TaxJar

About TaxJar

TaxJar Pricing

https://www.taxjar.com/pricing/

Starting price:

$19.00 per month

Free trial:

Available

Free version:

Available

Most Helpful Reviews for TaxJar

1 - 5 of 75 Reviews

Anonymous

11-50 employees

Used weekly for less than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed December 2018

Nice for State Taxes

I like all of it, got the 30 day free trial. It's great to use Taxjar if you're selling online, makes managing state sales taxes for shipments easy. State sales tax is a huge pain for most businesses just because taxes are so different across states, but Taxjar makes it simple.

PROSIt integrates with Walmart, Amazon, Shopify, and most other major online sellers, makes taxes for selling multichannel very easy. The integration is fast and sends data automatically.

CONSThey could always add more channels, but Taxjar has the big channels covered.

Anne

Internet, 1 employee

Used weekly for more than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed September 2017

TaxJar is the ONLY way to collect state sales tax for eCommerce!

One of my lifeline go to products to run my eCommerce Internet sales business. It pulls in info from Amazon, eBay and PayPal to calculate which states I owe sales tax too. I was a life saver when I went compliant regarding my FBA sales tax. Thanks TaxJar!

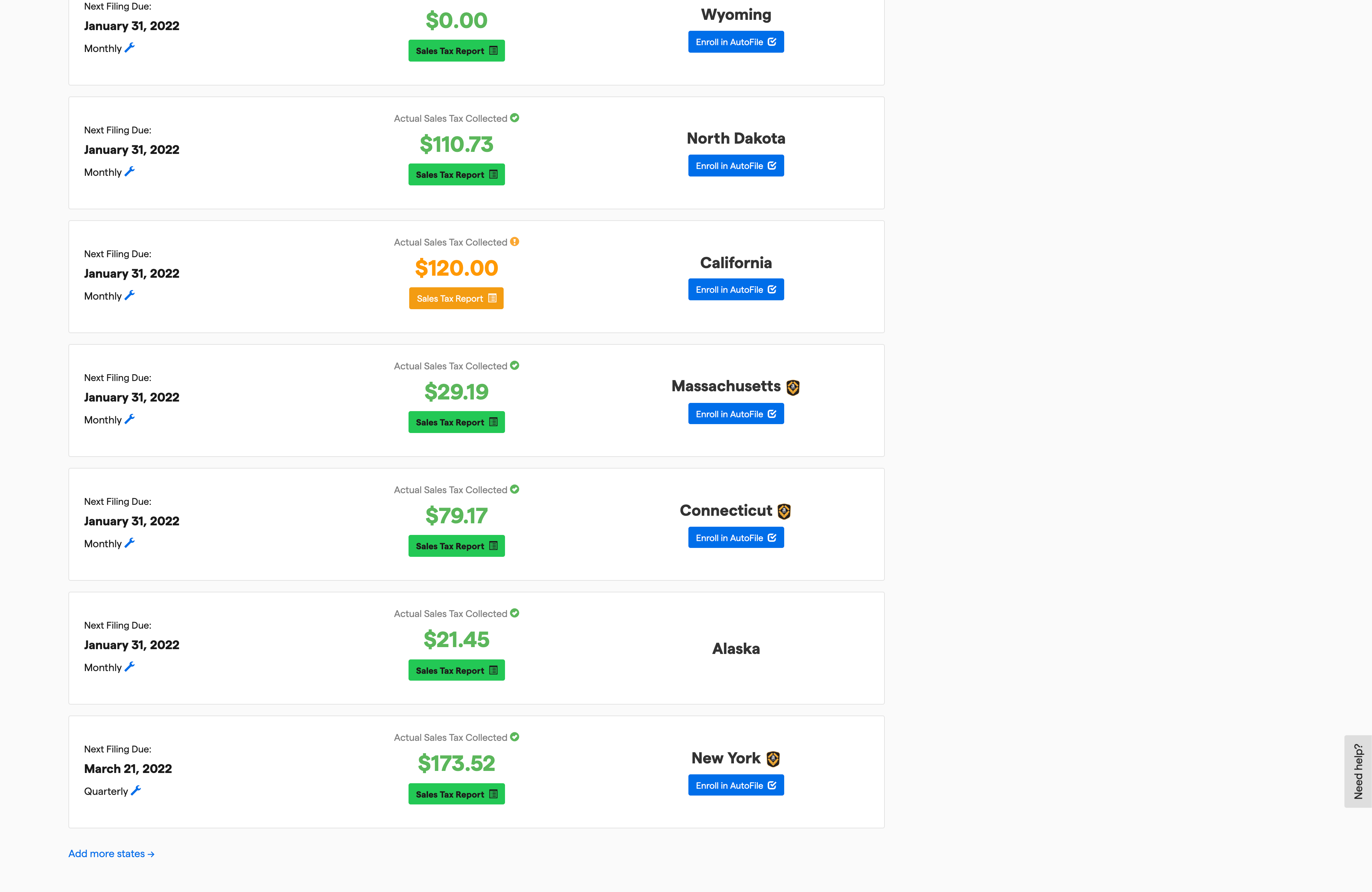

PROSTaxJar has an ease of use that once you are set up, you are good to go. They make registering for states you have nexus in a breeze. I started with my home state of CA and worked with it for over a year before becoming compliant with other states that I had nexus in for Amazon FBA. As an eCommerce seller I was able to easily link to my eBay and PayPal accounts. They pull in the info needed and on a monthly basis I can see which states I have to make payment to. I easily log into the states websites and submit everything online. Such a time saver I can't even tell you. They give you step by step instructions for everything having to so with EACH and every state in the USA. Simply the best! As a solopreneur, I am my own book-keeper and accountant. I have all the info in TaxJar to make my business run regarding sales tax.

CONSWhile I haven't yet used autopay, where they would do my filing, I hesitate because my sales are not great. I wish the fee was based on how much or how little one sold. I would use in a New York minute if that were the case.

Luke

Information Technology and Services, 11-50 employees

Used daily for less than 12 months

OVERALL RATING:

1

EASE OF USE

1

VALUE FOR MONEY

1

CUSTOMER SUPPORT

1

FUNCTIONALITY

3

Reviewed May 2021

Classic bait and switch by sales. Non-existent support. Massive over-payment of sales taxes.

Unbelievably poor support once the sales transaction was complete. No communication automated or otherwise when serious issues happen that result in large transactions drafting from your bank accounts. No remorse or support when serious issues happen to recover funds drafted in overpayments. No priority support no matter what even when things go wrong fee based or otherwise, and absolutely no care or concern about it from anyone include the sales team.

PROSInitially what was pitched as a robust flexible API, auto-file service to take the burden of multi-state sales tax nexus off our finance team, and "great support" in the event of integration support needs or post purchase assistance. Great up-front sales response working to close the deal.

CONS1) Unclear or illogical API logic that results in under collections and overpayment. Senior software engineers with decades of backend billing systems integration experience confused by the way it functions. 2) When they autofile for your company, they will happily remit any amount ($10s of thousands of dollars!) more than you collect and not send any kind of alert or make any kind of contact informing you of this atrocity. 4) When you discover a major issue (like overpayment), they remind you the service is not managed, the onus is on you to check everything, and offer fee based services to refile returns once you've corrected data they used to over remit sales taxes to states with a wait time of *6 to 8* weeks. 5) Poor to nonexistent support (phone support goes to voicemail 99% of the time and callbacks never occur, emails take 3-5 days for responses and often need engineering to answer further questions which take a further number of days or weeks for a response). Little to no care or concern expressed whatsoever when support is needed. Sales answers the phone, support doesn't, but will sales not help you one bit after you've signed up with Taxjar. 6) A web interface that provides no ability to manually adjust anything other than whether a transaction is tax exempt or not. Searching for transactions is best done by exporting data and using excel. 7) Auto-file rendered useless in multiple states with sales tax exemptions the platform doesn't support.

Reason for choosing TaxJar

Sales approach and what was pitched as a team that would support our custom integration, a pitch that resonated with our software engineering team in particular. Our real experience has been the polar opposite, one of self service and hope for the best. Our end expenses particularly with consultant labor to attempt to recover overpayments in sales taxes to multiple states will result in a total cost far exceeding any completing platform.

Kelly

Sporting Goods, 11-50 employees

Used daily for more than 2 years

OVERALL RATING:

4

EASE OF USE

4

CUSTOMER SUPPORT

4

FUNCTIONALITY

4

Reviewed August 2022

Makes Filing Nexus State Taxes Easy

We needed to be able to handle multiple states that we had nexus in and Taxjar made it easier to not only collect the correct taxes but to file in every one of those states automatically. Saving us both time and money every month.

PROSAuto filing of multiple sales taxes for nexus states. Manages tax collection for multiple states and counties. Made collecting taxes within our shopping cart and ERP easy.

CONSIntegration with other services and systems. Works well with some not at all with Shopify (but that is on Shopify not TaxJar).

Geri

Used daily for less than 2 years

OVERALL RATING:

5

EASE OF USE

5

VALUE FOR MONEY

5

CUSTOMER SUPPORT

5

FUNCTIONALITY

5

Reviewed March 2018

Takes the pain out of paying my salestax

Worry free tax filing and tracking.

PROSThe best thing about TaxJar is the ability to connect it to my Amazon store and it monitors all of the sales tax that needs to be submitted and filed. I also use the added service of letting TaxJar actually submit my tax return. Saves me time and frees me to do things that will help me grow my business.

CONSI rarely even visit my TaxJar account because it is automated and there's really nothing for me to do. I do check in once in a while to make sure it's tracking everything correctly. There is no real con for me so far.