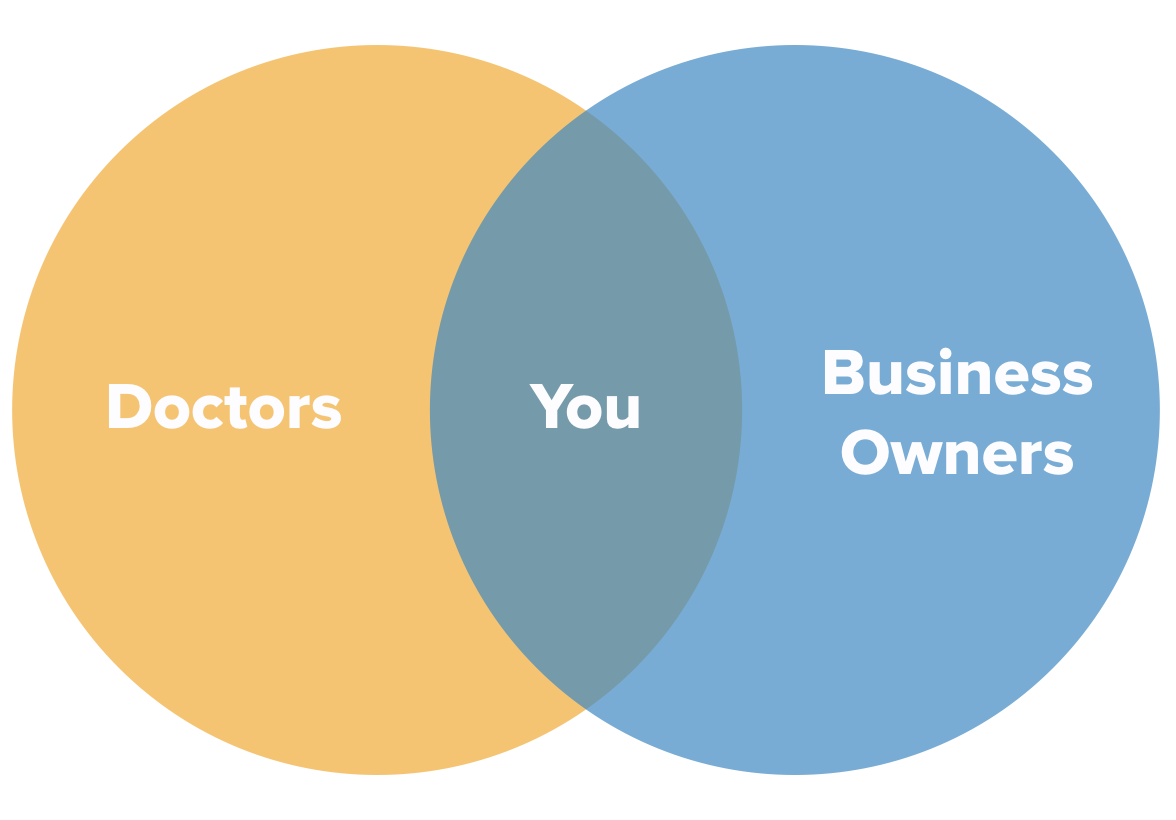

Every doctor who owns their own independent practice has to be two things: a medical provider and a business owner. Most have the first role down pat, but things tend to get trickier when it comes to managing a successful business.

That’s where KPIs come in.

Key performance indicators in health care are a critical step toward becoming a profitable medical practice, and owners who elect to track these business metrics will gain the advantage of valuable insights that empower them to make faster, wiser business decisions than their competitors.

We’ve identified three medical business metrics that can help provide a complete view of how your practice is performing.

Here’s what we’ll cover:

Net Collections Rate: Find Out How Much You’re Actually Making

Clean Claim Rate: Find Out How Good You Are at Submitting Claims

Patient No Show Rate: Find Out How Many Patients You’re Seeing

Net Collections Rate: Find Out How Much You’re Actually Making

It’s appropriate that the very first metric on our list relates to your revenue cycle because paying attention to your finances is always the first step in running a successful business.

You may already be tracking the things you’re billing in some capacity, but just knowing what invoices are being sent out isn’t enough to tell you how much money you’re making. For one thing, plenty of those invoices go unpaid, so this metric simply isn’t informative enough.

Instead, you’ll want to start looking for the actual dollar amount your practice receives, which in addition to helping you keep an eye on your financial well-being can also be a useful performance metric for your billing staff.

To do this, you need to start tracking your net collections rate. Here’s the most common formula for finding this value:

**(Payments – Credits)

*

(Charges – Contractual Adjustments)**

So let’s say you charged $1,000,000, but had write-offs in the amount of $200,000. You then received $750,000 in payments, but had to pay rent and insurance fees totaling $100,000. Here’s what the formula would look like:

($750,000 – $100,000) / ($1,000,000 – $200,000) = Net Collections Rate

$650,000 / $800,000 = Net Collections Rate

81.25% = Net Collections Rate

Why it’s useful: Because this formula takes contractual adjustments, reduced fees and write-offs into account, it gives you the actual dollar amount you’re receiving out of the actual dollar amount you’re allowed to collect.

Clean Claim Rate: Find Out How Good You Are at Submitting Claims

You know we couldn’t get through this list with just one revenue cycle metric, so let’s talk about your clean claim rate (CCR).

Your clean claim rate is a phenomenal way to determine the quality of data your team is collecting and reporting in claims because it tells you the percentage of claims you submit that pass all edits and require no intervention.

If we put it into a formulaic expression, it would look something like this:

**Claims processed on first pass

*

Claims re-submitted for acceptance**

I know that’s a bit wordy for a formula, so let’s just say you submitted 100 claims in a month. Out of those 100, 50 claims were approved on the first pass without requiring any edits or changes, and 50 came back because of incomplete information.

50 / 100 = Clean Claim Rate

50% = Clean Claim Rate

Alternatively, you could calculate this rate if you divide the number of claims that require resubmission by the total number of claims submitted. They both give you the same number, so it’s entirely up to you.

Why it’s useful: This metric tells you two things at once. First, it tells you how good your team is at recording the data required for claims; and second, it gives you an idea of how much time and effort your team is spending correcting claims errors. Knowing both makes it easier for you to fix common claims issues and save money.

Patient No Show Rate: Find Out How Many Patients You’re Seeing

Just one step away from revenue cycle metrics is where we’ll find this invaluable key performance indicator for any health care business. You can’t make money if you don’t see patients, so it’s imperative that you pay attention to how many patients you’re seeing and—more importantly—how many you aren’t seeing.

One of the best ways to turn this into a metric is to track your rate of no shows, which you can find using the following formula:

**Number of missed appointments

*

Total number of scheduled appointments**

Imagine you have 200 unique patient appointments scheduled in one month, but you saw only 150 of those patients.

50 / 200 = No Show Rate

25% = No Show Rate

You may also want to use more specific metrics such as cancellation rates and late arrivals to help you suss out any issues you’re having with patient visits, but these should only be in addition to tracking your no show rate as it’s the most informative metric for patient visits.

Why it’s useful: In 2017, missed appointments cost the health care industry a staggering $150 billion. Even broken down to individual practices, that’s a lot of money you’re not making. Start tracking your no shows so you can first determine how well you’re doing compared to other practices of your size and specialty, and then use it to test solutions aimed at decreasing no shows.

What’s Next?

Once you’ve started tracking these metrics, you’ll want to use them to figure out how you’re performing in comparison to other practices like yours. This step lets you set accurate benchmarks to aim for each quarter so you’ll be working toward clearly defined goals.

From there, you can continue using these KPIs to monitor your progress and hone the strategies you’re using to improve these metrics.

Keep an eye out for the sequel to this piece, in which we’ll further the discussion of these metrics with ideal benchmarks for each, red flags to look out for and what to do when your performance isn’t up to snuff.